- with readers working within the Law Firm industries

- within Environment, Criminal Law, Litigation and Mediation & Arbitration topic(s)

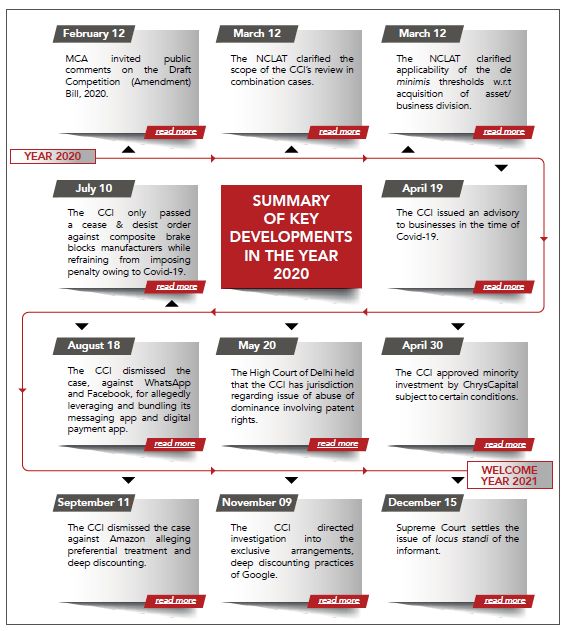

The pandemic redefined the reality and forced an unprecedented social, economic, and business response. While addressing the present and planning for the future, our lives have already adjusted to the 'new normal'. In India, as seen across the world, the competition law regulator demonstrated nimbleness not only in its working but also in its application of the law. This article presents a nuanced overview of the key developments in the competition law sphere in India.

INTRODUCTION

The year 2020 will be remembered by posterity for the havoc caused by the Covid-19 pandemic. Much like the businesses, who adapted to the 'new normal' and came up with newer models of functioning, the Competition Commission of India ("CCI") also tailored its working style and approach to ensure continued effective implementation of the Competition Act, 2002 ("Competition Act").

Since the government placed lockdowns of varying degrees to deal with the rising curve of the Covid -19 cases, in order to enable the businesses to continue to avail the facility of pre-filing consultation and obtain approval for their combinations, the CCI modified its procedures and made such processes available digitally. Additionally, on April 19, 2020, the CCI issued an advisory to businesses ("Advisory") reiterating that with the exception of efficiency-enhancing joint ventures, concerted actions amongst competitors are anti-competitive. The Advisory noted that to overcome disruptions in the supply chain of critical healthcare products and other essential commodities/ services caused due to the pandemic and to ensure continued supply and fair distribution, businesses may need to collaborate by sharing information (of stock levels, timings of operation) or joint use of distribution network and infrastructure, transport logistics, R&D, production, etc. However, only such collaborations which are: (i) pro-competitive, i.e., increase efficiencies in production, supply, distribution, storage, acquisition or control of goods/ services; and (ii) deemed necessary and proportionate to address concerns arising from the pandemic, will not fall foul of the provisions of the Competition Act. The Advisory also cautioned the businesses not to take undue advantage of the pandemic to indulge in anti-competitive behaviour.

Other key developments of the year are discussed below:

INVITATION OF PUBLIC COMMENTS ON THE DRAFT COMPETITION (AMENDMENT) BILL, 2020

In line with the recommendations of Competition Law Review Committee (CLRC) Report released in July 2019, the Ministry of Corporate Affairs ("MCA") kicked off the year by inviting public comments on the Draft Draft Competition (Amendment) Bill, 2020 ("Draft Bill") in February 2020. It is indubitably a milestone for Indian competition law jurisprudence as it seeks to bring the Competition Act in line with the evolving business environment and to align it with the best international practices. Key amendments proposed in the Draft Bill are:

Proposed antitrust amendments

- Recognition of buyer's cartel - Presently, the definition of cartel under the Competition Act is restricted to the sellers, producers, distributors and service providers. The Draft Bill proposes to amend this definition to explicitly bring within its purview buyers' cartel. In consonance with this proposed amendment, the penalty clause is also proposed to be amended to include the word 'buyer';

