Overview

1. Income Tax

1.1. Corporation Income Tax

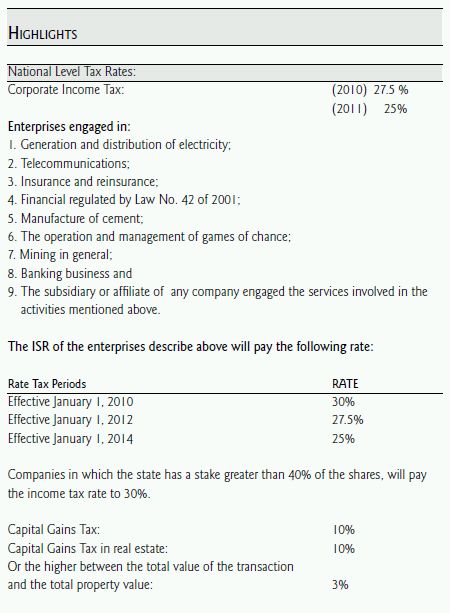

Companies will pay the Income Tax at a rate of 27.5% (year 2010) – 25 % (year 2011 ).

1. Net taxable income calculated by the method established in this title. The first step is to reduce from the gross income from Panamanian source the deductible costs and expenses, what gives the taxable income. Then, on the taxable income is deducted tax incentives and carry over losses, that gives the net taxable income (traditional method)

2. CAIR is eliminated, however, remains an estimate calculation for corporations whose taxable income exceeded US$ 1.5 million annual.

These corporations will pay the higher amount between:

1. The taxable net income calculated by the traditional method, and

2. The taxable net income resulting from applying 4.67% to the total taxable income.

The total taxable income for tax purposes is the amount resulting from subtracting form the total income of the taxpayer's the exempt income and / or non-taxable income and the income of foreign source.

Loss Carry-forward.

Losses of the tax payer will be able to be deduced in the 5 following fiscal years at the rate of 20% of the loss per year.

1.3. Foreign Gains and Losses

Panama applies the principle of territorial source, in such a way that only the income generated within the Republic of Panama is taxable. (Article 694 of the Fiscal Code).

The same Article 694 of the Fiscal Code had a modification by means of which it will be considered produced in Panama (Panamanian source income), the income received by individuals or corporations domiciled outside Panama, derived from any service or act that benefit persons within the Republic of Panama. Income includes among others, fees and incomes for copyrights, commercial and trade names, patents of invention, know-how, technology and scientific knowledge, commercial or industrial secrets, in the way that these services affect the production of income of Panamanian source and its value has been considered deductible expenses by the person in Panama who received them.

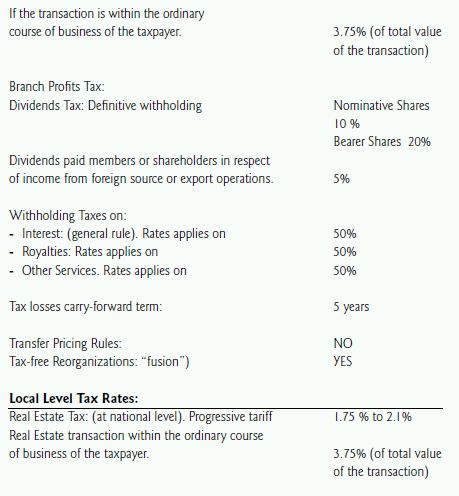

As a consequence, individual and corporations in Panama who benefits of the service, will have to apply the rates settled in Articles 699 (27.5% - 25%) and 700 (progressive tariff) of the Fiscal Code on the fifty percent (50%) of the amount to be transferred to the beneficiary outside.

Individuals or corporations that, because of their activities of international businesses, performs activities outside Panama that are required with the purpose to get income in Panama, will not be subject to withholding taxes.

1.4. Payment

Income tax is set up through a annual tax return to be filed out before March 15 . (individuals).. Together with the annual tax return, taxpayer must present an estimated income tax ,The estimated income must be paid on June 30, September 30, and December 31 , respectively (individuals).

When referring to corporations, annual tax return must be presented within three months after the closing of the fiscal year (12 months).

1.5. Dividend Tax

Dividends are subject to a final (definitive) income tax withholding of 10% (in case of nominative shares) or 20% (bearer shares).

Dividend tax of 5% in case of distribution of proceeds from tax exempt income or income from foreign source

In the case of income derived from services and other activities rendered outside Panama, that benefits persons in Panama, payments made from persons in Panama are subject to a definitive withholding applied on 50% of the amount transferred and according with rates settled in Articles 699 (27.5% - 25%) if beneficiary abroad is a corporation or progressive rates if beneficiary is an individual.

If there is not dividends or distribution is under 40% of the fiscal income, corporation must pay a special tax (Impuesto Complementario), as an advance tax on Dividend Tax.

