The Union Cabinet has approved the draft Model Tenancy Act in 2021 which was drafted by the Ministry of Housing and Urban Affairs in 2020. According to the Census of 2011, a total of approximately 1 crore houses is unrented and vacant in urban areas1. The concerns for the same being various conflicts in the landlord-tenant relationships, fear of repossession, non payments, late payments, damage to the premises, delayed court procedures, old local rental laws of each States which were not amended for many decades etc. After two years of announcement and one year of preparing of the draft, the Union Cabinet aims to enhance and improve the status of rent laws with Model Tenancy Act, 2021. Unlocking those houses for rent and creating a transparent and more balanced relationship as well as minimizing the cause of conflicts between the landlords and tenants for future is the objective of the Model Tenancy Act.

As there already exists local rent laws of each State, with the Model Tenancy Law coming into force, the State Governments can enact and pass afresh entirely a new rent legislation repealing the previous Rent Act or they can amend their existing rent law to include the provisions of the Model Tenancy Law. Like, for instance, Maharashtra Government is taking a two-fold pathway for implications of Model Tenancy Laws on new projects whereas the already rented occupations will remain under the Maharashtra Rent Control Act.

Some of the major highlights of Model Tenancy Act (MTA) are as follows:

- Model Tenancy Act will be applicable prospectively and will not affect tenancies already in existence.

- The definition of premises does not extend to industrial purposes. The definition also excludes premises such as hotel, lodging house, dharmshala or inn from its scope. It includes premises let on rent for Commercial, Residential and Educational use.2

- It provides for establishment of a Rent Authority to regulate renting of premises and to protect the interests of landlords and tenants.3

- There has to be an original copy of written agreement signed between both landlord and tenant with both the parties and a copy of rent agreement is to be provided to the Rent authority within 2 months from the date of the rent agreement. 4

- A unique identification number (UIN) will be provided to the parties and the details of the tenancy agreement will be uploaded to the rent authority website within 7 days of receiving of such information.5

- The security deposit has to be paid by the tenant, the amount for which has to be decided by the parties. The amount of security deposit should not exceed the amount of rent for two months for residential premises and six months for non-residential premises. 6

- Sub-Letting of property of the landlord by tenant has been restricted in MTA without the permission of landlord. No tenant shall transfer, assign or sub let any part or whole of the premises without executing the agreement for the same. The rent for sub let shall not be more than that of the rent of the tenant.7

- Within two months of executing the sub-letting agreement between the parties, the same shall be informed in description to the Rent Authority jointly by both, landlord and tenant.8

- In no circumstances can the landlord or property manager restrict the inflow of any essential supply and services like electricity, water, stairs, lifts etc, in the premises occupied by the tenant. In case of the contravention, the Rent Authority shall immediately pass an interim order for the inflow of the essential supply and services after examining the matter. 9

- The tenant shall not make any structural changes in the rental premises without any consent and permission of the landlord.10

- The landlord is entitled to get a compensation of double the monthly rent for the first two months(and four times the monthly rent thereafter till the tenant continues to occupy the said premises)if a tenant does not vacate the premises after tenancy has been terminated by order, notice or as per agreement.11

- In the case of any improvements or alterations in the premises of the rented property by the landlords, the cost for the same can be taken by them with the upcoming rent. And in case the alterations or changes are done by the tenant, it shall not be done without any written consent.12

- The revision of rent between the landlord and the tenant shall be in accordance with the terms of the tenancy agreement.13

- Rent Courts and Rent Tribunals to be set up at district level to deal with landlord-tenant grievances on an immediate basis.14

RENT COURT AND RENT TRIBUNAL

The District Magistrate or District Collector with the approval of the State Government shall appoint Additional Collector or Additional District Magistrate to be the Rent Court within his jurisdiction.15 The State Government, in consultation with its High Court, may by notification appoint the District Judge or an Additional District Judge as the Rent Tribunal in every District.16

No civil court shall entertain any case in relation to the provisions of the Act.17

