- in United States

- within Technology, Media, Telecoms, IT, Entertainment and Transport topic(s)

- with readers working within the Law Firm industries

Introduction

Non-Fungible Tokens or NFT's are a part of the multi-billion-dollar industry that seems to be growing steadily. NFT's have been around in the market for a few years now but have been introduced into the mainstream market in the recent years. They are unique or "one of a kind" digital assets that can determine ownership and assert value of an underlying digital asset such as an original image, video, or audio. NFT's are "minted" on these assets by using blockchain technology such as Ethereum and smart contracts such as Binance Smart Chain which create a unique digital signature thereby making them highly secure. NFT's are currently the digital treasure that opens portals to newer crypto audience. They have taken up the world with their growing economic, social as well as cultural importance. NFT's seem to be holding the "trend" market of these times as the digital assets have created the position of holding massive opportunities for renowned artists and creators to not only have more revenue for their art piece but also develop a new series of connections with the general public. It has also helped NFT's to garner a stronger response from creators and consumers alike.

According to a report by Reuters, the market for NFT was recorded to be $2.5 billion in the first half of 2020.1 NFT is a digital asset for whom the uniqueness can be determined using a high-end technology involving the Distributor Ledger Technology (DTL) that allows a simultaneous access and validation along with record updating. Since NFT's are largely a part of the "mint" collection, once in its mint formation they can neither be edited nor deleted. They are used as investments as well as collectibles and continue to generate business, investments, and consumer interests alike.

NFT's have gained a popular attraction towards themselves in the digital space by holding the potential to digitise the unique physical assets that they possess? If considered in respect of its principality, all physical assets should be tokenized as fungible tokens as they contain unique importance well in themselves? What has been noted in the cryptocurrency scenario is that that these NFT's can enable better commercialisation regarding the unique assets that are otherwise difficult to sell or hold ownership of. Even though there are many other digital assets, NFT's have time and again offered the potential to bifurcate ownership so that every purchaser of the NFT's, proportionally enjoy the benefit of the said underlying asset.

If we take a look at the start of these Digital Tokens, we go way back to the artist named "Beeple" who sold his artwork named, "Everydays: The First 5000 Days" for a breath-taking $69 million. Since then, we see a staggering growth in the NFT market wherein more and more people seem interested in investing and buying the original works of many artists alike.

Features of NFT

- NFTs are fundamentally different from cryptocurrencies such as Bitcoin which are indistinguishable and therefore, fungible in nature. The NFT's are exist-able on the blockchain wherein it can neither be copied nor manipulated. It also offers easier authentication to the people regarding its authenticity.

- "Fungibility"- is the ability of currencies or assets to be freely exchangeable because they are equivalent. For example, the value of a 100 rupee note will always be equal to the value of another 100 rupee note. Similarly, in cryptocurrencies, the value of one Bitcoin is equal to another Bitcoin. Conversely, each NFT is unique and different and therefore, they cannot be exchanged like-for-like2.

- Royalty collection - NFT's may come with an automated royalty generation system through smart contracts. Such technology would automatically transfer a pre-decided amount of the re-sale proceeds to the original creator of the asset.

- Originality - NFT's are designed to give the purchaser of the asset the claim for originality. Even though others can use the same picture, audio or video file, the artist has the rights to retain the copyright and also hold all the production rights just like any other physical assets. Example- Every person interested in buying a "Monet" print can have the freedom to do so, but only the one who has the original can control its ownership and enjoy all other rights.

Treatment of NFTs Globally

NFT's are appropriately traded globally as the DLT platforms usually operate better beyond the global borders. The main concern for many issuers and advisers usually consist of determining the legal and regulatory framework that appear across the jurisdictions. NFT's is also renamed as the play of the ultra-wealthy, whose sole purpose of investing into NFT's is in regard to the status symbols rather than a healthy investment. One of the concerns surrounding NFTs that has prompted the response of regulatory authorities around the world is the possibility of illegal activities that can be facilitated by the cryptocurrencies since they are anonymous. In fact, the Financial Action Task Force has expressed its concern over NFTs by acknowledging that it may facilitate money laundering or terrorist funding activities.

