- within Immigration, Intellectual Property and Environment topic(s)

- in European Union

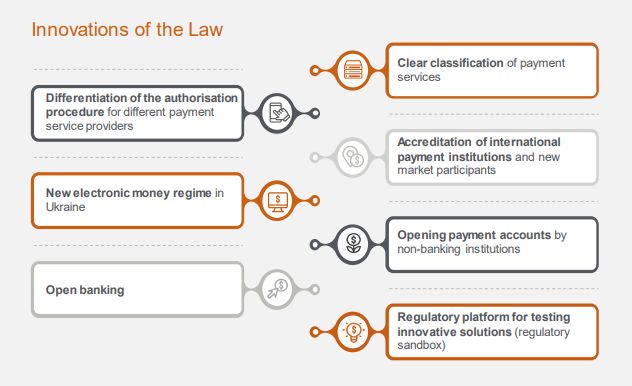

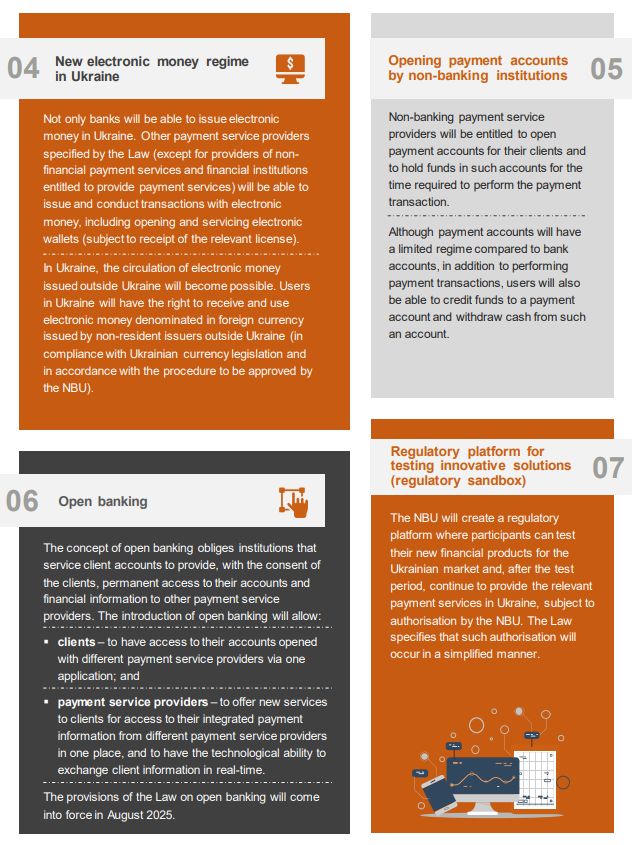

At the end of June 2021, the Ukrainian parliament adopted the Law of Ukraine "On Payment Services" (the "Law"), which aims to modernise the payment infrastructure in Ukraine, make the payment services market more transparent and open to new players, expand the range of payment solutions, and improve the quality of payment services. With the exception of certain provisions, the Law enters into force on 1 August 2022.

The Law primarily establishes the basic requirements for the operations of payment service providers in Ukraine and determines the general parameters for the provision of the relevant services, while leaving a wide range of issues to the discretion of and further regulation by the state regulator, i.e., the National Bank of Ukraine (the "NBU").

It will therefore take time and will require appropriate subordinate legislation in order to see the full potential of the new Law in operation. However, it is already worth paying attention to some of its individual provisions, which will significantly change the landscape of the Ukrainian payment services market.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.