In recent years, DNB's screening process for prospective managing and supervisory directors of financial undertakings has been heavily criticised. The criticism was directed mainly at the suitability screening and raised the lack of transparency of the process and the legal protection of the involved parties. DNB has taken the criticism to heart and has published new fact sheets with additional information and organised information meetings about the screening process. Also, an external evaluation commission has been appointed to see if the current screening process is adequate. This commission will also look at AFM screening.

In addition to improving its transparency and communication, DNB also aims to improve legal protection and the legal certainty of the screening process. To achieve this, the supervisory authority will, as an experiment and on an interviewee's request, record the screening interview. The interviewee will also be allowed to have someone at the interview, for example, a lawyer.

Who has to be screened for suitability and integrity?

All managing directors (and other daily policymakers) and supervisory directors of financial undertakings are required to be screened for suitability and integrity. These screenings, however, are not limited to these persons. The outline below shows which individuals involved in a financial undertaking have to undergo integrity and, if necessary, suitability screening. Some of these requirements also apply to holdings (financial holdings, insurance holdings or mixed financial holdings).

Which suitability and integrity requirements apply to pension funds depends on the governance model and articles of association of the pension fund in question.

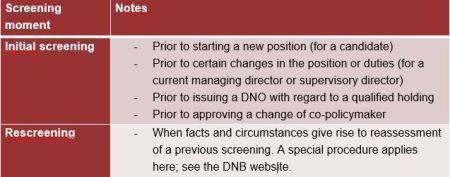

When is screening for integrity and suitability required?

DNB distinguishes two screening moments:

Because the suitability screening is about determining the suitability of a candidate for a specific position, this screening is required in connection with every change of position and certain changes in duties. If a new position closely resembles a previously held position, the screening may be completed more easily. The fact remains, however, that the supervisory authority will have to re-screen the candidate's suitability. In addition, the supervisory authority will not just assess the suitability of the candidate for the particular position, but also the suitability of the collective of which the candidate will be a member (the entire management board or supervisory board). This means that the supervisory authority also has to be notified if a member of the board resigns. The supervisory authority can then assess whether the suitability of the collective is sufficiently safeguarded.

Integrity does not depend on the position, and relates solely to the candidate in question. Therefore, the integrity of a candidate has to be assessed just once. Only when new relevant facts and circumstances give rise to reassessing the candidate's integrity is rescreening merited. DNB regards rescreening as a severe measure not to be employed lightly. DNB safeguards this procedure by providing additional assurances; for example, DNB consults a lawyer and the decision to rescreen is made at management level.

For initial screening, a positive result for the integrity screening and, where applicable, for the suitability screening is required before either the candidate can be appointed, or a DNO or an approval of change of co-policymaker can be issued. It is possible to appoint a candidate subject to the condition precedent of approval. In the case of a share transaction, an agreement could be entered into under the condition precedent for completion of the transaction that approval of the supervisory authority is obtained.

For reappointments, no screening is required. Informing the supervisory authority in a timely manner in writing about the reappointment suffices.

Seven practical tips for the suitability and integrity screening

Below, we give seven practical tips for candidate managing directors and supervisory directors for a new position at a financial undertaking. These tips also apply to pension fund management board and supervisory board members.

Take the screening and a possible screening interview seriously

A job well begun is a job half done. According to DNB, the main cause for "rejection" is poor preparation. It is important to take the screening seriously, not only because approval is necessary to get the desired position, but also because every screening is important for any subsequent career steps in the financial sector. DNB keeps a record of all screened candidates, even candidates that withdraw from the screening procedure after an indication from DNB that it intends to issue a negative decision (despite DNB not issuing a decision because of the withdrawal). Properly preparing entails, at a minimum, that the candidate reads up on the undertaking in question, based on public records and that he/she considers his or her added value for the undertaking. It would be better still if the candidate learned more about the undertaking by accessing confidential information and having conversations with the relevant people (see tip 3).

2. Give proper attention to the documents to be provided

The suitability and integrity screening requires several documents:

- The Prospective Appointment Notification Form and Integrity Screening Form or, in the case of screening of the second echelon, the Integrity Screening Form 2e echelon, and the Resultaten betrouwbaarheidsonderzoek onderneming Form (make sure the most recent versions of the relevant forms are used; older forms will not be considered);

- An updated CV (be thorough in explaining your position and responsibilities, especially where it concerns positions outside the Netherlands and it is not immediately clear what the position entails; clearly state the number of additional activities and positions that count towards the applicable limitation on the number of additional positions held (see also tip 6);

- A Supervisory Board Expertise and Capability Matrix (clearly state the composition of the suitability of the collective and be honest about the L/M/H scores for the various categories – suitability is tested on an individual and collective level, so members of the management and supervisory board do not all have to have high individual scores in every category, but can complement each other in certain categories);

- A position profile, the recruitment and selection procedure; and decision-making, reasons and considerations for appointment (to be drafted by the financial undertaking; it is advised to include a comprehensive description);

- A legible copy of a valid passport or ID of the candidate.

