- within Corporate/Commercial Law topic(s)

- with readers working within the Law Firm industries

- with Finance and Tax Executives

- with readers working within the Law Firm and Construction & Engineering industries

- in European Union

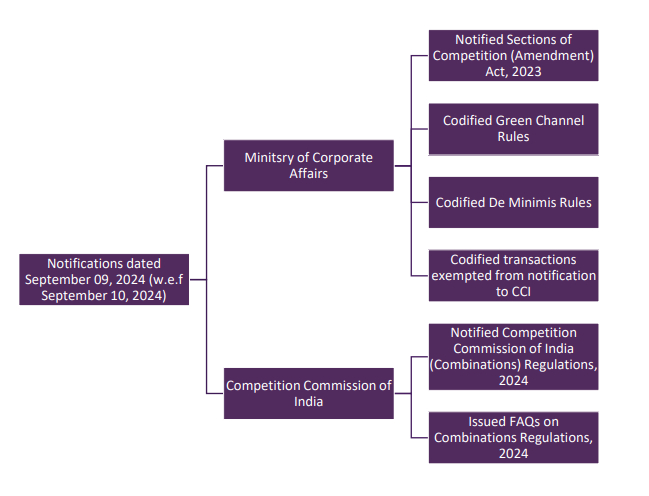

On September 09, 2024, the Ministry of Corporate Affairs, Government of India ("MCA") and Competition Commission of India ("CCI") overhauled the Indian merger control regime and brought in significant transformations. The MCA notified several provisions of the Competition (Amendment) Act, 2023 related to merger control in India and other rules related to Green Channel route, De Minimis thresholds, and transactions exempted from notification to the CCI.

Simultaneously, the CCI notified new Competition Commission of India (Combinations) Regulations, 2024 ("Combinations Regulations") repealing the old Competition Commission of India (Procedure in regard to the transaction of business relating to combinations) Regulations, 2011 ("Old Regulations"). In addition, the CCI also issued FAQs on Combinations Regulations. The notifications issued by the CCI as well as MCA have come into force with effect from September 10, 2024. For ease of reference, a snapshot of these notifications is provided below:

What provisions of the Competition (Amendment) Act, 2023 have been notified?

The Competition (Amendment) Act, 2023 was introduced in April 2023, and has been enforced in a staggered manner. The MCA on September 09, 2024, has finally notified the remaining provisions that are related to merger control. To ensure smooth enforcement of the changes introduced by the said amendment, the CCI simultaneously notified the new Combinations Regulations. To provide further clarification on the applicability of the new regime, the CCI also issued FAQs on Combinations Regulations. A summary of key changes introduced by the mentioned notification is outlined below:

Introduction of Deal Value Threshold – Section 5(d) of the Competition Act, 2002 (as amended in 2023) ("Competition Act")

- Deal value thresholds ("DVT") as per Section 5(d), includes any transaction in connection with acquisition of control, shares, voting rights or assets of an enterprise, merger or amalgamation:

-

- whose value does not exceed INR 2000 Crores (approx. USD 238 million / EUR 215 million); and

- the target enterprise has 'substantial business operations' in India.

- Introduction of deal value thresholds marks a significant shift

in the merger control regime, which will result in regulatory

scrutiny of high-value deals despite limited tangible assets or

revenues in India, unless are specifically exempted.

If a transaction requires a notification to CCI, such transaction must immediately observe standstill obligations (including at a global level) until CCI approval; else attract penalties for gun-jumping. However, transactions that were previously exempt, but now meet the DVT, and are either - yet to close or have been partconsummated, will not be fined for gun-jumping; but still require notification to CCI.

The DVT applies also for all transactions which are yet to fully close as on September 10, 2024, the effective date of Combinations Regulations. - Determination of 'Value of transaction' or 'Deal Value' for DVT:

-

- Includes every valuable consideration, direct or indirect, immediate or deferred, cash or otherwise and any other considerations stipulated under Regulation 4(1) of the Combinations Regulations.

- Definition of 'substantial business operations' – In terms of Regulation 4(2) of the Combinations Regulations, an enterprise (target) is deemed to have substantial business operations in India, if:

-

- The target provides digital services and has – (i) 10% or more of its global business users or end users in India; or (ii) a GMV in India of 10% or more of its global GMV in the 12 months preceding the relevant date; or (iii) a turnover in India of 10% or more of its global turnover in the preceding financial year; or

- Gross Merchandise Value ("GMV") of the target for the period of 12 months preceding the relevant date in India is – (i) 10% or more of its global GMV, and (ii) more than INR 500 Crores; or

- Turnover of the target during the preceding financial year in India is – (i) 10% or more of its total global turnover derived from all the products and services, and (ii) more than INR 500 Crores.

