What is the Long-term Outlook?

At least every two years the Alberta Electric System Operator (AESO) shares with the market its long-term (20 year) forecast of Alberta's electricity demand and the generation capacity needed to meet that demand. The forecast is called the Long-term Outlook ("LTO"), and the AESO uses it to help guide transmission planning in Alberta. This is because it is the AESO, and not transmission companies, that determines and implements transmission system expansions and enhancements.

The LTO is important to Alberta's electricity market participants because it describes some of the factors affecting future load growth, generation development and, though not expressly discussed in the LTO, power pool prices in Alberta. After all, the AESO has access to market data, stakeholder and government information, experts (including its own) and internal Alberta industry experience and knowledge that is not available to most of us in the market.

The AESO recently published the 2017 LTO. It is no surprise that, despite the AESO's significant resources, its crystal ball is a little cloudy these days. Alberta's electricity industry is in a state of transition, due in part to changing government policies like Alberta's Climate Leadership Plan and the introduction of a capacity market. Uncertain economic conditions in the province also make forecasting difficult.

This led the AESO to include not only a "Reference Case" (its main corporate outlook or base case for future load growth and generation development) in the 2017 LTO, but also six other scenarios to account for uncertainties and that answer plausible "what if" questions.

What does the Reference Case tell us?

According to the assumptions used by the AESO in its Reference Case:

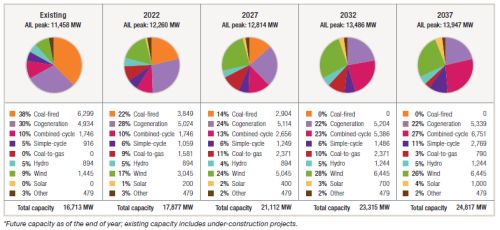

- Load Growth: Future load growth in Alberta will be lower than the AESO previously forecasted, due to the adverse impact that low oil prices will have on future economic growth in Alberta, and to improvements in energy efficiency. The AESO now expects the load to grow in Alberta by an average of 0.9% per year until 2037 – significantly less than the 1.9% forecasted by the AESO in the 2016 LTO. However it is still growth, and will result in peak demand growing from 11,458 MW in 2016 to 13,947 MW in 2037.

The AESO load growth prediction does run counter to the recent winter and summer record peaks set in Alberta, but the AESO claims that those record peaks are due to unusual weather and the ramp up of recently completed oil sands projects. Accordingly, the higher recent load growth is not forecasted to continue.

Renewables: Alberta will deliver on the promised 5000 MW of new renewable generation supported by the Renewable Electricity Program (REP). The AESO also assumes that additional renewables will be developed outside of the REP. After all renewable projects did get built in this province before the REP. As a result, Alberta is forecasted to achieve its 30% of electricity generated in Alberta coming from renewables by 2030 policy – actual renewable capacity is forecasted to get to 36% by 2030.

Wind capacity is assumed to be added at a rate of about 400 MW per year (5000 MW in total) and will be split between the south and central regions, with some wind development anticipated to also occur in the northwest. This assumption is consistent with the AESO's stated goal of having regular rounds of procurements under the REP. Utility-scale solar will locate in the south (best) and central regions (highly suitable). Solar capacity additions will be lower than wind, and total 1000 MW by 2037. Hydro capacity additions of 350 MW are forecasted to occur on the Peace River around 2030, though the AESO acknowledges that other potential hydro resources also exist in Alberta.

Coal Generation: All coal-fired generation will be retired by the end of 2030 – no surprises here as the coal retirement assumption is consistent with both Alberta's and Canada's coal policy. This firm power will be replaced by gas-fired generation – a mix of coal-to-gas conversion, combined-cycle and simple-cycle additions.

Coal-to-Gas Conversion: About 2,400 MW of the current 6,299 MW of coal generation in Alberta is assumed to convert to gas in the early 2020s. The converted coal units are assumed by the AESO to be at Sundance (Units 3, 4, 5 & 6) and Keephills (Units 1 & 2). These converted units will operate for only 15 years before being forced to retire due to the likely federal emissions standards that will then apply to these units.

AlbertaPowermarket.com recently described the economics behind coal-to-gas conversion decisions here in Alberta.

New Capacity: In total, about 13,900 MW of new capacity (excludes coal-to-gas conversion) is assumed to be developed in Alberta by 2037 to meet demand. The AESO assumed a 15% reserve margin in forecasting this new capacity.

Besides renewables and the coal-to-gas conversion described above, the AESO also forecasts new gas-fired development will occur (7,000 MW) mainly at brownfield coal sites, and that some cogeneration development will occur (400 MW plus what is under development now) mainly at the Fort McMurray and Cold Lake oil sands facilities.

Under the AESO's Reference Case the generation mix (capacity) in Alberta changes between now and 2037 as follows:

What do the other scenarios in the 2017 LTO tell us?

Besides economic uncertainty, there is a lot of regulatory uncertainty around the potential for coal-to-gas conversion in Alberta. The federal government is currently developing gas-fired emission regulations which will set limits on the emissions of units converted from coal to natural gas. These emission regulations will apply to the converted units for 15 years or until 2045, whichever comes first, and after which a currently unattainable emissions requirement of 420 tCO2/GHh (a combined cycle standard) is expected to apply to the converted units.

Industry is currently being consulted about the emissions intensity requirements that the coal-to-gas conversion units will initially be required to meet under these regulations. Those emissions requirements will impact the economics and technical feasibility of coal-to-gas conversion in Alberta. Accordingly, besides the Reference Case that assumes 2,400 MW of converted coal, the 2017 LTO includes a high conversion scenario where 5,400 MW is converted to gas, and another scenario where no coal-to-gas conversion occurs at all in Alberta.

The 2017 LTO also recognizes that the Regional Electricity Cooperation and Strategic Infrastructure Initiative (RECSI) may impact Alberta's generation mix. RECSI is funded by the federal government and is looking at electricity projects in Western Canada and the Northwest Territories that could assist Alberta and Saskatchewan transition to a sustainable, non-emitting generation portfolio.

Two projects being considered by RECSI are large scale hydro development in Alberta and a new intertie between Alberta and British Columbia. Accordingly, besides the Reference Case, the 2017 LTO includes: 1. a scenario whereby a new 1,000 MW run-of-the-river hydro facility is built on the Slave River after 2030 and some uprates totaling 170 MW are also done on existing hydro facilities on the North Saskatchewan River; and 2. a scenario whereby a new 1,700 MW transmission line is built between Alberta and British Columbia to permit the increased import of electricity to Alberta.

The 2017 LTO does not address all of the uncertainties that will impact Alberta's electricity market over the next 20 years. For example, the design of the capacity market and future election results will likely impact the future mix of Alberta's electricity generation. So will climate change, prices on carbon emissions, oil and gas prices, pipelines to tidewater, technology innovation, and the changing cost to construct and operate alternative types of generation. Alberta's generation mix will therefore not be what the AESO's 2017 LTO forecasts for 2037 – a bold prediction we know. But, if you are a facility owner, developer, investor, financier or just a person interested in some of the issues currently playing out in the Alberta electricity market then the 2017 LTO is worth a read.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.