- within Tax, Intellectual Property and Corporate/Commercial Law topic(s)

- with readers working within the Law Firm industries

Discussion Paper on "MSME Registration and disclosure framework under CIRP" dated August 23, 2024.1

- The Micro, Small and Medium Enterprises (MSMEs) form backbone of an economy. Given their importance, in order to encourage greater participation and to achieve the objective of value maximisation of a Corporate Debtor, the Insolvency and Bankruptcy Code, 2016 (IBC) provides for certain dispensations in terms of Section 240A and Chapter III - A of the IBC.

- However, in order to take advantage of such dispensations, it is necessary that the status of a Corporate Debtor as an MSME is ascertained. Pertinently, neither the IBC nor the IBBI (Insolvency Resolution Process for Corporate Persons) Regulation, 2016 (CIRP Regulations) mandate provisioning of status of the Corporate Debtor as an MSME.

- By way of this Discussion Paper, the IBBI proposes to amend

Regulation 36 of the CIRP Regulations to insert Regulation

36 (2) (ka) in the CIRP Regulations to:

- Mandate disclosure of details of the registration status of a Corporate Debtor as an MSME in the Information Memorandum prepared under Regulation 36.

- Empower the Resolution Professional to obtain Udyam Registration certificate, in case a Corporate Debtor meets the criteria for being classified as an MSME (as per the documents available), and include such information in the Information Memorandum prepared under Regulation 36.

V.S. Palanivel v P. Sriram CS, Liquidator – Supreme Court

Judgment dated August 28, 2024 [Civil Appeal Nos. 9059-9061 of 2022]

Background facts

- This Appeal was preferred by the suspended director of Sri Lakshmi Hotels Pvt. Ltd. (Corporate Debtor) undergoing liquidation proceedings in terms of Order dated July 17, 2019 passed by the NCLT, Chennai.

- Pursuant to the initiation of liquidation process, the Liquidator obtained valuation of the assets of the Corporate Debtor and scheduled an auction in accordance with the IBBI (Liquidation Process) Regulations, 2016 (Liquidation Regulations). However, the scheduled auction failed.

- Thereafter, the Liquidator reduced the reserve price by 25% and scheduled second auction process for the Corporate Debtor. Herein, the sole bidder i.e. KMC Speciality Hospitals (India) Ltd. (Successful Bidder) was declared as the successful bidder.

- The Liquidator vide letter dated December 24, 2019 demanded the balance consideration from the Successful Bidder, which was required to be paid within 90 days as per the Liquidation Regulations. However, the successful bidder failed to make the payment within 90 days.

- The Successful Bidder filed an application before the NCLT, Chennai seeking extension of time for payment of balance sale amount, which was allowed on May 05, 2020. Accordingly, the successful bidder made payment of balance sale consideration on August 24, 2020 and a sale deed was executed by the Liquidator in his favour only on August 28, 2020.

- The Appellant filed an application before the NCLT, Chennai seeking setting aside of auction proceedings and also challenged the execution of Sale Deed by way of another application, seeking recall of the Order dated May 05, 2020 passed by the NCLT, Chennai. Both these applications were dismissed by the NCLT, Chennai, which order was upheld by the NCLAT in Appeal.

- The Appellant inter-alia argued that the timeline under Clause 12 of Schedule I of the Liquidation Regulations are sacrosanct and no extension could have been granted by the Liquidator. He further argued that the reduction of reserve price by 25% was arbitrary and unjustified, given the higher valuation of the property in question.

- The Respondent Liquidator, refuting the submissions of the Appellant, argued that the auction process was conducted according to the provisions of the IBC and IBBI Regulations. Further, the delay in payment of balance consideration was caused because of lockdown due to the COVID-19 pandemic, a force majeure event. Reliance was placed on Suo Moto Writ Petition (Civil) No. 3 of 2020, which extended all statutory timelines, including those under IBC.

Issues at hand?

- Whether the timelines under Clause 12 of Schedule I of the Liquidation Regulations are directory or mandatory?

- Whether the extension granted for the successful bidder for payment of balance sale consideration was lawful?

- Whether the Liquidator was justified in reducing the reserve price by 25%?

Decision of the Court

- The Supreme Court, while partially allowing the Appeal, upheld the validity of the auction process conducted by the Liquidator.

- The Supreme Court observed that Clause 12 of Schedule I of the Liquidation Regulations was mandatory in nature as it prescribes a consequence for non-payment of sale consideration i.e. cancellation of the sale. While the liquidator does not have any power to condone the delay beyond 90 days, in the present case, the Supreme Court held that the successful bidder was entitled to an extension in terms of Regulation 47A inserted to balance the disruptions caused by the pandemic.

