Manish Tully

Associate Partner, Vaish Associates Advocates

Tel: +91 9810364682, 011-42492513

A: Background

India has always encouraged foreign players to enter its domestic market. This drive has gained significant momentum with the launch of the 'Make in India' program by the Government of India. According to World Investment Report 2020 by United Nations Conference on Trade and Development ("UNCTAD"), India ranked as the 9th largest recipient of foreign direct investment in 20191.

According to most recent statistics released by the Reserve Bank of India ("RBI"), net foreign direct investment inflows into India as of August 2020 (for the year 2019-2020) stands at USD 43013 million2.

Whenever a foreign entity proposes to enter India for establishing their place of business, the foremost question is: which entry route can a foreign entity/ body corporate could consider? There are various forms in which business can be conducted by a foreign entity in India. These include:

(a) by incorporating a company through establishing a joint venture, or a wholly owned subsidiary; or

(b) by incorporating a limited liability partnership; or

(c) by establishing an office, which could, based on their requirements, could either be: (x) a branch office; or (y) a liaison office; (z) a project office.

In this document, we will principally cover the broad legal requirements for establishment of branch or liaison or project office in India by foreign entities, related compliances under Foreign Exchange Management Act, 1999 ("FEMA") and Companies Act, 2013 ("CA 2013") and the closing down of such offices.

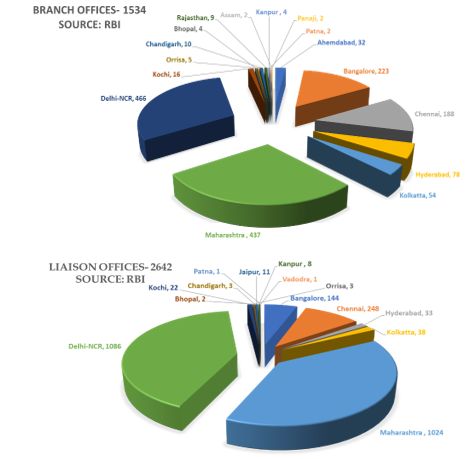

First, an insight into the number of branch and liaison offices India and their concentration in different states of India can be gained from the following data:

The aforesaid pie-charts indicate that branch and liaison offices are primarily concentrated in Delhi, Maharashtra, Chennai, and Bangalore (Bengaluru). Furthermore, from the data available on the website of RBI, it is noted that entities from USA have largest number of branch and liaison offices in India, followed by United Kingdom, Singapore, Germany, China, Japan, and Hong Kong.

B: Applicable Regulations

FEMA: Following are the relevant regulations under FEMA which regulate establishment and operations of the branch, liaison, and project offices in India:

(a) FEMA 22(R)/ 2016-RB, dated 31.03.2016: Foreign Exchange Management (Establishment in India of Branch Office or Liaison Office or a Project Office or any other Place of Business) Regulations, 2016.

(b) Master Direction No. 10/2015-16 Dated 1-1-2016: Master Direction on Establishment of Branch Office (BO)/ Liaison Office (LO)/Project Office (PO) or any other Place of Business in India by Foreign Entities.

(c) Master Direction No. 18/2015-16 Dated 1-1-2016: Master Direction on Reporting under Foreign Exchange Management Act, 1999.

CA 2013: Following are the relevant sections of the CA 2013 that are also required to be complied with:

(d) Provisions given under Chapter XXII of CA 2013 which inter alia provides for the compliances to be undertaken by companies incorporated outside India in case they establish their place of business in India.

(e) Companies (Registration of Foreign Companies) Rules, 2014.

C: Definitions

To understand which route to take vis-à-vis a branch office, a liaison office, or a project office, it is imperative to look at the conceptual and legal differences between the three.

A branch office, in relation to a company, means any establishment described as such by the company. These are those establishments which carry on the same activity or business that their head office or holding company undertakes.

