Introduction

"NFTs", or Non-Fungible Tokens, is a term that is not generally defined under Japanese law, but is generally understood to mean tokens minted on a blockchain that are irreplaceable. Because NFTs are digital data generated on a blockchain, but have the characteristic of being irreplaceable through the unique values assigned to them, their usage is increasing in various areas. For example, there are games in which in-game items are transferable on blockchain (hereinafter referred to as "Blockchain Games"). In Blockchain Games, unlike conventional games, users can own and manage their own unique in-game items and characters as NFTs. These NFTs can be freely transferred and sold on blockchain, even outside the game. In August 2020, Coincheck, a major crypto asset exchange service provider ("CAESP") in Japan, announced the launch of an NFT marketplace, and businesses using NFTs have been attracting increasing attention recently. The size of the NFT market was only about JPY 20 billion in 2019, and grew to about JPY 30 billion in 2020. This was only approximately 1/1000 of the total value of the crypto asset market. With that said, JPY 30 billion represents a tenfold expansion of NFT market since the beginning of 2018. Moreover, there are now a variety of businesses that utilize NFTs. There is therefore significant potential for further rapid growth in the NFT market.

As a legal matter, Blockchain Games give rise to the following issues: (i) whether in-game items issued as NFTs constitute crypto assets under the Payment Services Act of Japan (the "PSA"), and (ii) whether the issuance of such items amounts to gambling (which is a criminal activity under Articles 185 and 186 of the Penal Code of Japan (the "Penal Code")) if conducted via the so-called "gacha" (loot box) system. A related issue relates to the implementation of login bonuses or ranking campaigns to attract new players, which have to be carefully implemented so as not to violate the restrictions against premiums under the Act against Unjustifiable Premiums and Misleading Representations ("AUPMR").

Definition of CA

Bitcoin, commonly viewed as the representative token using blockchain technology, is regulated as a "Crypto Asset" under Japanese law ("CA"). As NFTs are also tokens using blockchain technology and are tradable with fiat currency or other CAs, an important question is whether they constitute CAs under the PSA.

CA is defined in Article 2, paragraph 5, of the PSA as:

- proprietary value that may be used to pay an unspecified person the price of any goods purchased or borrowed or any services provided, where such proprietary value may be sold to or purchased from an unspecified person (limited to that recorded on electronic or other devices by electronic means and excluding Japanese and other foreign currencies and currency denominated assets), or transferred using an electronic data processing system ("Type I CA"); or

- proprietary value that is reciprocally exchangeable for other proprietary value specified in the preceding item with an unspecified person, where such proprietary value may be transferred using an electronic data processing system ("Type II CA").

For this purpose, "currency denominated assets" is defined in Article 2, paragraph 6, of the PSA as assets denominated in JPY or a foreign currency, or with respect to which the performance, repayment, or any other activity equivalent thereto will be carried out in JPY or a foreign currency. Based on this definition, a digital coin whose value is pegged to JPY, USD, or any other fiat currency (such as, for example, where the price of a digital coin is always fixed at one JPY or one USD, or where a digital coin is redeemable at one JPY or one USD) would fall outside the definition of CA.

Definition of CAES

A business operator that conducts business constituting crypto asset exchange services ("CAES") will be required to undergo registration as a CAESP under the PSA.

Article 2, paragraph 7, of the PSA defines CAES as engagement in any of the following activities as a business:

- sale or purchase of CAs, or the exchange of a CA for another CA;

- intermediating, brokering or acting as an agent in respect of the activities listed in item (i);

- management of customers' funds in connection with the activities listed in items (i) and (ii) above; or

- management of CAs for the benefit of others.

Additionally, CAESPs are required to comply with the relevant regulations under the PSA, including the following:

- User Protection Measures

- A CAESP is required to explain certain matters (such as the fact that a CA is not considered to be equivalent to the JPY nor any other fiat currency) to users in advance, before providing any CAES to users.

- A CAESP must provide information to users, protect users, and take necessary measures for the proper and secure provision/performance of its services to and for users. To ensure the protection of users and the proper and secure provision/conduct of CAES, a CAESP is required to establish adequate internal rules.

- A CAESP is also required to establish systems for providing (a) training to its employees, (b) guidance to its outsourcees, and (c) such other matters for the purpose of ensuring that its business is operated based on such internal rules.

- Segregation of Users' Funds

- A CAESP must segregate users' assets from its own assets, and regularly undergo an audit of the status of such segregated management by a certified public accountant or audit firm. More specifically, the PSA requires a CAESP to manage users' funds separately from the CAESP's own funds. In addition, a CAESP is required to both manage users' funds separately from its own funds, and to entrust users' funds to a trust company or a trust bank in accordance with the provisions of the relevant Cabinet Office Ordinances. In other words, a CAESP is required not only to manage users' funds in bank accounts separately from its own, but also to entrust such funds to a trust company or a trust bank, acting as trustee.

- Segregation of Users' CA

- A CAESP must segregate users' CAs from its own CAs. 95% or more of users' CAs must be controlled using fully offline wallets or wallets having safety protection of a level equivalent to those for fully offline wallets ("Fully Offline Wallets, etc.").

- It should be noted that a CAESP is required to (1) hold for its own account CAs of the same kind and quantity as users' CAs stored in wallets other than Fully Offline Wallets, etc. ("Performance Assurance CAs"), and (2) manage Performance Assurance CAs separately from its own CAs (other than Performance Assurance CAs). In other words, when a CAESP manages its users' CAs in wallets other than Fully Offline Wallets, etc., the CAESP is required to (a) hold its own CAs of the same kind and quantity as the User CAs managed in Fully Offline Wallets, etc., and (b) manage Performance Assurance CAs in Fully Offline Wallets, etc. separately from its own CAs (other than Performance Assurance CAs).

