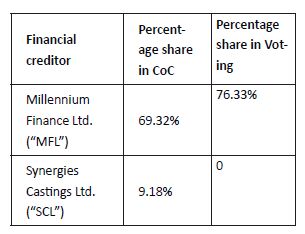

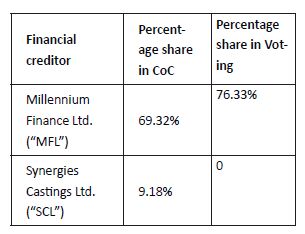

The National Company Law Tribunal, Hyderabad (hereinafter referred as "Adjudicating Authority"), after hearing to all the concerned parties on 23.01.20171 admitted the application filed by Synergies-Dooray Automative Limited (hereinafter referred as "Corporate Debtor") under section 10 of the Insolvency and Bankruptcy Code (hereinafter referred as "the Code") and had appointed Ms. Mamta Binani as an Interim Resolution Professional (hereinafter referred as "IRP"). Pursuant to the order of the Adjudicating Authority, the IRP issued the public announcement and invited claims from the creditors in order to constitute the Committee of Creditors. After collation of the claims, the first meeting of Committee of Creditor was called on 22.02.2017 in which the IRP was appointed as Resolution Professional (hereinafter referred as "RP"). Thereafter, list of the creditors was forwarded to the Adjudicating Authority reflecting the percentage of exposure and voting rights (as provided in the table below)

As per the requirement of section 25(2)(h) of the Code, the RP had initiated the process of inviting prospective Resolution Applicants for submission of Resolution Plans for the resolution of the Corporate Debtor. In the response, 4 participants applied for the offer document, out of which, only 3 entities sent the Resolution Plan namely, 1) SMB Ashes Industries; 2) Synergies Casting Limited (SCL); 3) Suiyas Industries Private Industries. The resolution plan of SCL was selected by a vote of 90.16% (majority) during the second meeting of Committee of Creditor. Thereinafter, the RP had submitted the Resolution Plan approved by Committee of Creditors for seeking approval from the Adjudicating Authority under section 30(6) of the Code.

The main features of the Resolution Plan which was submitted with the Adjudicating Authority were (i) the total recovery of INR 5,408.21 lakh by the Creditors and same be paid by way of long term funds and accruals (sum of investments or interests) of SCL over a time span of five years; (ii) A merger to take place between SDAL and SCL; (iii) the state government to exempt the stamp duty as applicable on the proposed merger; (iv) all the existing tax dues of Corporate Debtor were to be paid from the end of fifth year in which the payment of Creditors will be over and the said payment of existing dues will also be made in a time span of five years without any interest; and (v) The Resolution Applicant to finance any shortfalls in making timely payments to the tax authorities or any other debtors and to induce funds for all other obligations under the Resolution Plan.

OBJECTION BY EDELWISE:

EARC, one of the financial creditors holding 9.84% in voting share, had filed objection with respect to the incorrect admission of claims and constitution of invalid Committee of Creditor by IRP under section 60(5)(c) of the Code read with Rule 14 and 34 of the NCLT Rules 20162. The sub-section (5)(c) of Section 60 of the Code provides that the NCLT has jurisdiction to entertain or dispose of any application wherein "any question of priorities or any question of law or facts, arising out of or in relation to the insolvency resolution or liquidation proceedings of the corporate debtor or corporate person under the code". EARCL has made the following objections before the Adjudicating Authority:

- IRP has failed to consider that an Assignment Agreement which was entered into on 24 Nov. 2016 by which the existing debt of the Corporate Debtor has suspiciously changed hands from a related party of the Corporate Debtor being SCL to a third-party MFL and the same is invalid as it was entered into with the mala fide ulterior motive of reducing the voting rights of the Applicant in the meeting of the Committee of Creditor;

- EARC stated that under the Code a related party of a corporate debtor is not entitled to any participation or voting rights in meeting of the Committee of Creditors of a Corporate Debtor. SCL being a group company of the Corporate Debtor is a related party and therefore, cannot in any manner whatsoever be part of the Committee of Creditor of the Corporate Debtor;

- Further the debt assigned by SCL to MFL by the Assignment Agreement would also not be considered for the voting in the committee of Creditors.

ADJUDICATING AUTHORITY OBSERVATIONS:

The Adjudicating Authority looked into the objections raised by EARC and given the following observations with respect to it.

- The Adjudicating Authority said that by reading the provision of section 60(5)(c) of the Code, it is established beyond doubt that the said Section empowers this NCLT to determine question of priorities or question of law or facts arising out of or in relation to the insolvency resolution of the Corporate Debtor;

- The Adjudicating Authority observed that question of priorities or question of law or facts as amenable to the jurisdiction of this Tribunal can only be in terms of the existing debts or liabilities of the Corporate Debtor. The aspect of inter-se transfer between the Financial Creditors of the Corporate Debtor cannot fall within the purview of the jurisdiction of the Tribunal. Therefore, the Tribunal cannot adjudicate on the aspect of validity of the Assignment Agreement between SCL and MFL;

- The Tribunal also observed that by reading section 5(24) of the Code, MFL does not fall into any of the conditions which makes an entity a related party of the Corporate Debtor and trigger the applicability of the said section. Further, it is evident that SCL as a part of its commercial decision assigned its dues to MFL and MFL also as a part of its business decision as a Non Banking Financing Company acquired the debts from SCL. Therefore there is no relation between SCL and MFL;

- The Tribunal, in the passing reference also said that with regard to the intention of the Corporate Debtor and SCL, the proceeding before the Tribunal under the Code is summary proceedings and therefore, mens rea cannot be raised before the Tribunal.

CONCLUSION:

The Adjudicating Authority approved the resolution plan under section 31(1) after scrutinizing the said resolution under the requirement mentioned under section 30(2) of the Code. It is to be noted that Section 30(2) of the Code makes it obligatory on the part of the Resolution Professional that the Resolution plan confirm the various requisites as provided under various sub-clauses of Section 30(2) of the Code. Though the Resolution Plan is approved, it is pertinent to mention that the amount proposed to be recovered through the resolution plan is only 54.04 cr. (w.r.t Creditors) whereas the total debt shown in the application which was presented by the Corporate Debtor before the Adjudicating Authority under Section 10 of the Code was to the tune of INR 971.25 cr (which includes interest also). The Adjudicating Authority has approved approximate haircut of 94%, which might set the bar of recovery too low.

Here, it would be worth mentioning that the main reason for the approval of the Resolution Plan by the Committee of Creditors at first instance was the voting right of MFL as financial creditor in the Committee of Creditors. MFL was holding 76.33% share in the voting and the as the Hon'ble Adjudicating Authority rightly observed while deciding CA. No. 57 of 2017 IN CP (IB) No. 01/HDB/2017 that the assignment of debt by SCL to MFL just before the enactment of Code is similar to "Tax Planning" as because of this assignment deed, the share of all the financial creditors were reduced and the resolution plan was approved smoothly.

Footnotes

1 C.A. No. 123/2017 in CP(IB) No.01/HDB/2017

2 CA No. 43 of 2017 in CP No. 01/IBC/HDB/2017

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.