On the other hand, a liaison office is a place of business to act as channel of communication between the head office i.e., the foreign parent company and the entities in India but which does not undertake any commercial/ trading/ industrial activity, directly or indirectly and maintains itself out of inward remittances received from the parent company.

A project office is a place of business in India to represent the interests of the foreign company executing a project in India.

D: Permitted Activities

In the case of a Branch Office, following activities can be undertaken:

(a) Import and export of goods.

(b) Providing professional and consultancy services.

(c) Representing foreign shipping and Airline Company.

(d) Carrying out research work in the field in which parent company is involved.

(e) Promoting financial and technical collaboration between Indian company and the parent company or overseas group company.

(f) Representing the parent company and acting as buying/selling agent in India.

(g) Development of software and rendering IT services.

(h) Providing technical support to the products supplied by the parent company.

In the case of a Liaison Office, the following activities can be undertaken:

(a) Promoting export and import from/to India.

(b) Representing parent company / group company in India.

(c) Promoting technical and financial collaborations between parent/group companies and Indian companies.

(d) Communication channel between the parent company and Indian companies.

Other than the activities mentioned above, a liaison office is not permitted to undertake any business activity in India and is not allowed to earn any income in India. Since liaison office cannot undertake any type of commercial/ trading/ industrial activities, they are allowed to accept inward remittances from their parent company to meet their expenses in India.

Furthermore, a branch office is not permitted to undertake any manufacturing or processing activities in India. A branch office is also required to procure permission from the regulators each time any new activity is proposed to be undertaken in India. A branch office cannot expand its activities other than what has been expressly approved by the regulators.

E: Approval for setting up a Branch, Liaison and Project Office

There are two routes available to set up a branch, liaison, or project office: (a) approvals granted by Authorised Dealer Category-1 Bank ("AD Bank"); and (b) specific approval by RBI.

Approvals granted by AD Bank: They are allowed by RBI to grant approvals in all cases for establishing either branch, liaison, or a project office, unless the application falls under the category which requires specific approval of RBI.

Approvals to be granted by RBI in consultation with the Government of India: Any application from a person resident outside for opening of a branch, liaison, or a project office in India shall require prior approval of RBI (through its Delhi Office) in the following cases where:

(a) The applicant is a citizen of or is registered/incorporated in Pakistan.

(b) The applicant is a citizen of or is registered/incorporated in Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong or Macau and the application is for opening a liaison, branch or project office in Jammu and Kashmir, North East region and Andaman and Nicobar Islands.

(c) The principal business of the applicant falls in sectors relating to defence, telecom, private security and information and broadcasting. However, prior approval of RBI is not required in cases where Government approval or license/permission by the concerned Ministry/Regulator has already been granted. Furthermore, for opening a project office relating to defence sector, no separate reference or approval of Government of India shall be required if the said non-resident applicant has been awarded a contract by/ entered into an agreement with Ministry of Defence or Service Headquarters or Defence Public Sector Undertakings.

(d) The applicant is a NGO, Non-Profit Organisation, Body/Agency/Department of a foreign government (Note: if they are also covered under Foreign Contribution (Regulation) Act, 2010 (FCRA), they shall obtain certificate under FCRA and not under FEMA 22(R)).

It is important to note that the following do not require approval:

(a) Banking company resident outside India for establishing their office in India provided that such company has procured approval by the Department of Banking Regulation under Banking Regulation Act, 1949. No Unique Identification Number ("UIN") is required for such offices from the foreign exchange department.

(b) An Insurance company resident outside India for establishing their office in India provided that such company has procured approval from IRDA under Insurance Regulatory and Development Authority Act, 1999. No UIN is required for such offices from the foreign exchange department.

(c) Foreign company establishing a branch office in special economic zones to undertake manufacturing and service activities provided that:

. Such branch office is functioning in the sectors where 100% foreign direct investment is permitted.

. Such branch office complies with chapter XXII (Companies Incorporated outside India) of Companies Act, 2013.