- Hub-and-spoke cartels - Recognising that competitively sensitive data may not always be exchanged directly amongst the competitors but indirectly via a third party, such as suppliers or distributors, the Draft Bill proposes to bring such hub-and-spoke arrangements within the ambit of the Competition Act. While allegations of such nature have been already considered by the CCI in the Samir Agrawal's case, the explicit recognition of such hybrid arrangements will bring more teeth to the antitrust regime in India;

- Settlement and commitment - With a view to promote shorter life cycle of antitrust cases while ensuring sufficient correction of anti-competitive practices in the market, the Draft Bill proposes to introduce settlement and commitment mechanism (except in cartel cases). Interestingly, in the year 2015, in the Tamil Nadu Film Exhibitors Association's case, the High Court of Madras, took international best practices into account and remarked that although the Competition Act does not have an explicit provision for settlement, it may be allowed if the CCI believes that a settlement between parties would not lead to the continuance of the anti-competitive practices and is in the interest of consumers; and

- Leniency plus - The Draft Bill proposes to bolster the leniency regime in India by introducing leniency plus policy by providing an added incentive to the companies. Thus, if a leniency applicant in one cartel discloses a cartel in a separate market, the applicant can avail reduction in penalty for both the cartels.

Proposed merger control amendments

- Widening the scope of control - The Competition Act defines 'control' as controlling the affairs or management of a company. The Draft Bill proposes to codify the CCI's decisional practice and lower the threshold of 'control' to mean 'exercising material influence' over the management or affairs or strategic commercial decisions of a company;

- Introduction of value-based thresholds - The Draft Bill proposes to authorize the Central Government (in consultation with the CCI) to formulate a new criterion (such as a deal value threshold) to trigger mandatory notification obligation. This proposal appears to provide flexibility to the Central Government to examine transactions, especially in the digital markets, which currently avail the de minimis exemption and escape scrutiny;

- Introduction of 'Green Channel' - The Draft Bill authorises the Central Government to provide a deemed approval process for transactions which are not currently exempted from the mandatory notification obligation. This provision will also grant statutory recognition to the amendments made to the CCI (Procedure in Regard to the Transaction of Business Relating to Combinations) Regulations, 2011 ("Combination Regulations") in August 2019, which introduced the deemed approval process under the green channel for combinations that do not involve any form of overlap (namely, horizontal, vertical or complementary) between the business activities of the parties ("August Amendment");

- Reduction in the timeline to approve combination - The Draft Bill proposes to reduce the statutory timeline for deemed approval of a combination notified to the CCI from 210 calendar days to 150 calendar days. While such reduction is proposed with a view to have a shorter gestation period for transactions, it may however increase the pressure on the CCI, which may resort to issuing requests for information to buy additional time; and

- Waiver of standstill in certain cases - Presently, the Competition Act prescribes a standstill obligation whereby the parties to a transaction are not permitted to consummate any part of a combination till receipt of the CCI's approval. In line with the mandate of the Central Government of ease of doing business in India, the Draft Bill proposes to ease the regulatory burden on listed companies and waive off the standstill obligation in combinations involving implementation of an open offer or an acquisition of convertible shares or securities on a stock exchange (if the prescribed conditions are met).

DEVELOPMENTS IN ANTITRUST

Supreme Court settles the issue of 'locus standi' in antitrust cases

In May 2020, the National Company Law Appellate Tribunal ("NCLAT") upheld the CCI's order dismissing allegation of cartelisation amongst the platforms of cab aggregators i.e., Ola and Uber and their respective drivers. Further, the NCLAT delved into the issue of locus and remarked that as the information had been filed by an independent law practitioner, who failed to demonstrate any legal injury caused due to the practices of Ola and Uber, he did not have locus to file the information with the CCI in the first place. On appeal, the Supreme Court("SC") in December 2020, set aside the narrow interpretation of the NCLAT regarding 'locus standi' and inter alia noted that the word 'complaint' used originally under the Competition Act was subsequently substituted by the term 'information' via the Competition (Amendment) Act, 2007. This was a conscious attempt by the legislature to enable the CCI to take cognizance of information filed by a person who may not be personally affected. Thus, the SC confirmed that the proceedings under the Competition Act are in rem, which affects public interest.

