In a decree published November 6, 2020, the German tax authorities confirmed their view that transactions between non-German parties (e.g., between two U.S. companies) are generally taxable in Germany, if this income is related to IP registered in a German register (e.g., trademarks, patents). This view may have significant tax implications for the parties involved and may lead to substantial tax payments – even for the past.

What is the issue?

As a rule, royalties paid by a licensor based in Germany to a licensor outside Germany (e.g., in the United States) are subject to taxation in Germany. In this case, the royalties are "sourced" from Germany, which justifies Germany's right of taxation. This is in line with general international taxation rules and is not surprising in this respect.

However, German tax laws also provide for a right of taxation on remuneration paid for the licensing or sale of intangible assets ("IP") that are "registered in a German register". Under German law, the following rights are generally registered with a German register (i.e., the German Patent and Trade Mark Office, DPMA Deutsches Patent und Markenamt) to provide protection for the entire territory of the Federal Republic of Germany ("German Registered IP"):

- Patents (including "small patents," so-called Gebrauchsmuster)

- Trademarks

- Designs (Protection of ornamental design of products)

- Plant varieties ("Plant breeders" rights)

- Semiconductors (Protection of semiconductor products)

In this regard, the German tax authorities take the view that rights, e.g., patents that are registered in a German register as a result of an application to the European Patent and Trademark Office in accordance with the European Patent Convention and even EU patent and trademarks, have to be considered as rights registered in a German register (i.e., as German Registered IP).

The wording of the relevant tax law thus also covers transactions relating to German Registered IP that are concluded between parties all of whom are resident outside Germany. In practice, however, this provision, which has been in existence for almost 100 years, has not been applied to these purely extraterritorial cases ("Extraterritorial IP Transactions"). Nevertheless, the German tax authorities now deviate from the previous practice and take the view that such Extraterritorial IP Transactions are also taxable in Germany; the German Federal Ministry of Finance has now confirmed this view in its decree dated November 6, 2020.

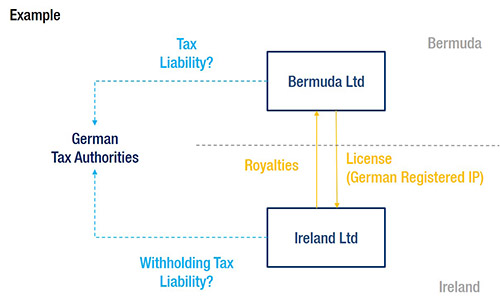

According to this view, for example, royalties paid by an Irish licensee to the Bermuda-based licensor for the use of a patent (registered in the German patent register) are taxable in Germany. The latter would also be the case for all further transactions related to this patent right (e.g., if the Irish licensee grants a sub-license to a Chinese resident company).

What are the consequences?

On the basis of the view taken by the tax authorities, the following consequences may arise in particular in Germany.

- Withholding Tax: Royalties paid by the licensee are subject to German withholding tax ("WHT") at a flat rate of 15.825%. A potential WHT relief under European directives or applicable double taxation treaties ("DTT") may be applicable. However, such relief generally requires a formal application by the licensor and a certification by the German tax authorities prior to payment of the royalties. If WHT was not withheld, which is the typical the case with regard to German Registered IP, the licensee as well as the licensor may be held liable for the payment of WHT. Since the view taken by the German tax authorities is not based on a "new" tax law, WHT would have to be paid for all periods that are not statue-barred.

- Tax liability for sales proceeds: Income resulting from the sale of German Registered IP is not subject to WHT so that there is no liability risk for the buyer. The seller, however, is generally subject to tax in Germany at a flat tax rate of 15.825% (if the seller is a corporation domiciled outside of Germany). However, the profit from the sale of German Registered IP is usually effectively exempt from German taxation under the applicable DTT. A (significant) tax risk there remains in cases where the seller is domiciled in a jurisdiction that does not have a DTT with Germany (e.g., Bermuda, Brazil, etc.). It should be noted that restructuring measures may also qualify as a sale in this regard.

- Criminal proceedings: If taxes are deliberately or willfully not paid on time, this can constitute an administrative/criminal offense. Under current legislation, criminal charges cannot be brought against a company, but only against the responsible persons (e.g., management). Although we are not aware of any case yet where criminal proceedings have been initiated with regard to German Registered IP, the risk of criminal prosecution may be mitigated or even excluded by filing a qualified disclosure of the unpaid WHT, which, however, requires a full disclosure of all unpaid WHT at least within the last 10 years.

What to do?

The view of the tax authorities is controversial. In particular, there are arguments that the Extraterritorial IP Transactions are not taxable in Germany at all, or that at least only a very low portion of the remuneration is taxable in Germany. It has to be analyzed in each individual case whether these arguments can be applied.

All persons and companies that are or were party to an Extraterritorial IP Transaction should evaluate their tax and risk positions as quickly as possible. On this basis, it should then be decided which measures need to be implemented and which options exist to mitigate a possible tax exposure in Germany.

We are happy to assist in case of any questions.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved