Consultation Paper No. 1/2021 on the Proposed Amendments to the Main Market and ACE Market Listing Requirements in relation to Director's Appointment and Independence

PROPOSAL 1

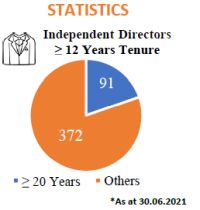

Limiting the Tenure of an Independent Director ("ID") to not more than a cumulative period of 12 years

Issues & Challenges of Long Serving ID

|

|

Rationale

Periodic board renewal is necessary to attract new ideas and foster diverse perspectives in the boardroom

Proposed Amendments

- Amending the definition of "independent director" in the Listing Requirement to stipulate that an ID is one who has not served as an ID of a listed issuer or its related corporations for a cumulative period of more than 12 years from the date of his 1st appointment as an ID.

- 12-year period will be "refreshed" after cooling-off period of minimum 3 years.

PROPOSAL 2

Publish Fit and Proper Policy for Appointment and Re-appointment of Directors

Current Flaws

- Actual aspects of "character", "experience", "integrity", "competence" and "time" being evaluated remain relatively opaque

- The disclosures relating to board election & assessment in the Nominating Committee Statement ("NCS") tend to be "process-centric"

Proposed Amendments

- Requirements to:

- establish a fit and proper policy;

- ensure the policy addresses board quality and integrity; and

- make available the policy on its website.

- Requirement to disclose the application of the fit and proper policy in the NCS.

Further Guidance: Corporate Governance

Further guidance on Fit & Proper Policy via Bursa's Corporate Governance Guide will include the following aspects:

- Character and integrity

- Probity

- Financial integrity

- Personal integrity

- Reputation

- Experience and competence

- Time and commitment

Implementation Period

12 months Grace Period

Closing of Public Consultation

Ends on 1 September 2021

Conclusion

It appears that these proposals are much needed to enhance board independence while improving board quality and promoting greater transparency in the appointment and reappointment of independent directors. Any feedback on the above proposal can be submitted to Bursa or you can email us before 31 August 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.