Interplay between the jurisdiction of the CCI and sectoral regulators

The Competition Act itself provides for safeguards to avoid turf war with other regulators by providing for a non obstante clause (i.e. an overarching or overruling clause) and clarifying that the Competition Act is in addition to and not in derogation of other laws. However, the respondent companies continue to agitate this issue, repeatedly.

In the case of Monsanto Holdings Private Limited, the High Court of Delhi ("HCD"), in May 2020 dismissed the writ filed by Monsanto challenging the CCI's order directing the Director General ("DG") to conduct an investigation into the conditions imposed in its sub- licence agreement(s) of Bt. technology. By way of the writ, Monsanto challenged the CCI's jurisdiction on the ground that only the patent controller can examine the issues arising from exercise of rights granted under the Patents Act, 1970 ("Patents Act"). The HCD held that there was no irreconcilable repugnancy or conflict between the Competition Act and the Patents Act. Thus, the jurisdiction of the CCI to entertain information regarding abuse of dominance in respect to patent rights could not be excluded.

Moreover, the HCD clarified that the SC's decision of December 2018, in the Bharti Airtel case (in which SC held that CCI will exercise jurisdiction post the Telecom Regulatory Authority of India's ("TRAI") determination of technical aspects) was based on merits of the case and the specific role discharged by the TRAI, and does not mean that where there is a statutory regulator, the CCI's investigation will always be contingent on findings of the regulator. Thus, the HCD order expanded on the SC's order and provided additional clarity on the interplay of jurisdiction between the CCI and various other sectoral regulators.

The CCI also had the occasion to examine this issue in December 2020, in the case of Brickwork Ratings India Private Limited ("Brickwork"). Brickwork filed information before the CCI alleging cartelisation amongst various other credit rating agencies ("CRAs"). The CRAs argued that their regulation falls strictly within the domain of Securities and Exchange Board of India ("SEBI") and the CCI has no jurisdiction. While rejecting such proposition, the CCI relied on the SC's decision in the Bharti Airtel case and observed that even though regulation of CRAs may be the subject-matter domain of the SEBI, examining any anti-competitive conduct on part of CRAs falls within the exclusive jurisdiction of the CCI. On merits, the CCI noted that while there is price parallelism, the same can however be explained through the transparent historical price trends and the L1 bids (i.e. the lowest bids) in the previous financial years. Given the lack of evidence to demonstrate meeting of minds amongst the CRAs, the CCI dismissed the information.

Evidence required for prosecution of cartels

The CCI in its decisional practice has held that an agreement by itself cannot be the basis of cartel prosecution. For a finding of cartel, there should be economic consequences arising out of such an agreement. In February 2020, the CCI expanded this principle to include cases initiated pursuant to a leniency application. In the case of In Re: Cartelisation in the supply of Anti-Vibration Rubber Products and Automotive Hoses to Automobile Original Equipment Manufacturers, although there was evidence that suppliers of anti-vibration rubber products and automotive hoses discussed bid prices and allocated the request for quotations issued by automobile original equipment manufacturers amongst themselves, the CCI agreed with the DG that such conduct had no effect on competition in India. Hence, the CCI closed the case.

In a separate investigation against importers of Phenol, in October 2020, the CCI upheld the DG's findings and reiterated that price parallelism per se does not amount to collusion between the importers. Conscious parallelism is insufficient for a determination that the importers were engaged in concerted action as their pricing behaviour can be based on independent action or in response to the economic conditions such as anti- dumping duties, crude oil prices, exchange rate, etc. Hence, the CCI closed the case.

Trends in the e-commerce sector

a. Market study on e-commerce

As the businesses and customers are increasingly migrating from brick-and-mortar to online business model, the CCI has increased its scrutiny of the e-commerce sector and its players. Hence, to understand the e-commerce sector in India and identify impediments to competition in the sector, the CCI initiated a Market Study on E-commerce in India in April 2019. The findings were submitted in January 2020 which identified certain issues being prevalent in the sector, namely: (i) lack of platform neutrality; (ii) unfair platform-to-business contract terms; (iii) exclusive contracts between online marketplace platforms and sellers/service providers and platform price parity restrictions; and (iv) prevalence of deep discounts.

