- within Finance and Banking topic(s)

- in United States

- within Antitrust/Competition Law, Technology and Law Practice Management topic(s)

- with readers working within the Banking & Credit industries

Introduction

Partnerships are vehicles of choice for the asset management industry, especially in the field of private equity, real estate, debt and other 'illiquid' strategies.

Luxembourg law has known partnerships since the implementation of the Law of 10 August 1915 on commercial companies ("Luxembourg Company Law"), and to some extent since the enactment of the first Commercial Code in 1807.

In 2013, Luxembourg seized the opportunity of the implementation of Directive 2011/61/EU on alternative investment fund managers ("AIFMD") to increase its attractiveness as a leading investment fund centre and to boost the attractiveness of its partnerships. Luxembourg lawmakers thoroughly amended and modernised the limited partnership regime and sought to align the regime of local partnerships with those of competing jurisdictions, thus expanding the structuring possibilities of investment vehicles electing for the partnership regime, mainly to respond to the needs of the asset management industry.

The new Luxembourg partnership, whilst sticking to its original principles, embraces the flexible nature of Anglo-Saxon types of partnerships, with only a few variations. This new approach has allowed asset managers to set up private funds benefiting from the AIFMD marketing passport in a format that they are more familiar with and which allows full interaction with other vehicles of their product range (e.g. Delaware feeder of parallel funds for the US market).

The Luxembourg Laws of 25 February 2022 (securitisation) and of 21 July 2023 (fund toolbox) have moreover broadened the scope of regulatory options available for managers allowing them to form certain retail alternative investment funds and securitisation vehicles as partnerships.

Managers looking to set up their fund in Luxembourg can choose between three types of partnerships: two are based on the Anglo Saxon models, the common limited partnership ("SCS" or société en commandite simple) and the special limited partnership ("SCSp" or société en commandite spéciale), and one is based on the more continental type of partnership, the partnership limited by shares ("SCA" or société en commandite par actions).

The purpose of this Memorandum is to describe the principal features of the different Luxembourg partnerships (while focusing mainly on the SCS and the SCSp), and the regulatory options under which they may be set up. Unless provided otherwise, reference to "Partnership(s)" in this Memorandum should be understood as an indistinct reference to the SCA, SCS and SCSp.

Chapter I: Partnerships in the Luxembourg toolbox

1. Types of partnerships

Although the SCS, SCSp and SCA are all "partnerships", the SCS and the SCSp are comparable to Anglo-Saxon types of partnerships, whereas the SCA is similar to a public limited liability company (société anonyme or "SA").

Therefore, although it is still subject to some flexibility, the SCA remains a more continental type of partnership subject to several corporate requirements.

Managers who are contemplating launching a vehicle in the form of an SCS should also carefully consider the few key differences between the SCS and the SCSp.

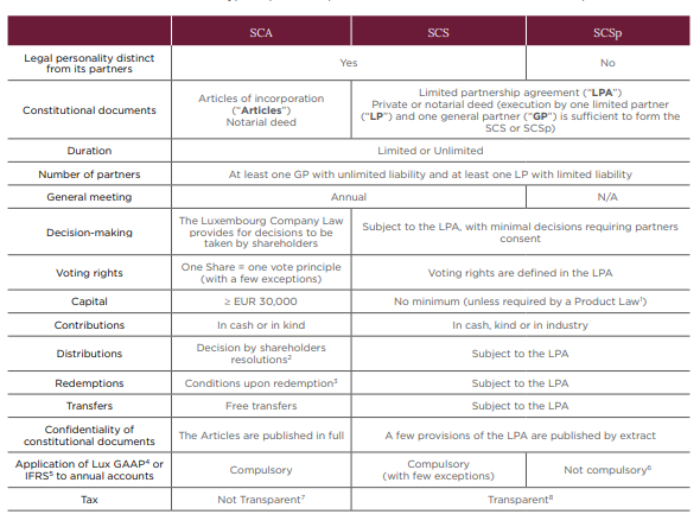

The following table offers a comparison of the main distinctive factors between Partnerships:

2. Regulatory options available

Luxembourg offers several regulatory options under which partnerships may be set up. In a nutshell, a partnership may take the form of a vehicle that is:

- " supervised by the Luxembourg financial regulator (Commission de Surveillance du Secteur Financier or "CSSF") i.e. a Part II undertaking for collective investment ("Part II UCI(s)"), a specialised investment fund ("SIF(s)") or an investment company in risk capital ("SICAR(s)") (with the possibility of falling within the scope of the AIFMD – in which case it will be eligible for the AIFMD marketing passport – or not);

