1. Introduction

Previously, Japanese labor laws and regulations required employers to pay wages to their workers only in cash or by transfer into the workers' bank accounts or other similar accounts at financial institutions. After prolonged discussions by the Japanese government since 2019 and the collection of public comments by the Ministry of Health, Labour and Welfare (the "MHLW")1, an amendment to the Ordinance for Enforcement of the Labor Standards Act (Ordinance of the Ministry of Health and Welfare No. 23 of 1947, as amended; hereinafter, the "Ordinance") was passed in 2022 and went into effect on April 1, 2023, allowing employers to make such wage payments to accounts of workers held with Fund Transfer Service Providers ("FTSPs"; such accounts, "FTSP accounts") under certain conditions (the "Amendments").

This article summarizes the requirements and application process necessary for FTSPs to offer digital wage payment services to employers ("Digital Wage Payment Services"), as well as the essential steps required for the employers to utilize such digital wage payment services, based on the Amendments as well as the guidelines published by the MHLW (the "Guidelines")2, which provide further detail and clarification on the legal requirements.

2. Eligibility to Provide Digital Wage Payment Services

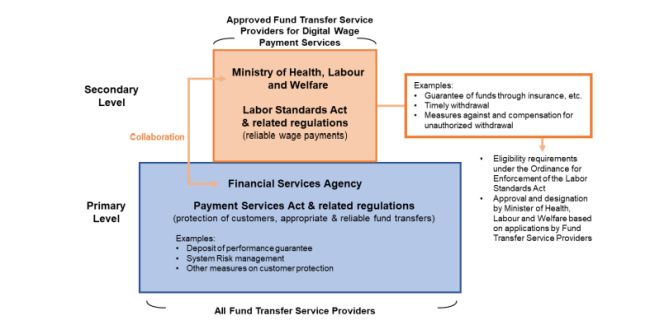

Only Type II FTSPs that satisfy each of the requirements stipulated under Article 7-2(1)(iii) of the Ordinance are allowed to provide Digital Wage Payment Services. Type II FTSPs are registered FTSPs providing Type II Fund Transfer Services (meaning they process fund transfers of amounts not exceeding JPY 1 million) under the Payment Services Act (Act No. 59 of June 24, 2009, as amended), and are subject to various regulations under the Payment Services Act to ensure their provision of sufficient customer protection and appropriate and reliable fund transfer services. Below is a chart showing the legal framework regarding the Digital Wage Payment Services and in particular, the relationship and interaction between the regulations under the Payment Services Act and the Labor Standards Act (Act No. 49 of 1947, as amended).

The requirements under Article 7-2(1)(iii) of the Ordinance, as supplemented by the Guidelines, are summarized as follows:

2.1 Having implemented measures with respect to account that will be used in the fund transfer for wage payment ("Account") to either (i) set an upper limit on the balance of the Account not exceeding JPY 1 million, or (ii) promptly reduce the balance of the Account to less than JPY 1 million if it exceeds JPY 1 million;

2.1.1 In the event that the balance of the Account exceeds JPY 1 million, the FTSP must transfer funds to a pre-designated bank account to reduce the balance per (ii) above, and the instruction for such fund transfer must be made within the same day the excess occurs.

2.2 Having a mechanism to guarantee the repayment of debts owed to workers in the event of difficulty in fulfilling its payment obligations due to bankruptcy, insolvency or other financial difficulties;

2.2.1 Specifically, the FTSP must enter into a guarantee entrustment contract with a guarantee institution to the effect that prompt repayment to workers by the guarantee institution will be made in the event a filing for bankruptcy or other insolvency proceedings has been made with respect to the FTSP, and additionally, a similar guarantee contract between the workers and the guarantee institution must be made

2.2.2 The FTSP may act as an agent on behalf of the guarantee institution, being entrusted by the guarantee institution to enter into the guarantee contract with the workers.

2.2.3 The envisaged guarantee institutions include banks, insurance companies and guarantee companies.

2.3 Having a mechanism to compensate the workers for any losses incurred in the event of difficulty in fulfilling its payment obligations to the workers due to reasons not attributable to the workers;

2.3.1 While the FTSP may compensate worker on a case-by-case basis if there is negligence on the part of the worker, the FTSP may not take a uniform approach of not compensating any worker found to be negligent.

2.3.2 If the worker is required to notify the FTSP within a certain period from the date of loss as a condition to the FTSP's compensation, the notice period must be at least 30 days from the day following the date of loss.

2.4 The balance of the Account remaining valid for at least 10 years from the last date of balance change;

2.5 Having implemented measures to enable fund transfers to Accounts in one-yen increments;

2.6 The worker holding the Account being able to receive the transferred funds in the Account in one-yen increments through methods such as using ATMs or transfers to bank accounts without incurring fees at least once a month for such receiving method;

2.6.1 The FTSP may set a daily withdrawal limit, but in such a case, the amount of wages that the worker can receive in the Account must be set below such specified withdrawal limit.

