Introduction & Market Update

The Alberta Electric System Operator (AESO) released its 2021 Long-term Outlook on June 29, 2021. According to the report, moderate load growth is expected over the next 20 years but at a lower rate than in the previous 20-year period. Load growth is expected in the near term due to economic recovery as COVID-19 health restrictions ease. It is expected there will be generation growth and natural gas is anticipated to be the primary fuel source to replace coal in the generation mix.

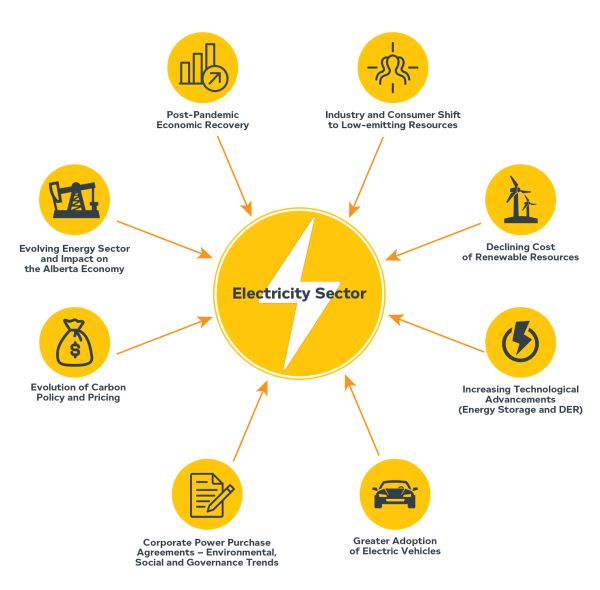

The electricity sector in Alberta is transforming in direct response to the following key drivers:

Source: AESO 2021 Long-term Outlook Report Highlights (July 2021), online: www.aeso.ca/assets/LTO-Report-Highlights_2021.pdf.

Key Developments in 2021

A number of key developments occurred in 2021, including the Alberta Utility Commission's (AUC) Distribution System Inquiry Final Report, the phasing out of distribution connected generation (DCG) credits and legislative changes to facilitate new technology and the diversification of Alberta's electricity market.

Distribution System Inquiry Final Report - On February 19, 2021, the AUC released its Distribution System Inquiry Report (Report) summarizing its distribution system inquiry (Inquiry) which was commenced in December 2018. The Inquiry was launched to provide a forum for Alberta's electricity industry to consider a regulatory response to mounting economic and technological pressures affecting Alberta's electric distribution systems. The Inquiry focused on understanding three questions relating to new technologies affecting the grid, how electricity distribution utilities will be expected to respond to alternative approaches and how distribution facility rate structures should be modified to incentivize efficient cost-effective use of the grid. The Inquiry involved participation from 90 parties.

The Inquiry and its findings are a result of a shared responsibility among the Government of Alberta, the AESO, the AUC, transmission and distribution facility owners, generators, technology solution providers and consumer groups to modernize the distribution grid through opportunities to develop a smarter, more flexible distribution system.

The Report identified a number of broad themes to achieve this goal, including:

- driving efficiency and competition across all aspects of the Alberta Interconnected Electric System;

- the need to ensure a level playing field across different types of technology;

- the importance of consumers paying their fair share of costs related to grid usage;

- establishing a consistent and predictable policy framework for market certainty; and

- the ability of grid users to respond to price signals as the system and technologies evolve.

One of the main topics of focus throughout the Report was the integration of distributed energy resources (DERs), which are devices used to automatically manage electricity consumption. Due to decreasing costs in technology, new government policies and a shift in consumer preferences, DERs have become more frequently used in Alberta. However, DERs also allow customers to potentially bypass utility services and the associated tariff charges. Accordingly, avoided costs must be recovered from other customers, amounting to an uneconomic bypass of the grid. In order to avoid the unequal distribution among customers, the industry will need to adapt to market pressures and changing technologies, including the use of DERs.

AUC DECISION 26090-D01-2021 - DCG CREDITS - RELEASED JUNE 2021

In Decision 26090-D01-2021 (DCG Decision), the AUC addressed the uncertainty surrounding the fate of the ISO Tariff DCG credits. The current DCG credit mechanism will be discontinued and all DCG credits will be phased out based on a four year transition period as set out in detail in the DCG Decision.

