- within Finance and Banking topic(s)

- with readers working within the Retail & Leisure industries

- within Finance and Banking topic(s)

- within International Law, Tax and Corporate/Commercial Law topic(s)

- with readers working within the Business & Consumer Services industries

1. What defines a Small Payment Institution in Poland?

A Small Payment Institution (SPI) in Poland, known in Polish as 'Mała Instytucja Płatnicza' (MIP), is a regulated entity that conducts small to mid-sized payment services within the country.

Although an SPI can provide nearly all types of payment services, it must adhere to certain restrictions. These include operating exclusively within Poland, limiting the balance of individual client accounts to a maximum of 2,000 euros, and ensuring that the average monthly value of all transactions does not exceed 1,500,000 euros.

2. Ideal for small-scale payment ventures.

Small Payment Institution offers a flexible entry point, particularly beneficial for startups and small enterprises. It allows these entities to offer a wide range of payment services with fewer stringent requirements compared to national payment institutions.

This setup is particularly advantageous for entrepreneurs looking to explore the Polish market, familiarize themselves with legal obligations, understand the practices of the Polish Financial Supervisory Authority, and meet the demands of their target clientele.

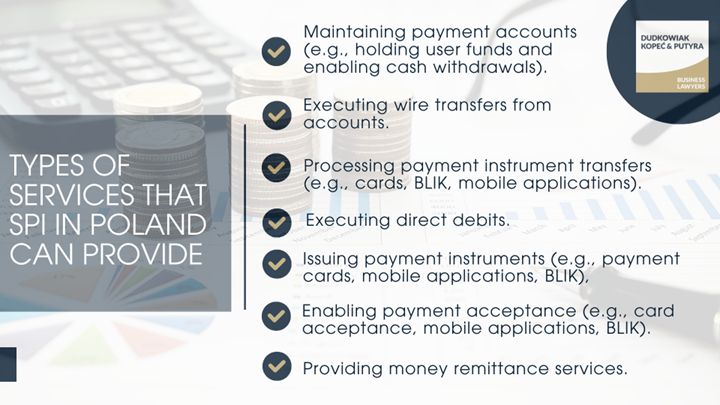

3. Types of services that SPI in Poland can provide

Small Payment Institution in Poland can offer a wide range of payment services, including:

- maintaining payment accounts (e.g., holding user funds and enabling cash withdrawals),

- executing wire transfers from accounts,

- processing payment instrument transfers (e.g., cards, BLIK, mobile applications),

- executing direct debits,

- issuing payment instruments (e.g., payment cards, mobile applications, BLIK),

- enabling payment acceptance (e.g., card acceptance, mobile applications, BLIK),

- providing money remittance services.

However, Small Payment Institutions are not permitted to conduct payment services related to open banking, such as:

- initiating payment transactions (PIS),

- accessing account information (AIS).

4. The flexibility to offer hybrid services

Small Payment Institutions have the flexibility to offer hybrid services, combining both payment and non-payment services. This capability allows them to integrate seamlessly into the business models of entities looking to expand their service offerings, such as incorporating payment processing alongside existing services.

5. No legal form requirements for establishing a Small Payment Institution in Poland

There are no specific legal form requirements for establishing a Small Payment Institution in Poland. This means that various types of entities, including joint-stock companies, limited liability companies, and sole proprietors, can conduct monetary services. The registration process is simplified, making it easier and more accessible for a broader range of entities to set up a Small Payment Institution.

6. No capital requirements

Small Payment Institutions in Poland do not have specific capital requirements beyond those generally applicable to all companies under the Commercial Companies Code. The minimum capital requirements are:

- PLN 5,000 for a limited liability company,

- PLN 100,000 for a joint-stock company,

- PLN 50,000 for a limited joint-stock partnership.

However, if an SPI also intends to provide loans to consumers, it must comply with the Consumer Credit Act, which mandates a minimum capital of PLN 200,000.

