- within Technology topic(s)

Target Audience? Finance / Economics

Key Words? What is a Central Bank Digital Currency? (CBDC)

Central bank digital currencies (CBDCs) are a form of digital currency issued by a country's central bank. Countries like the USA are developing CBDCs and looking to provide legislation so as to help regulate these digital currencies.

Although CBDC's are similar to cryptocurrencies which have gained popularity in the recent years, the difference is that CBDC's would be set by the Country's Central Bank and their value is fixed to the equivalent of the country's fiat currency. Cryptocurrencies as they are decentralized are not as reliable as they are highly volatile.

The benefits of CBDC's would be to provide businesses and consumers with privacy, convenience, accessibility and financial security. Many US households up through 2020 did not even have bank accounts or access to financial services. Benefits would also include lower risk of money laundering and financial crimes as the consumers would be dealing directly with the Central Bank rather than private banks. This would also reduce the costs of having expensive infrastructure and the need to have multiple banks in each country.

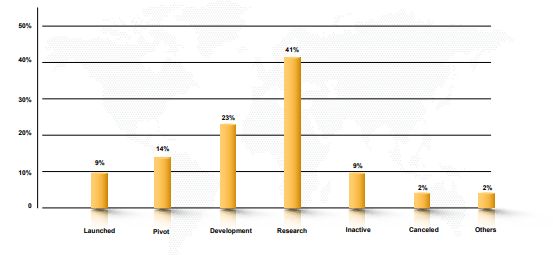

As of this year, approximately 11 countries/territories that have already implemented CBDCs. Approximately 130 other countries have pilot programs in place and are performing the necessary studies as the implementation of CBDCs would require stability in the market and not the constant fluctuation similar to the cryptocurrency market.

China's pilot, which currently reaches 260 million people, is being tested over 200 scenarios including payment in the public transit and e-commerce to name a few. Since Russia's invasion of Ukraine and the G7 sanctions response, wholesale CBDC developments have doubled.

Conclusion

In conclusion, cryptocurrencies have gained a lot of momentum over the years due to convenience, privacy and accessibility and ability to deal in cross border transactions without any additional hassles. Given the emergence of Artificial Intelligence, the more extensive use of technology in society as a whole, the movement towards a cashless society seems inevitable.

Given de-dollarization and the impact of many countries trying to do business with countries like Iran, Russia (especially after the Russia/Ukraine war and Russia being a key exporter of oil, gas and wheat to the world) and others, cryptocurrencies have been a popular alternative which has been a big indication in the market globally that people are ready to rely on digital currencies.

CBDCs will ultimately come into place within the next 10-15 years once proper regulation/legislation and testing has been completed to ensure a proper transition into a cashless society. CBDCs will help reduce overall costs in dealing with banks and cross border transactions and reduce risks of money laundering financial crimes amongst other benefits.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]