- " not directly supervised by the CSSF but may benefit from the AIFMD marketing passport provided that it qualifies as an alternative investment fund under the AIFMD ("AIF(s)") and appoints an alternative investment fund manager ("AIFM(s)") authorised in the European Union ("EU")9, i.e. a reserved alternative investment fund ("RAIF(s)") or a "simple" AIF (i.e. not under a Product Law);

- " neither supervised by the CSSF nor in scope of the AIFMD, e.g. a "simple" Partnership such as a non-AIF (a holding vehicle or a fund of one), an AIF managed by a non-EU AIFM or an AIF managed by a "small"' AIFM10;

- " a securitisation vehicle, which will not be supervised by the CSSF (unless it issues financial instruments to the public on a continuous basis) and may benefit from the AIFMD marketing passport if it qualifies as an AIF and appoints an authorised AIFM.

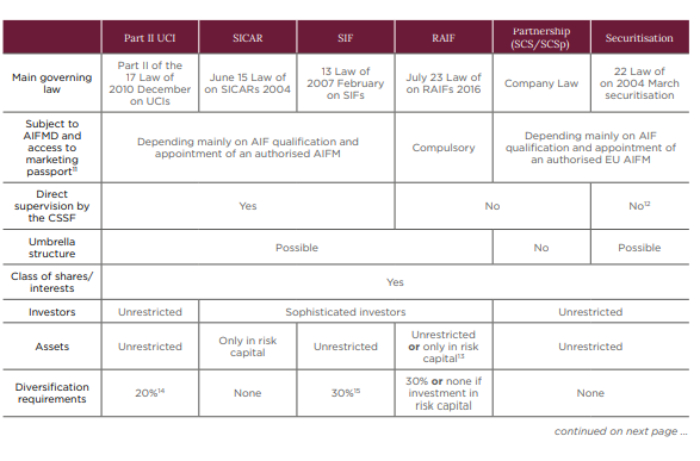

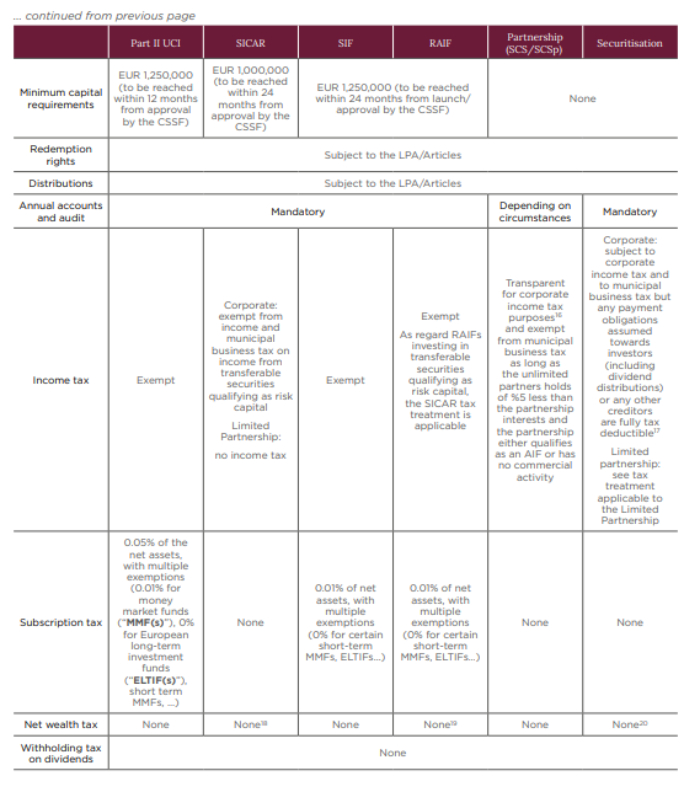

The next table summarises the different regulatory options under which a Partnership may be set up and the key differences between them:

Chapter II: Marketing and listing

1. Marketing to professional investors21

Luxembourg Partnerships are the gateway to EU (professional) investors for managers that manage illiquid strategies. Access by Luxembourg Partnerships to the AIFMD marketing passport for distribution to professional investors in the EU, however, is conditional upon the Partnership qualifying as an AIF, appointing an AIFM and being subject to the full scope of the AIFMD.

This passport, which is granted to the AIFM (which needs to be established in the EU for now and authorised) and not to the Partnership itself, will allow the Partnership to be marketed to professional investors in the EU.