DCG is a supply-side distributed energy resource. DCG credits are the payments that ATCO Electric, ENMAX and FortisAlberta Inc. (Fortis) provide to DCGs (both without associated load and as part of self-supply and export configurations) connected to their respective distribution systems. These credits are calculated and paid pursuant to provisions within their respective tariffs: Option M for Fortis, Rate D32 for ATCO Electric, and Rate D600 for ENMAX.

The credits are calculated based on the electrical energy delivered by the DCG to the distribution system, and represent the difference between the AESO transmission charges (Rate Demand Transmission Service and Rate Supply Transmission Service) that the distribution utility must pay with the DCG in operation, and the hypothetical charges that would have been incurred if the DCG had not been in operation. The calculated credits are then allocated to, and recovered from, all load customers of that distribution utility.

The AUC held that DCG credits are not consistent with just and reasonable ratemaking because:

- the credits unnecessarily increase payments made by customers without providing any quantifiable benefits; and

- the credits promote an un-level playing field causing distortionary harm to the wholesale electricity market, which is also a detriment to ratepayers.

Although an application by a number of generators to review and vary the DCG Decision was unsuccessful, the DCG Decision remains the subject of a judicial review application. The applications for leave to appeal the DCG Decision are currently scheduled for the end of Q1 of 2022.

LEGISLATIVE AMENDMENTS

Bill 86: Electricity Statutes Amendment Act

Alberta introduced Bill 86, or the Electricity Statutes Amendment Act, which if passed, will amend the laws and regulations which currently govern and regulate energy storage, sale and transmission in Alberta, including the Alberta Utilities Commission Act (AUC Act), the Electric Utilities Act and the Hydro and Electric Energy Act. Through this omnibus bill, Alberta is proposing legislative changes to modernize its electricity system in response to new technologies, including the integration of energy storage.

Highlights of the proposed legislative amendments (Proposed Amendments) include:

- Unlimited Self-Supply and Export: Under the Proposed Amendments, self-supply with export will be unlimited and would allow market participants to produce electricity for their own use. Under the current regime, market participants can only self-supply and export to the grid in four prescribed scenarios including at designated industrial sites, certain micro-generation facilities, flare gas generators and certain municipality-owned facilities. The Proposed Amendments are responsive to the issue of eligibility to self-supply which has been contentious and most recently considered by the AUC within the context of an Alberta bitcoin mine.

- Distribution Facility System Planning: Distribution facility owners will have a duty to prepare distribution system plans and to make decisions about "non-wire services" as part of any decisions regarding amendments to its electric distribution system.

- Integration of Energy Storage: The integration of energy storage into the electricity system in both the competitive market and the transmission and distribution system. The Proposed Amendments will create and define a new separate category of energy storage facilities for which AUC approval will be required. In addition, transmission and distribution facility owners will be able to use energy storage facilities to provide utility services and non-wire solutions for the benefit of the transmission and distribution systems. However, based upon the current wording, distribution and transmission facility owners may not be able to sell any electric energy from such energy storage facilities to the power pool.

Red Tape Reduction Implementation Act, 2021

On June 21, 2021, Bill 62: the Red Tape Reduction Implementation Act, 2021 (Bill) received royal assent. The Bill amends the AUC Act to provide for mandated timelines for AUC decisions about utility rates that will be prescribed in the AUC Rules (Rules). This could potentially speed up the decision-making process for the benefit of operators and distribution companies. As of September 2021, the AUC reported that it had achieved a 48% reduction in regulatory requirements set out in its Rules, exceeding its red tape reduction target as set by the Government of Alberta to reduce mandatory requirements by one third.

CONTINUED GROWTH IN POWER PURCHASE AGREEMENTS

In this era of ever greater focus on corporate sustainability, and with the federal government of Canada targeting net-zero emissions by 2050, companies are increasingly pursuing renewable energy alternatives to advance their environmental, social and governance (ESG) initiatives, including through power purchase agreements (PPAs). In addition to the Renewable Electricity Support Agreements entered into between successful proponents through the AESO's Renewable Electricity Program, Alberta has seen a high level of activity in the area of corporate PPAs among developers and purchasers of energy and associated environmental attributes from renewable energy projects.