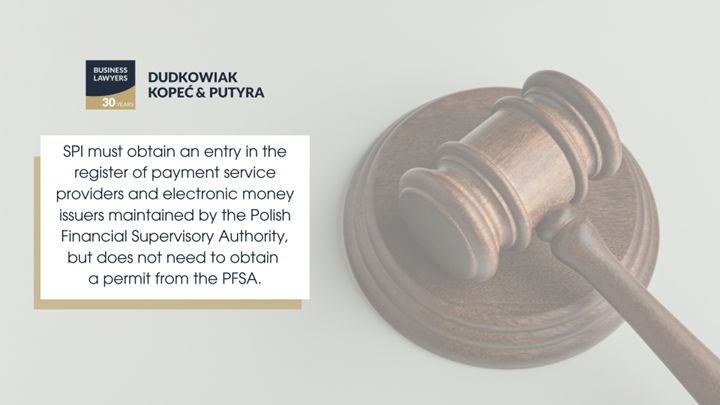

7. Requirements before starting operations in Poland

SPI must obtain an entry in the register of payment service providers and electronic money issuers maintained by the Polish Financial Supervisory Authority, but does not need to obtain a permit from the PFSA. It may only operate in Poland, including through branches or agents. The average of the total amount of payment transactions over the previous 12 months must not exceed the equivalent of EUR 1,500,000 per month.

8. Organisational arrangements that SPI must have in place to be able to operate

SPI must have organisational arrangements in place to calculate the total monthly amount of payment transactions and to comply with AML and terrorist financing obligations under the AML Law. The person managing the SPI must not have been validly convicted of offenses against the administration of justice, economic turnover, money, and securities trading.

Offenses under Article 165a of the Criminal Code, offenses committed for financial or personal gain and fiscal offenses. In addition, the SPI must have an activity programme and financial plan for the first 12 months and an up-to-date risk management procedure.

Small Payment Institutions in Poland – FAQ:

Does operating as a Small Payment Institution require an authorisation from the FSA?

No, operating as an SPI does not require the FSA permit, but only an entry in the FSA's register of payment service providers and electronic money issuers.

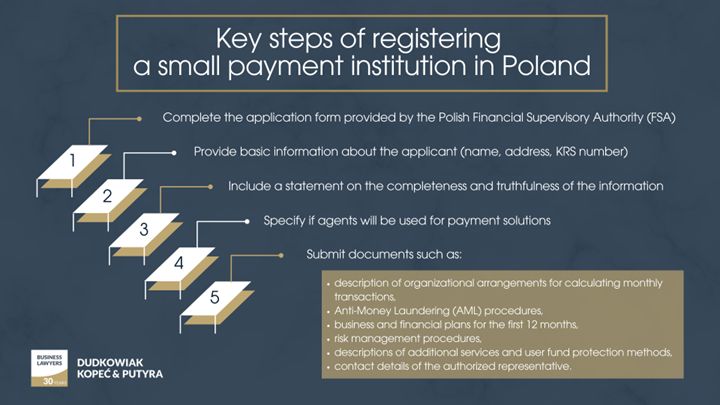

How can one register a Small Payment Institution in Poland, and what are the key steps involved?

1. Prepare Business Plan:

- complete the application form provided by the Polish Financial Supervisory Authority (FSA),

- provide basic information about the applicant (name, address, KRS number),

- include a statement on the completeness and truthfulness of the information,

- specify if agents will be used for payment solutions,

- submit documents such as:

-

- description of organizational arrangements for calculating monthly transactions,

- Anti-Money Laundering (AML) procedures,

- business and financial plans for the first 12 months,

- risk management procedures,

- descriptions of additional services and user fund protection methods,

- contact details of the authorized representative.

2. Prepare Internal Procedures:

- list the payment services to be provided, along with a graphic diagram and description,

- detail the organizational solutions for calculating monthly payment service amounts,

- provide a business and financial plan for the first year,

- outline risk management and AML procedures,

- describe any additional business activities (e.g., currency exchange, data processing),

- ensure documentation related to customer onboarding, service agreements, outsourcing, and GDPR compliance is in place,

- include a statement confirming the completeness and truthfulness of the application data and familiarity with the conditions for operating as an SPI, under penalty of criminal liability,

- provide contact information of the applicant, including the authorized representative's details and correspondence addresses.

