Originally published 6 October 2009

Keywords: Pfizer, GM Deals, Chinese merger control, MOFCOM, AML, merger control system, Wyeth, Intervet, Akzo Nobel

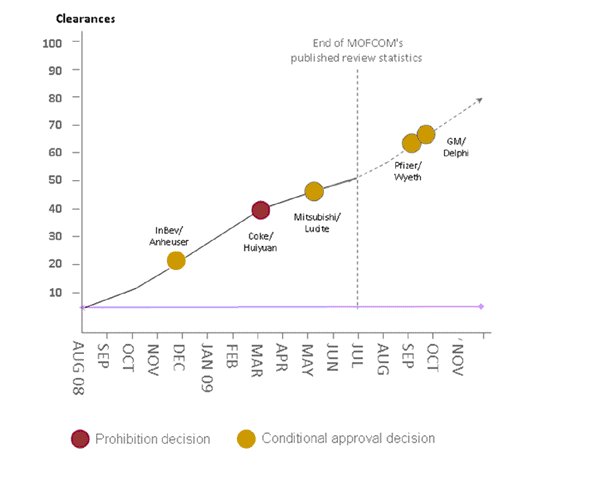

China's Ministry of Commerce (MOFCOM) has announced two new conditional clearance decisions under the country's Anti-Monopoly Law (AML) merger control system, meaning five deals have now been subject to conditional approval or outright prohibition since the law commenced.

On the basis of statistics published by MOFCOM in July this year, it is now estimated that approximately 8% of all reviewed deals have failed to obtain unconditional clearance1. This is higher than the prevailing pattern of review outcomes in more mature antitrust jurisdictions such as Europe and the U.S.A.

Pfizer / Wyeth conditional clearance

After a 105 day review process, MOFCOM published its conditional clearance decision in relation to Pfizer, Inc's proposed $68 billion acquisition of rival drugmaker Wyeth on 28 September 2009.

The clearance was subject to a commitment by Pfizer to divest its PRC swine mycoplasmal pneumonia vaccine business (used in veterinary medicine) to an approved third party, in order to address MOFCOM's concerns about the merged company's high market share in this area.

MOFCOM determined that Pfizer and Wyeth would have a combined market share of 49.4% in this area after merging, significantly higher than Intervet (part of Akzo Nobel) which holds an 18.35% share. In this context, and given Pfizer's strength in the sub-market for swine flu vaccines (a high-profile sector in China at present), the divestiture conditions are not regarded as particularly surprising.

The divestiture must include all assets, including intellectual property, and the vaccine's purchaser must meet criteria set by the authority. If requested by the purchaser, Pfizer must also provide technical and supply support for three years after completion of the purchase, and MOFCOM has reserved its right to appoint a trustee to dispose of the business (on such terms as it deems appropriate) if a suitable purchaser is not found by the parties within six months.

MOFCOM's Anti-Monopoly Bureau is understood to have accepted Pfizer's notification of the transaction on 15 June 2009. After expiry of the standard 30 calendar day 'preliminary' review process, MOFCOM identified sufficient concerns about the deal's prospective impact on competition to move into second stage review.

This second stage review phase was due to expire on 13 October 2009, however it appears that intensive negotiations between the transaction parties and MOFCOM on appropriate behavioural remedies allowed conditional clearance to be provided just before the PRC national public holidays (which run from 1 to 8 October, and may have delayed substantive progress on the review if it had continued into this period).

MOFCOM's decision statement is only two pages in length, but pleasingly includes a greater number of references to 'best practice' methodologies (such as application of the Herfindahl-Hirschman Index, which measures the size of firms in relation to the industry and an indicator of the degree of competition among them) than has appeared in some of the regulator's earlier published decisions.

General Motors / Delphi Corp conditional clearance

One day after the Pfizer / Wyeth decision, MOFCOM announced that it was also imposing conditions on General Motors Co.'s acquisition of auto parts maker Delphi Corp. The transaction is part of Delphi's efforts to emerge from bankruptcy after four years in Chapter 11 status by selling assets to General Motors and its lenders.

The parties filed a merger notification in relation to the deal on 18 August 2009, but MOFCOM's official review period did not begin until 31 August 2009. After this delay, which was apparently due to MOFCOM's request for two separate supplementary submissions from the parties, the review appears to have proceeded quite quickly - with a decision able to be reached within the preliminary review period.

It is understood that several hearings into the transaction were convened during this period, following the expression of concerns by local car makers and representatives from the Chinese Automobile Dealers Association.

In the process of its review, MOFCOM identified four areas of possible anticompetitive concern arising out of the deal. These included worries that the merged entity would be able to undermine the competitiveness of Chinese car manufacturers, and reservations about the prospect of Delphi being able to pass sensitive customer information to General Motors.

General Motors and Delphi provided assurances to MOFCOM to specifically address each of these concerns, including that the two businesses will not exchange trade secrets about Delphi's other customers, and that Delphi will supply parts to other automakers in a timely and reasonable fashion. MOFCOM's clearance was provided subject to fulfilment of these conditions.

MOFCOM also required that General Motors not unduly restrict or delay customers of Delphi from moving to other suppliers, and that General Motors avoid unfairly discriminating amongst component and other suppliers in favour of Delphi. Reports on compliance with these conditions are required to be supplied to MOFCOM on a regular basis.

Key take-outs from the decisions

Neither of the two decisions are seen as being overly controversial, or involving particularly onerous conditions.

However, the frequency with which MOFCOM is identifying China-focused concerns with foreign-to-foreign deals will be causing some angst amongst multinationals currently planning M&A deals.

As these most recent cases show, it will be important for parties participating in any deals that must be notified to MOFCOM to ensure they allow sufficient time for AML review, and are conscious of the fact that MOFCOM appears to attach considerable weight to concerns that may be expressed by Chinese competitors and customers. Consultation, both with MOFCOM and other interested parties in China, may be essential to avoid unduly restrictive conditions and delays impacting international transactions.

MOFCOM's review record to date (based on statistics to July 2009):

Footnote

1. At the end of July 2009, MOFCOM announced that it had concluded its review of 52 notified transactions since the AML commenced on 1 August 2008. This represents a review conclusion rate of around 5 deals per month, and the clearance estimate percentage provided assumes this review rate has remained steady in August and September 2009.

Learn more about our Hong Kong office and Antitrust & Competition practice.

Visit us at www.mayerbrown.com

Learn more about our Hong Kong office.

Copyright 2008. JSM, Mayer Brown International LLP and/or Mayer Brown LLP. All rights reserved. Mayer Brown is a global legal services organization comprising legal practices that are separate entities ("Mayer Brown Practices"). The Mayer Brown Practices are: JSM, a Hong Kong partnership, and its associated entities in Asia; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; and Mayer Brown LLP, a limited liability partnership established in the United States. The Mayer Brown Practices are known as Mayer Brown JSM in Asia.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.