What investors around the world have believed, is that the NFT market is inundated with supply and speculations that allow them to earn money quickly. This has at times caused price volatility across nations. Even though it is hard to forge an NFT, what the general concern of the world lies is in the fact that NFT's are not free from foul play. There are bogus individuals who create several accounts to artificially inflate the said prices by using the "pump and dump" method. Countries have unitedly recognized that it is currently too soon to determine whether NFT's are a long-term investment or just a part of the "trend"3.

Investors have constantly advised individuals interested in blockchain trading that trends change too fast and create a lack of track record that add uncertainty as well as an unbalance in the market. It is essential for people around the world to realise what these NFT's offer and exactly what value they hold. Others, define crypto assets as "a cryptographically secured digital representation of value or contractual rights that uses a form of distributed ledger technology and can be transferred, stored or traded electronically" under the Money Laundering Regulations, 2017. This means that dealing in activities involving cryptocurrency related properties would require registration.

Regulations in India

India is currently in the building process of creating strong NFT laws. According to a report by NASSCOM, it was reported that the Indian public sector has constantly supported and driven block-chain based businesses wherein more than half the country is involved. This might, however, change after passing of the Banning of Cryptocurrency & Regulation of Official Digital Currency Bill, 2019. The Bill prohibits mining, generating, holding, selling, dealing in, issuing, transferring, disposing of or using Cryptocurrency in India under Section 3. "Cryptocurrencies" are defined under the Bill as "any information or code generated through cryptographic means that is not a part of any Official Digital Currency and provides a digital representation of value which is exchanged with the promise or representation of having inherent value in any business activity which may involve risk of loss or an expectation of profits or income, or functions as a store of value or a unit of account and includes its use in any financial transaction or investment, but not limited to, investment schemes. Since NFT's do provide a digital representation of an inherent value, they may possibly fall under "cryptocurrencies".

However, in 2018, the Supreme Court in Internet and Mobile Association of India v. RBI,4 held that the RBI circular dated 06.04.2018 prohibited national/ scheduled/co-operative banks and NBFCs to deal in virtual currencies. Along with various other reasons, the Court acknowledged that the Inter-Ministerial Committee constituted on 02-11-2017, which initially recommended a specific legal framework including the introduction of a new law namely, Crypto-token Regulation Bill 2018, was of the opinion that a ban might be an extreme tool and that the same objectives can be achieved through regulatory measures. In light of this, the current legal position of NFTs is that they are not prohibited under the Indian law.

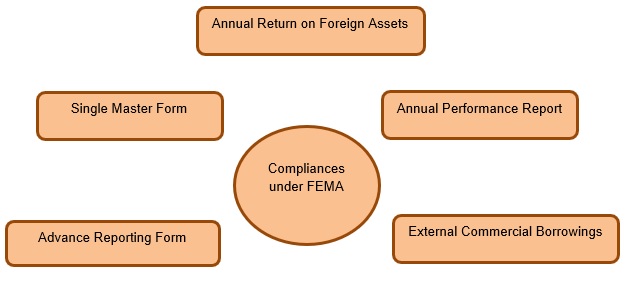

- FEMA Laws pertaining to NFT's — As discussed above, NFT's have not yet been governed by any specific act in India but there are a few specific FEMA laws that do prevent crypto-trading. Even if allowed the laws for crypto-trading or NFT's would depend solely on how the assets in question have been treated in relation to ownership. Lawmakers will have to keep in mind that Bitcoin or NFT's although are unique items, they in no way act as a means of exchange. FEMA laws have time and again acted as the controller of the flow of currency across Indian Borders. If we review the existing FEMA laws, crypto assets should be rendered as intangible assets such as software property and the intellectual property's so protected by FEMA regulations. We as by-standers have to realize that majority of the buyers and sellers for NFT are located outside the borders of India, thus participants from India are often seen making cross border transfers outside the country to invest in this new upcoming market so popularly known as "NFT". We could safely say that the position of NFT in the Indian market is in an ambiguous position. If the participants from India do continue to invest in the crypto-market they must do so through fiat currencies that are reported to their authorized dealer banks to have a more risk averse approach.