- 'Relevant Date' is to be reckoned as the date of (i) approval of the Target's Board to the proposal relating to merger or amalgamation; or (ii) execution of any agreement/document for acquisition or acquiring of control.

Revised definition of 'Control' – Explanation (a) to Section 5 of the Competition Act

- In line with the decisional practice of the CCI, the definition of 'control' now includes the aspect of 'material influence', in any manner whatsoever, over the management or affairs or strategic commercial decisions by one or more enterprises or groups (either jointly or singly) over another enterprise or group.

- Summarily, CCI's decisional practice over the years indicates that the acquisition of control may be achieved through - (i) Material Influence; (ii) De facto control; (iii) De jure control; (iv) Negative control; (v) Operational control.

No obligation to notify within 30 days under Section 6(2) of the Competition Act

- Earlier, the parties were under obligation to notify the CCI within 30 days from the date of approval of the proposed combination. However, this obligation has now been suspended and the parties are required to notify the CCI any time before consummation.

No standstill obligation for Open Offers etc. under newly inserted Section 6A of the Competition Act

- The parties may now implement – a) Open offers and b) acquisition of shares or securities convertible into other securities, through a series of transactions on a regulated stock exchange, before receiving an approval from the CCI, if:

-

- A notice of acquisition is filed within 30 days from the date of first acquisition of shares as per Regulation 5(4) of the Combinations Regulations; and

- In terms of Regulation 6 of the Combinations Regulations and Section 6A (b) of the Competition Act, the acquirer only avails economic benefits such as dividends or any distribution, bonus shares, buy-backs, stock-splits etc. and exercise voting rights only in relation to liquidation and/or insolvency proceedings.

Transition provision – Regulation 34 of Combinations Regulations

- Provisions of Section 6(2), Section 6(4), and Section 6A of the Competition Act are applicable to all transactions which will come into effect on and after September 10, 2024.

- Transactions closed prior to September 10, 2024, are not required to be notified.

- Transactions for which trigger event has occurred prior to September 10, 2024, but are not yet closed will have to be notified.

What clarifications have been accorded by the CCI via FAQs on Combinations Regulations?

The CCI in its FAQs has clarified that enterprises should re-assess if any of their unconsummated transactions which prior to September 10, 2024, were exempted under the old regime but are now notifiable as per the new regime. Such unconsummated transactions are to be notified to the CCI as per the new regime.

The CCI also clarified that no penalty for gun- jumping under Section 43A of the Competition Act will be levied on transactions which were partially consummated prior to September 10,2024.

What are the criteria for the Green Channel route?

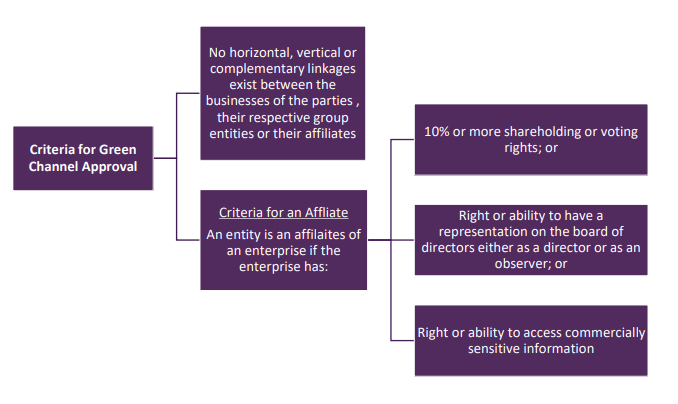

The Green Channel route, typically, allows parties to notify the CCI of a transaction, while dispensing with the waiting period for approval. The approval is deemed to be granted, on filing. A transaction will qualify for a filing under the Green Channel route if there are no horizontal overlaps, vertical linkages, or complementarity between the businesses of the acquirer and its group (including affiliates) vis-a-vis the target enterprise.

The MCA has notified Competition (Criteria of Combination) Rules, 2024 codifying the current criteria for the transactions notifiable under the Green Channel route. Though most part of the Green Channel Rules remain unchanged from the draft Rules published by CCI for public comments, the said rules have revised the criteria for an 'Affiliate'.