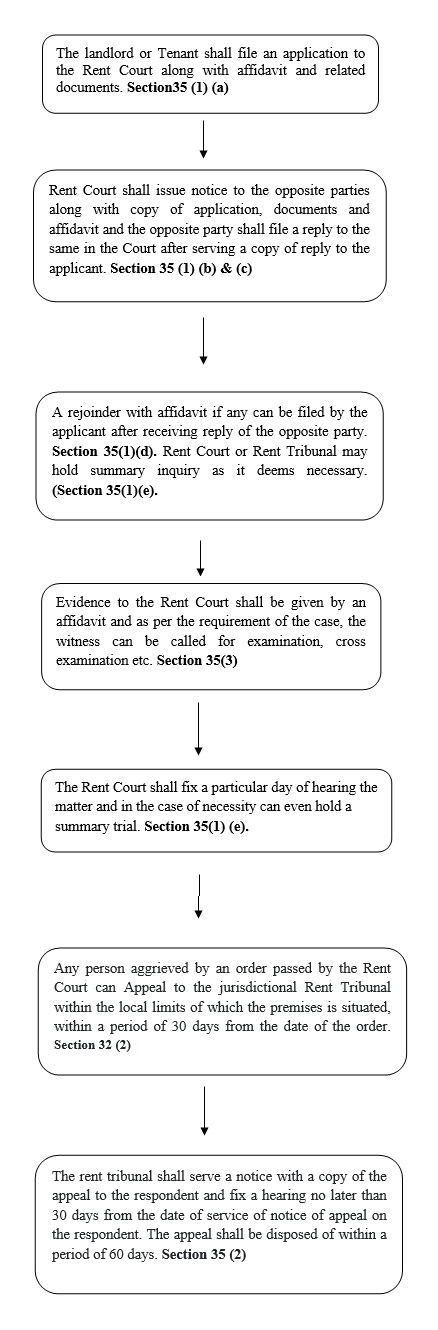

The Procedure to be followed by the Rent Court and Rent Tribunal is explained herein below:

Other provisions

If there is a confusion as to whom the rent as to be paid i.e. the landlord or manager or if in case they are unavailable then rental charges shall be deposited to the rent authorities in the manner prescribed and if the payment is being made through the electronic modes, the bank acknowledgment of the same shall act as a proof of payment.18 The premises of the tenancy shall be maintained and except for normal wear and tear, any damage caused will be improved by tenants expenditure.19 In the case of force majeure conditions such as earthquake, cyclone, war, flood etc, certain advantages and concession shall be provided to the tenant and if the tenant is in the termination period, then leniency of an extra month shall be given to have enough time for vacate the premises. In case if the premises has been affected so badly due to force majeure condition that it is impossible to reside in it, then the rent shall not be charged till the time the premises has not been restored and made inhabitable. 20

Conclusion

The Model Tenancy Act, 2021 is the need of the hour as it relaxes the burden on Civil Courts. It is significant as it provides necessary safeguards to both the landlord and the tenant. Some landlords breach right to privacy of their tenants by coming to the premises uninvited or unnecessarily. The Act takes care of it. It further protects a tenant from a sudden hike in the rent amount. The Act protects the landlords from the fear of their property being unauthorizedly possessed by the tenants. The provision under Section 23 relating to enhancement of rent in case of refusal by tenant to vacate is important. It ensures that the landlord will benefit from a tenant who illegally remains in possession of the tenanted premises even after the termination of tenancy. This provision would help in ensuring that more property owners would become willing to put their premises on rent, which is one of the desired objective of the proposed legislation. It will also promote the property of non-resident Indians (NRIs) to be available for rent as in the present scenario, they prefer keeping their property vacant rather than dealing with tenants who may cause trouble in future. Therefore, as it can be seen, it is expected that State tenancy laws based on draft Model Tenancy Act will be beneficial for both landlords and tenant, thus providing a win-win situation. The setup of a grievance redressal mechanism with a process ensuring speedy disposal will act as an encouragement for both parties and promote more renting of premises. It would also ensure fair dealing in business of leasing.

Footnotes

1 http://mohua.gov.in/upload/uploadfiles/files/3%20ENGLISH.pdf

2 Section 2(d) of the Model Tenancy Act.

3 Preamble and Section 30 of the Model Tenancy Act

4 Section 4 of the Model Tenancy Act

5 Section 4 (4) the Model Tenancy Act

6 Section 11 of Model Tenancy Act

7 Section 7 of Model Tenancy Act

8 Ibid.

9 Section 20 of Model Tenancy Act

10 Section 26 (1) of Model Tenancy Act

11 Section 23 of Model Tenancy Act

12 Section 9 (2) of Model Tenancy Act

13 Section 9(1) of Model Tenancy Act

14 Sections 33and 34 of Model Tenancy Act

15 Supra

16 Section 34 of Model Tenancy Act

17 Section 40 of Model Tenancy Act

18 Section 13 and 14 of Model Tenancy Act

19 Section 15(1) of Model Tenancy Act

20 Section 15(6) of Model Tenancy Act

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.