- Intellectual Property and NFT — Since NFT's are digital tokens minted on an underlying digital asset, the question arises that whether the owner of a NFT has ownership or copyright over the asset upon which the NFT is minted. This question is answered in the negative as experts point out that NFTs do not grant copyright privileges and the buyer is only vested with ownership of the digital asset much like a painter continues to enjoy copyright of his work even after the physical painting is sold to a buyer.5 Therefore, unless the owner expressly transfers his copyright through assignment or licence under the Copyright Act, the buyer cannot claim copyright over the asset. Further, the digital asset owned by a buyer is also protected under the Copyright Act from unauthorised reproduction or distribution. Section 14 of the Copyright Act6 gives the owner of a work the right to reproduce or distribute copies of his work. Hence, unless the smart contract between the buyer and the owner does not envisage resale or reproduction of the digital asset, any such acts would attract the provisions of the Copyright Act.

- NFT and the Income Tax Act – With the introduction of the Finance Act, 2020 a non-resident "e-commerce operator" is required to pay 2% equalisation levy the amount of consideration received or receivable by him. "E-commerce operator" is defined under the Act as a non-resident who owns, operates or manages digital or electronic facility or platform for online sale of goods or provision of services or both, facilitated by the e-commerce operator. This will be applicable if such goods and services are provided to a resident of India, to a person who buys such goods or services or both using internet protocol address located in India and in certain circumstances to a non-resident as well. According to this, foreign entities engaged in selling NFTs will be required to pay the equalisation levy if they want to operate in India.7

- Cross border NFT transactions8 – Currently there exists no general rule that regulates cross-border NFT transactions. As suggested by experts, NFT's may come under the Foreign Exchange Management Act ("FEMA") as "intangible assets". If they are classified as intangible assets then it would be essential to determine their location as they are backed up by cryptocurrencies, which are acknowledged to be "global-ledgers", that is, the data is recorded, shared, and synchronized across multiple data stores, or through a distributed network of different network participants.9 This will make it difficult to associate a location with the NFT.

Conclusion

A key valuable proposition of the Non-Fungible Tokens is their constant need to be authentic and unique. As we've come to know NFT's are a part of the growing market and seem to be a trend-setter for the new generation that seems invested into the idea of trading over cryptocurrencies. The global market has seen a huge rise in the trends of investing into NFT's and has left its impact on the Indian market as well. India on the other hand as a developing nation has started looking at its laws that might require a few amendments to fit the block in.

Footnotes

1 Dragos.I. Musan, "NFT-finance Leveraging Non-Fungible Tokens", (June 15, 2020), available at https://www.imperial.ac.uk/media/imperial-college/faculty-of-engineering/computing/public/1920-ug-projects/distinguished-projects/NFT.-finance-Leveraging-Non-Fungible-Tokens.pdf , (p.141), (last accessed on 19th October, 2021).

2 Boggiano Kristin, "FAFT Guidance on NFT". (April 12,2021) available at https://www.law.com/legaltechnews/2021/04/12/fatf-guidance-of-nft-defi-and-digital-assets-void-for-vagueness/ last accessible on 20th October 2021.

3 National Law Review, "Taxing Non Fungible Tokens", ( May 4, 2021) available at https://www.natlawreview.com/article/taxing-non-fungible-tokens-nfts , last accessible on 20th October, 2021

4 2019 SCC OnLine SC 1800

5 Rishikaa, "The Nifty Affairs Of NFT's And Copyrights", (July 15,2021) available at https://sc-ip.in/2021/07/15/the-nifty-affair-of-nfts-and-copyright/?utm_source=Mondaq&utm_medium=syndication&utm_campaign=LinkedIn-integration , last accessible on 20th October,2021

6 Act 14 of Copyright Act,1957 as amended up to Act 33 of 2021

7 Meyappan N, The status and future of NFTs and crypto art in India (April 08, 2021) available at https://economictimes.indiatimes.com/tech/catalysts/the-status-and-future-of-nfts-and-crypto-art-in-india/articleshow/81970883.cms last accessible on 20th October,2021

8 Ferdinand Regner, NFTs in Practice – Non-Fungible Tokens as Core Component of a Blockchain-based Event Ticketing Application, (December,2019) available at https://www.researchgate.net/publication/336057493_NFTs_in_Practice_-_Non-Fungible_Tokens_as_Core_Component_of_a_Blockchain-based_Event_Ticketing_Application, last accessible on 20th October,2021

9 K. Parikshit Arvindan Calculating the overlap between Blockchain Technology and Non Fungible Tokens. (21st July2021) (Jus Corpus Law Journal) (ISSN 2582-7820) available at https://www.juscorpus.com/wp-content/uploads/2021/07/69.-K.-Parikshith-Arvindan.pdf , last accessible on 20th October,2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.