In principle, the supervisory authority assesses the candidate based on the information provided. If this information is complete and sufficiently clear, DNB forgoes a screening interview unless they plan to reject the candidate or if the candidate is to be appointed as CEO or president of the supervisory board at a significant bank. Submitting all relevant documents at once is therefore likely to save time. Also, DNB can suspend the decision-making period if they require additional information.

3. Get to know the undertaking and the other directors or supervisory board members beforehand

DNB encourages financial undertakings and candidates to get acquainted with each other and the other directors or supervisory board members. It can be highly beneficial to prepare for the screening process by, for example, reviewing confidential documents (previous management board or supervisory board meeting minutes), or participating in these meetings. A non-disclosure / confidentiality agreement can be drafted for this purpose. This will assist the candidate to better understand the goings-on at the undertaking and to better shape his or her view on governance and strategic issues. The candidate can then present this view during the screening interview. Moreover, by engaging in conversations with the other members, the candidate can better assess his or her contribution to the collective (as mentioned previously, suitability is assessed on both an individual and collective level), and explain to DNB what his or her added value is.

4. Inform yourself on issues relevant to the sector

A candidate needs to know what is going on in the sector and what the important regulatory themes are. Currently, conduct and culture and focus on the client's interest are relevant themes. It is important that the candidate develops and is able to communicate his or her view on these themes as well as their relevance for the undertaking. The same goes for having a vision on market developments, legislation, and important challenges and issues relevant to the undertaking. These views can be tailored depending on the board committees the candidate will be a member of. DNB uses the 2012 Policy Rule on Suitability as a point of reference for its screenings. This document is only available in Dutch. However, it is recommended to be advised on its contents.

If during the preparation it becomes apparent that the candidate does not yet have the knowledge required for the position, he or she is advised to draw up a "gameplan" to overcome this knowledge gap. This can be addressed by, for example, providing an introductory programme or within the context of permanent education. Whatever the path chosen, it is important to be able to explain to DNB how the required knowledge will be gained.

De Brauw has assisted various candidates in preparing for screenings by providing training on financial supervision law. This helps them understand the legal context, to come to grips with important topics and risks for the undertaking, and to ask discerning questions. The knowledge gained at this training is very useful for the screening interview, and will of course also be highly valuable in their new position upon the supervisory authority's approval.

5. Provide many examples

A screening interview is in many ways similar to a job interview. Like a job interview, it is important to come up with many real situations, describe how you handled them, and explain if you would handle them differently now. Also, it is important, especially for candidate supervisory board members, to show that you are capable of asking discerning questions and that you can act independently. On its website, DNB has posted a few sample questions for the screening interview. In addition, inspiration can be found in the suitability matrix and the competences mentioned in the 2012 Policy Rule on Suitability. In addition to the substantive skills, the "soft skills" and the "tone at the top" are considered important. For inspiration, see the brochures of DNB about behaviour and culture, also with a focus on the boardroom.

6. Be prepared for questions about time allocation

The supervisory authority assesses whether you can spend sufficient time in your new position. For significant banks and pension funds there are specific (more stringent) rules in place for management board and supervisory board members. For supervisory board members at other companies, only the limitations in the general corporate law provisions of the Dutch Civil Code apply. It is important to indicate on your CV all of your additional activities and how much time you spend on each of them. Doing so in advance might prevent further questions.

7. Be honest and transparent about your background (antecedent events)

On the Integrity Screening Form you have to disclose what DNB calls "antecedent events," basically your background: criminal, financial, tax compliance and any other antecedent event. Be honest and transparent about these. Not disclosing an antecedent event is an antecedent event in itself. The supervisory authority carries out background checks with various authorities (Public Prosecution Service, Dutch Revenue Service, etc.). As a rule of thumb, DNB feels it is better to disclose too many, rather than too few relevant details. When DNB discovers information that has not been disclosed, DNB will as a rule summon that candidate for an interview. Therefore, always immediately report new (or mistakenly undisclosed) antecedent events to the supervisory authority. The amount of transparency and the time between a violation and the disclosure of the violation can be mitigating factors during the integrity screening. Moreover, antecedent events can be taken into account during the suitability screening of the candidate as well.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.