- within Law Department Performance topic(s)

- in India

INTRODUCTION

The Directorate of Revenue Intelligence ("DRI"), which functions under the Central Board of Indirect Tax and Customs (Ministry of Finance, Department of Revenue), is an anti-smuggling intelligence, investigation, and operations agency of India.

DRI enforces the provisions of the Customs Act, 1962 ("Customs Act") and over fifty other allied legislations, including the Arms Act, 1959, Narcotic Drugs and Psychotropic Substances Act, 1985, Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974, Wildlife Protection Act, 1972, and Antiquities and Art Treasures Act, 1972.

DRI operates to secure India's national and economic security by preventing smuggling of contraband such as gold, narcotics, fake Indian currency notes, firearms, wildlife and environmental products, and antiques. It also functions to prevent the proliferation of black money, trade-based money laundering, and commercial frauds.

History

The initiation of DRI dates back to 1953, the year when a nucleus cell, called the Central Revenue Intelligence Bureau ("CRIB"), was set up for dealing with all matters connected with anti-smuggling and anti-corruption in the Customs and Central Excise organizations pan India. CRIB, a small unit composed of an Assistant Collector and two Superintendents within the Directorate of Inspection (Customs and Central Excise), New Delhi, worked directly under the Central Board of Revenue.

On the recommendations of the Chairman, Central Board of Revenue and Finance Secretary, CRIB was reorganized in 1957, in its new avatar as DRI, from, December 4, 1957. Its work focused exclusively on the collection and scrutiny of information on smuggling activities and the deployment of all anti-smuggling resources at pan India level, besides arranging training for the intelligence and investigation officers of the Customs Houses and Central Excise Collectorates engaged in similar work.

Charter

- Collection of intelligence on the smuggling of contraband goods, narcotics, under-invoicing etc.

- Analysis and dissemination of such intelligence to the field formations for action and working on such intelligence, where necessary.

- Keeping watch over important seizures and investigation cases. Associating or taking over the investigations which warrant specialized handling by the Directorate.

- Guiding important investigation/ prosecution cases. Keeping liaison with foreign countries, Indian Missions and Enforcement agencies abroad on anti-smuggling matters, liaising with INTERPOL.

- To refer cases registered under the Customs Act to the Income Tax authorities for action under the Income Tax Act, 1961.

Organisational Structure

DRI is headed by the Director General (equivalent to Chief Commissioner) at its headquarters in New Delhi.

DRI is divided into the following zonal units, each under the charge of an Additional Director General (equivalent to a Commissioner).

- Ahmedabad

- Bangalore

- Chennai

- Cochin

- Delhi

- Guwahati

- Hyderabad

- Indore

- Kolkata

- Lucknow

- Ludhiana

- Mumbai

The zonal units are further divided into Regional Units, Sub-Regional Units, and Intelligence Cells with a complement of Additional Directors, Joint Directors, Deputy Directors, Assistant Directors, Senior Intelligence Officers, and Intelligence Officers.

Official Hierarchy

- Director General (Chief Commissioner)

- Additional Director General (Commissioner)

- Additional Director (Additional Commissioner)

- Joint Director (Joint Commissioner)

- Deputy Director (Deputy Commissioner)

- Assistant Director (Assistant Commissioner)

- Senior Intelligence Officer (Superintendent of Customs/Appraising Officers of Customs)

- Intelligence Officer (Inspector/Examiner/ Preventive Officers of Customs)

- Class III & Class IV Staff (Ministerial & Constables)

- DRI officers are on deputation from the Customs & Central Excise Department and the Corporate Law Service of India

FUNCTIONS ANDCOVERAGE

DRI is the enforcement agency responsible for securing India's economic frontiers and ensuring compliance with the applicable laws for goods entering or leaving the country. The Customs Act empowers the Customs officers to intercept any goods that do not comply with the provisions of relevant legislations in respect of import and export of goods.

DRI's wide-sweeping role covers various functions enforceable under multiple legislations. These functions can be grouped under three categories:

- Outright smuggling

- Commercial frauds

- Non-fiscal enforcement

Outright Smuggling

Smuggling is the clandestine movement of goods across national borders to evade payment of customs duties or restrictions on import/ export of specified products. Typically, smuggling occurs either when high customs duties tempt a smuggler to make a handsome profit on the smuggled goods or when the demand for prohibited goods is strong. The goods most targeted for smuggling include gold, narcotics, foreign currency, arms and ammunitions, and electronic items.