3. Pay the Stamp Fee

A fixed duty stamp fee of 616 PLN must be paid when submitting the application.

4. Submit the Application to FSA via:

- ePUAP (electronic platform),

- mail,

- in person.

Can a foreigner or non-Polish resident serve as a director in a Small Payment Institution?

Yes, a foreigner or non-Polish resident can be a director in a Small Payment Institution in Poland, provided they have a clean criminal record.

The Polish Financial Supervision Authority does not evaluate the experience and education of board members during the application process. Presenting a clean criminal record is not a technical requirement with the application.

However, as best practice, especially if the SPI plans to become a National Payment Institution (KIP), it is recommended that:

- board members possess appropriate education, reputation, and experience for prudent and stable management,

- the management board (and supervisory board, if applicable) has enough members to ensure effective, proper, and prudent management, typically recommending at least two to three board members,

- at least half of the board, including the chairman and the board member responsible for risk management, should speak Polish,

- the duration of board member duties is adequate to ensure efficient governance, considering the entity's size, specifics, and operational scope.

Additionally, any connections with Russia or Belarus could result in the registration being denied due to the FSA resolution from April 14, 2022. The institution must provide payment services effectively, in line with the scope and scale of their activities.

Is a Small Payment Institution allowed to hold client money?

Yes, a Small Payment Institution in Poland can hold client money under specific conditions. If the SPI maintains payment accounts, it can hold up to EUR 2,000 per client. Additionally, the average total amount of payment transactions over the previous 12 months, including those by agents, must not exceed EUR 1,500,000 per month.

The SPI must protect customer funds by adhering to these requirements:

- funds accepted for payment transactions must not be mingled with any other funds held by the SPI,

- funds received for payment transactions that are not transferred to the recipient by the end of the next business day must be:

-

- deposited in a bank account specifically designated for this purpose, or

- invested in safe, liquid, low-risk assets, and deposited in a separate account designated for this purpose.

Can a Small Payment Institution provide cryptocurrency services, such as storage and trade?

Yes, an SPI can offer cryptocurrency services like storage and trading. In fact, several entities in the Polish market combine payment services with cryptocurrency services.

However, it is important to note that such an entity must fulfill two requirements:

- obtain a Small Payment Institution license,

- register in the virtual currency register, as mandated by Article 129m of the Polish AML Act.

What obligations does an SPI have towards the FSA?

The SPI must inform the FSA of the total value and number of payment transactions on a quarterly, annual, and monthly basis. It must also provide annual financial statements, update risk management procedures, report on payment fraud, comply with the FSA's recommendations, fulfil its obligations under the AML Act, inform about data changes, and its intention to cease operations.

What fees are associated with registering an SPI?

Entry in the register is subject to a stamp duty of PLN 616 and, if acting through an attorney, an additional PLN 17 must be paid for the submission of the power of attorney document.

By what date does the FSA make an entry of an SPI in the register?

The FSA shall make an entry within 3 months of the receipt of a complete application. If the application is incomplete, the FSA shall call for its completion within a period of no less than 7 days.

What are the obligations of an SPI after its entry in the register?

The SPI is obliged to inform the FSA of the total value and number of payment transactions. It is also obliged to submit an annual financial report, to assess and update its risk management procedures, to submit fraud data and to implement the FSA's recommendations.

In what situations may the FSA refuse to make an entry of an SPI in the register?

The FSA may refuse an entry if the application is incomplete and has not been supplemented within the prescribed period, or the data contained in the application is inconsistent with the facts.

The refusal is obligatory if the entrepreneur has a valid prohibition to conduct activities covered by the entry or has been deleted from the register as a result of a decision of the FSA within the last 3 years.

What are the SPI's obligations if the limit on the average total amount of payment transactions is exceeded?

If the limit is exceeded, the SPI must either adjust the size of its business to comply with the €1,500,000 limit or apply for an authorisation to provide payment services as a National Payment Institution. This must be done within 30 days of the end of the overrun period.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.