- The Supreme Court further upheld the reduction of reserve price by 25% being in accordance with Clause 4A of Schedule I under Regulation 33 of the Liquidation Regulations and observed that the advice of the SCC is not binding on the liquidator.

- However, considering the delay on the part of the successful bidder, the Supreme Court directed the successful bidder to pay an additional sum of 5 Crores which is 50% of the difference between the original liquidation value and the reserve price set for the second auction, as well as interest at 9% per annum on this amount from March 26, 2020, until the date of payment.

HSA Viewpoint

This judgement emphasises on the mandatory nature of payment

timelines prescribed under Clause 12 of Schedule I of the

Liquidation Regulations. Even while granting the benefit of

Regulation 47A, the Supreme Court directs the Successful Bidder to

pay interest for failure to meet the timelines prescribed under the

Liquidation Regulations..

Vijay Kumar Singhania v Bank of Baroda & Ors. [NCLAT, New Delhi]

Judgement dated December 12, 2023 [Comp App (AT)(INS) No. 1058 of 2023], as upheld by the Supreme Court in Civil Appeal (Diary No.) 5768 of 2024 vide Order dated August 14, 2024

Background facts

- This appeal has been preferred by the suspended director of Cygnus Splendid Limited (Corporate Debtor) challenging the CIRP admission order passed by the NCLT, New Delhi.

- Briefly, the Corporate Debtor obtained loan facilities from Bank of Baroda (BoB), however, failed to maintain financial discipline and was declared as NPA on 13.03.2017.

- Thereafter, BoB initiated recovery proceedings under the SARFAESI Act, 2002. In the meanwhile, the Appellant submitted a One Time Settlement with the bank on several occasions, but to no avail.

- Later, the BoB filed a Company Petition under Section 7 of the IBC against the Corporate Debtor. The NCLT, New Delhi after examining the documents placed by the BoB admitted the Company Petition filed and initiated CIRP in respect of the Corporate Debtor.

- The Appellant inter-alia argued that BoB has not adhered to the Insolvency and Bankruptcy Board of India (Information Utilities) Regulation, 2017 (IU Regulations) as it has neither submitted information of default to the Information Utilities (IU) nor any authentication of default has been obtained from the IU.

- The Appellants also argued that no debt is due and payable to the BoB as the Corporate Debtor has a counter claim against the BoB, which is pending before the Debt Recovery Tribunal.

- On the other hand, the Respondent Bank argued that the Appellant having acknowledged the debt and having taken efforts to settle the same cannot be allowed to contend that there is no debt or default. Further, the no provision under the IBC or its attendant regulations provide that the record of default issued by the IU is mandatory for admission of a Section 7 Petition.

Issue at hand?

- Whether it is mandatory for Financial Creditor to file information of default with the IU?

- Whether an application filed under Section 7 of IBC, without obtaining an authentication of default under Regulation 21 of the IU Regulations, maintainable?

- Whether a counter claim or pending money suit has any bearing on the initiation of CIRP under section 7 of the IBC?

Decision of the Tribunal

- The NCLAT dismissed the Appeal filed by the Appellant and upheld the CIRP admission Order passed by the NCLT.

- The NCLAT noted that Section 7(2) provides that Financial Creditor shall make an application under sub-section (1) in such form and manner and accompanied with such fee as may be prescribed. Further, Section 7 (3) provides that the financial creditor shall, along with the application furnish record of the default recorded with the IU or such other record or evidence of default as may be specified. Section 7(3)(a) of the IBC deals with record of the default recorded with the IU or such other record or evidence of default as may be specified.

- The NCLAT further noted that Regulation 2A of the CIRP Regulations and Rule 4 of the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016 (AAA Rules), which states that for purposes of proving a default, a Financial Creditor is entitled to furnish certified copies of entries to the relevant account in the bankers' book as defined in clause (a) of Section 2 of the Bankers' Book Evidence Act, 1891 which is one of the evidences mentioned for proving the default.

- The NCLAT further noted Regulation 20 of the IU Regulations as amended w.e.f 14.06.2022, which require that before filing an application to initiate CIRP, the creditor shall file the information of default, with the IU and the IU shall process the information for the purpose of issuing record of default in accordance with Regulation 21.

- The NCLAT also noted that there is no consequent amendment in Section 7 of the IBC which empowers Financial Creditor to file record of the default recorded in the IU or such other record and default as may be specified.