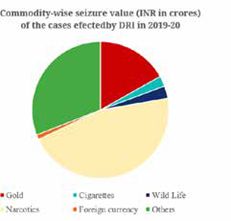

Source: Smuggling in India Report 2019-20

Commercial Frauds

Commercial frauds can be categorized as follows:

Trade Based Money Laundering

Trade-based money laundering ("TBML") entails concealing the proceeds from criminal activities and transferring the value via trade transactions in an attempt to legitimize their illegal origins. In other words, TBML is a process of transferring money via trade transactions.

In practice, TBML is achieved through misrepresentation of the value, quantity, or quality of imports/exports. The frauds are triggered by malpractices such as over- and under-valuation of goods and services, multiple invoicing of goods and services, over- and under-shipment of goods and services, and misleading description of goods and services

Mis-declaration

Importers at times resort to mis-declaration of the description of goods, country of origin, end-use of the imported goods, etc., with the intent to avoid payment of customs duties (including countervailing duty and anti-dumping duty) and to thwart non- tariff barriers.

Under-valuation

Under-valuation typically takes place by producing forged or false documents before the Customs authorities, under-valuation of the goods, avoiding the inclusion of allied cost components in the assessable value at the time of filing bills of entry.

Violation of end use and other conditions

Policy makers provide relief and encourage specific sectors by issuance of exemption notifications. These exemption notifications are issued with conditions that either restrict the eligibility or require fulfilment of certain post-import requirements. For ease-of- doing-business and to fast-track clearances, Customs authorities rely on self-declarations made by the importers. This practice encourages mis-declaration of eligibility criteria, description of goods, or end- use/post importation conditions.

Abuse of Foreign/ Preferential Trade Agreement(s)

India has entered into many bilateral and multilateral trade agreements with other countries to promote trade relations and expand its market. But wherever such agreements allow the exporting country certain tariff and/or non-tariff benefits, they offer the possibility of misuse.

Wrongful use of export promotion schemes

The Government of India provides various benefits to exporters through export promotion schemes under the Foreign Trade Policy such as advance authorization, Merchandise Exports from India Scheme, Services Export from India Scheme, and Export Promotion Capital Goods. These schemes are misused when exporters avail of the export benefits by using wrong description/ declaration of goods and services, over-valuation of exports, diversion of duty free imports, etc.

Misuse of Importer Exporter Code

The Importer Exporter Code ("IEC"), which is linked with the permanent account number, is a unique number allotted by the Directorate General of Foreign Trade ("DGFT"). It is mandatory for every importer/ exporter to obtain an IEC for easy identification. However, to carry on illicit transactions, bogus IECs are used to carry out dubious transactions.

Details of import frauds booked by DRI in FY 2019-20

| Category | No. of cases | Duty (in INR mn) | Duty (in USD mn)1 |

| Under valuation | 45 | 1,068.52 | 14.73 |

| Mis-declaration | 173 | 3,329.20 | 45.89 |

| Evasion of ADD | 6 | 127.59 | 1.76 |

| Evasion of CVD | 3 | 105.98 | 1.46 |

| Misuse of end use and other notification | 18 | 1,179.05 | 16.25 |

| Mis use of FTA, overvaluation and others | 250 | 9,728.64 | 134.10 |

| Evasion of IGST | 5 | 372.63 | 5.14 |

| Total | 500 | 15,911.60 | 219.32 |

Source: Smuggling in India Report 2019-20

Non-Fiscal Enforcement

The Government of India is a signatory to various treaties and conventions under which trans- border movements of specified commodities are regulated. Multilateral agreements, such as the Basel Convention on the Control of Trans-boundary movements of Hazardous Wastes and their Disposal, the Convention on International Trade in Endangered Species of Wild Fauna and Flora, the Cartagena Protocol on Bio-safety, and the Montreal Protocol on substances that delete the ozone layer, regulate the cross-border movements of several products. DRI has made several efforts to limit the violations of these multilateral agreements.

Click here to continue reading . . .

Footnote

1. USD 1 = INR 72.55

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.