- within Corporate/Commercial Law topic(s)

Premier Li Keqiang submitted the China's State Council Institution Reform Plan (Hereinafter referred to as Reform Plan) which was formed in accordance with the Communist Party of China (CPC) and State Institution Reform Plan, to the First Session of the 14th National People's Congress for deliberation on March 7, 2023; National People's Congress approved the Reform Plan on March 10, 2023. Among them the relevant content of the establishment of the National Financial Regulatory Administration became the dominant topic in the financial industry. According to the Reform Plan, the National Financial Regulatory Administration will be unified and responsible for the supervision of the financial industry except for the securities industry, strengthening institutional supervision, conduct supervision, functional supervision, penetrating supervision and continuous supervision, and coordinating the protection of the rights and interests of financial consumers and other matters. The financial regulatory mechanism reform is wide-ranging, far-reaching and attention-grabbing. This article briefly reviews the evolution of financial supervision and management mechanism in China, and briefly analyzes and outlooks the challenges that will be brought by this reform.

I. Brief Review of the Evolution of the Financial Regulatory System

Upon the completion of the financial regulatory mechanism reform, China's "One Bank, Two Commissions and One Committee" regulatory model will become history, replaced by the new regulatory model of "One Bank, One Bureau, One Commission and One Committee". In fact, the financial regulatory reform is not an overnight matter. As early as years ago, many experts and scholars have put forward the concept of unified supervision and demonstrated it in detail.

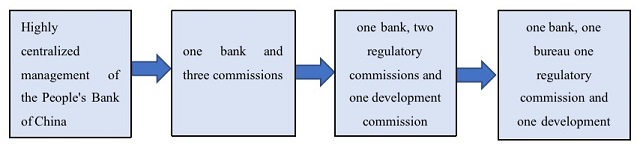

Figure 1 Evolution of China's financial regulatory system

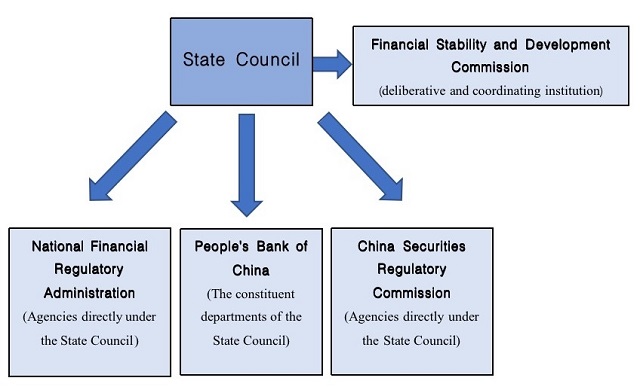

Looking back at the reform of China's financial regulatory mechanism, it can be summarized as a process from integration to division, and then from division to integration again. Before the reform and opening up, the financial supervision of China is unified and highly centralized by the People's Bank of China (PBOC). After the reform and opening up, various financial entities were established one after another with the development of market economy. In order to optimize the regulatory mechanism, the China Securities Regulatory Commission (CSRC), the China Insurance Regulatory Commission (CIRC) and the China Banking Regulatory Commission (CBRC) were established one after another, forming the regulatory mechanism of "One Bank and Three Commissions" in China. In 2017, with the establishment of the State Council's Financial Stability and Development Committee and the subsequent merger of the CBRC and the CIRC to form the China Banking and Insurance Regulatory Commission (CBIRC), the new structure of "One Bank, Two Commissions and One Committee" was established and has been used up till now. The Reform Plan proposed the "One Bank, One Bureau, One Commission and One Committee" regulatory framework, "One bank" refers to the PBOC, "One bureau" refers to the new National Financial Regulatory Administration, "One Commission" refers to the CSRC, "One Committee" refers to the State Council's Financial Stability and Development Committee.

Figure 2 The structure chart of "One Bank, One Bureau, One Commission and One Committee"

From "One Bank and Three Commissions" to "One Bank, Two Commissions and One Committee" to "One Bank, One Bureau, One Commission and One Committee commission", "big supervision" model is gradually implemented. Xi Jinping, general secretary of the Communist Party of China Central Committee, pointed out in the report of the 20th CPC Congress "Deepen the reform of the financial mechanism, build a modern central banking mechanism, strengthen and improve modern financial supervision, strengthen the financial stability protection mechanism, bring all types of financial activities under supervision in accordance with the law, and ensure the bottom line of no systemic risk." Guo Shuqing, party secretary of the PBOC and chairman of the CBIRC, expressed earlier this year "The general requirement for deepening the reform of the financial mechanism is to strengthen the centralized and unified leadership of the CPC Central Committee on financial work. Specifically,......strengthen and improve modern financial supervision, establish a sound coordination mechanism for financial stability and development, and strengthen the financial stability protection mechanism......." Thus, it can be seen that this reform of the financial regulatory mechanism is in line with the guiding spirit of the 20th CPC Congress, and is a specific initiative to strengthen and improve modern financial supervision.

Overall, the reform of the financial regulatory mechanism has given the National Financial Regulatory Administration more comprehensive responsibilities than the CBIRC, which is unified and responsible for the supervision of the financial sector except for the securities industry. Bringing all financial sectors under unified supervision will help eliminate regulatory blind spots and differences, and further improve the efficiency and quality of supervision.