2.Marketing to nonprofessional investors

Marketing of Luxembourg Partnerships in the EU to investors other than professionals is not covered by the AIFMD marketing passport. Except in the case where the Partnership qualifies as ELTIF under the ELTIF Regulation22, non-professional investors in the EU may only be approached without a passport if permitted by the Member State in which the Partnership is to be marketed and subject to applicable requirements of that Member State.

The Luxembourg toolbox contains many vehicles that may, at least passively, accept non-professional investors. In this area, Part II UCIs are the vehicle of choice since they are (i) Luxembourg's domestic AIFs designed for retail investors, and (ii) regulated by the CSSF, which offers a layer of comfort to investors, distributors and foreign regulators. When they are authorised as ELTIF funds, Part II UCIs may also be marketed to retail investors under certain conditions throughout the EU with the ELTIF passport23.

A closed-ended Partnership issuing securities to the public might be required to issue a prospectus pursuant to the Prospectus Regulation24.

3. Listing

Partnerships may apply for the listing of their securities on a stock exchange (if securities are issued), subject to the rules governing the relevant market. To the extent that a Partnership is subject to a Product Law (other than a Part II UCI), managers shall ensure that secondary trading does not result in non-eligible investors holding securities of the Partnership.

It is under debate whether or not a Partnership (other than an SCA) may directly be the subject of a public offer.

To view the full article clickhere

Footnotes

1 "Product Laws" refer collectively to Part II of the Law of 17 December 2010 on UCIs, the Law of 15 June 2004 on SICARs, the Law of 13 February 2007 on SIFs and the Law of 23 July 2016 on RAIFs

2 Flexibility available if set up under a Product Law. Interim dividends can be paid on decision of the GP.

3 Flexibility available if set up under a Product Law.

4 "Lux GAAP" refers to the Generally Accepted Accounting Principles applicable in the Grand Duchy of Luxembourg

5 "IFRS" refers to International Financial Reporting Standard.

6 "US GAAP"refers to the Generally Accepted Accounting Principles applicable in the United States and is generally available for an SCSp but some limitations on other GAAP will apply in case the SCSp qualifies as an AIF and has appointed an authorised AIFM.

7 Possibility to check the box for US tax purposes. 8 Certain jurisdictions might not recognise the transparency of the SCS/SCSp. This might result in hybrid mismatches under ATAD 2

9 For the purposes of this Memorandum, the terms "European Union", "EU" and " Member States" also refer to and include the European Economic Area ("EEA") and the States that are contracting parties to EEA agreement other than the Member States of the European Union, within the limits set forth by this agreement and related acts. 10 "Small AIFM"refers to an AIFM who manages AIFs whose total assets under management, including any assets acquired through use of lev

erage, do not exceed EUR 100 million, or whose total assets under management do not exceed EUR 500 million and whose portfolios of AIFs consist of AIFs that are unleveraged and have no redemption rights exercisable during a period of 5 years following the date of initial investment in each AIF.

11 The AIFMD passport will allow the marketing of the Partnership to professional investors in the EU.

12 Unless it issues on a continuous basis financial instruments offered to the public.

13 Depending on the tax regime elected for.

14 A Part II UCI may not, in principle, invest more than 20% of its net assets in one single issuer although this limit may change depending on the asset class (e.g. for infrastructure assets). The CSSF may also grant derogations on a case-by-case basis upon adequate justification and/or accept a "start-up period" during which Part II UCIs may depart from the applicable risk diversification rules.

15 For SIFs, the risk diversification limit is, in principle, 30% but may change depending on the asset class (e.g. infrastructure assets). It is also possible to obtain derogations from the CSSF and/or to benefit form a "start-up period" during which SIFs may depart from the applicable risk diversification rule

16 Anti-hybrid mismatch rules need however to be monitored (see Chapter V, section 3 of this Memorandum).

17 Interest deduction limitation rule to be monitored unless the securitization vehicle qualifies as AIF.

18 A minimum net wealth tax is, however, applicable.

19 A minimum net wealth tax is, however, applicable for RAIF investing in transferable securities qualifying as risk capital.

20 A minimum net wealth tax is, however, applicable.

21 The concept of "professional investors" under the AIFMD refers to any investor that is considered as, or may be treated as, a professional client under Annex II of MiFID.

22 "ELTIF Regulation" refers to Regulation (EU) 2015/760 on European long-term investment fund, as amended. For further detail on the ELTIF, please check our dedicated brochure available on our website www.elvingerhoss.lu.

23 For more information on Part II UCIs, please check our dedicated brochure available on our website www.elvingerhoss.lu.

24 "Prospectus Regulation" refers to Regulation (E

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.