1. Introduction

1.1 Malta as a Gambling Jurisdiction of Choice

Throughout the past decade and a half, Malta has positioned itself in a unique regulatory and operation position within the remote gambling industry. Being one of the first jurisdictions to plunge into substantially regulating remote gambling, operators have flocked to Malta in the pursuance of legal certainty and legitimacy. From an economic point of view, the industry has worked wonders for Malta. In 2018 alone, the industry accounted for over 12% of the local GDP.

The immediate success of the industry and the allure of Malta has naturally faced competition over such a period, with other European jurisdictions seeking to tap into an industry. This is, perhaps, one of the best compliments which Malta, as a jurisdiction, could have received. It has kept regulators and industry professionals on their toes, as is evident via the 2018 remote gambling regulatory overhaul, and has ensured that Malta retains its stronghold as one of the European jurisdictions of choice for operators across different segments.

It is no secret that matters revolving around the morality of the industry is a century long debate and policy has undoubtedly changed over the years, bringing along with is different challenges and concerns to the industry. This is without exception to the fact that the world in 2004, when Malta initially plunged into the hollows of remote gambling regulation was very different to the world we live in today, in 2021. It is safe to say that a primary driver of such differences has been technological improvement and innovation. Accessing an online casino from a touch-based cellular phone was not considered to be the norm in 2004.

Enter 2021, and this seems to be rather mainstream. Time have indeed changed! It is no secret that the pliability of any skilled and efficient businessman is to be able to adapt to change and to see opportunity in the same. Such sentiment may easily extend to regulators and law makers, which may indeed be left behind and may become redundant if they are not open to change and evolution.

1.2 Enter Blockchain

Blockchain technology has undoubtedly challenged the status quo in a number of sectors, ranging from financial services to supply chain management of edible goods. It has provided the world with a new dimension as to how the concepts of trust, integrity and certainty are interpreted through today's most powerful force - technology. Ever since the emergence of the concept of decentralisation, it could be said that it was only a matter of time until technology dabbles with the remote gambling industry.

It seems like a match made in heaven - a rapidly changing and adaptable technology for an industry that thrives on change and innovation. It is somewhat romantic! A quasi impenetrable gaming platform making use of a payment method outside the scope of financial institutions and banks, with full transparency and immutable transaction ledgers may have seemed like a utopia of sorts seventeen years ago, but not today! We have evidenced the emergence of a new concept of 'decentralised gaming', which may merely mean the willingness of an operator to allow players to use a cryptocurrency and/or the deployment of an online gambling platform, such as an online casino, which is purely decentralised and which provides full transparency and accountability via public ledger transactions.

For regulators in the space, it really is sink or swim, you either choose to embrace the technology and attempt to be a driving force in the space or you may simply agree to observe and adapt along the passage of time, missing the boat of opportunity in due course.

Malta decided to swim but swim intelligently.

2. Decentralised gambling

2.1. Concept

So, what exactly is a decentralised gaming platform? Different models provide unique characteristics, however, in summary, this may be considered to be an open, seamless and transparent platform through which transactions in blockchain-based digital assets, such as player wagers in cryptocurrency, are publicly recorded on a blockchain, ensuring full transparency and accountability in due course. Decentralised gaming platforms may also allow for community-based ownership of platforms, whereby developers have a stake in the respective platform's operation through their development efforts, also exists. Such platforms may be B2B or B2C in nature.

Undoubtedly, the adoption of such a concept in an already regulated industry is bound to stretch the efficacy and boundaries of the law. In this respect, Malta has scaled a regulatory framework which, from a bird's eye view, is desirous of achieving the following:

- The provision of regulatory certainty for transactions in virtual financial assets (cryptocurrency);

- The protection of consumers dealing in such assets and/or dealing on/using decentralised innovative platforms;

- Imposing Malta as a regulatory jurisdiction of choice for decentralised business ventures