. Such branch office functions on standalone basis.

F: Financial Conditions

Certain financial conditions are required to be fulfilled by the applicant for setting up either a branch or a liaison office. These are elaborated in Table 1:

Table 1:

|

Criteria |

Branch Office |

Liaison Office |

|

Profitability |

Applicant should be profitable in immediately 5 preceding financial years in the home country |

Applicant should be profitable in immediately 3 preceding financial years in the home country |

|

Net Worth* |

Applicant's net worth should not be less than USD 100,000 |

Applicant's net worth should not be less than USD 50,000 |

*Net Worth means total of paid-up capital and free reserves, less intangible assets, as per the latest Audited Balance Sheet or Account Statement, certified by a Certified Public Accountant or any Registered Accounts Practitioner by whatever name called.

Applicants who do not satisfy the eligibility criteria and are subsidiaries of other companies can submit a Letter of Comfort from their parent company, subject to the condition that the parent company satisfies the eligibility criteria as prescribed above.

G: Application Process

As given under the relevant provisions of FEMA, an entity / applicant looking to establish a branch, liaison or project office must undergo an application process, the details of which are given as follows:

Form: Form FNC, as prescribed under FEMA regulations must be filed with the AD Bank with whom the applicant wants to pursue its banking relations.

Accompanying Documents: Following documents are generally submitted along with the form:

(a) Copy of Certificate of Incorporation/ Registration of applicant, attested by Notary.

(b) Charter Documents attested by Notary.

(c) Audited balance sheet for last 3/5 years, for liaison and branch office, respectively.

(d) Banker's report from applicant's banker in the host country / country of registration showing the number of years the applicant has had banking relations with that bank.

(e) Power of attorney in favor of signatory of Form FNC in case head of overseas entity is not signing the Form FNC.

(f) Copy of the profile of the applicant containing description of its activities.

(g) Certificate from certified public accountant certifying that applicant's profit-making record since last 3 or 5 financial years and its net worth is not less than USD 50,000/ USD 100,000 for liaison and branch office, respectively.

(h) Letter from the applicant addressed to the AD Bank setting out in detail the (a) applicant's background ; (b) antecedents of promoters; (c) descriptive nature of activity of proposed branch/ liaison office and its location and (d) sources of funds (general information about sources of income of the applicant and proposed funding for the branch/ liaison office).

(i) Letter to AD Bank giving summary of the application and justification for establishing branch/liaison office.

(j) Letter of authority in favor of their legal counsel/consultant to handle their application process and interact with the regulators.

(k) Value of goods imported from or exported to India by the applicant in last three years.

(l) Particulars of any existing arrangements for representing applicant in India.

Note: Documents submitted with the application should be in English. In case the documents are in any other language, they should be translated in English by an authorized translator, duly notarized after translation, and must be cross verified by Indian Embassy/ Consulate in home country of the applicant.

The AD Bank will assess the application and check whether all the criteria stipulated under FEMA are complied with before forwarding their recommendation to RBI. Before issuing the approval letter, the AD Bank must forward a copy of the Form FNC along with the details of the approval proposed to be granted, to the Delhi office of RBI for allotment of UIN. After issuance of said UIN, AD Bank can then issue the final approval letter.

H: Standard Conditions for the Approval

The approval that is granted for establishment of either for a branch or liaison or project office, is generally subject to the following conditions:

(a) Once the approval is granted, the applicant must intimate to the AD Bank/ RBI as to the date on which branch, liaison or project office is setup.

(b) If office is not setup in six months from the date of the approval, the approval automatically stands lapsed.

(c) Validity period for a liaison office is generally three years, except in case of non-banking financial corporations, entities in construction and development sector, where the validity is two years.

(d) Validity for the project office is for the duration of the tenure of the project. RBI has now granted general permission to foreign entities to establish their project office, provided that they have secured a contract from an Indian company to execute a project in India and that the project is funded directly by inward remittance from abroad; the project is funded by a bilateral or multilateral International Financing Agency; the project has been cleared by an appropriate authority; a company or entity in India awarding the contract has been granted term loan by a public financial institution or a bank in India for the project.

I: Bank Accounts

The following tables concisely explains the comparative legal requirements regarding opening of bank accounts and permitted debits and credits from the bank accounts of branch, liaison, and project office:

Table 2:

|

Liaison Office |

Branch Office |

||

|

To open that bank account: Applicant to approach AD Bank |

|||

|

Can maintain only one bank account - No prior RBI Approval (To open more than one account, prior permission from RBI needs to be procured) |

|||

|

Permitted debits (Dr.) and credits (Cr.) |

|||

|

Permitted Dr. |

Permitted Cr. |

Permitted Dr. |

Permitted Cr. |

|

Only for meeting the local office expenses of the office |

Funds from head office for meeting office expenses |

Expenses incurred by branch office |

Funds from head office to meet office expenses |

|

Refund of security deposit paid from liaison office account or directly by head office |

Remittance of profits and winding up proceeds |

Legitimate receivables arising from business operations |

|

|

Refund of taxes, duties etc. paid from liaison office bank account |

|||

|

Sale proceeds of assets of liaison office |

|||

Table 3:

|

Project Office |

|

|

To open the bank account approval AD Bank is required |

|

Project office can have two foreign currency accounts- one denominated in USD and other in the home currency of the awardees of the project- but with the same bank |

|

|

Permitted debits (Dr.) and credits (Cr.) |

|

|

Permitted Dr. |

Permitted Cr. |

|

Payment for project related expenditure |

Foreign exchange receipts from project sanctioning authority |

|

Foreign exchange receipts from parent/ group company abroad or bilateral/ multilateral international financing agency |

|

|

The foreign currency accounts must be closed upon completion of the Project |

|

J: Post Establishment Compliances

Under FEMA: Following compliances are to be undertaken under FEMA:

(a) Registration with Police authorities: Entities from Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong, Kong, Macau and Pakistan shall have to register with the State Police authorities. Copy of approval letter for persons from these countries shall be marked by the AD Bank to the Ministry of Home Affairs, Internal Security Division - I, Government of India, New Delhi for necessary action and record. All other countries are exempted from registering with the State Police authorities.

(b) Reporting with Director General of Police ("DGP") : The aforesaid entities are required to submit a report in the prescribed format within five working days of their office becoming functional to the DGP of the State concerned in which such branch, liaison or project office is established.

Under CA 2013: Following compliances are to be undertaken under CA 2013:

(c) Filing of Form FC-1 within thirty days of the establishment of its place of business in India (u/s 380 of CA 2013 r/w Companies (Registration of Foreign Companies) Rules 2014. [Note: In this form foreign entity needs to give details of name and address of at least one person resident in India authorized to accept on behalf of the entity service of process and any notices or other documents to be served on the entity]

K: Annual Compliances

Under FEMA and its relevant Regulations/ Directions: Following annual compliances are to be undertaken under FEMA:

(a) Annual Activity Certificate ("AAC"): Submit AAC as at the end of March 31, along with the audited financial statements including receipt and payment account to AD Bank and a copy of the same to the Director General of Income Tax (International Taxation), Drum Shape Building, I.P. Estate, New Delhi 110002 on or before September 30 of every year.

In case the annual accounts of the branch, liaison, project office are finalised with reference to a date other than March 31, the AAC to be submitted along with the audited financial statements may be submitted within six months from the due date of the Balance Sheet

(b) Annual Report to Director General of Police: Annual Report in the format prescribed under Master Directions - Reporting under FEMA to be sent to DGP of the State where branch, liaison or project office is situated.

