- in United States

- within Criminal Law and Technology topic(s)

Key takeaways

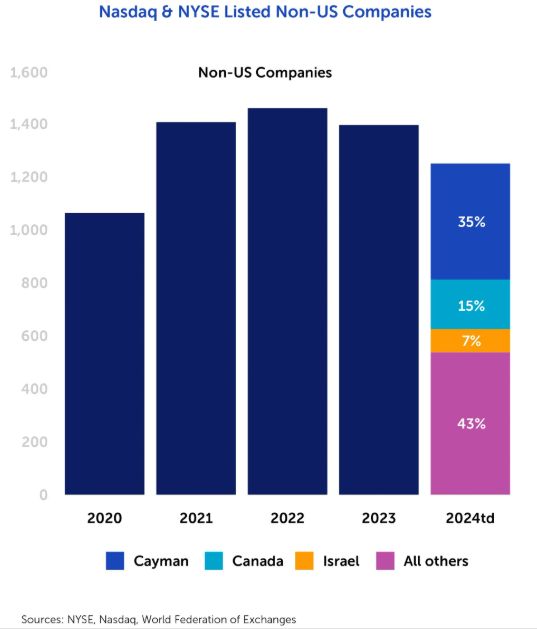

- The Cayman Islands is the most common non-US jurisdiction for listed entities out of 47 different jurisdictions currently listed on the NYSE and Nasdaq.

- Special Purpose Acquisition Companies (SPACs) have been the most significant factor in the increase of Cayman Islands listed entities since 2020.

- The Foreign Private Issue (FPI) status is a key benefit associated with Cayman Islands listed entities as it offers a more flexible regime.

The Cayman Islands is the most common non-US jurisdiction for listed entities

Entities established in 47 different jurisdictions are currently listed on the NYSE and Nasdaq. Of these different jurisdictions, outside of the United States, the Cayman Islands accounts for more listed entities than any other jurisdiction. As at November 2024 there were 430 Cayman Islands entities listed on NYSE and Nasdaq accounting for approximately 35% of listed entities formed outside of the United States.

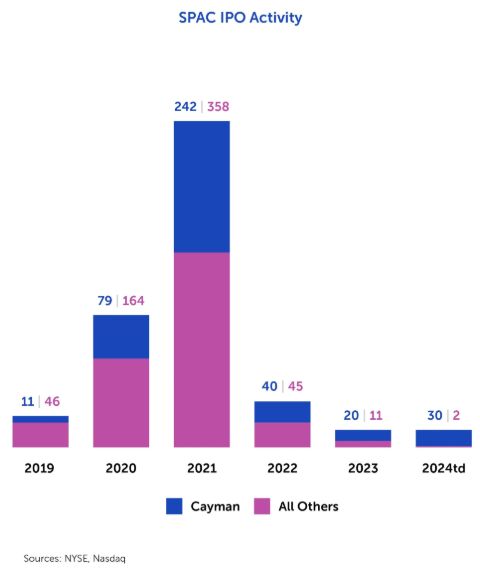

95% of all SPACs launched in 2024 are established in the Cayman Islands

The most significant factor in the increase in the number Cayman

Islands listed entities has been the volume of Special Purpose

Acquisition Companies ("SPACs") launched from 2020

onwards.

While the number of SPAC launches since 2021 has reduced

significantly, the proportion of SPACs listed in the Cayman Islands

has increased substantially from 33% in 2020 to 95% of the 32 SPACs

launched in 2024.

Why Cayman Islands entities are used for listing on NYSE and Nasdaq

Foreign (non-US) entities listed on both the NYSE and NASDAQ in many cases qualify for "Foreign Private Issuer" (FPI) status. FPIs benefit from a more flexible regime in terms of securities registration, accounting and ongoing reporting. They are permitted to comply with "home country" governance standards. The home country governance standards applicable to Cayman Islands entities provide a well established and attractive governance framework for issuers.

A material influence on the dominance of the Cayman Islands as the jurisdiction of choice for new SPACs has been the increase in SPAC litigation in the Delaware courts. Cayman Islands SPACs and their directors have not been exposed to this litigation to the same extent. Although the non-SPAC IPO market has been subdued in recent years, we are seeing an increased recognition of the advantages that incorporation in the Cayman Islands has to offer in terms of mitigating litigation risk.

Looking towards 2025, in the expectation that the number of IPOs will increase, the Cayman Islands is well placed to build upon its established reputation as the jurisdiction of choice for prospective issuers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.