2.2. The Malta DLT Regulatory framework at a glance:

Malta's DLT regulatory framework is composed of three primary pieces of legislation which integrate with one another to provide the solid ground upon which Malta's quest to become the 'blockchain island' may indeed become a reality. The three main pieces of legislation are the following:

i. The Virtual Financial Assets Act

This act has coined the 'cryptocurrency' asset class as 'virtual financial assets' ('VFA') and primarily seeks to regulate issuers of such VFAs operators providing investment like activity to consumers with respect to such VFAs. This act, despite being primarily directed towards regulation within the financial services space, could be said to be the cornerstone of the Maltese regulatory framework as it has provided an avenue through which an asset may be classified, with legal certainty, as a VFA (i.e., "any form of digital medium recordation that is used as a digital medium of exchange, unit of account, or store of value and that is not electronic money, a financial instrument or a virtual token" ). Such classification has opened the door for the regulated use of such an asset class in segments beyond investment services, such as remote gambling.

ii. The Malta Digital Innovation Authority Act

This act established an authority known as the 'Malta Digital Innovation Authority', which is tasked with promotion and oversight of national policies targeting technological innovation. This authority is also tasked with vetting and overseeing systems auditors which are entrusted with providing a seal of approval for the proper functioning and legitimacy of DLT based platforms. The authority is a key player in ensuring that the adoption of emerging technologies such as blockchain is rolled out in a manner which promotes Malta's competitiveness but retains the highest level of consumer protection.

iii. The Innovative Technology Arrangements and Services Act

This act complements the Malta Digital Innovation Authority Act, in that it provides for a basis upon which technology platforms and services on the same are regulated accordingly. The Malta Digital Innovation Authority is the designated competent authority in this respect. The act notes that a technology arrangement is one that avails of a distributed, decentralised and/or replicated ledger, is public or private, is permissioned or permissionless, is cryptography-based and is auditable. A blockchain-based gaming platform falls squarely within such a definition. Such successful classification would render the platform as an 'innovative technology arrangement' ('ITA'), and accordingly, may be audited and certified by an approved systems auditor.

The framework, generally, is drafted in a high-level manner in order to ensure that it remains relevant within the fast-paced technology field. From a remote gambling point of view, the three acts intertwine with one another to provide for a legitimate funnel upon which a Malta-based remote gambling operator may seek to adopt an element of decentralisation within its product.

2.3. Funnel for remote gambling operators

Such a funnel to the Gaming Act (Chapter 583 of the Laws of Malta) is one that has been met with caution, however. The caution applied, rather than aiming to fend off the imposition of decentralisation in remote gambling business ventures in Malta, has created a methodology through which such platforms are evaluated, tested and scrutinised prior to being released to consumers within the regulated Maltese remote gambling market.

The Malta Gaming Authority 'MGA') has developed a 'Regulatory Sandbox' which is aimed at providing already licensed remote gambling operators with an avenue through which their innovative product is tested against the objective set forth in applicable guidelines, prior to being released to consumers at large. The sandbox may be considered to be a safe harbour of sorts, which therefore allows for the roll-out of a decentralised platform within supervised and shock absorbing parameters.

3. The MGA Sandbox

3.1. Introduction and background

Initially, the sandbox regime became effective as of the 1st of January 2019, with the primary focus being on the provision of an avenue through which already licenced MGA remote gambling operators may accept virtual financial assets as a means of payment within the online gaming environment. In mid-2020, through the publication of the document titled "Guidance on the use of Innovative Technology Arrangements and the acceptance of Virtual Financial Assets and Virtual Tokens through the implementation of a Sandbox Environment - June 2020 ", the sandbox regime extended in scope in order to allow for the adoption of ITAs by remote gambling operators, with the MGA committing to an applicability of the sandbox regime until the 31st of December 2021. In simplistic terms, the respective guidance document is drafted against the general backdrop of key pillars within the Maltese regulatory framework, which, colloquially, may be denoted as being:

- Product legitimacy, in that, a product delivered to a consumer is delivered in a manner and form which meets a reasonable consumer's expectations, in line with any restrictions and/or safeguards as imposed by law;

- Approved based approach, in that, the platform and the respective games offered on the same need to be pre-approved by the MGA against the backdrop of an independently carried out audit. Such pre-approval extends to elements within the remote gambling operation's infrastructure, including key function holders and the respective IT infrastructure availed of;

- Consumer protection, in that, consumers, especially players, are safeguarded from a fraud, safeguarding of funds and operator integrity point of view.

- Supervision and legal adherence, in that, the MGA, as the competent authority in terms of the Gaming Act, duly supervises operators and products and/or services offered by the same, through the due exercise of its powers as established at law.

