Introduction

The investment funds industry in Guernsey has achieved significant growth in recent years. Statistics show that as at 30 September 2014 there were £261 billion of assets under management in Guernsey. The Island has developed into a leading jurisdiction for the establishment of investment funds and a large number of Guernsey funds are listed on the London and other stock exchanges. Guernsey and Jersey have established The Channel Islands Securities Exchange Limited where special procedures exist to enable the relatively easy listing of Guernsey and Jersey funds. Please visit www.cisx.com for further information.

Fund Types

There are a wide variety of funds under management in Guernsey including equities funds, bond funds, money market funds, commodities and futures funds, hedge funds, property funds, feeder funds, umbrella funds, private equity and venture capital funds and emerging markets funds. In addition, there are a large number of institutional investment schemes established in Guernsey which have become increasingly popular for use as special purpose vehicles in asset securitisation, real property and other specialised schemes.

Modern Legislation

The growth of the investment funds industry in Guernsey is attributable in part to the policies of the Guernsey authorities and the flexibility of the regulatory system. Growth is also attributable to the high quality of services available in Guernsey in relation to fund management and custody. The Protection of Investors (Bailiwick of Guernsey) Law, 1987 (as amended) (the "POI Law") sets up a modern statutory structure for the regulation and administration of collective investment schemes in Guernsey. The law provides a framework for investor protection whilst retaining the flexibility to adapt quickly to changing market conditions.

Guernsey Financial Services Commission

The Guernsey Financial Services Commission (the "GFSC") seeks to maintain Guernsey's reputation for probity in the international financial community and its general duty to protect and enhance the Bailiwick's reputation is reflected in its approach to regulation. There is a policy of selectivity which means that great weight is given to the status of the intended promoters. Only those of the first rank are encouraged. Normally a demonstrable and favourable track record in the establishment and/or management of collective investment funds is required. Please visit www.gfsc.gg for further information.

International Recognition

Guernsey is one of the most established, transparent and well-regulated offshore jurisdictions. Guernsey is a member of the OECD and was placed on the G20 white list of offshore jurisdictions in 2009. It has also obtained designated territory status under the UK Financial Services and Markets Act, 2000 (the "FSMA"). Guernsey's low tax status, proximity to the financial markets of Europe and a sophisticated banking and professional infrastructure have also contributed to the success of the Island as a base for investment funds.

Regulatory Framework

The establishment and operation of both open and closed-ended investment funds in Guernsey is governed principally by the POI Law together with the rules made thereunder. An open-ended fund is basically defined as a vehicle where investors are entitled to redeem their holdings at a price related to the value of the underlying assets. A closed-ended fund does not entitle investors to redeem at a price related to the value of the underlying assets although redemptions may be made by the directors or manager.

POI Law

Both funds and persons providing services to funds are regulated by the POI Law. In order to provide services such as management or custody, a person must obtain a licence under the POI Law.

Licensees are subject to conduct of business and capital adequacy rules. Funds (whether open or closed-ended) must be authorised or registered before issuing units or shares.

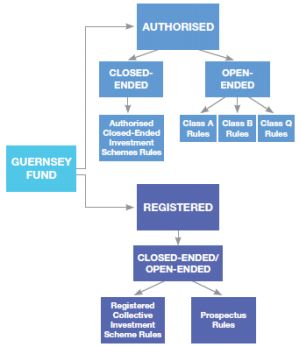

All Guernsey funds (whether open or closed-ended) are categorised as either:

- authorised (i.e. regulated) funds which are subject to ongoing supervision by the GFSC; or

- registered funds which are not authorised and are subject to a lighter touch regulatory regime.

Factors which may be relevant in deciding between an authorised or a registered fund may include the following:

- investor preference (whether investors would prefer more or less regulatory supervision);

- other regulatory or listing authorities (e.g. Euronext) may require the fund to be authorised.

The diagram below demonstrates the various fund types and applicable rules:

Application procedure for authorised funds

Applications for authorisation of an authorised open or closed-ended fund are made under the POI Law to the GFSC.

There are three stages in the standard authorisation process: outline authorisation, interim authorisation and formal authorisation. Where new and innovative funds are proposed or some other part of the application process is unsuitable or can be improved, the GFSC can be flexible in its procedures and it will generally be possible to discuss and agree alternative application procedures where necessary.

Promoters should discuss applications with Ogier as soon as possible in the planning and launch of a fund.