- Regulations regarding Responses to Complaints and Financial ADR

System

- In the event of any dispute with customers, a CAESP is required, in principle, to seek resolution of such dispute through financial ADR proceedings.

Applicability of NFT to Crypto Asset

Since NFTs are digital items minted on a blockchain and are exchangeable for other Type I CAs such as Ether, the question is whether NFTs also constitute CAs under the PSA.

As noted above, Article 2, Paragraph 5, Item 1 of the PSA stipulates, in respect of Type I CAs, that they "pay an unspecified person the price of any goods purchased or borrowed or any services provided", i.e., that they serve an economic function, such as the function of a means of payment.

Therefore, if NFTs merely represent, for example, game characters, in-game items, or trading cards for playing and progressing in a Blockchain Game, they would not be considered as serving any economic function, and would not be considered Type I CAs.

If, on the other hand, NFTs themselves do not serve as a means of payment, but are exchangeable with Bitcoin, Ether, or other Type I CAs between unspecified parties, they would seem to fall within the definition of Type II CAs.

Nevertheless, the PSA serves to "ensure the appropriate implementation of services related to payment settlement, user protection, etc.,... and contribute to the improvement of the safety, efficiency and convenience of payment settlement systems", and is premised upon the regulation of means of payment with settlement functions (Article 1 of the PSA).

Furthermore, according to the Crypto Asset Guidelines I-1-1(iii) published by the Financial Services Agency of Japan (the "JFSA"), one of the factors for determining whether an asset constitutes Type II CA is "whether the CA has the same economic function as the relevant CAs, in addition to being a product, right, etc. that can be purchased or sold using Type I CAs".

In this regard, in the JFSA's response to public comments published on September 3, 2019, it was stated that even if trading cards and in-game items recorded on a blockchain are exchangeable with the Type I virtual currency (i.e., Type I CA under the current PSA), they would not be deemed Type II virtual currencies (i.e., Type II CA under the current PSA) because they do not serve the same economic functions as Type I virtual currency, such as the function of a means of payment.

In light of this, even trading cards and in-game items recorded on a blockchain that are exchangeable with Type I CAs would not constitute Type II CAs, if they do not serve economic functions such as a means of payment, like Type I CAs.

Therefore, if the specifications or functions of NFTs are limited, for example, to trading cards and in-game items, and do not extend to economic functions such as a means of payment like Type I CAs, they would not constitute Type II CAs as well.

However, whether or not a specific NFT serves economic functions like Type I CAs and falls within the definition of Type II CAs should be examined and judged on a case-by-case basis, based on the specifications and functions of that NFT (as designed by the content holder), the structure of the application or platform within which the NFT is used, and the form of usage of the NFT.

NFT and Gambling regulation

Under the Penal Code, gambling is a criminal offence punishable by law. "Gambling" is understood as (i) the placing of wagers on properties, (ii) competing for acquisition or loss of property or property rights (iii) and where the outcome (of loss or gain) is decided by chance.

Many conventional smartphone games employ the "gacha" (loot box) system, in which players spend in-game currency to acquire valuable items at random.

If a Blockchain Game adopts such a system and items acquired therein can be sold to external parties, such game would involve the three constituents of gambling discussed above. In such a case, there would be a high risk of the Blockchain Game being deemed gambling under the Penal Code.

NFT and AUPMR

In recently developed games (including Blockchain Games), it is common for items to be distributed: (i) to attract new players, (ii) to keep existing players in the game, (iii) according to the level of progress in the game, and (iv) according to the player rankings. With respect to Blockchain Games, when distributing bonuses in the form of tokens as incentives to play the game, careful consideration of the AUPMR regulations would be necessary.

The AUPMR limits the provision of Premiums (as defined below) to players.

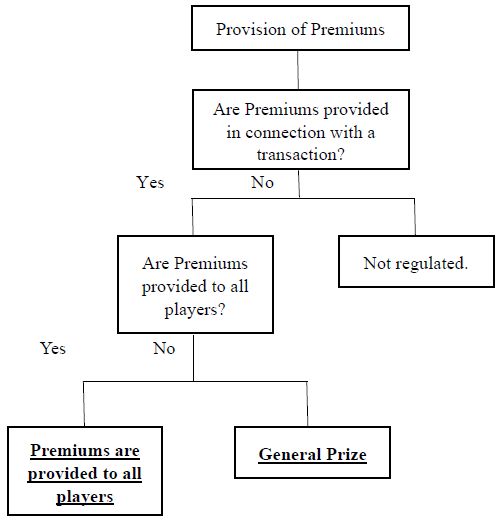

"Premiums" is defined in the AUPMR as any article, money, or other source of economic gain given as a means of inducing customers, irrespective of whether a direct or indirect system is employed, or whether a lottery system is used, by an entrepreneur to another party, in connection with a transaction involving goods or services supplied by the entrepreneur. The category of Premiums and the limits on provision of Premiums are as set out below.

For example, if the entrepreneur of a Blockchain Game provides an article or money to players in a campaign, such article or money could constitute Premiums, in which case provision thereof will be limited to the extent prescribed in the AUPMR.

[Categories of Premiums]

Limits on Premiums if Premiums are provided to all players

| Value of transaction | Maximum amount of Premiums allowed |

| Less than JPY 1,000 | JPY 200 |

| JPY 1000 JPY or more | Two-tenths of the value of the transaction |

Limit on Premiums if a General Prize is provided

| Value of transaction | Limit of Premiums | |

| Maximum amount | Total amount | |

| Less than JPY 5,000 | 20 times the value of the transaction | 2% of the total sales amount in relation to the General Prize |

| JPY 5,000 or more | JPY 100,000 | |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.