3.2. Eligibility

On the basis of a cautious approach, operators which may seek admission to the sandbox are ones which are already in possession of the relevant MGA licence and any other licence or approval which may be required in terms of law (such as, for example, approval for the offering of a specific virtual financial asset). This ensures that operators in the space are already known to the MGA and that a track record exists with respect to their operations and activities. Additionally, a sandbox applicant must ensure that any test-net environment subject to application must have a live environment that is capable of going live by such time as the MGA may allow, which can be no more than three (3) months after the approval is issued. Accordingly, it is evident that platforms that are the target of this MGA initiative are ones that are in a phase of advanced development and not ones that are of a raw nature not capable of full operational capacity.

3.3. Use of Decentralised Assets by MGA operators

Prior to availing of any DLT based asset, an operator must conduct the financial instruments test duly issued by the Malta Financial Services Authority, to duly classify the asset as a virtual financial asset, virtual token, electronic money or financial instrument. Application to the MGA must also be accompanied by a legal opinion issued by a licenced VFA Agent in terms of the Virtual Financial Assets Act, which highlights the licensability or otherwise of the MGA operator's use of the DLT based asset in question, in terms of applicable financial services and payments related law and regulation.

As a rule of thumb, the MGA shall only allow the use of assets which are classified as VFAs and, in line with the sentiment noted in the sandbox document, shall only allow the use of financial instruments, electronic money or virtual tokens as a means of payment on the gaming platform if specifically approved by the MGA on a case-by-case basis.

Without prejudice to the MGA's right, In order to be able to accept VFAs a method of payment, MGA operators need to ensure that such VFAs:

- Have financial value in that, inter alia, the technology represented by the token addresses a market requirement which is yet to be met and/or helps solve a problem, the underlying network is trustless and decentralised and it is easy for members to participate in the economy, having control of their wealth and the freedom to invest in it as they choose.

- Have technological value, in that, inter alia, the technology is secure and has a prompt response to deficiencies and weaknesses.

- Are based on technology which is scalable, in that, inter alia, there are practical applications, in the present and/or future for the technology in question.

- From a market characteristic point of view, the VFA is capitalised sufficiently to a level of acceptable competition, it is not restricted to a specific geographic region and that a trading pair exists with a fiat currency. Provided always, that the aforementioned fiat currency pair condition may be waived by the MGA if the objectives of the sandbox are still achieved.

- From an asset economics perspective, the VFA must, inter alia, be subject to future plans and milestones, be backed by a reputable and strong issuing team and must also be connected to a service and/or product offering.

It is also to be noted that the MGA may allow, on a discretionary basis, the use of virtual tokens, i.e. a "form of digital medium recordation whose utility, value or application is restricted solely to the acquisition of goods or services, either solely within the DLT platform on or in relation to which it was issued or within a limited network of DLT platforms". Such an assessment will be based on the economic factors as above mentioned, as well as a consideration of the technology, company structure, market applications, security and human resources associated with the virtual token.

3.4. Wallets

Wallets which store VFAs for remote gambling purposes must have a specific address and must allow for the seamless deposit and withdrawal (conditional on available balance) of that specific asset. It is critical that a wallet used it tied to the player registered on the platform. Remote gambling operators are hence placed with an onus to ensure that such a link is established and recorded.

3.5. Deposits

The sandbox guidance document seeks to streamline the manner players may deposit VFAs and virtual tokens, through the establishment of a procedure which must be adhered to. The deposit process for VFAs may be summarily noted as being inclusive of player registration and wallet address identification, with an obligation being placed on remote gambling operators to freeze any pending amounts if detail as to who has control over the wallet cannot be identified.

Any deposit in VFA must be subject to a wager in the same VFA and withdrawal must be done using the same VFA. Accordingly, therefore, such remote gambling operators do not act as intermediaries. With respect to virtual tokens, the guidance document provides that remote gambling operators may issue virtual tokens to players in exchange for fiat currency on the platform itself. Additionally, the guidance document highlights that any withdrawal made following the use of any virtual token by a player must be put into effect using fiat currency.

Of utmost importance is the fact that no remote gambling operator may accept deposits in VFAs in general by a player exceeding the equivalent of ?1,000 per month. This deposit limit is the summative value of all deposits in VFA denominated in Euro at the time of deposit on the basis of a rate of exchange established from a VFA exchange chosen by the remote gambling operator and as reported with the MGA .

