On March 31, 2015, the Canadian Securities Administrations (the "CSA") published for comment significant amendments to the rules regulating takeover bids in Canada (collectively, the "Proposed Bid Amendments"). In this Securities Law Bulletin we will:

- describe three of the most significant amendments contained within the Proposed Bid Amendments;

- provide a sample timeline illustrating the impact of the Proposed Bid Amendments on a hostile takeover bid; and

- highlight certain effects of the Proposed Bid Amendments on those persons or entities considering making a hostile take-over bid in the event that the Proposed Bid Amendments are adopted in the current form.

Three Significant Amendments

As highlighted by the CSA, the key amendments set forth in the Proposed Bid Amendments would require that all non-exempt take-over bids:

- "receive tenders of more than 50% of the outstanding securities of the class that are subject to the bid, excluding securities beneficially owned, or over which control or direction is exercised, by the offeror or by any person acting jointly or in concert with the offeror (the Minimum Tender Requirement);

- be extended by the offeror for an additional 10 days after the Minimum Tender Requirement has been achieved and all other terms and conditions of the bid have been complied with or waived (the 10 Day Extension Requirement); and

- remain open for a minimum deposit

period of 120 days unless

- the offeree board states in a news release a shorter deposit period for the bid of not less than 35 days that is acceptable to the offeree board, in which case all contemporaneous takeover bids must remain open for at least the stated shorter deposit period, or

- the issuer issues a news release that it has agreed to enter into, or determined to effect, a specified alternative transaction, in which case all contemporaneous take-over bids must remain open for a deposit period of at least 35 days

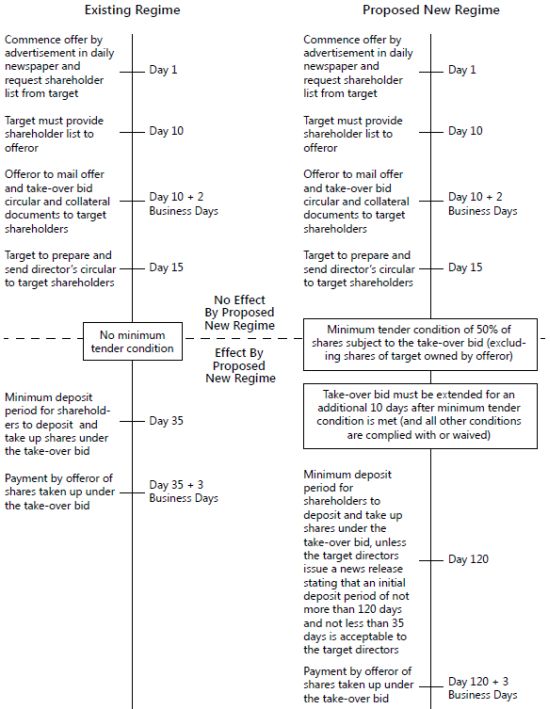

Sample Timeline

The following sample timeline illustrates the potential impact of the Proposed Bid Amendments on a hostile takeover bid in the event that the Proposed Bid Amendments are adopted in the current form.

Sample Hostile Take-over Bid Timelines

Certain Effects of the Proposed Bid Amendments

Some of the effects of the Proposed Bid Amendments on those considering making a hostile take-over bid in the event that the Proposed Bid Amendments are adopted in the current form include:

- The Minimum Tender Requirement and the 10 Day Extension Requirement are intended to address the "pressure to tender" and other related matters, and could be viewed as resulting in a take-over bid now requiring a "majority of the minority" approval for a takeover bid and as providing an extension of the time in which a shareholder can tender to join the majority once the majority has tendered to the hostile take-over bid;

- The 120 Day Requirement will in essence provide every target company with a shareholders' rights plan (or poison pill) since the board of directors of the target company will have up to 120 days (much longer than the 45-60 days after the commencement of the bid that poison pills typically would provide) to seek alternative proposals to enhance shareholder value, which was the stated purpose of poison pills. This additional time period will allow, among other things, the board of directors of the target to receive an additional proposal but will also afford additional hostile offerors the opportunity to emerge;

- The 120 Day Requirement, when coupled with the current requirement under the existing take-over bid regime that a take-over bid not be subject to a financing condition, will mean that an offeror will require financing commitments with a longer expiration period than required under the existing take-over bid regime, likely resulting in additional commitment fees to be paid by the offeror to its capital provider(s); and

- The 120 Day Requirement, together with the ability of the board of directors of the target company to reduce the deposit period less than 120 days but greater than 35 days, creates a meaningful incentive for offerors (or potential offerors) to negotiate with the board of directors of the target company to arrive at a more amicable solution or leave the bidder with greater transaction uncertainty over an extended period of time.

The Proposed Bid Amendments can be found on the Ontario Securities Commission website. The Proposed Bid Amendments are open for comment until June 29, 2015.

Footnote

1. Proposed Amendments to Multilateral Instrument 62-104 Take-Over Bids and Issuer Bids (MI 62-104) and Proposed Changes to National Policy 62- 203 Take-Over Bids and Issuer Bids (NP 62-203). See: http://www.osc.gov.on.ca/documents/en/Securities-Category6/csa_20150331_62-104_rfc-proposed-admendments-multilateral-instrument.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.