On Friday 17 February 2017, the two week period for appeal expired and the court in Seoul declared Hanjin Shipping bankrupt. Hanjin will not be the only headline-capturing casualty of 2017 as the shipping market continues to suffer. Earlier this year, one of the major names in the market, Norwegian bank DNB, announced loan losses of US$903 million for 2016. This, as well as the bank's NOK 25.7 billion ($3.08 billion) of non-performing and doubtful loans, attributed to clients across the shipping and offshore sectors.

New lending is generally not available except for the "blue chip" of shipping companies with tried and tested relationships. We see two trends emerge: on the one hand, enforcements of existing bank facilities due to non-performance or where re-financing is not available; and, on the other, Chinese liquidity in the form of lease finance where traditional bank finance has dried up. As reported by Tradewinds, industry data and projections in November 2016 estimated the top ten largest Chinese lessors to have spent around $11.5 billion on vessels last year.

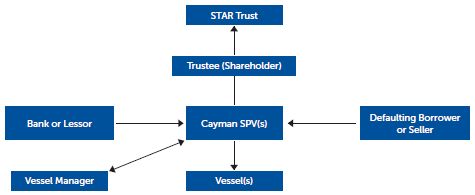

In this article, we look at why financiers use Cayman Islands orphan SPVs as preferred vehicles for enforcement as well as for new leasing deals and how these structures add value. First, let's consider a typical structure:

What is a Cayman orphan SPV structure?

The set-up:

- One-ship owning Cayman Islands

exempted companies, generally referred to as "special purpose

vehicles" or "SPVs", are incorporated specifically

for the transaction.

- In an enforcement scenario, the SPVs acquire ownership of the ships via the bank's rights under the ship mortgage. Where there are likely to be complications to enforce the mortgage (due to, for example, location of the ship), the Cayman SPV, in the alternative, can be used to hold the shares in the defaulting borrower(s) via enforcement of share security over the borrower.

- In the finance lease context, an owner finances the ship through a sale and leaseback structure with a lessor via a Cayman SPV.

- Legal title in the shares of the Cayman SPV is held by a professional trust company such as Walkers Fiduciary Limited in its capacity as trustee of a Cayman Islands trust. The trust company also provides independent directors for the Cayman SPV which provides comfort that the business of the SPV will be limited to the enforcement work-out/financing (as the case may be).

- The trust company creates a trust over the shares. A discussion of the types of trust available is beyond the scope of this article but Cayman STAR trusts are providing increasingly popular. They can be established to hold assets for the purpose of a particular transaction and specifically drafted to meet the requirements of that transaction. STAR trusts are being used increasingly as an alternative to the charitable trust, which has previously been more common in deals of this type (although charitable trusts remain a popular option in the Asian market). STAR trusts can be used as substitutes for charitable trusts where, for example, the settlor wishes to control who has the right to enforce the trusts. They are also useful in circumstances where it is not entirely certain that the proposed charitable objects would be regarded as wholly charitable under Cayman law.

- Each SPV enters into an administration agreement with the trust company to provide administrative services for the SPV and maintain it.

- Each ship-owning SPV appoints a technical manager and a commercial vessel manager to operate, manage and, where applicable, market the vessel on its behalf.

- Where employed, earnings of the vessel flow up through the structure to service debt pending sales of the ships by the enforcing bank (in the enforcement context) or finance lease payments (in the finance lease context).

- The shares of the SPVs are often made subject to a share charge given by the trust company in favour of the enforcing bank/lessor (or financier of the lessor, where applicable). As security for the debt, the SPV will grant mortgages or charges over the vessels and related contractual rights in favour of the financiers (eg insurances, earnings, requisition compensation, charter rights).

How does a Cayman Islands trust add value on enforcement of shipping loans or for Chinese lessors and their financiers?

- Off-balance sheet

treatment.

This attribute is particularly valuable both to enforcing banks and new lessors. Amongst other things, the off-balance sheet treatment may mitigate a financier's exposure to the commercial, legal and reputational risk associated with ship ownership and operation. One of the more extreme examples of this would be an oil spill. In the US, potential financial liability under the US Oil Pollution Act 1990 can be, in certain circumstances, unlimited. This as well as the reputational and political risk attached to extensive environmental damage. - Bankruptcy

remoteness.

The trust structure is intended to produce the result that the insolvency of a transaction party will not result in the shares or the assets of the SPV becoming subject to those insolvency proceedings.

- In the enforcement context, this "bankruptcy remoteness" is an enhancement for the enforcing bank compared to leaving the borrower(s) as a wholly owned subsidiary of a transaction party (and therefore subject to insolvency of its parent). It should be borne in mind that competing claims arising against the vessel or its defaulting borrower owner may undermine bankruptcy remoteness in a new Cayman SPV orphan structure.

- In the new leasing context, for similar reasons set out above, bankruptcy remoteness is an enhancement for any financier or a lessor.

- No tax.

In the Cayman Islands, there is no direct tax which means no corporation taxes on any company carrying out business within or outside the Cayman Islands. The use of Cayman Islands' administrators means that SPVs are centrally managed and controlled in the Cayman Islands, which, subject to the tax analysis specific to a transaction should mean that the SPV will not be taxable in another jurisdiction on the basis of its "mind and management" being in that other jurisdiction.

Additionally, in relation to payments made by an SPV there is no tax withheld by the Cayman Islands' Government on any payment of principal, interest or charter hire and no requirement to file tax returns or financial statements in the Cayman Islands. This simplifies the administration and cost of any transaction. - Flexibility and certainty of

relevant legislation.

The laws of the Cayman Islands are essentially based on English common law, so the central issues of corporate power, directors' fiduciary duties, corporate personality, limited liability and corporate benefit are substantially the same as the position under English common law. At the same time, Cayman Islands' domestic legislation has introduced a number of features designed to facilitate the use of SPVs in international transactions. - Other:

- Setting up an SPV in the Cayman Islands is flexible and quick. A Cayman Islands' SPV can be set up in as little as 4 hours where "express incorporation" is selected which can be considerably quicker than in other offshore jurisdictions where there can be a need for an 'in principle' consent from the local regulator which can slow down the process.

- The Cayman Islands remain relatively inexpensive and the set up costs for SPVs in the Cayman Islands are still low. For example, the fee payable to the Cayman Islands Government for incorporation of an SPV can be as low as US$731.71 for a "standard incorporation" and US$1,219.51 for an "express incorporation".

- There are no foreign exchange controls in the Cayman Islands. As such, money and securities in any currency may be freely transferred to and from the Cayman Islands.

Ship owners face a capital intensive business and the challenges in the market continue to impede access to all-important credit facilities. An estimated value of $11.5bn worth of Chinese leasing deals in 2016 suggests one possible route for owners. Despite the hefty price-tag, the long tenor of leasing deals become attractive to shipowners planning ahead against bullet payments and lack of certainty of finding new bank credit to roll over existing deals. Cayman orphan SPVs are quickly becoming a vehicle for leasing deals, offering an entity in a stable legal and political environment with zero direct taxation, flexible legislation and regulatory framework, low government fees and a rapid 4 hour incorporation time.

For those many shipowners struggling to find new bank credit or a leasing deal, a harsher reality awaits. Where enforcement is unavoidable, a Cayman orphan SPV structure can be set up to meet the time pressured demands typical of enforcement scenarios (including, in our experience, giving a secured lender an option to quickly move its collateral ahead of a shipping company filing for bankruptcy protection). Critically, enforcing financiers can take comfort that through a Cayman orphan SPV structure the commercial, legal and reputational risk associated with vessel ownership can be meaningfully mitigated.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.