In the background of its market study and findings, in the year 2020, the CCI examined a variety of online business models and allegations in a plethora of cases and dealt with them in a nuanced manner.

b. Online marketplaces/ platform under scanner

In January 2020, the CCI based on the information filed by Delhi Vyapar Mahasangh("DVM") directed the DG to investigate the conduct of Flipkart Internet Services Private Limited ("Flipkart Marketplace") and Amazon Seller Services Private Limited ("Amazon Marketplace"). DVM had alleged that Flipkart Marketplace and Amazon Marketplace have indulged in anti-competitive practices such as: (i) deep discounting; (ii) preferential listing; and

(iii) exclusive tie-ups, which led to the foreclosure of other non-preferred sellers from these online marketplaces. Subsequently, Amazon Marketplace filed a writ petition before the High Court of Karnataka ("HCK") against the aforesaid CCI order. The HCK placed reliance on the SC's order in the Bharti Airtel Case and granted an ad- interim stay. In October 2020, the CCI moved to theSC for modification and vacating the said ad-interim stay, which was denied.

Previously, All India Online Vendors Association ("AIOVA") had filed information with the CCI alleging that Flipkart Marketplace and Flipkart India Private Limited ("Flipkart India") (together "Flipkart") has abused its dominance in the market for 'services provided by online marketplace platforms for selling goods in India' by awarding preferential treatment to certain sellers (allegedly its affiliate) on its platform who also indulged in deep discounting. In November 2018, the CCI did not find Flipkart dominant and dismissed the case. Aggrieved by the order of the CCI, AIOVA filed an appeal with the NCLAT. In March 2020, the

NCLAT relied on the April 2018 order of the Income Tax Appellate Tribunal ("ITAT") against Flipkart India and observed that Flipkart India had links with certain sellers who appeared to indulge in predatory pricing. Hence, it remitted the matter back to the CCI to cause an investigation into the matter. In December 2020, the SC stayed the NCLAT order. Given the presence of strong players such as Amazon Marketplace and the recent entry of new players such as Paytm Mall (Paytm's e-commerce marketplace) and JioMart (Reliance Retail Limited's ("RRL") e-commerce marketplace), it will be interesting to see the SC's approach to the matter.

Information was also filed against Amazon Marketplace alleging that it indulged in exclusive arrangements, deep discounting and preferential listing of its affiliated entities. However, in September 2020, the CCI dismissed the case on the ground that Amazon Marketplace was not dominant in the 'market for services provided by online platforms for selling fashion merchandise in India'. Further, the CCI observed that exclusive tie-ups between platforms and fashion brands do not seem to exist and there are plenty of channels of intermediation available for fashion brands, sellers/retailers and consumers to access/reach each other.

c. Pre-installation of apps under scanner

With the growing popularity of digital payments, in two separate cases, the CCI examined allegations of competition law violations owing to pre-installation of digital payment apps offered by WhatsApp Inc. ("WhatsApp") held by Facebook Inc. ("Facebook"), and Google LLC ("Google") in August 2020 and November 2020, respectively. While the CCI dismissed the case filed against WhatsApp, it ordered an investigation against Google.

In the WhatsApp case, it was alleged that WhatsApp has abused its dominance by pre-installing WhatsApp's payment app namely 'WhatsApp Pay' on its users' smartphones embedded within the WhatsApp messenger app. Thus, WhatsApp was allegedly leveraging its dominance in the 'market for Over-The- Top ("OTT") messaging apps through smartphones in India' ("OTT Messaging Market") to manipulate 'market for UPI enabled digital payment applications in India' ("Digital Payment Market") in its favour. While the CCI observed that the WhatsApp/ Facebook group is dominant in the OTT Messaging Market, it dismissed the information as: (i) WhatsApp offered full discretion to the users for registration/ use of WhatsApp payment, irrespective of it being pre-installed; (ii) it is implausible that WhatsApp Pay will automatically garner market share due to pre-installation as the Digital Payment Market is renowned for players competing vigorously; and (iii) it is unlikely that the consumer traffic will be diverted by WhatsApp using its strength in the OTT Messaging Market since WhatsApp does not involve paid services for normal users.