II. Challenges to the reform of the financial regulatory system

This reform of the financial regulatory mechanism covers a wide range of areas and brings many challenges as well.

1 Integration of regulatory mechanism

The National Financial Regulatory Administration was established on the basis of the CBIRC and received some of the functions from the PBOC and the CSRC. How to organize and integrate the relevant mechanisms introduced by the three regulators, how to smoothly carry out the transition and how to retroactively address the issues in the implementation process are yet to be resolved. For example, financial consumer protection and investor protection currently adopt the parallel mechanisms of the CBIRC and the CSRC, with differences in penalty mechanisms and penalty intensity. It is worth paying attention to whether relevant mechanisms will be integrated and protection standards will be unified after the implementation of the Reform Plan.

2 Adjustment of institutional structure

In terms of the reform of the branches of the PBOC, the smooth connection of the relevant business is also a challenge since the county-level branches will be cancelled. In addition, the Reform Plan only mentions the use of administrative staffing for the State Administration of Foreign Exchange (SAFE), and does not involve its institutional adjustment. If the branches of the SAFE will not be adjusted, there will be no county-level branch of the PBOC while the SAFE has a county-level branch. In this case, it remains to be seen whether the staffing and institutional functions of the SAFE branch will be adjusted accordingly.

3 Cross-departmental coordination

In this Reform Plan, the CSRC will be responsible for the review of corporate bond issuance formerly under the National Development and Reform Commission (NDRC), that is, the CSRC will be responsible for the review of company (enterprise) bond issuance. It is also urgent to formulate specific policies and transition plans on how to link up relevant documents and projects for the review of bond issuance. In addition, the registration of foreign debts, which is the responsibility of the NDRC, is not mentioned in the Reform Plan. Therefore, the recently implemented the Measures for the Examination and Registration of Medium and Long-term Foreign Debts of Enterprises (Order No.56 of the NDRC) (Document No.56) should theoretically be unaffected by the Reform Plan and will continue to be conducted by the NDRC. However, in the context of the adjustment of the review responsibility of the company (enterprise) bonds issuance, whether Document No.56 will be improved accordingly remains to be observed in practice.

4 Local financial supervision starts again

The Reform Plan proposes to deepen the reform of the local financial regulatory mechanism explicitly, to establish the local financial regulatory mechanism based on the local dispatch agencies of the central financial administration, and requires the local government to set up financial regulatory agencies dedicated to regulatory responsibilities expressly. On the one hand, the new local financial supervision mechanism has established the main role of the local dispatched offices of the central financial management departments, on the other hand, it will also change the current problem of overlap between local financial regulators and local financial offices (financial bureaus), showing the determination and basic ideas of China in the reform of local financial supervision.

5 Specific business regulation

This Reform Plan should have less impact on the regulatory mechanism of specific businesses such as funds, trusts, wealth management, asset management, leasing and insurance, but whether the regulatory mechanism of various businesses within the National Financial Regulatory Administration will be reformed simultaneously is yet to be clarified. In addition, whether the relevant laws and regulations will be further sorted out and integrated also needs to be clarified. For example, the CBIRC consolidated the related regulations of the former CBRC and the former CIRC, and implemented the Measures for the Administration of Related Transactions of Banking and Insurance Institutions (CBIRC Order〔2022〕No.1) in 2022, while the PBOC's Measures for the Administration of Related Transactions of Financial Holding Companies (PBOC Order〔2023〕No.1) was just released and implemented this year. After this reform, it is yet to be clarified how the financial holding companies will manage their connected transactions and whether they will further start from integrating the regulations. In addition, as the penetrating regulation and conduct regulation requirements, which have been mentioned many times in recent years in financial regulation, are also mentioned in this reform proposal, Therefore, it is believed that the effective implementation of such regulatory requirements at the specific business level will continue to be an important focus of specific business regulation.

6 Maintaining financial stability is still on the way

The Reform Plan does not mention the State Council's Financial Stability and Development Committee, but its status and role in maintaining financial stability is precisely the most important. As the deliberative and coordinating institution of the State Council to coordinate major issues concerning financial stability and reform and development, its responsibilities includes implementing the decisions and arrangements of the CPC Central Committee and the State Council on financial work, reviewing the major plans for financial reform and development, coordinating the major issues of financial supervision, studying the major policies of preventing and handling systemic financial risks; guiding the local financial reform, development and supervision, etc. Under the financial regulatory mechanism described in the Reform Plan, the State Council's Financial Stability and Development Committee continues to play a key role in coordinating macro and micro regulatory policies and effectively guiding the financial sector to serve the real economy. Considering that the Financial Stability Law (draft) was solicited last year, the implementation of the financial stability mechanism is already expected. In the future, under the framework of the Financial Stability Law, the "One Committee" will coordinate with "One bank, One Bureau and One Commission" and local financial regulators and give full play to their role in maintaining financial stability, which will be both challenging and promising.

Reform is a universal truth. The content of financial supervision mechanism in the Reform Plan is the reform according to the current situation of financial development and the need of financial supervision, and conforms to the development of the times. At the same time, reform will bring challenges, and reform can be achieved only when challenges are solved. We will continuously focus on the latest trends of the reform of the financial regulatory mechanism, and will make further analysis and interpretation in due course.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.