Outline authorisation

Form GFA (Application for Outline Acceptance of a Collective Investment Fund Open or Closed-Ended) is submitted to the GFSC. The form sets out general information regarding the structure of the fund, its investment activities and the parties involved. Form GFA requires the supporting signature of the proposed administrator (and, in the case of an open-ended fund, the proposed trustee/custodian).

At this stage, the GFSC also considers whether the promoter of the fund meets its stated policy as follows:

"The GFSC places great emphasis on the status of an applicant. Essentially the applicant must have a favourable track record in an established jurisdiction which appears free of malpractice, dishonesty or incompetence. Authorisation by another regulatory body will be taken into consideration but does not guarantee a favourable outcome to an application. The 'track record' must be in business equivalent to that to be conducted in Guernsey and should be financially successful. Selectivity criteria also apply to the specific nature of the business to be conducted in Guernsey."

"The GFSC regards the "Promoter" of a fund as the party ultimately responsible for its success. A promoter may, for example, be a fund management company, a new investment boutique or a group of experienced professionals. The GFSC welcomes approaches from promoters of the first rank who have a favourable track record in the establishment and/or management of investment funds."

Where the promoter of the fund is not known to the GFSC, in order to facilitate the GFSC's consideration of its suitability as a potential sponsor, the promoter should also submit a completed New Promoter's Introductory Checklist form together with the requested information on the proposed promoter's full background and status, including details of any authorisation by a regulatory authority, professional body, investment exchange, clearing house, etc. Alternatively, the New Promoter's Introductory Checklist and accompanying information may be submitted on its own or prior to Form GFA. Where the Checklist is submitted on its own, the GFSC will carry out its own due diligence checks and will notify the applicant as to whether it would be willing to consider a formal application from the applicant as the promoter of a Guernsey fund.

The information (which should all be in English) requested by the Checklist includes:

- the full name of the promoter (being the party ultimately standing behind the proposal for new business);

- details of the promoter's authorisation by any regulatory authority, including membership number. If the promoter is not itself regulated, details of any regulatory approvals held by its principals may be provided;

- details of the promoter's main activities, including its operating history;

- details of the ultimate beneficial ownership of the promoter, including the full name of any individual or entity with any interest of 15% or greater, who should complete a Form PQ (discussed below) if not known to the GFSC. It is a requirement to provide details of the name and address of all individuals or entity with any interest of 5% or more but less than 15%;

- third party evidence of a favourable track record by the promoter in the establishment and/or management of collective investment schemes;

- if the promoter lacks a track record in its own right, evidence of the track record of its principals;

- a copy of the promoter's latest audited accounts, or latest management accounts if no audited accounts are available or the audited accounts are for a period ending more than six months prior to the date of the application;

- to the extent known, a brief description of the proposed collective investment fund(s) to be established in Guernsey;

- if known, details of any individuals not already disclosed and not already known to the GFSC who will have key roles in the management of the fund (for example, as director of the fund or any management company, or as investment adviser).

The GFSC also takes account of the other parties involved with a proposed fund including administrators, custodians, auditors and lawyers and, in cases where such other parties are not already known to the GFSC, the provision of background information with the Checklist would be helpful.

If the fund and promoter appear acceptable, a letter of 'outline authorisation' is issued within a few days.

Interim authorisation

The final draft prospectus is submitted to the GFSC. Other documents may also be required at this stage as follows:

- Forms PQ (for directors of corporate funds and directors of managers);

- Form APA (for a Class A fund), plus drafts of all constitutive documents;

- Form APB (for a Class B fund);

- Form APQ (for a Class Q fund);

- Form APC (for a closed-ended fund); and

- application fee.

If the GFSC is content with the detailed submission, 'interim authorisation' is granted, normally subject to amendment or clarification of the draft constitutive documents. Before proceeding to the final stage and usually within 10 business days of receipt of the application, any amendments or clarifications are agreed with the GFSC.

Formal authorisation

Certified copies of the final constitutive documents are filed with the GFSC together with the following, where relevant:

- lawyer's certificate (Class A open-ended scheme);

- lawyer's certificate or manager's certificate (Class B open-ended scheme);

- manager's certificate (Class Q open-ended scheme); and

- certified copy of all final constitutive documents and agreements with relevant service providers.

A formal letter of authorisation follows in a matter of days or, if prior arrangement is made with the GFSC, immediately.

Depending upon the complexity of the investment structure and the extent to which the proposals have been finalised prior to the first approach to the GFSC, the whole procedure can be completed within several weeks.

It should also be mentioned that an investment fund established outside Guernsey may obtain authorisation in Guernsey, provided that it and its licensees comply with any relevant provisions of the POI Law.

To read this Brochure in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.