In the Google case, it was alleged that Google has abused its dominance mainly by: (i) pre-installation and prominent positioning of 'Google Pay' on android smartphones; (ii) imposing exclusivity regarding mode of payment for purchase of apps and in-app purchases ("IAP"); and (iii) prominent placement of 'Google Pay' on the Google Play Store. The CCI observed that Google is dominant in the markets for: (i) licensable mobile operating system for smart mobile devices; (ii) app stores for Android OS; and (iii) apps facilitating payment through UPI. While the CCI did not find sufficient evidence of prominent placing of 'Google Pay' on the Google Play Store, it ordered an investigation against Google as: (i) pre-installation of 'Google Pay' may create a sense of exclusivity as users may not opt for downloading competing apps; (ii) mandatory use of Google Play Store's payment system for purchase of apps and IAP restricts the choice available to the app developers to select a payment processing system of their choice; and (iii) exclusivity and better user experience given to 'Google Pay' may lead to denial of market access for competing apps.

Pandemic and penalty trends

In March 2020, the NCLAT upheld the CCI's order finding Adani Gas Limited ("AGL") guilty of imposing onerous and unilateral terms (such as one-sided billing and payment clause, force majeure clause, etc. favoring the seller) in its Gas Supply Agreement ("GSAs"). However, based on AGL's voluntary revision of the GSAs prior to the conclusion of enquiry by the CCI, the NCLAT reduced the quantum of penalty from 4% to 1% of AGL's average relevant turnover as it eliminated the anti- competitive effect of the onerous terms.

In July 2020, the CCI found 10 companies engaged in the manufacture and supply of composite brake blocks ("CBB") to the Indian Railways ("IR") guilty of bid-rigging. The CCI noted that CBB manufacturers exchanged competitively sensitive information by way of meetings, e-mails, and calls, and subsequently submitted identical bid prices. They further offered similar discounts although IR held separate negotiations with them. Thus, based on such direct evidence, the CCI found them guilty of cartelisation. However, the CCI did not impose any monetary penalty and only directed the CBB manufacturers and their office bearers to cease and desist from cartel conduct based on mitigating factors, namely: (i) cooperation extended during investigation;

(ii) some CBB manufacturers were micro, small and medium enterprises; (iii) miniscule annual turnover in the segment under investigation; and (iv) prevailing economic situation arising due to the Covid-19 pandemic.

Earlier in June 2020, In Re: Cartelisation in Industrial and Automotive Bearings, although the case was initiated pursuant to a leniency application, the CCI refrained from imposing any penalty and passed only a cease and desist order.

Thus, it appears that the forums in India are increasingly adopting a holistic approach by taking into account the parties' conduct as well as extenuating circumstances while imposing/ evaluating penalties. However, there is still no uniformity with regard to aggravating and mitigating circumstances which may be considered by them while calculating penalties to be imposed on the contravening companies. An indicative penalty guideline providing some structure and criteria is the need of the hour. Such guidelines will bring clarity and certainty with respect to the standard of the CCI in terms of: (i) applicability of the relevant turnover; (ii) procedures for the determination of the penalty; and (iii) procedure for application of aggravating and mitigating factors.

DEVELOPMENTS IN MERGER CONTROL REGIME

NCLAT clarifies applicability of de minimis exemption and scope of the CCI's review in combinations

In March 2020, the NCLATset aside the CCI's order of July 2016 imposing a fine of INR 10 lakhs (approximately USD 0.013 million) on Eli Lilly and Company ("Eli Lilly") for not notifying its acquisition of Novartis Animal Health ("NAH") in India i.e., a business division of Novartis India Limited ("NIL"). The NCLAT agreed with Eli Lilly's contention that in the instant case, the thresholds prescribed under the de minimis exemption shall be applied only to NIL and not to NAH. Based on the subsequent de minimis notificationsand press release issued by the Central Government, the NCLAT noted that in case of an acquisition of a business division, the de minimis thresholds shall be applied only to such business division and not to the entire company. Thus, the NCLAT held that there was no need to notify the combination to the CCI.

