Introduction

In respect of an open tender for surgical tapes dated 26.05.2016 invited by the All India Institute of Medical Sciences (AIIMS) (hereinafter, referred as the "Tender"), the Competition Commission of India (CCI) on a letter received by it dated 26.05.2016 from the Assistant Store Officer of AIIMS, took suo moto cognizance on the allegation of cartelization between two of the thirteen bidders of the Tender, namely, Romsons Scientific & Surgical Industrial Private Limited (hereinafter, referred as "Romsons") and BSN Medical Private Limited, now Essity India Private Limited (hereinafter, referred as "BSN" or "Essity").

It was noted by the CCI that both the bidders had quoted identical prices up to the last two decimal places for 4 out of the 8 items mentioned in the Tender. The CCI further observed that it was highly improbable for the two bidders to quote identical rates as the two bidders were operating in different regions, (Romsons was based in Agra, UP, and had offices in Noida and Delhi while Essity was based in Mumbai), and having separate labour costs, raw materials, transportation, etc. to quote identical rates to the extent of last two decimal places. The CCI was of the view that the same cannot be a mere coincidence. The identical rates quoted by the bidders along with the presence of facilitating factors which are conducive for cartelization, like limited players, homogeneous products, etc. compelled the CCI to find a case of bid- rigging against the two bidders and directing the Director General (DG) to investigate the matter.

Investigation by the DG

The key issue needing investigation by the DG was whether Romsons and Essity colluded to fix the prices of the items in the Tender which would be in contravention of the provisions of Section 3(3)(d) of the Competition Act, 2002 (the "Act").The DG noted that out of eight different categories of surgical tapes listed in the Tender, the rates quoted by Romsons and Essity were identical up to at least two decimal points for four of these categories.

As per the DG's investigative report, the quoting of prices in different patterns in the respective bids submitted by the parties, despite the mandate by AIIMS to submit quotes in a particular manner, was indicative of their intent to indulge in collusive bidding.

Further, a significant aspect considered by the DG was that while Romsons manufactured surgical tapes, Essity imported them. The DG highlighted that the nature of costs involved in the manufacture and import of surgical tapes was so varied that pricing could not have been unintentionally identical.

After examining certain other plus factors such as the parties' different geographical locations, and "evasive justifications" by the parties' personnel, the DG determined that Romsons and Essity had indulged in bid-rigging and had contravened the Act.

With the above said considerations and by placing reliance on the ruling in Excel Crop Care Ltd. v CCI (Excel Crop case), the DG concluded that the bidders had colluded and contravened Sections 3(3)(a) and 3(3)(d) read with Section 3(1) of the Act. The DG also recommended proceedings to be initiated against the officials of the bidders under Section 48 of the Act for imposing penalties.

|

LEGAL SNIPPETS The Kerala High Court has passed a big judgment with respect to the interpretation of rape as a sexual crime. It said " When the body of the victim is manipulated to hold the legs together for the purpose of simulating a sensation akin to penetration is an orifice; the offence of rape is attracted. When penetration is thus made in between the thighs so held together, it would certainly amount to 'rape' as described under Section 375 of the Indian Penal Code." The Court noted that the availability of law includes penetration to alternative components of the body of a woman and isn't confined to anus or vagina. |

CCI's decision on merits

After the submission of the DG's report, the CCI heard both the bidders and observed that besides the one-off instance of identical pricing, there was no evidence that indicated collusion by the two. The CCI noted that there was no evidence of any communications or meetings between the bidders and there was a lack of any other "plus factors" also (like proof of conscious parallel behaviour before affixing any liability for contravention of competition law) which could indicate implicit collusion between the bidders.

It was also observed that the market of surgical tapes was not conducive to cartelization since the product was not homogenous and there were no entry barriers in the market as well. The CCI rejected the DG's findings that the bidders should have quoted different rates because they operated from different geographical locations and noted that the cost of production of the bidders were in a similar range and the prices charged by them were uniform across India.

Conclusion

The CCI's said Order reaffirmed the principles laid down in the past precedents of the Supreme Court in the case of the Rajasthan Cylinders and Containers Ltd. v/s Union of India wherein the Supreme Court has clearly stated that parallel or identical pricing alone is not sufficient for a finding of bid-rigging.

As such without there being any "plus factors" or additional evidence in the present case, the allegations of bid rigging against the bidders were rejected by the CCI in line with the above judgment of the Supreme Court. The plus factors with regard to bidding comprises of certain circumstantial evidence and indicators like market conditions, presence of a small number of players, appointment of common agents by the bidders, consistent matching of prices, identical typographical errors in bids, past business relations etc.

|

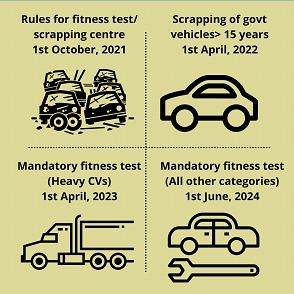

LEGAL SNIPPETS Prime Minister Narendra Modi, at the Investor Summit in Gujarat, launched the National Vehicle Scrappage Policy. "We are promoting a circular economy. The aim is to develop a sustainable and environment-friendly economy. The decision is a step necessitated by India's commitment to the Paris Agreement", said the Prime Minister. Why did this policy come into existence? In order to promote clean mobility, low emission rates and reduced fuel import, this policy is a necessity. Quite a many vehicles in India are less- fuel efficient which in result contribute to rising pollution levels. Union Minister said that personal vehicles over 20 years old and commercial vehicles over 15 years old are to be scrapped. The government plans to set up between 450-500 automated vehicle fitness testing stations across India on a public- private partnership (PPP) basis involving private firms and state governments. Incentives of the policy The policy would provide benefits like tax rebate up to 25%, waiver of registration fee and discount by vehicle manufacturers. The policy would also attract a good investment of over Rs 10,000 crore and would help generate around 50,000 jobs across the country.

|

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.