- The NCLAT, after making note of the above Rules and Regulations, observed that statutory scheme contemplates furnishing record of default by the Financial Creditor as recorded with the IU or such other record or evidence of default as may be specified.

- The NCLAT held that a record of default recorded with the IU is not the only document which has to be furnished by Financial Creditor and a Financial Creditor is at liberty to submit such other record of default as may be specified.

- In so far as the counter claim is concerned, the NCLAT observed that mere disputing the debt by the Corporate Debtor is not relevant for the purposes of Section 7 Petition and when debt and default is proved, a Section 7 application has to be admitted. Accordingly, it was held by the NCLAT that filing of counter claim or money suit shall not absolve the Appellant from its liability to discharge its debt. If a financial debt is due and default is committed by the Corporate Debtor, proceedings under Section 7 can be initiated.

HSA Viewpoint

This judgement harmonises the provisions of IU Regulations, CIRP

Regulations and the AAA Rules to clarify that it is not mandatory

for a financial creditor to file an information of default with the

IU, for the purposes of filing a Section 7 Petition against a

Corporate Debtor.

Asha Chopra & Ors. v M/s Hind Motors India Ltd – NCLAT, New Delhi

Judgment dated August 29, 2024 [Company Appeal (AT)(INS) No. 1425-1428 of 2024]

Background facts

- This Appeal was preferred by alleged depositors of the Corporate Debtor challenging Order dated 31.05.2024 passed by the National Company Law Tribunal, Chandigarh Bench (NCLT, Chandigarh) whereby the NCLT, Chandigarh inter alia dismissed their application filed under Section 12A seeking direction to call meeting of Committee of Creditors (CoC) in terms of Regulation 30A of the CIRP Regulations. The Appellants also challenged the sale process conducted by the Liquidator by way of separate applications. However, while dismissing the application before it, the Ld. NCLT, Chandigarh observed that an Application under Section 12A is not maintainable during liquidation process.

- The Appellants argued that the NCLT, Chandigarh committed an error in holding that Section 12A application was not maintainable in the liquidation proceedings. They placed reliance on the judgement passed by NCLAT, New Delhi in V Navneetha Krishnan' Vs. `Central Bank of India, Coimbatore & Anr., 2018 SCC OnLine NCLAT 904 to submit that a 12A application is maintainable even in a Liquidation Proceeding.

- The Appellant further argued that the Liquidator is proceeding to sell the assets of the Corporate Debtor without constituting a Stakeholders Consultation Committee (SCC) as required in terms of Insolvency and Bankruptcy Board of India (Liquidation Process) (Second Amendment) Regulations, 2022 (Second Liquidation Regulations Amendment) and therefore the Sale Notice deserves to be set aside.

- On the other hand, the Liquidator submitted that Application under Section 12A is not maintainable during Liquidation Process. Further, since the Liquidation commencement order was passed on 12.09.2017, before coming not force of the Second Liquidation Regulations Amendment, the Second Liquidation Regulations Amendment will not be applicable on the facts of the present case.

Issue at hand?

- Whether an Application for withdrawal of CIRP under Section 12A is maintainable after commencement of Liquidation Proceedings?

- Whether the Second Liquidation Regulation Amendment is applicable to the Liquidation processes which commenced prior to coming into force of this Amendment?

Decision of the Tribunal

- The NCLAT dismissed the Appeals holding that an Application under Section 12A of the IBC is not maintainable after the commencement of liquidation process.

- The NCLAT observed that a Liquidation Order is passed under Section 33 of IBC either when no resolution plan is received before the expiry of CIRP or when the Resolution Plan received under Section 30 (6) is rejected.

- The NCLAT noted that Section 12A contemplates withdrawal of the Application with the approval of the 90% voting share of the CoC. However, as per the scheme of IBC, the CoC exists only during the period of CRIP and ceases to be in operation after passing of an order of liquidation under Section 33.

- The NCLAT, differentiating the facts of the judgements relied upon by the Appellant, observed that the scheme of liquidation do not contemplate for withdrawal under Section 12A. Rather, the scheme of Liquidation provides for compromise or arrangement under Regulation 2B of the Liquidation Regulations.

- Further, in so far as applicability of Second Liquidation Amendment Regulations is concerned, the NCLAT observed that Regulation 31A of the Liquidation Regulations did not require constitution of SCC with regard to the Liquidation processes which commenced prior to the provision for SCC, which is clarified in the statute itself by way of explanation to Regulation 31 A.