In the same month, the NCLATupheld the CCI's order approving the acquisition of majority shareholding of Flipkart India by Walmart International Holdings Inc. ("Walmart") and dismissed the appeal preferred by Confederation of All India Traders ("CAIT") challenging the said acquisition mainly on the grounds that: (i) Flipkart India indulges in predatory pricing, gives preferential treatment to select e-tailers on its platform; and (ii) Walmart would sell its inventory on Flipkart India's platform directly or through preferred sellers and thus, preference would be given to the inventory of Walmart, hence the combination is anti-competitive. The NCLAT concurred with the CCI that the said acquisition is not likely to cause any appreciable adverse effect on competition ("AAEC") in the market as there was no evidence to demonstrate that the acquisition resulted in elimination of any major player in the market. Thus, the NCLAT clarified that in absence of a prima facie finding of AAEC, the CCI is required to only approve a combination and not launch an antitrust investigation.

Orders where remedy was suggested

In February 2020, the CCI approved ZF Friedrichshafen's ("ZF") acquisition of 100% shareholding of WABCO Holdings Inc. ("Wabco") subject to certain conditions. The CCI noted that both ZF (through its joint venture with TVS group viz. Brakes India) and Wabco operated in the automotive product sector and their activities overlapped in markets for the supply of foundation brakes, clutches and other brake and clutch components for light commercial vehicles and heavy commercial vehicles in India. Given the strong market position and capabilities of the parties to combination and exit of Brakes India, the CCI opined that the combination is likely to adversely impact competition in the overlapping markets.

To address these concerns, ZF offered voluntary modification, namely, divestment of its entire 49% shareholding in Brakes India and undertook to neither re-acquire shares/control over Brakes India nor form other joint venture with TVS group in the overlapping product segments.

First time modification in minority investments

In July 2020, for the first time, the CCI approved minority investment subject to certain conditions as the acquirer had prior investments in the competing companies of the target. ChrysCapital (a private equity fund) had approached the CCI for approval of its acquisition of additional 3% shareholding in Intas Pharmaceuticals Limited ("Intas") along with certain contractual rights (such as right to: (i) receive information; (ii) appoint a director on Intas' board; and (iii) veto certain corporate actions, etc.). The CCI observed that by way of such acquisition, ChrysCapital will be able to exercise material influence over strategic affairs of Intas. Further, ChrysCapital had minority investments in Intas' competitors (such as Mankind Pharma Limited ("Mankind"), Eris Lifesciences Limited, GVK Biosciences Private Limited and Curatio Healthcare Private Limited) over whom it already exercised material influence. Given the strong market position of Intas and ChrysCapital's portfolio companies, the CCI opined that ChrysCapital may have the ability to pursue anti-competitive goals.

To address these concerns, ChrysCapital offered voluntary modifications, namely: (i) removal of its director from the board of Mankind; and (ii) limited exercise of veto rights/ non-public information received from such portfolio investments. Thus, it appears that the CCI, much like its global counterparts, is closely scrutinising minority investments in the same sector.

Analysing data in combination cases

In June 2020, the CCI approved Facebook's acquisition of 9.99% shareholding in Jio Platforms Limited ("Jio"), a subsidiary of Reliance Industries Limited ("Reliance"), which owns and operates digital applications. The combination envisages a separate commercial arrangement between Jio, WhatsApp, and RRL pursuant to which WhatsApp would develop an electronic chat feature to connect users with JioMart (a new e-commerce marketplace of RRL). The CCI approved the combination as it would not result in AAEC in all the identified plausible relevant markets namely: (i) market for consumer communication applications; and (ii) advertising services, due to presence of other major players in these markets.