There are two kinds of PPAs: (1) traditional or physical PPAs; or (2) virtual PPAs (VPPA). With either option, the company agrees to pay a fixed price for every megawatt-hour of clean energy that is generated. Buyers have the option to purchase either bundled or unbundled associated renewable energy certificates (RECs) or offsets and other environmental attributes associated with the generation of power from the project.

Why PPAs are Attractive

Achieve Net-Zero Targets Purchasing RECs, offsets or other environmental attributes directly from power generators is a cost effective way for companies to reduce emissions without having to invest directly in renewable energy infrastructure.

Capital Investment ESG issues have become much more important for long-term investors. Access to capital now hinges on the ability of companies to demonstrate that they are reducing their emissions and meeting particular ESG goals.

No Physical Restrictions With PPAs, depending on the nature of the environmental attribute acquired, such attributes can be used to achieve goals in jurisdictions besides the jurisdiction where the power generation is occurring. This allows for greater investment opportunities and more choice when determining the kind of energy generation projects to invest in, whether it's wind power, solar power, hydro-electric power or otherwise.

Hedge Market Risk For developers of renewable power projects, PPAs allow for a hedge against fluctuations in market prices (pool prices) over the life of the project, giving more certainty for capital and financing considerations.

Given Alberta's deregulated, energy-only power market, Alberta is an ideal market for PPAs. In the last 3 years, VPPAs in Alberta have become highly attractive. In 2021 alone, the following major companies have invested in VPPAs in Alberta:

- Amazon entered into a VPPA to purchase 400 MW of power from the Travers Solar Project;

- Budweiser entered into a long-term VPPA to purchase 51% of the electricity generated from Capital Power's 75 MW Enchant Solar facility located in Taber, Alberta;

- Cenovus Energy Inc. entered into a VPPA off-take deal with Elemental Energy Inc. from a roughly 150-MW solar project proposed in Alberta by compatriot Elemental Energy Inc.;

- Pembina Pipelines entered into a VPPA with TransAlta Corp. for 100 MW of its 130 MW Garden Plain Wind Power Project;

- Groupo Bimbo Canada entered into two VPPAs with Renewable Energy Systems (RES) to procure renewable electricity that will offset 100% of the company's electricity consumption in Canada; and

- Shell Energy North America (Canada), Inc. entered into a VPPA with BluEarth Renewables for the offtake of 100 MW at its Hand Hills Wind Project.

Click here to review Noteworthy AUC and ISO Rule Changes

WHAT'S NEXT FOR ALBERTA - NEW TECHNOLOGY & DIVERSIFICATION

It is anticipated that 2022 will be another growth year for Alberta. With the release of Alberta's Recovery Plan in Q3 2020, the Alberta Hydrogen Roadmap and the release of the 2021 Federal Budget, which earmarks a significant amount of funds for the net-zero transition, the focus on innovation and the push towards clean technology, it is anticipated that Alberta's electricity industry will continue to undergo its transition in 2022 to a greener economy.

In the fall of 2021, Alberta signalled its intention to release a new climate strategy. As discussed within our environmental article, we anticipate Alberta will formulate an updated provincial strategy to tackle its unique emission and industry profile. It will be important to monitor the development of a new climate strategy and the potential impacts to the power industry and participants in Alberta's electricity market.

Highlights for some key growth industries in Alberta are summarized below:

Hydrogen: As a major player in the global energy market and on the heels of following the Federal Hydrogen Strategy released in December 2020 and Alberta's Natural Gas Vision and Strategy released on October 6, 2020, the Province of Alberta released its highly anticipated Alberta Hydrogen Roadmap (Roadmap) on November 5, 2021, setting out the plan for Alberta to become a leader in the emerging hydrogen economy.

The first phase of implementing the Roadmap focuses on establishing policy, investing in technology to reduce the carbon intensity of hydrogen production and accelerating commercialization across the supply chain. The second phase will focus on growth and achieving scale through improved technologies and commercialization. For an overview of the hydrogen economy and further details on the Roadmap please refer to the Hydrogen Overview article.

Geothermal: The global geothermal energy market is projected to register a compound annual growth rate of more than 3% between 2021-2026. Alberta has a natural geological advantage to develop geothermal energy in this growing market. Additionally, the Province has a number of other advantages, including opportunities to repurpose inactive oil and gas wells, well sites and infrastructure; leadership in drilling technology; extensive oil and gas expertise; and a well-established service sector tied to energy production.

