- within Finance and Banking topic(s)

- in Asia

- in Asia

- in Asia

- in Asia

- within Finance and Banking, Real Estate and Construction and Employment and HR topic(s)

- with readers working within the Retail & Leisure industries

Compliance is an integral part of doing business in Indonesia. Business actors need to be aware of these ongoing compliances after the establishment of their businesses and issuance of their licenses. One of the mandatory ongoing compliances in Indonesia is the Investment Activity Report (Laporan Kegiatan Penanaman Modal or "LKPM").

LKPM is a mandatory, periodic report to the Indonesia Investment Coordinating Board (Badan Koordinasi Penanaman Modal or "BKPM"). A business actor needs to submit an LKPM every three or six months, depending on the scale of the business. LKPM includes the total manpower, production realization, export value, and total investment.

Business actors often experience difficulties during the submission course due to the lack of information on LKPM. Issues could be related to the procedure, timeline, or requirement. We provide herein, the guideline on LKPM, particularly the: (i) entities that are required to submit the investment activity reports, (ii) Submission Periods, (iii) content of LKPM, and (iv) administrative sanctions.

Entities that are Required to submit LKPM

LKPM applies to all business sectors and/or premises, meaning that if a business actor is involved in more than one businesses and/or premises, he/she must submit an LKPM for each of his/her businesses and/or premises (Article 32 of BKPM Regulation No. 5 of 2021 on Guidelines and Procedures of Risk-Based Business Permits Supervision ("BKPM 5/2021"). Some businesses are exempted from the LKPM obligation. They are:

a. Micro-businesses or each one having a capital of less than IDR1 billion; and

b. Companies operating in certain sectors, such as upstream oil-and-gas businesses, banking, non-bank financial institutions, and insurance. These sectors are subject to specific periodic reporting obligations governed by the relevant sectoral regulations.

(Article 32 (5) of BKPM 5/2021)

Other than that, any business actor is required to submit the periodic LKPM reports.

Submission Periods

As previously mentioned, submission periods depend on the scales of businesses or investment values.

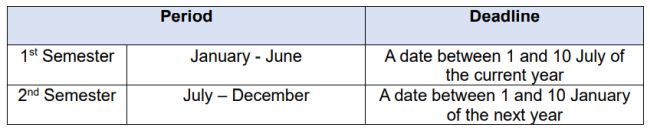

- Submission Period for Small Business Actors: Any business with a capital ranging from IDR1 billion to IDR5 billion ("Small Business Actor") shall submit an LKPM report every six months, with the following schedule:

New Small-Business Actors whose BKPM licenses are issued in the first semester are required to submit their LKPM reports on a date between 1 and 10 of July. If they obtain their licenses on a date in the seventh month of the current year, they should submit their LKPM reports in the next semester (i.e., the first Semester of the next year or on a date between 1 and 10 of July) (Article 33 (1) of BKPM 5/2021)

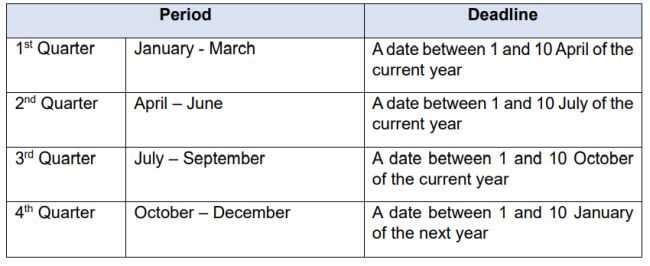

- Submission Periods for Medium-and-Large Business Actors: Any business with a capital of more than IDR5 billion, must submit LKPM quarterly, with the following details:

Similar to Small Business Actors, if the license is issued in the first quarter of the year, a medium-or-large business must submit an LKPM report on a deadline date in the first quarter (i.e., between 1 and 10 April) of the year. If the medium-or-large business company obtains the license in the fourth month, it should submit the LKPM report on a deadline date in the next quarter of the year (i.e., the third Quarter or on a date between 1 and 10 October of the year) (Article 33 (2) of BKPM 5/2021).

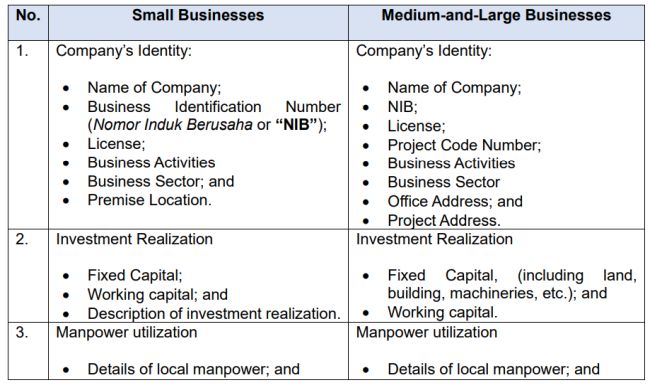

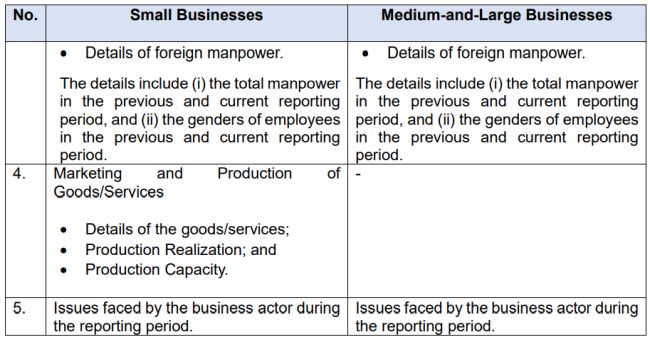

LKPM Content

The content of LKPM also depends on the scale of the business. For your ease of reference, kindly refer to the following table below:

An LKPM must be submitted via the Online Single Submission ("OSS") system, a system managed by BKPM. This system is also used by BKPM to issue NIBs and other licenses. Hence all businesses operated in Indonesia are required to have OSS accounts (Article 15 of BKPM Regulation 5/2021).

Administrative Sanctions

Any delay or non-compliance of LKPM submission may result in the imposition of administrative sanctions on the business actors, in the form of:

i. Written warning;

ii. Temporary suspension of business activities; or

iii. Revocation of Business License.

(Article 47 of BKPM Regulation 5/2021)

Given the existence of applicable sanctions, business actors should submit LKPM report in a timely manner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.