Introduction

Home advantage is often an important factor in sport. Similarly, in cross-border deals, parties often wish to ensure that disputes will be dealt with in their own country or, at the very least, a neutral country which has no links to either party and has a system of law with which both parties are familiar. Issues can arise when cross-border parties sign more than one contract to cover different aspects of their relationship. The agreements may also be entered into by different companies within their respective groups. Where multiple transaction documents are agreed between parties based in different jurisdictions, careful drafting is required to ensure certainty of jurisdiction in case of disputes.

This point was well made in the recent judgment of the High Court of Hong Kong in Madison Communications Private Limited v. Le Ecosystem Technology India Private Limited [2017] 5 HKLRD 284. The case concerned a commercial dispute involving Indian and Hong Kong companies that had signed more than one contract to govern their relationship.

Background

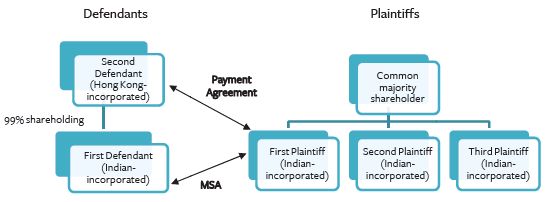

All three plaintiffs were Indian companies providing advertising services and sharing a common majority shareholder. The first defendant was also an Indian-incorporated company, which marketed and sold smart phones in India. The second defendant was incorporated in Hong Kong and was the 99 percent majority shareholder of the first defendant. The defendants also shared the same ultimate beneficial owner.

In early 2016, the first plaintiff and the first defendant signed a Marketing Service Agreement (the "MSA") for the first plaintiff to provide media services to the first defendant. The second defendant did not sign the MSA. The jurisdiction clause in the MSA stated that the agreement was to be governed by the laws of India and that the courts at Bangalore (in India) had exclusive jurisdiction over disputes.

Subsequently, the second defendant signed an undertaking that it would settle the invoices of the first plaintiff for its services under the MSA (the "Payment Agreement"). The Payment Agreement did not contain a jurisdiction clause, nor was it signed by the first defendant.

The dispute

In early 2017, the plaintiffs commenced legal action in Hong Kong against both defendants for their failure to pay the invoices issued by the plaintiffs.

The second defendant argued that the case should not be heard in Hong Kong, but in the courts of Bangalore as:

- it could rely on the jurisdiction clause in the MSA (which it did not sign) because the MSA and the Payment Agreement were in effect parts of 'one single agreement'; and

- as the MSA and the Payment Agreement were related, and disputes arising out of the MSA were to be resolved in the courts of Bangalore, the present Hong Kong proceedings in relation to the second defendant's breach of the Payment Agreement should also be resolved in the courts of Bangalore, together with claims under the MSA.

Decision of the High Court

The High Court of Hong Kong rejected the second defendant's arguments and dismissed its application to discontinue the plaintiffs' proceedings before the Hong Kong court.

First, in the correspondence between the parties, the Payment Agreement was referred to as a 'supplemental agreement', and there were also references to 'tri-patriate [sic] agreements' and 'tri-agreements'. However, based on Indian law expert opinions, the Hong Kong court ruled that as the second defendant was not a party to the MSA, it was not entitled to rely on the jurisdiction clause contained in it. It was also determined that the MSA and the Payment Agreement did not constitute parts of a 'composite transaction' under Indian law, nor did the Payment Agreement have the effect of amending or modifying the MSA.

Second, no proceedings had been started against the first defendant in Bangalore as it was rumoured to be in dire financial straits. Therefore, the plaintiff's argument for claims in the Hong Kong action to be resolved together with any claims before the Bangalore courts could not be accepted.

Third, based on expert evidence on Indian law, it was arguable that in any event the courts of Bangalore may not have jurisdiction over the second defendant, as it was a Hong Kong company with no apparent place of business or substantive operation in Bangalore.

Key points to note

This case highlights the need for parties based in different countries to be clear and consistent as to where disputes should be heard and the relevant governing laws. This is especially true where there is more than one contract governing the parties' relationship.

Where multiple documents are intended to facilitate one large transaction, it is recommended that the 'standard' clauses, such as those on governing law, jurisdiction, notices and confidentiality, be included in each of the documents. Where clauses in one document are intended to also apply to another document, this should be expressly and clearly stated, whether repeated or simply referred to, in each other document.

Learn more about our Corporate & Securities practice.

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2018. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.