Through Regulation NAC-DGERCGC22-00000033 issued by the General Director of the Internal Revenue Service, the deadlines for complying with the tax obligations related to VAT, excise tax (ICE) and income tax were extended to those taxpayers with domicile in the provinces of Chimborazo, Tungurahua, Cotopaxi, Pichincha, Pastaza, Azuay, Imbabura, Sucumbíos and Orellana.

- Taxpayers qualified as special taxpayers may file the VAT, excise tax and income tax withholding forms corresponding to the period of June 2022 and make the applicable payment until July 28, 2022.

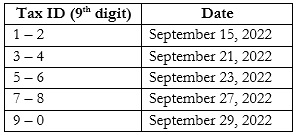

- Taxpayers that are not qualified as special taxpayers may file the VAT, excise tax and income tax withholding forms corresponding to the period of June 2022 and the first semester of 2022 (as applicable), within the following deadlines:

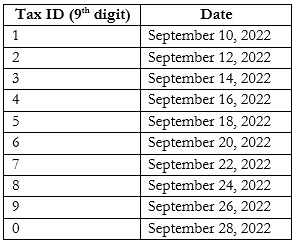

- Subjects obliged to file the Tax Compliance Report (ICT) corresponding to fiscal year 2021, may do so according to the following calendar:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.