- within Coronavirus (COVID-19), Litigation and Mediation & Arbitration topic(s)

When preparing for the voluntary liquidation of any British Virgin Islands ("BVI") entities that are soon to near or have reached the end of their life cycle, the process need not be complicated. There are a number of things to be aware of and simple steps that can be taken to save the cost and administrative burden of extending the life of a BVI company past its natural endpoint.

The Maples Group's team of legal, fiduciary and fund services experts can provide a range of restructuring and liquidation services and guidance through the voluntary liquidations process for a BVI company.

For a straightforward voluntary liquidation with no assets, we can wrap up the proceedings in about six to eight weeks. Companies looking to embark on the process should be aware of the following deadlines to ensure a swift wind down and avoid paying unnecessary fees.

What are the Annual Deadlines for BVI Voluntary Liquidation Registration?

1. BVI Companies Incorporated or Registered during the first half of the year

For BVI companies registered or incorporated during the first half of any given year to avoid unnecessary annual government registration fees, an appointed voluntary liquidator will be required to file the final notice for a company on or before 31 May.

To ensure that your company does not miss this deadline, we recommend that a company start the BVI voluntary liquidation process before mid-April.

2. BVI Companies Incorporated or Registered during the second half of the year

For BVI companies registered or incorporated during the second half of any given year, to avoid incurring unnecessary Registry fees for entities that have reached the end of their life cycle, an appointed voluntary liquidator will be required to file the final notice for a company on or before 30 November.

To meet this deadline, we recommend that the voluntary liquidation commence prior to mid-October.

Who Can Act as a BVI Voluntary Liquidator?

Depending on a role within or a relationship to the company in question, certain individuals are prohibited from acting as a BVI voluntary liquidator. Generally, this includes people who have served as director or in a senior management position of the company (or an affiliated company). For the full list of who can and cannot serve as a voluntary liquidator, anyone interested can review Section 19(2) of the BVI Business Companies Regulations.

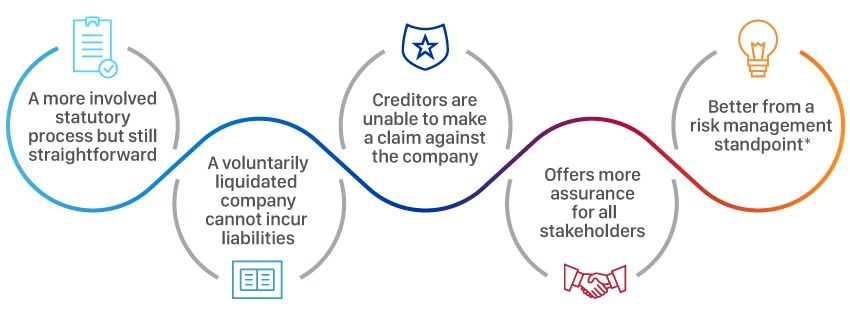

Benefits of Voluntary Liquidation

* in comparison to abandoning the company simply to have it struck off by the BVI Registry for non-payment of fees.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.