HSA Viewpoint

This judgement rightly creates a distinction between the CIRP and

Liquidation processes under the IBC and clarifies that the only way

of settlement during a liquidation process is compromise or

arrangement under Regulation 2B of the Liquidation

Regulations.\

Resolution of Lanco Amarkantak Power Ltd

- The NCLT, Hyderabad bench (NCLT) vide Order dated August 21, 2024 approved the Resolution Plan submitted by M/s Adani Power Ltd (SRA), in the CIRP of Lanco Amarkantak Power Ltd (Corporate Debtor), undergoing CIRP in terms of Order dated September 05, 2019 passed by the NCLT.

- Pertinently, the Corporate Debtor is an entity of the Lanco Group incorporated to undertake a coal fired thermal based project.

- Pursuant to the initiation of CIRP, the Resolution Professional constituted CoC for the Corporate Debtor and published Form – G inviting Expression of Interest (EOI) on November 18, 2019 from prospective resolution applicants (PRAs).

- The RP received a total of eleven (11) EOIs out of which, only two PRAs submitted their resolution plans for the Corporate Debtor. However, these Resolution Plans were rejected by the CoC and a fresh Form G was issued by the Resolution Professional on January 25, 2022.

- Pursuant thereto, the Resolution Professional received eleven

(11) EOIs out of which, the following three PRAs submitted their

resolution plans for the Corporate Debtor.

- Adani Power Ltd (APL/SRA)

- Reliance Industries Ltd

- Consortium of PFC Projects Ltd and REC Ltd (PFC Consortium)

- After deliberation, the resolution plans submitted by the above PRAs were put to vote and the PFC consortium was declared as the successful resolution applicant for the Corporate Debtor and an application under Section 30(2) was filed before the NCLT. The approval of resolution plan was objected by certain members of the CoC on the grounds of mechanism of distribution, liquidation value, etc and an appeal was preferred before the NCLAT.

- Later, APL issued a letter offering a higher resolution amount for the Corporate Debtor. Consequently, an application was preferred before the NCLT seeking permission to consider eligible offers and conduct fresh challenge process, which was allowed by the NCLT.

- Pursuant to a fresh challenge process, APL was declared as H1 bidder. The CoC also examined the feasibility and viability of the Resolution Plan submitted by APL and approved the Resolution Plan of APL by 95.40% voting share.

- Consequently, the Resolution Professional issued a Letter of Intent to APL which was unconditionally accepted and a performance security by way of bank guarantee amounting to INR 100 Cores was submitted by APL.

- The Resolution Plan proposes a total financial outlay of INR 4101 Crores as against the admitted debt of INR 15190.13 Crores. Notably, the entire sum of INR 4101 Crores is being paid to the Secured financial creditors of the Corporate Debtor having an admitted claim of INR 14631.71 Crores.

- It is relevant to highlight here that the Fair Value of the Corporate Debtor is INR 3632 Crores and the Liquidation Value of the Corporate Debtor is 2241 Crores.

- Pertinently, no avoidance transactions have been reported by the transaction auditor.

- An Implementation and Monitoring Committee comprising of a member of the CoC, one members of the SRA and the Resolution Professional shall be constituted in order to supervise the implementation of the resolution plan

- As regards the reliefs sought by the Corporate Debtor, the NCLT directed the SRA to approach the concerned authorities who shall pass necessary orders. With these above observations, the NCLT observed that the Resolution Plan meets the requirements of Section 30(2) of the IBC and Regulations 37, 38 and 39 of the CIRP Regulations and accordingly approved the Resolution Plan submitted by the SRA.

Resolution of Monarch Brookefields LLP

- The NCLT, Mumbai (NCLT) vide Order dated August 27, 2024 approved the resolution plan submitted by Planet Builders and Developers (SRA), in the CIRP of Monarch Brookefields LLP (Corporate Debtor), as unanimously approved by the CoC.

- Pertinently, the Corporate Debtor is a SPV formed by Monarch Universal Lifespaces Pvt Ltd and Mr. Gopal A. Thakur in the name and style of LLP for undertaking activities as Builders & Developers, Construction, developing and running of Hotels and Hospitality, etc and other ancillary business.

- CIRP in respect of the Corporate Debtor came to be initiated on September 27, 2019 and a Resolution Professional was appointed to manage the affairs of the Corporate Debtor. Pursuant thereto, the Resolution Professional received claims of INR 377.17 Crores out of which, claims amounting to INR 275.57 Crores were admitted by the Resolution Professional. Notably, the Corporate Debtor has only one secured financial creditor having a claim of INR 139.95 Crores and the remaining are creditors in a class having voting share of about 49.21%. No claims of Operational Creditors have been admitted by the Resolution Professional.