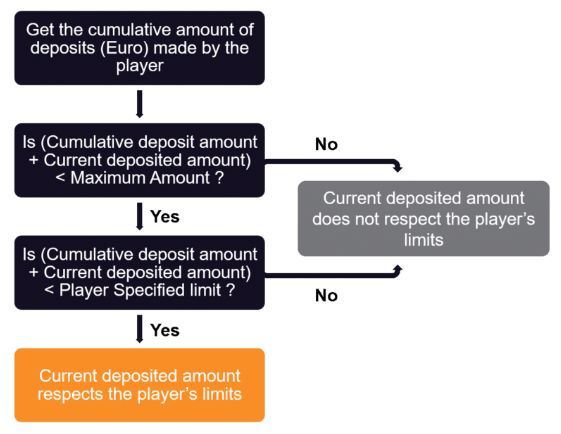

For the sake of clarity, given the volatile nature of most VFAs, the MGA established a matrix which should be used by remote gambling operators to establish whether a deposit value by a player is in line with the aforementioned limit. The matrix is the following, as duly displayed in Section 2.5, Figure 1 of the guidance document:

It is evident, therefore, that a core principle of gambling law, which is player protection from a responsible gambling perspective has been carried forward and has been embodied in the guidance document accordingly.

3.6. Innovative technology arrangements

The guidance document makes it explicitly clear that the adoption of an ITA, which may indeed be the adoption of a DLT based platform and/or smart contract within the gaming ecosystem operated by the remote gambling operator, must be specifically approved by the MGA and must be duly included in the sandbox. Such ITAs must be audited by a systems auditor duly licensed to act as the same by the Malta Digital Innovation Authority.

Any positive adoption of the ITA is subject to a positive opinion provided by the auditor and is also subject to proper ascertainment that the platform does not impair the operator's capacity to abide by applicable law and/or regulation. In a move which also runs congruent to the 'prior approval' pillar of Maltese gaming regulation, administrators of the ITA must be assessed by the MGA from a competence point of view.

To further expand the scope of the sandbox regime, the MGA has also allowed the hosting of games, game components and essential components on a distributed network is also possible, subject to a satisfactory audit and proper legal compliance as aforementioned.

From a smart contracts point of view the MGA has opted to focus on the use of such contracts in a game transaction execution scenario, whereby, for example, VFAs are held by way of escrow and are released on the basis of a game's outcome. In this regard, for admission to the sandbox, such smart contacts must adhere to a pre-set number of conditions which are inclusive of, for example, the imposition of self-exclusion limits by players, positive ascertainment on the player's control of the wallet, the fact that the contract itself is reviewed by a systems auditor duly approved by the Malta Digital Innovation Authority.

3.7. Location

From a technical infrastructure point of view, in the event that a remote gambling operator wishes to implement/adopt a public and permissionless blockchain-based platform, a node would need to be established in Malta which would serve as a means of replication of regulatory data, that is, any data which an operator is obliged to "compile, retain or report" to the MGA in terms of the Gaming Act or any other relevant regulatory instrument . Such flexibility and departure from the regular requirement that the hosting architecture must be in Malta or any other EU/EEA state complements the wide and distributed reality which encompasses blockchain technology.

4. Concluding remarks

What may seem like a small step which has its very own limitations is indeed a step in the right direction, and one which has been borne following industry demand. Whilst the MGA sandbox has limitations as to eligibility and restrictions of operational activities, it embodies Malta's efforts to provide the remote gambling industry with a new dimension and new way of gaming, paying respect to decentralised technology as a force to be reckoned with whilst ensuring that consumers are protected and the integrity of Malta as a remote gambling jurisdiction of choice is retained.

On a concluding note, it is safe to say that the MGA's acknowledgement that the local remote gambling regulatory framework is not technologically agnostic has opened a safe harbour avenue worthy of consideration which acts as an appropriate filter in the funnel between Malta's DLT regulatory framework and the well-established Gaming Act. Naturally, moving out of a sandbox mindset to a fully-fledged legislative mindset will bring about challenges of its own, however, Malta is on the right track and the track it is on is not one explored by many.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.