FEMA& INTERNATIONAL TAX

External Commercial Borrowing (ECB) under Foreign Exchange ManagementACT (FEMA):

External Commercial Borrowings are commercial loans raised by 'eligible resident borrower' from 'recognised non-resident entities' AND should confirm to parameters specified in ECB guidelines such as minimum maturity period, permitted end-use of funds, maximum all-in-cost ceilings etc.

The framework for raising ECB is divided into following THREE Tracks:

TRACK 1 – Foreign currency denominated ECB with minimum average maturity period of 3/5 years

TRACK 2 - Foreign currency denominated ECB with minimum average maturity period of 10 years

TRACK 3 – Indian Rupee denominated ECB with minimum average maturity period of 3/5 years

In this paper, we will discuss the ECB raised under Track 1 hereunder:

Forms of ECB

ECBs can be raised in any of the following forms:

- Loans

- Issue of non-convertible, optionally convertible or partially convertible preference shares/debentures

- Buyers' credit

- Suppliers' credit

- Foreign Currency Convertible Bonds (FCCBs) or

- Foreign Currency Exchangeable Bonds (FCEBs)

Eligible Borrowers:

Any Indian Company, body corporate or firm can raise money through ECB. Following categories of entities can raise ECB under track 1:

- Companies in manufacturing sector

- Software development sector

- Shipping and Airlines Companies

- Units in Special Economic Zones (SEZs)

- Companies in infrastructure sector

- Certain categories of NBFCs.

Recognised Lenders:

Following non-resident lenders are recognised lenders under ECB:

- International Banks

- International Capital Markets

- Multilateral Financial institutions

- Export Credit Agencies

- Suppliers' of Equipment

- Foreign Equity Holder-Foreign Equity Holder would mean direct equity holding of minimum 25% in borrowing Company OR indirect equity holder with minimum indirect equity holding of 51% OR group Company with common parent Company.

7. Overseas branch or subsidiary of Indian bank-However, they are not permitted to participate in refinancing of existing ECB.

These lenders proposing to extend ECB to Indian borrower have to furnish a certificate of due diligence from overseas bank and is subject to regulations of host country which should clearly mention:

- The lender maintains account with the bank since minimum of 2 years;

- The lending entity is organised as per local laws and it held in good esteem by business community and

- There is no criminal action pending against it.

This host country must adhere to Financial Action Task Force (FATF) guidelines on Anti-money laundering, combating the financing of terrorism.

Permitted End-use of funds:

Indian borrower, while raising ECB from recognised lender, is permitted to use the funds strictly in any one of the following purposes:

- ECB can be utilised for Capital

Expenditure in any of the following form:

- Import of Capital Goods including payment for import of services, technical knowhow or license fee if the same are part of these capital goods;

- Local sourcing of capital goods;

- New project;

- Modernisation or expansion of existing project;

- Investment in Overseas Company under Overseas Direct Investment (ODI) route;

- Acquiring share of public sector undertaking under the divestment program of Government;

- Refinancing existing "trade credit" raised for import of capital goods;

- Payment of capital goods already shipped or imported but not yet paid;

- Refinancing of existing ECB provided the residual maturity period is not reduced.

- Units in SEZ can raise ECB only for their own requirements;

- Shipping and Airline Companies can raise ECB only for import of vessels and aircrafts respectively;

- IV. ECB can be used for general corporate purpose including working capital provided the ECB is raised from direct/indirect equity holder or from group Company for a minimum average maturity period of 5 years.

ECBs for import of second hand capital goods will be considered only under Approval route.

Minimum Average Maturity period:

Indian borrower can accept ECB from non-resident recognised lender with minimum maturity period as below:

| 1. For ECBs up to USD 50 million or its equivalent | 3 years |

| 2. For ECBs beyond USD 50 million or its equivalent | 5 years |

| 3. Companies in infrastructure sector | 5 years, regardless of amount of borrowing |

| 4. Certain categories of NBFCs | 5 years, regardless of amount of borrowing |

| 5. FCCBs or FECBs | 5 years, regardless of amount of borrowing |

All-in-cost ceiling:

The term 'All-in-Cost' is the maximum cost that the borrower is allowed to incur on the ECB and it includes rate of interest, guarantee fees, other fees, expenses, charges etc but does not include commitment fee, pre-payment charges, withholding tax payable in INR. This is generally prescribed by RBI through a spread of certain basis points over last 6 months' LIBOR.

Penal interest, in case of default or breach of agreement, should not be more than 2% over the contracted rate of interest.

Debt-Equity ratio:

For ECB raised from direct equity holder under automatic route, the ECB liability of the borrower towards foreign equity holder should not be more than 4 times the equity contributed by the foreign equity holder. This mean that the debt equity ratio towards the foreign lender should not be more than 4:1. For ECB raised under approval route, this ratio should not be more than 7:1. However, for ECBs raised by the borrower is less than USD 5 million, these restrictions would not apply.

