- within Corporate/Commercial Law, Tax and International Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Transport and Law Firm industries

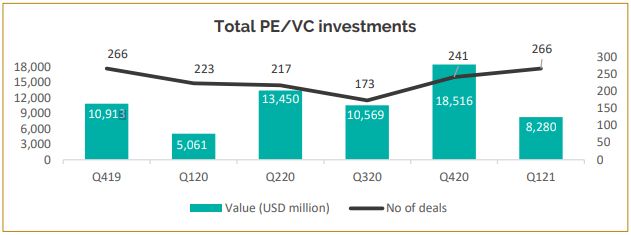

INVESTMENT AND DEAL ACTIVITY ANALYSIS

Q4 of FY 2020-21 witnessed a sequential month on month increase in PE/VC investment activity, from USD 1.6 billion in January 2021 to USD 4.6 billion in March 2021. On a year-on-year basis, investments grew by 64% in this quarter. There were 22 large deals aggregating to USD 4.8 billion, with pandemic resilient sectors like pharma, healthcare, edtech, online media, SaaS etc. continuing to see good traction in both value and volume of PE/VC deals.

PE/VC exits also picked up momentum in this timeframe with exits worth USD 4.2 billion, which is 70% of the total value recorded last year. The largest exit saw Alibaba, IFC and Abraaj sell their stake in Bigbasket for USD 1 billion to TATA group. The quarter also recorded 9 PE-backed IPOs, which is the highest quarterly number so far. Additionally, as of now, there are over 90 IPOs that have filed their DHRPs with SEBI of which more than 45 are PE-backed.

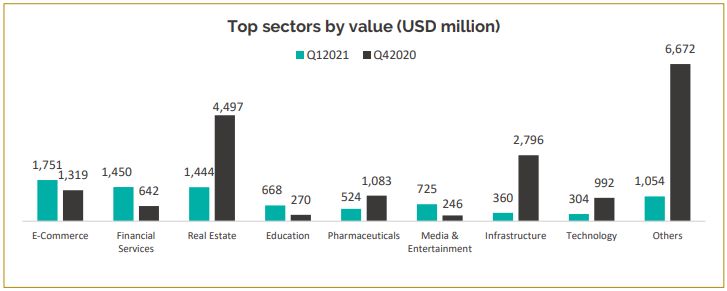

From a sectoral perspective, e-commerce was at the top (USD 1.8 billion across 45 deals), which represents the highest quarterly value of investments in this sector in the past five quarters, followed by real estate (USD 1.4 billion across 18 deals) and financial services sector (USD 1.4 billion across 50 deals).

E-commerce has emerged as new IPO intense sector wherein six companies have filed their DHRPs including Zomato, Nykaa and Grofers. If these companies see favorable investor interest, a significantly higher number of companies from the e-commerce sector could follow through.

Source: IVC Association and Ernst & Young Monthly PE/VC Roundup, April 2021

The encouraging build up in PE/VC investment and exit activity in this quarter saw some levelling-off towards the later part of March 2021 in light of the resurgence of the pandemic and fresh concerns regarding sustained economic recovery. which could endanger the recovery underwriting thesis. Investors could turn cautious till more clarity emerges on government response to the second wave.

Source: IVC Association and Ernst & Young Monthly PE/VC Roundup, April 2021

RELAXATIONS MADE TO THE DEFINITION OF LISTED COMPANIES

The Central Government has introduced multiple measures aimed at improving the ease of doing business in India. In line with this intention, a significant set of amendments were made to the Companies Act, 2013 (Companies Act) through the Companies (Amendment) Act, 20201 (Amendment Act 2020).

One such amendments aim to tweak the definition of a listed company. As result, a proviso has now been added under Section 2 (52) of the Companies Act which deals with definition of listed companies. As per the proviso, the Central Government may, in consultation with the Securities and Exchange Board of India (SEBI), exclude from the definition of listed companies, certain classes of companies which have listed or intend to list a prescribed class of securities on any recognized stock exchange. This amendment was also suggested by the Company Law Committee in November 2019.

Amendment Act 2020 and its implications

Earlier, as per Section 2(52) of the Companies Act, the definition of a listed company referred to any company which has its securities listed on a recognized stock exchange. The definition for securities is provided under the Securities Contract Regulation Act, 1956 (SCRA 1956). As per Section 2(h) of SCRA 1956, a security includes shares, scrips, stocks, bonds, debentures, debenture stock or any other marketable security.

As a result of the inclusive definition under the SCRA 1956 and Companies Act, private limited companies which had their debt securities listed on a stock exchange were compelled to follow the compliances applicable to the listed companies (viz., adhere to norms such as filing of returns, maintenance of records, appointment of auditors, appointment of independent director and women director, constitution of board committees, etc.), which are subject to more stringent requirements as compared to unlisted companies.

However, with effect from 1 April 2021, as per Section 2(52) the Companies Act read with the newly inserted Rule 2A of the Companies (Specification and Definition Details) Rules, 2014, following classes of companies will now be excluded from the definition of listed companies:

- Public companies which have not listed their equity shares on a recognized stock exchange but have listed non-convertible debt securities issued on private placement basis in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008, and/or non-convertible redeemable preference shares issued on private placement basis in terms of SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013

- Private companies which have listed their non-convertible debt securities on private placement basis on a recognized stock exchange in terms of SEBI (Issue and Listing of Debt Securities) Regulations, 2008

- Public companies which have not listed their equity shares on a recognized stock exchange but whose equity shares are listed on a stock exchange in a foreign jurisdiction as specified in sub-section (3) of section 23 of the Companies Act

As a result of the Amendment Act 2020 and w.e.f. April 1, 2021 the above-mentioned companies will now benefit from a major compliance relief such as filing of returns, maintenance of records, appointment of auditors, appointment of independent director and women director, constitution of board committees etc. amongst other stringent requirements.

Another critical implication of the Amendment Act 2020 is amendment under Section 23(3) of Companies Act. The amendment now empowers the Central Government to allow certain class of public companies to list classes of securities on a permissible foreign jurisdiction without any simultaneous listing in India. While the amendment is not yet effective, it will provide relief to listed foreign companies from compliance requirements applicable to listed companies under the Companies Act 2013.

The move to include relaxations in the definition of listed companies will, to a large extent, make it easier for smaller companies to approach debt markets, in turn boosting the listing of debt securities. The move also lays out the road for domestic companies to tap foreign equity markets in a comparatively hassle-free manner. The impetus to growth is very welcome at this stage of the economy where an attempt at recovery is being made in the post-covid era.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.