These Rules also affirm the CCI's existing practice that requires parties to map overlaps between the ultimate controlling person of the acquirer (and its affiliates) or its group vis-a-vis the target enterprise. The Indian merger control regime provides for an automatic / deemed approval of the CCI upon filing of the prescribed notice under Section 6(4) of the Competition Act. A snapshot of criteria for a transaction to qualify for an approval under Green Channel is provided below:

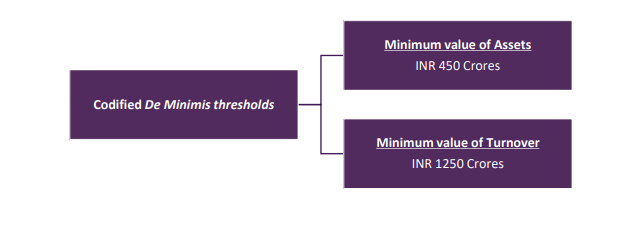

What are the codified De Minimis thresholds?

The MCA has notified the Competition (Minimum Value of Assets or Turnover) Rules, 2024 that codifies the already existing De Minimis thresholds as set out in MCA's notification dated March 07, 2024. Under the said rules, certain transactions falling within the stipulated thresholds are exempted from being notified to the CCI. These codified thresholds, in respect of target asset/target entity/merging entity/amalgamating entity, are stated below:

An exemption as per the De Minimis thresholds continues to be available if either the value of the assets or the turnover of the target company in India is below the prescribed threshold levels. However, the De Minimis exemption does not apply to transactions that qualify the DVT.

Which transactions have been exempted from notification to the CCI?

The Competition (Criteria for Exemption of Combinations) Rules, 2024 codifies categories of combinations that are exempt from being notified to the CCI, including exemptions for minority share acquisitions, intra-group transactions, bonus issues, stock splits and creeping acquisitions. Earlier, such exemptions were provided at schedule I to the Old Regulations which have been replaced by the new rules now. The transactions which stand exempted under the new rules are tabulated below:

Acquisition of shares in ordinary course of business (Rule 1 of the Schedule)

- Acquisition of unsubscribed shares by a registered underwriter or by a registered stockbroker, as the case maybe, not resulting in acquisition of 25% or more shares or voting rights of the target

- Acquisition of shares by a registered mutual fund, not resulting in acquisition of 10% or more shares or voting rights of the target.

Acquisition of shares/voting rights solely as an investment (Rule 2 of the Schedule)

- Exempted only if such acquisition does not entitle the acquirer to hold more than 25% of total shares or voting rights of the target or result in acquisition of control of the target.

- Meaning of 'solely as an investment' (Explanation at Rule 2 of the Schedule)Acquisition of shares/voting rights shall be treated as 'solely as an investment' when –

a) No right or ability is gained by the acquirer to have representation on the board of directors of the target either as a director or as an observer.

b) No right or ability is gained by the acquirer to access commercially sensitive information of the target.

c) No horizontal, vertical and complementary linkages exist between the acquirer, its group entities or its affiliates vis-à-vis the target, its downstream group entities or affiliate. In case such linkages exist, the acquisition should not lead to acquiring of 10% or more shares or voting rights of the target.

Acquisition of additional shares or voting rights (Rule 3, 4 & 5 of the Schedule)

- Acquisition of additional shares or voting rights of the target when the acquirer already holds not more than 25% of shares or voting rights (either prior or after the acquisition), exempted only when (Rule 3) –

a) No acquisition of control of the target occurs.

b) No right or ability is gained by the acquirer to have representation on the board of directors of the target, either as a director or as an observer.

c) No right or ability is gained by the acquirer to access commercially sensitive information of the target for the first time. However, if the acquirer already has a right or ability to have a representation on the board of directors as a director, then the parties are required to notify the CCI if any commercially sensitive information is being accessed for the first time.

d) In case there exist horizontal, vertical, or complementary linkages between the activities of the acquirer (including its group entities or affiliates) and the target (including its downstream group entities or affiliates), and if the incremental acquisition does not exceed 5% and the shareholding or voting rights of the acquirer does not result in an increase from less than 10% to 10% or more

- Acquisition of additional shares or voting rights when the acquirer or its group entities already holds more than 25% of the shares or voting rights of the target, but does not hold more than 50%, either prior or after the acquisition. Provided such acquisition does not result in change in control of the target. (Rule 4)

- Acquisition of shares or voting rights when acquirer or its group entities holds more than 50% of shares or voting rights of the target and the acquisition does not result in change in control of the target. (Rule 5)

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.