After 14 years of enforcement of China's Anti-Monopoly Law (the "AML") since 2008, the Standing Committee of the National People's Congress of China has amended the AML after a two-year review with several rounds of deliberations and issued a new version ("the New AML") on June 24, 2022. In addition to updating the rules regulating monopoly agreements and abuse of dominance, noteworthily, the New AML brings substantial changes to the merger control rules and procedures, such as introducing the "stop-the-clock" mechanism, establishing the categorized and classified merger control system and others.

Shortly after the promulgation of the New AML, a package of regulations sprang up, like bamboo shoots. On June 27, 2022, SAMR subsequently published several draft amendments of the implementation regulations for public comments, the draft implementation rules regarding notification threshold ("Threshold Rules") and review of concentration of undertaking ("Review Rules") are included. And uncoincidentally, with the aim to echo the categorized and classified merger control system in the New AML, SAMR Announcement Regarding Pilot Delegation of Anti-Monopoly Review of Certain Concentration of Undertakings Cases (the "Announcement") was issued on July 15, 2022. The table below shows the status of the above four legislations.

|

No. |

Laws and Regulations |

Status |

|

1 |

The New AML |

Will take effect on August 1, 2022 |

|

2 |

Threshold Rules |

Under the way of soliciting public comments, ended July 26, 2022 |

|

3 |

Review Rules |

Under the way of soliciting public comments, ended July 26, 2022 |

|

4 |

The Announcement |

Will take effect on August 1, 2022 |

While the Threshold Rules and Review Rules are still at the stage of soliciting public opinions, we believe changes reflected in the above legislation and draft legislations have plentiful implications to companies operating business in or related to China. Therefore, this article intends to snapshot those key changes to China's merger control regime, to the benefits of companies that are frequently obliged to file the antitrust notification in China.

- Imminent change of the filing thresholds

The former turnover thresholds have remained unchanged since the AML was promulgated in 2008 despite significant economic growth in China. Therefore, it has been criticized for being too low and thus these comparably low thresholds increased the number of transactions that are obliged to be notified to SAMR each year. This time, SAMR proposes to increase the turnover threshold to adapt to the country's economic development. In the meantime, it is noteworthy that a brand-new threshold category was introduced. Specifically, the proposed new filing thresholds are:

- The aggregated global turnover of all concentration undertakings in the last fiscal year exceeds RMB 12 billion (approx. USD 1.8 billion) (increased from RMB 10 billion), and at least two of these undertakings each had a turnover of more than RMB 800 million (approx. USD 120 million) (increased from RMB 400 million) within the territory of the PRC; or

- The aggregated turnover of all the concentration undertakings exceeds RMB 4 billion (approx. USD 600 million) (increased from RMB 2 billion) within the territory of the PRC, and at least two of these undertakings each had a turnover of more than RMB 800 million (approx. USD 120 million) (increased from RMB 400 million) within the territory of the PRC; or

- An undertaking that has a Chinese turnover of more than RMB 100 billion (approx. USD 15 billion) in the last fiscal year; and the other undertaking in a merger or the target in an acquisition had a market value or market valuation of more than RMB 800 million (approx. USD 120 million), plus its turnover within the territory of PRC is more than one-third of its global turnover.

With the increase of the turnover thresholds, SAMR may be able to better focus its limited administrative resources on complex cases. Also, it can be estimated that certain small companies with low revenue could be relieved from the filing obligation if the increased turnover thresholds are adopted in the end.

|

Compliance tips:

|

- Categorized and classified merger control system

The New AML adds a declaratory provision that SAMR should complete and perfect a categorized and classified merger control system, strengthening the review of concentrations in critical areas concerning national development and livelihood.