2.6.2 The payments must be cashable within Japan.

2.7 Having a system to promptly report to the Minister of Health, Labour and Welfare on the implementation status of the Digital Wage Payment Services and the FTSP's financial condition; and

2.7.1 The FTSP must sign and submit a pledge to respond to the MHLW's requests to report.

2.7.2 FTSPs that contract with guarantee institutions to meet the requirements of fund preservation mechanism must also have the guarantee institutions sign pledges to respond to the MHLW's requests to report and submit to the MHLW.

2.8 Having the technical capability to perform digital wage payment related operations appropriately and reliably, and possessing sufficient social credibility.

2.8.1 Factors to be considered include:

2.8.1.1 Whether any business suspension order or business improvement order has been issued against the FTSP;

2.8.1.2 Whether the FTSP has taken measures to ensure that wages are reliably paid, such as confirming the existence of the designated account of the worker before initiation of payment and confirming the eligibility of the worker's account for digital wage payment;

2.8.1.3 Whether the FTSP has obtained Privacy Mark or ISMS certification; and

2.8.1.4 Whether there has been any fact that would raise doubt about the FTSP's technical capabilities or social credibility.

3. Application to MHLW

An FTSP seeking designation and approval by the Minister of Health, Labour and Welfare must submit a designated application and attach documents evidencing that it provides Type II Fund Transfer Services and satisfies all requirements listed above for providing Digital Wage Payment Services. Specifically, the FTSP must submit various documents specified in the Guidelines as supporting materials to the contents of the application (including descriptions of measures taken to fulfill the eligibility requirements).

4. Actions Required on Employers

An employer seeking to utilize Digital Wage Payment Services must take the following actions:

4.1 Executing a Labor-Management Agreement;

4.1.1 If there is a labor union formed by the majority of workers in the workplace, a labormanagement agreement between the employer and the labor union is required; and if none, a labor-management agreement between the employer and the representative of the majority of workers is required.

4.1.2 The agreement should specify the scope of workers eligible for digital wage payments, the range of eligible FTSPs and other relevant details.

4.2 Amending the Rules of Employment;

4.2.1 As matters pertaining to the methods for payment of wages are required to be included in an employer's rules of employment 3 , the employer must amend its rules of employment when adding digital wage payment as a wage payment method.

4.3 Explaining the digital wage payment method to the employees and obtaining consent.

4.3.1 The employer must provide explanations and alternative options to, and obtain consent from, the workers regarding the digital wage payment method4 . The MHLW has provided sample consent forms5.

4.3.2 The employer must explain and clarify the following matters to workers:

4.3.2.1 The FTSPs do not accept deposits, savings, or installment savings. The worker must set his/her own desired range and amount of wages to be transferred to his/her FTSP account within the range and amount expected to be transferred through the FTSP account in light of his/her usage history and anticipated usage. Further, the desired amount must be no more than (i) the account balance limit or (ii) the daily withdrawal limit (if a daily withdrawal limit is set by the FTSP).

4.3.2.2 In the event of the FTSP's bankruptcy, insolvency or other financial difficulty, the guarantee institution will ensure the repayment of the worker's account balance based on the guarantee contract between the worker and the guarantee institution.

4.3.2.3 In case of unauthorized withdrawals or other fraudulent activities on the FTSP account, the entire amount of loss will be compensated if there is no negligence on the part of the worker. If the worker is negligent, while compensation will be decided on a case-by-case basis, there will not be a uniform non-compensation policy for losses.

4.3.2.4 Through withdrawals methods, such as using ATMs or transferring to bank accounts, at least once a month, workers can withdraw from the FTSP account without incurring fees.

4.3.2.5 The account balance must be maintained for at least 10 years from the last date of fund transfer into or out of the account.

4.3.3 Although the employer may delegate the explanation to the FTSPs, it must obtain the workers' consents by itself.

In addition, given that (i) wages paid into the FTSP account designated by the worker must be in a state that allows for funds transfer (available for instructions for transfer to the worker's bank account, allocation for payments at stores, instructions for third-party transfers, etc.) by 10 a.m. on the designated wage payment date, and the full amount of the wages paid must be available for withdrawal within the designated wage payment date, and (ii) the deadline for instructing fund transfers to the worker's designated FTSP account to facilitate the aforementioned conditions may vary for each FTSP, employers need to confirm the instruction deadlines in advance and proceed with wage payments accordingly.

Footnotes

1. The results of the public comments on the Amendments are available in Japanese at: https://publiccomment.e-gov.go.jp/servlet/Public?CLASSNAME=PCM1040&id=495220170&Mode=1.

2. Guidelines on Wage Payments to Accounts of Fund Transfer Service Providers – For Fund Transfer Service Providers (資金移動業者の口座への賃金支払に関する 資金移動業者向けガイドライン), published by the Labor Standards Bureau, Wage Division of the MHLW as of March 8, 2023, available in Japanese at: https://www.mhlw.go.jp/content/11200000/001069053.pdf.

3. Article 89(ii) of the Labor Standards Act.

4. Article 7-2 of the Ordinance; "Regarding Bank Transfer of Wages", Director's Notice No. 2, issued on November 28, 2022, available in Japanese at: https://www.mhlw.go.jp/content/11200000/001017090.pdf.

5. Sample consent forms are available at: https://www.mhlw.go.jp/stf/seisakunitsuite/bunya/haigusha_00002.html.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.