- The Resolution Professional published Form – G on

February 25, 2021 and April 29, 2021 inviting EOIs from PRAs. The

Resolution Professional received three (3) EOIs from the following

PRAs , who later submitted their respective resolution plans.

- Priyanka Regency Builders and Developers Pvt Ltd

- Planet Builders and Developers

- Nirvana Builders and Developers LLP

- The Resolution Plan submitted by Priyanka Regency was found to be non-compliant as per IBC and was rejected. Thereafter, on detailed discussions and deliberations, the CoC resolved to unanimously approved the resolution plan submitted by Planet Builders and Developers on November 17, 2021.

- The SRA proposed a financial outlay of INR 54.90 Crores as

against the admitted claims of INR 275.57 Crores in the following

manner.

- A sum of INR 1.50 Crores towards the CIRP Cost within 60 days.

- A sum of INR 12 Crores to the Secured Financial Creditors (in five tranches) within 730 days

- Delivery of Unit to homebuyer on payment of balance consideration.

- 60% refund to unauthorised shop owners.

- As per the approved Resolution Plan, any amount realised from the avoidance applications shall be credited to the benefit of the Corporate Debtor.

- Further, as per the approved resolution plan, a Monitoring Committee comprising of the Insolvency Professional, two representatives of the CoC and two representatives of the Resolution Applicant shall be constituted to supervise the implementation of the Resolution Plan.

- The NCLT, after taking note of the reliefs and concessions sought as per the settled position of law, the compliances under Section 29A of the IBC, Regulation 38 and 39 of the CIRP Regulations, approved the Resolution Plan submitted by the SRA for the Corporate Debtor.

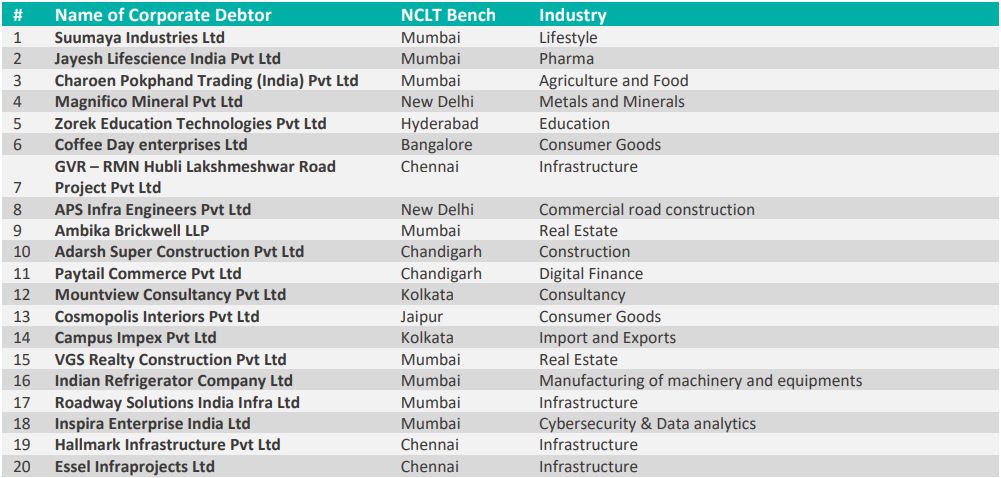

Companies admitted to insolvency

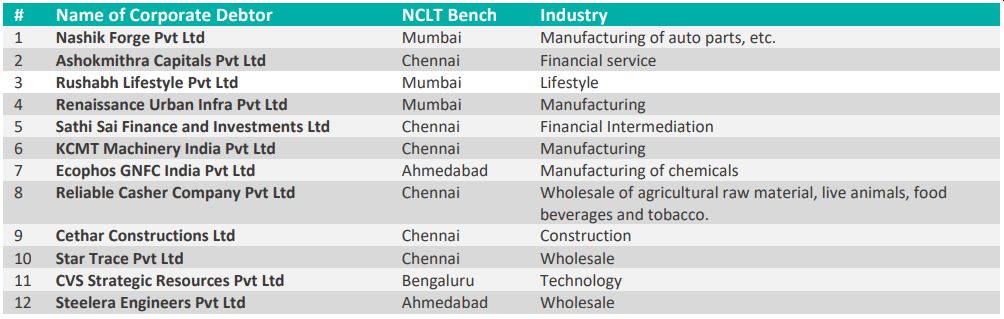

Companies admitted to liquidation process in the month of August 2024

Footnote

1. Discussion Paper on MSME Registration and Disclosure Framework under CIRP

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.