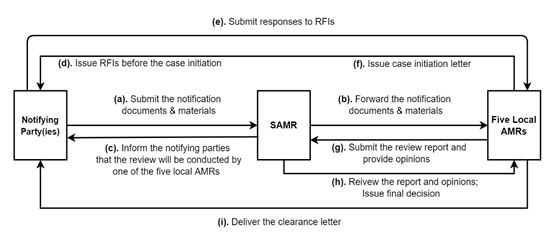

The Announcement details the above provision and specifies that, SAMR is to start delegating part of its function on reviewing simple cases to five local antitrust regulators, namely the respective Administrations for Market Regulation ("AMR") of Beijing, Shanghai, Guangdong, Chongqing and Shaanxi Province. The five local AMRs will start to handle simple case filings where one of the notifying parties, the proposed-established JV, or the relevant geographic markets defined have nexus in the respective region as early as August 1, 2022, when the New AML will take effect.

|

No. |

Local AMRs |

Responsible Regions |

|

1 |

Beijing AMR |

Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang |

|

2 |

Shanghai AMR |

Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong |

|

3 |

Guangdong AMR |

Guangdong, Guangxi, Hainan |

|

4 |

Chongqing AMR |

Henan, Hubei, Hunan, Chongqing, Sichuan, Guizhou, Yunnan, Tibet |

|

5 |

Shaanxi AMR |

Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang |

The below chart illustrates the workflow among the notifying party(ies), SAMR and local AMRs who are delegated to review the merger filings.

|

Compliance tips:

|

- Establishment of a "stop-the-clock" mechanism

The New AML introduces the 'stop-the-clock' mechanism to suspend the review process under three circumstances, including (i) where undertakings fail to provide necessary information or documentation; (ii) where new material facts which affect the review of the concentration need to be examined; and/or (iii) where conditions to be imposed on the proposed concentration need to be further evaluated and a relevant undertaking makes a request for suspension.

This amendment will afford SAMR more time and flexibility to review mergers, particularly cases subject to remedy negotiations. Prior to the amendment, the maximum period for review is 180 calendar days, however, in practice, SAMR is unable complete its review in most conditionally approved cases when the 180-day review period expires, thus the notifying parties frequently "pull and refile". With this amendment, SAMR will have a tool to stop the review clock during the review process.

|

Compliance tips:

|

- Heavy fines for not filing

Compared to the 2008 version of AML, the merger control-related penalty is significantly strengthened from the perspectives of both the pecuniary penalty and the negative impact on credit records. Under the New AML, the fines for failure to file are divided into two categories: (i) transactions which do not or are unlikely to restrict or eliminate competition; and (ii) transactions which do or are likely to restrict or eliminate competition. An undertaking will face up to a fine of RMB 5 million (approx. USD 0.75 million) if its transaction belongs to the first c category and will face up to 10% of its turnover in the last fiscal year if its transaction belongs to the second category.

In the meantime, Article 64 of the New AML states that "where an undertaking is subject to an administrative penalty due to a violation of this Law, the penalty shall be entered into the undertaking's credit records pursuant to the relevant provisions of the Law, and the information shall be disclosed to the public."

|

Compliance tips:

|

- Focus on "killer acquisition"

The New AML clarifies – and arguably encourages - SAMR's ability to investigate transactions falling under the turnover thresholds but which have or are likely to have the effect of excluding or restricting competition. It also clarifies that SAMR is entitled to impose conditions or prohibit such transactions, or in case the transaction has been closed, request the parties to unwind the transaction.

Regarding the specific procedure, Article 7 of the Review Rules states that if there is evidence that a transaction may exclude or restrict market competition even the mandatory turnover threshold is not met, SAMR has the right to notify by written notice the undertaking and require the undertaking involved to submit a notification within 180 days from the notification date. And further, SAMR clarifies that (i) if the transaction has not been implemented by the notification date, the undertakings must hold on the implementation until receiving clearance; whereas (ii) if the transaction has been implemented by the notification date, SAMR reserves the right to take necessary steps to restore market competition.

|

Compliance tips:

|

In summary, this briefing provides an overview of the important changes and potential ones to China's existing merger control rules and procedure. The public consultation for the Threshold Rules and the Review Rules will run until July 26, 2022, after which we expect further revisions to the draft. We are closely monitoring any changes and will provide further updates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.