Notably, in a first, the CCI recognised that combinations involving digital players with access to user data can be analysed from the perspective of data-backed market power. The assessment in such instances needs to focus on the incentives of the parties to pool or share their databank and monetise such data. In the instant combination, the CCI relied upon the clarification of the parties that no data will be shared as a part of the proposed combination. However, as the user data possessed by Jio and Facebook group are complementary to each other given the symbiotic interface between telecommunication business and OTT content/ application users, the CCI clarified that any anti-competitive conduct resulting from any data sharing in the future could be taken up by the CCI under the antitrust provisions.

Notable transactions approved by the CCI

The CCI also analysed and approved certain high-profile combination cases in the year 2020. In the automotive industry, in February 2020, the CCI approved the proposed joint venture of Mahindra and Mahindra and Ford Motor Corporation, and a proposed merger between Peugeot S.A. and Fiat Chrysler Automobiles N.V in June 2020.

In the real estate sector, the CCI approved two mega deals, namely: (i) acquisition of sole control by Brookfield group over 11 real estate projects held by the RMZ group in September 2020; and (ii) acquisition of certain assets of the Prestige group by the Blackstone group in December 2020. In the e-commerce sector, the CCI approved acquisition of minority stakes (i.e. 7.73% shareholding) of Jio by Google in November 2020. The proposed acquisition will enable Google and Jio to develop and launch a new smartphone in India.

Regulatory developments

- Notes to Form I - In addition to introduction

of deemed approval process, the August Amendment also amended the

Form I (i.e. short form) to seek certain additional information

from the parties such as market facing data for 3 years, details of

complementary activities of parties, etc. ("Amended

Form I"). With the aim to guide the parties for

furnishing such additional information in the Amended Form I, the

CCI in March 2020, published revised guidance note to Form I

("Revised Guidance Note"). The Revised

Guidance Note clarifies that:

- only if the parties' combined share exceeds 10%, market facing data for 3 years is to be provided; and

- complementary products / services means such products/ services which are related and are used together (e.g., printers and ink cartridges).

- Omission of non-compete restriction - In November 2020, the CCI amended the Combination Regulations and omitted the disclosure requirements regarding non-compete restrictions previously required to be made in Form I (i.e. short form). While such omission reduces the burden of the notifying party, it increases the onus of self-assessment to ensure that the non- compete clause is compliant with the provisions of the Competition Act.

- Exemption for banking companies - In the backdrop of an increasingly grim banking crisis in India, the MCA on March 11, 2020, issued a notification exempting banking companies which are placed in moratorium by the Reserve Bank of India under Section 45 of the Banking Regulation Act, 1949, from seeking mandatory approval of the CCI for combinations for a period of five years until March 11, 2025.

CONCLUSION

Owing to the pandemic, the year 2020 posed significant challenges for the CCI. However, it quickly aligned itself with the new normal and proactively addressed the challenges arising out of Covid-19 pandemic by issuing the Advisory and switching its functioning to electronic modes. As stated above, the Advisory recognised that businesses (operating in critical healthcare products and other essential commodities/ services) may collaborate (short of joint venture) to address disruptions in the supply chain caused due to pandemic. However, only such collaborations which are pro-competitive, and necessary and proportionate to address concerns arising from Covid-19 will not fall foul of provisions of the Competition Act. Further, the CCI took a feather- handed approach while analysing cartel cases (although the cartel conduct pre-dated the pandemic) and refrained from imposing penalty owing to economic hardships caused by Covid-19. These active steps taken by the CCI helped businesses continue as smoothly as possible in spite of the pandemic.

A boom was also seen in the year 2020 in the number of cases pertaining to the e-commerce sector with which the CCI was seized. The CCI's detailed analysis not only reflects its growing maturity and confidence, but also indicates that it knows the pulse of the e-commerce sector to identify, monitor and regulate anti-competitive conduct.

On the merger control side, the conditional approval of minority acquisition by ChrysCapital evidences the CCI's focus on same-sector investments. However, it remains to be seen whether this order will be the turning point in the treatment of common ownership in India or will be added to the list of 'one of its kind' cases.

With significant changes being proposed by the Draft Bill, the year 2021 looks promising in terms of developments in the competition law jurisprudence in India. While the Draft Bill is undoubtedly a step in the right direction, it will however be interesting to see, how many of the proposals made in the Draft Bill are actually accepted and implemented.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.