1.6. Capital Gains

Income from the occasional sale of real property, shares and other movable goods, are subject to a capital gain tax of 10%.

Capital Gains tax in Real Estate:

The taxpayer will be required to pay a sum equivalent to three percent (3%) of the higher between the total value of the transfer and the property value, as an advance of the income tax.

The taxpayer may choose to pay 3% of the total value of the transaction as the final capital gain tax.

If the transaction is within the ordinary course of business of the taxpayer.

If the transaction (sale) of a property is within the ordinary course of business of the taxpayer, the income tax (capital gain tax) is calculated at a flat and final rate of 3.75% on the higher value between the total value of the transaction and the property value.

2. Other Taxes

2.1. Transference of Movable Goods and Services Tax. (ITBMS)

ITBMS (for its Spanish abbreviation) is a type of Value Added Tax The rate is 7% applied on the amount of goods transferred and services performed within Panama, including goods imported.

Exception:

The producers, traders and service providers whose gross annual income is less than thirty-six thousand dollars (US$ 36,000.00) are not considered as taxpayers of this tax

This tax will be paid monthly or quarterly through a tax return, according to the monthly average of taxpayer revenue.

In the tax return, taxpayer will determine the tax by difference between the tax debit and tax credit.

a. Tax debit will be constituted by the amount of the taxes accrued in the sales of goods and services rendered in the fiscal period (month or quarterly).

b. Tax credit will be composed by:

1. The amount of taxes including in the invoices of purchase made in the internal market of goods and services corresponding to the same period, whenever they fulfill the exigencies anticipated in Paragraph 13 in the matter of documentation.

2. The tax paid in the referred period regarding the import of goods.

Tax credit will be apportioned to the goods or services that are affected directly or indirectly to the taxable operations.

2.2. Selective Consumption Tax (ISC)

Tax applied on the transfers of several goods and services performed considered luxurious or not essentials.

For instance, in addition to the ITBMS, the companies of cable television service, by satellite and microwaves, as well as the cellular services are subject to the ISC on the amount of the invoice in such concepts. The Jewelry, the guns and the cars also pay ISC at a variable rate depending on the value and type of the consumer goods.

2.3. Property Tax (national level)

Tax applied annually on the total value (land and improvements) of each immovable property, through a progressive tariff between 1.75% and 2.1%.

The combined progressive rate of this tax is as follows:

a. 1 .75% on the taxable rate that exceed thirty thousand dollars (B/.30, 000.00) up to fifty thousand dollars (B/.50, 000.00).

b. 1 .95% on the taxable surplus of fifty thousand dollars (B/.50, 000.00) to seventyfive thousand dollars (B/.75, 000.00).

c. 2 .10% on the taxable rate that exceed seventy five thousand dollars (B/.75, 000.00).

Tax base is defined as the sum of the value of land and constructing improvements if any.

Condominium property.

The existing tax exemption for the first thirty thousand dollars shall not apply to the land of the estate subject to the condominium property regime during the period that is legally exempt the value of improvements, in those cases apply a rate of one percent (1%).

When the period of exemption of improvements expires, apply the regular rate that covers the numerals of this article.

For the land of buildings subject to condominium property regime, whose condominiums are attached vertically, implement the following rate:

a. 1 .40% of the tax base up to US$.20,000.00

b. 1 .75% on taxable rate over US$20,000.00 to US$50,000.00

c. 1 .95% on the taxable surplus of US$50,000.00 up to U.S. $ 75,000.00

d. 2 .10% tax on the surplus of U.S. $ 75,000.00.

The properties for social housing are excepted form the application of this rule.

Alternative Rate

1. 0.75% on properties whose value of land and improvements does not exceed one hundred thousand dollars (B/.100, 000.00).

2. 1% on properties whose value of land and improvements exceed a hundred thousand dollars (B/.100, 000.00).

The property whose value of land and improvements does not exceed the sum of thirty thousand dollars (B/.30, 000.00) is exempt from this tax.

The alternative rate of this tax is not progressive.

2.4. Transfer of Property Tax.

This tax applies on the transfer of real property. The tax rate is 2%.

2.5. Licence Tax (Aviso de Operación)

Annual tax applied with a rate of 2% on the Net Wealth of individuals and corporations engaged in commercial activities. The maximum tax is B/60,000.00 (American dollars).

Exceptions:

a. Individuals and corporations with invested capital lower than B/10,000.00(American dollars).

b. The person or company established or to be established within international free trade areas that owns or operates the Colon Free Zone or any other zone or free zone established or to be created in the future, does not required to obtain a "Aviso de Operación". Nevertheless these companies are obliged to pay 1% (annually) on the capital of the company, with a minimum of B/ 100.00 (American dollars) and a maximum of B/.50,000.00 (American dollars).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.