GOODS AND SERVICE TAX (GST)

Advance Ruling under GST laws (s. 95 to s. 106 of The Maharashtra GST Act, 2017)

The Maharashtra Government have constituted the Maharashtra Authority for Advance Ruling for the state of Maharashtra, vide Notification dated 24th October, 2017.

The Authority consists of:

- One member from amongst the officers of Central tax AND

- One member from amongst the officers of state tax

What is Advance Ruling (AR)? s.95(a)

Any person (registered or desirous of obtaining Registration under the Maharashtra GST laws) can apply under the GST law, for ruling or decision on matters or questions in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by him. Such ruling or decision by the authority is called "Advance Ruling".

Which matters or questions can be applied for under the AR provisions?

AR can be sought on following questions: s. 97(2)

- classification of any goods or services or both;

- applicability of a notification issued under the provisions of this Act;

- determination of time and value of supply of goods or services or both;

- admissibility of input tax credit of tax paid or deemed to have been paid;

- determination of the liability to pay tax on any goods or services or both;

- whether applicant is required to be registered;

- whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both, within the meaning of that term.

Procedure for AR:

- An applicant desirous of obtaining an AR on any of the questions stated above, has to make application to the AR Authority in prescribed form and manner with prescribed fees. S.97(1)

- On receipt of aforesaid application,

the AR Authority shall examine the application (and the records if

any called for from the concerned departmental officer) and after

hearing the applicant, will pass an order either admitting or

rejecting the application.

In case application is rejected, reasons for rejection shall be specified in the order.

The AR authority shall not admit the application where the question raised in the application is already pending or decided in any proceedings in case of the applicant under any of the provisions of the Maharashtra GST Act.

The Government need to clarify as to what are the remedies/appeal provisions in case of the rejection of application.

- In case application is

admitted:

The AR authority shall examine the materials placed before it, hear the applicant and the concerned officer and pronounce its ruling on the question specified in the application, within 90 days from the date of receipt of the application.

Where the members of the AR authority differ on any question raised in the application, they shall state the point or points on which they differ and make a Reference to the AR Appellate Authority for hearing and decision on such question. s. 98 (5).

What are Appeal provisions? s.100

- The applicant or the concerned

officer aggrieved by any advance ruling pronounced by the AR

authority, may appeal to the Appellate Authority in prescribed

manner. Such appeal has to be filed within 30 days from the receipt

of the order.

The concerned Appellate Authority shall be constituted by the Government and known as "Maharashtra Appellate Authority for Advance Ruling for Goods and Service tax", consisting of two persons namely:

- The Chief Commissioner of central tax as designated by the Board; AND

- The Commissioner of State tax;

- The Appellate Authority may, after hearing parties to the appeal or reference (in para III above s. 98 (5)), pass order confirming or modifying the ruling appealed against or referred to. Such order shall be passed within 90 days from the date of filing of appeal or Reference u/s. 98(5).

- Where the members of Appellate Authority differ on any point referred to in appeal or reference, it shall be deemed that no advance ruling can be issued in respect of the question under appeal or Reference. s.101(3)

Is this constitutional? The Government need to clarify as to what are the

remedies available to the applicant in such situation.

Amendment of Order: (s.102)

The Authority of the Appellate Authority may amend any order passed by it under section 98 or section 101, so as to rectify any error apparent on the face of the record, if such error is noticed by the Authority or the Appellate Authority on its own accord, or is brought to its notice by the concerned officer, the jurisdictional officer, or the applicant or the appellant within a period of six months from the date of the order:

Provided that no rectification which has the effect of enhancing the tax liability or reducing the amount of admissible input tax credit shall be made unless the applicant or the appellant has been given an opportunity of being heard.

Binding effect: s.103(1)

The advance ruling pronounced by the Authority or the Appellate Authority under this Chapter shall be binding only –

- on the applicant who had sought it in respect of any matter referred to in sub-section (2) of section 97 for advance ruling;

- on the concerned officer or the jurisdictional officer in respect of the applicant.

Detection of fraud/suppression of facts etc. s. 104(1)

Where the Authority or the Appellate Authority finds that advance ruling pronounced by it under sub-section (4) of section 98 or under sub-section (1) of section 101 has been obtained by the applicant or the appellant by fraud or suppression of material facts or misrepresentation of facts, it may, by order, declare such ruling to be void ab-initio and thereupon all the provisions of this Act or the rules made thereunder shall apply to the applicant or the appellant as if such advance ruling had never been made:

Provided that no order shall be passed under this sub-section unless an opportunity of being heard has been given to the applicant or the appellant.

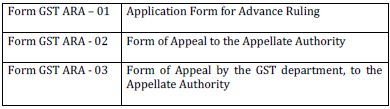

Relevant Forms:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.