The recent approval of the Code on Social Security, 2020 (CoSS) is part of the government's efforts to streamline India's labour laws by replacing multiple, and often outdated, regulations with a relatively more simplified set of rules. With the enactment of the CoSS, the government has set the ball rolling to extend universal social security to employees and workers in the organized, unorganized and other sectors. The CoSS, which was first introduced in the Lok Sabha in 2019, was subsequently referred to the Standing Committee on Labour for review. The Committee made 233 recommendations, of which 174 were included in the 2020 Code.

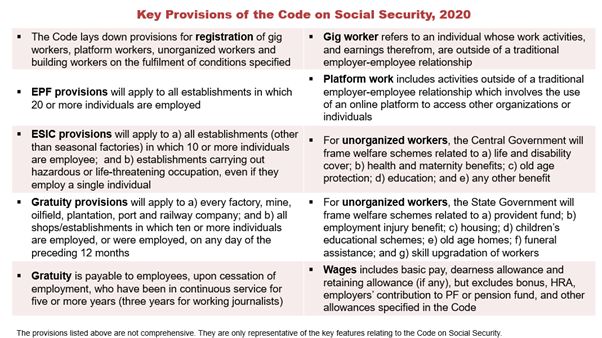

Among the most notable provisions of the CoSS is the expansion of social security coverage to include gig workers, platform workers, unorganized workers and fixed-term employees. The extension of welfare benefits to gig/platform workers is an important move considering that so far, they have not been covered under any legislation since their relationship with aggregators is not that of a typical employer-employee one. Aggregators will need to contribute 1%-2% of their annual turnover to a Gig and Platform Workers' Social Security Fund. The total contribution will be capped at 5% of the amount payable by aggregators to gig/platform workers.

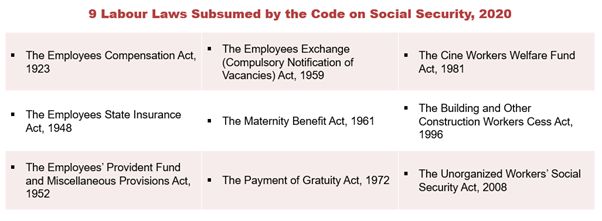

The CoSS subsumes nine labour laws related to social security and welfare:

The code proposes the constitution of various social security organizations, including:

- Board of Trustees of Employees' Provident Fund (EPF): To administer schemes related to EPF, EPS (Employees' Pension Scheme) and EDLI (Employees' Deposit Linked Insurance)

- Employees' State Insurance (ESI) Corporation: To administer ESI schemes

- National Social Security Board and State Unorganised Workers' Board: To administer schemes related to unorganized workers

- State Building Workers Welfare Boards: To administer schemes covering building workers

Much like the other labour laws – the Occupational Safety, Health and Working Conditions (OSHWC) Code and the Industrial Relations (IR) Code – which were enacted recently, the CoSS suffers from a high level of ambiguity. The wordings of many provisions, as well as their process of implementation, are open-ended.

It is not wrong to expect that a new labour law, enacted after much deliberation, will lay down specific provisions with regard to a critical aspect – workers' welfare and social security. Unfortunately, the CoSS falls short in many places. In the case of unorganized workers, for instance, the Code provides that the "Central Government shall formulate and notify, from time to time, suitable welfare schemes" relating to certain matters and "any other benefit as may be determined by the Central Government."

There are similar ambiguities with respect to the funding of schemes. Using the same instance of welfare schemes for unorganized workers, the Code provides that any such scheme notified by the government may be funded through one or more means, including combinations of partial funding by central and state governments, contributions from scheme beneficiaries or their employers, and even tapping into corporate social responsibility funds. Such ambiguity not only leaves room for potential misuse of the provisions but also raises doubts on how effectively such schemes will be implemented and managed.

Although the CoSS has provided separate definitions for gig workers, platform workers and unorganized workers, there are cases (example: drivers working simultaneously with multiple ride-sharing aggregators) when these definitions will overlap, since the same individual will meet the criteria of one or more of such categories of workers. In such a case, it is unclear which of the schemes under the Code will apply to them. There are also concerns that while the provisions under the CoSS will benefit gig workers, it will increase costs for aggregators – the latter may pass on the increased cost by deducting an equivalent amount from gig workers' remuneration.

The consolidation of nine different labour laws presented a significant opportunity to streamline complex bureaucratic processes and make it easier for social security and welfare benefits to be disseminated. It appears that the opportunity has been squandered. Instead of being entrusted to an apex body, various welfare schemes will continue being administered by different social organizations (as enumerated above). Such a disjointed setup is almost the same as what was in place earlier.

India's erstwhile social security ecosystem, particularly the pension and provident fund schemes, have been criticized for being too narrow in their coverage, thereby overlooking the interests of the most vulnerable populations. The CoSS has to evolve into an all-inclusive legislation to address previous shortcomings and ensure welfare in its truest sense.

A key criticism of retirement savings schemes such as provident and pension funds was that their coverage extends predominantly to workers in the organized sector. However, an overwhelming majority of India's workers are in the unorganized sector. While it can be claimed that the CoSS extends coverage to unorganized, gig and platform workers, there is still a lack of clarity on the type of benefits which will be available to the informal workforce. The provisions currently laid down are quite broad-based; moreover, the central and state governments have been given the power to formulate and notify schemes from time to time. This, in a way, defeats the very purpose of having a specific legislation.

What India needs is a comprehensive law which is broad-based and considers ground realities. The CoSS has largely taken existing social security laws and consolidated them into a single legislation, with the earlier Acts becoming chapters in the recently enacted Code. While this effort at simplification is a good first step, there is still a lot of ground to be covered to make the CoSS an all-inclusive legislation which guarantees minimum social security, removes administrative loopholes and lays down rules which are free from ambiguity. This calls for a radical shift in the way such a law (or any labour law) is drafted so that it can be considered truly universal.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.