To date, the development of geothermal resources in Alberta has been limited by the lack of a comprehensive regulatory framework. Geothermal project applications have been assessed on a case-by-case basis; a model that is inefficient for both industry and government. The Geothermal Resource Development Act , which received proclamation on December 8, 2021, establishes a regulatory regime for the responsible development of geothermal resources and related wells and facilities in Alberta. This Act applies to geothermal resource development whether commenced before or after the coming into force of the Act. This Act is modelled after the Oil and Gas Conservation Act (OGCA) and provides the Alberta Energy Regulator with the authority to regulate the responsible development of Alberta's geothermal resources.

Carbon Capture and Storage: In conjunction with the emphasis on greening the energy industry, carbon capture, utilization and storage (CCUS) is very attractive to Alberta's natural resource based industries and electricity generators. Industry has been quick to act on the booming sub-sector of CCUS. In the summer of 2021, major players such as Shell Canada, Suncor Energy and ATCO, TC Energy and Pembina Pipeline all announced proposed development of CCUS projects. The industry is also eagerly awaiting the details of the proposed federal tax credit referenced in the 2021 Federal Budget.

In May 2021, Alberta Energy announced, through an information letter, that it intended to move towards a competitive bid process for carbon sequestration tenure, to develop strategically located carbon sequestration hubs, allowing for additional volumes and multiple sources of CO2 to be stored and avoiding stand-alone injection operations. In connection therewith, Alberta Energy suspended the granting of pore space licenses while it developed the proposed hub model for sequestration.

Following a significant amount of interest received during the May 2021 Request for Expressions of Interest for Carbon Sequestration Hub Proposals (REOI), on December 2, 2021, Alberta Energy released a Request for Full Project Proposals for Carbon Sequestration Hubs (RFPP). The guidelines for submission for this RFPP can be found here. The Province has accepted proposals for Alberta's industrial heartland region in Edmonton and subsequent requests for proposals in additional regions are expected to open in Q2 2022. Only subsurface formations deeper than 1,000 meters with no associated hydrocarbon recovery (i.e. injection into a deep saline aquifer) are eligible. Projects that inject carbon dioxide as part of enhanced oil recovery, or formation acid gas injection, will continue to operate under current mineral rights tenure systems. All required regulatory approvals remain the responsibility of the proponent and will not be granted through the RFPP process.

The growth of CCUS in Alberta is also evidenced by the C$100 million of provincial funding to seven selected projects through Alberta's Industrial Energy Efficiency and Carbon Capture Utilization and Storage program, with another C$31 million to be provided to other CCUS projects by the end of 2021. Details regarding the seven selected projects can be found here.

Small Modular Reactors (SMRs):

Alberta is continuing to work to promote the expanded use of nuclear power. SMRs could potentially provide Alberta's energy sector with competitively-priced, environmentally-acceptable and reliable heat, power and hydrogen for oil sands operations. This could play a critical role in decarbonizing the resource extraction and processing in Alberta's oil sands. Additionally, uranium prospects have been identified in northeast and southern Alberta, which have a potential to contribute to the feedstock needed for SMR development and deployment.

On April 14, 2021, Alberta became a signatory to the SMR Memorandum of Understanding (MOU). In the MOU, the four provinces have agreed to collaborate on the advancement of SMRs as a clean energy option to address climate change and regional energy demands, while supporting economic growth and innovation.

After endorsing Canada's SMR Action Plan in December, 2020, Alberta has taken a number of actions in relation to the SMR Action Plan. Specifically, SMRs are to be connected to the Alberta Innovates Strategic Priorities and included in the Alberta Innovates Clean Technology Program. Initiatives that further low-carbon electricity solutions (e.g. projects that advance SMR deployment for Alberta applications or utilize Alberta's manufacturing operations and industrial services for the advancement of SMR technologies) are welcome to apply for funding through the Clean Technology Program.

As further discussed in our SMR article, Alberta became the fourth signatory to the SMR Memorandum of Understanding (MOU) on April 14, 2021. The next action identified in the MOU is the development of a joint strategic plan to be drafted in collaboration by the governments of Saskatchewan, Ontario, New Brunswick and Alberta. The plan was expected to be completed in the spring of 2021 but has not yet been released.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.