Under CA 2013: Following annual compliances are to be undertaken under CA 2013:

(c) Filing of Financial Statements: Every foreign company shall file with the Registrar of Companies the financial statement in e-Form FC 3, within a period of six months of the close of the financial year of the foreign company [u/s 381 of CA 2013 r/w Companies (Registration of Foreign Companies) Rules, 2014]. Along with this form, following documents are to be attached:

(i) Balance sheet and profit and loss account

(ii) Latest consolidated financial statements of the parent foreign company

(iii) Statement of related party transactions

(iv) Statement of repatriation of profits

(v) Statement of transfer of funds

(vi) List of all the places of business established by the foreign company in India as on the date of balance sheet

(d) Filing of Annual Return: Foreign Company shall prepare and file to the Registrar of Companies an annual return in e-Form FC 4, within a period of sixty days from the last day of its financial year [u/s 384 of CA 2013 r/w Companies (Registration of Foreign Companies) Rules, 2014].

L: Remittances of Profits/ Surplus

The following table gives an overview of remittances of profits or surplus for branch and project offices. As liaison office cannot undertake any business activities, the question of remittance of profits etc. by them does not arise.

Table 4:

|

Branch Office |

Project Office |

|

Permitted, net of taxes |

Intermittent remittances permitted pending winding up or completion of the project |

|

Following documents to be submitted with AD Bank: (i) Certified copy of audited balance sheet and profit and loss account for the relevant year. (ii) Chartered Accountant certificate certifying:

|

Following documents to be submitted with AD Bank: (i) Auditors/ Chartered Accountant Certificate confirming that a sufficient provision has been made to meet the liabilities in India including income tax (ii) Undertaking from the project office that remittance will not affect the completion of the project in India and that any shortfall of funds for meeting any liability in India will be met by inward remittances from abroad |

M: Closure of Branch, Liaison, Project Office, and transfer of assets

To close a branch, liaison, or a project office, a request for closure and remittance of winding up proceeds must be submitted to the AD Bank. For this purpose, following documents are to be submitted:

(a) Copy of approval letter.

(b) Auditors certificate indicating:

(i) the manner of arriving at remittable amount, supported by statement of assets and liabilities, indicating manner of disposal of assets.

(ii) confirming that all liabilities in India including gratuity and other benefits to employees have been fully met or adequately provided for.

(iii) confirming that no income accruing from sources outside India (including proceeds of exports) has remained unrepatriated to India.

(c) A confirmation from parent company/applicant that no legal proceedings are pending in any court in India against branch, liaison, or a project office and there is no impediment in remittances.

(d) Report from the Registrar of Companies confirming compliance with CA 2013 in case of winding up of branch or liaison office and all previous AAC have been filed.

Transfer of assets: Transfer of assets upon closure is permitted, provided that all compliances under FEMA have been duly carried out. In case, the operations of a branch, liaison, or project office is being closed by the non-resident entity, the AD Bank can allow transfer of their assets by way of sale to a joint venture or wholly owned subsidiaries. In this regard a certificate from the statutory auditory is required, furnishing the following details:

(a) Details of assets to be transferred - indicating their date of acquisition, original price, depreciation, present book value or written down value and sale consideration.

(b) confirmation that the assets have not been re-valued after their initial acquisition.

It must be ensured that:

(a) the sale consideration should not be more than their book value.

(b) the assets should have been purchased from inward remittances and no intangible assets such as goodwill, pre-operative expenses to be included.

(c) no revenue expense such as lease hold improvements incurred can be capitalized and transferred to joint venture/ wholly owned subsidiaries.

AD Banks must ensure that the payment of all applicable taxes in India while permitting transfer of such assets.

AD Bank may also permit the branch, liaison, or project office to donate their assets (like vehicles, computers, furniture and other office items) to a non-governmental organizations or other non-profit organizations, subject to the condition that AD Bank is satisfied with the bona fides of such a donation.

Footnotes

2.https://www.rbi.org.in/scripts/BS_ViewBulletin.aspx?Id=19755

© 2020, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.