- with Finance and Tax Executives

- in Canada

- with readers working within the Insurance, Healthcare and Property industries

Ontario Dispute Adjudication for Construction Contracts ("ODACC") recently issued its fifth annual report on construction adjudication in Ontario. Below, we consider its key takeaways and potential impacts for 2025.

Background

ODACC was created on October 1, 2019 as part of the adjudication and prompt payment regime instituted by the then-new Construction Act, R.S.O. 1990 c. 30 (the "Act") and O. Reg. 306/18. This marks the sixth year of ODACC administering adjudications under the Act, as well as overseeing the training of adjudicators in Ontario.

Every year, ODACC prepares a summary of key statistics from the past year in relation to adjudication. ODACC's fifth annual report included statistics for the 2024 fiscal year, which ran from August 1, 2023 to July 31, 2024. As noted in detail below, there appears to be steady and sustainable growth in the number of adjudications for construction matters, which indicates a broader reliance on the alternative dispute resolution mechanism.

The 2024 Annual Report

Broadly speaking, ODACC observed three notable trends in the 2024 fiscal year:

- an increase in adjudications in the industrial, commercial, and institutional sectors;

- a rise in subcontractors utilizing adjudication; and

- the value of the disputes in adjudication increased from previous years.

In the 2024 fiscal year, 277 adjudications were commenced, and 135 Determinations were delivered (including in respect of 31 that were commenced during the 2023 fiscal year). Further, 35 adjudications remained open and ongoing as of the date of ODACC's report, while certain other adjudications were either (1) terminated on consent of the parties (often due to a settlement or a transfer of the dispute into a different forum), or (2) technically considered to be at an end due to consolidation with another adjudication.

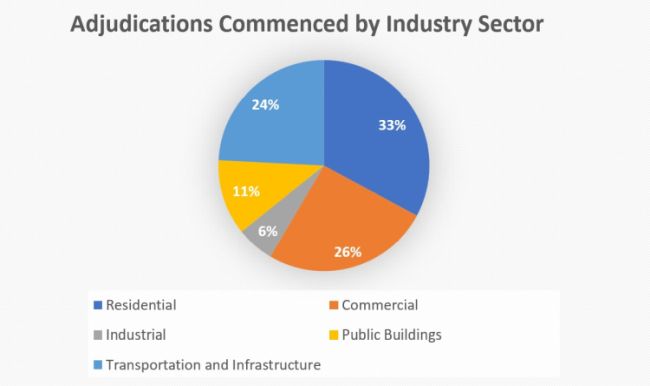

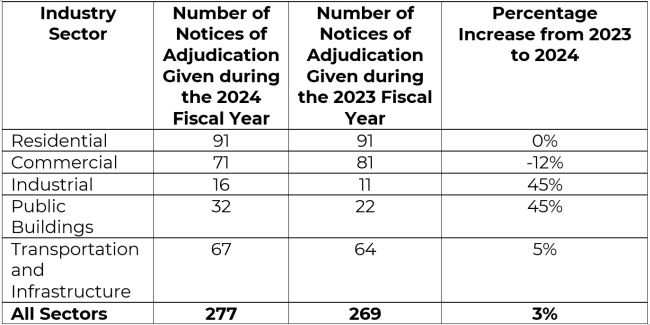

With respect to specific industry segments, adjudication was used across a variety of sectors within the construction industry, including residential (33%), commercial (26%), transportation and infrastructure sectors (24%), public buildings (11%) and the industrial sector (6%). Compared to 2023, there was a slight growth (in proportional terms) in adjudications pertaining to the public buildings sector of 3%, and the industrial sector of 2%; w by contrast, there was a slight decline in the residential sector of 1% and in the commercial sector of 4%. The percent of adjudications in the transportation and infrastructure sector remained unchanged from 2023 to 2024.

Based on the total notices of adjudication that were delivered, there appears to have been steady growth in the use of adjudication across the entire industry (with especially large increases in the industrial and public buildings sector). That being said, it appears that the commercial sector has slowed somewhat, with a 12% decrease compared to 2023 fiscal year.

b

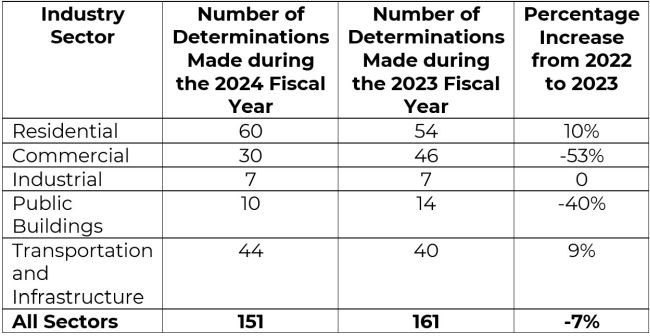

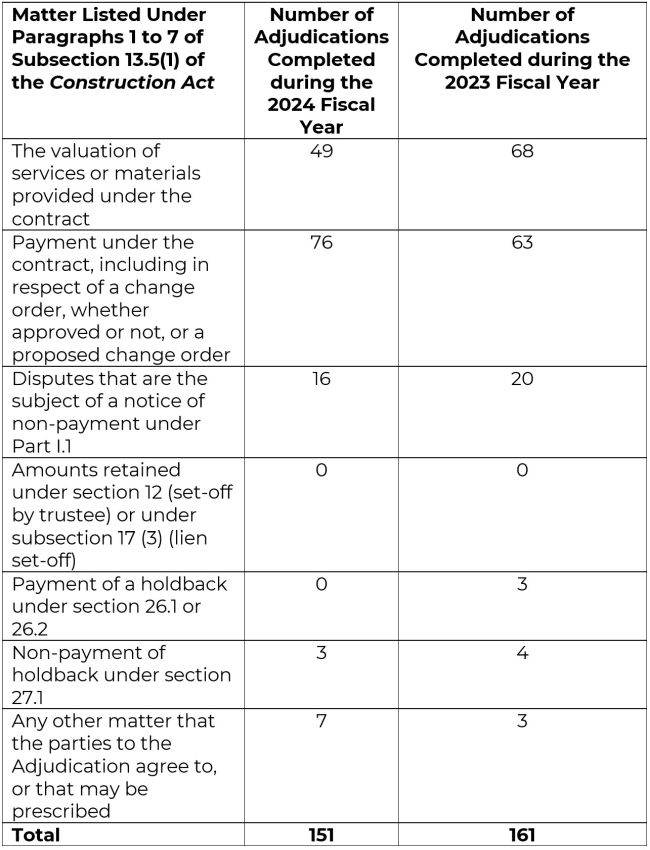

The number of determinations in 2024 actually decreased somewhat from 161 in 2023, to 151 in 2024 – a slight decrease of 7%.

On a sector-by-sector basis, there were large decreases in the commercial and public buildings sectors, with modest increases for the residential and transportation and infrastructure sectors, while the industry sector remained flat:

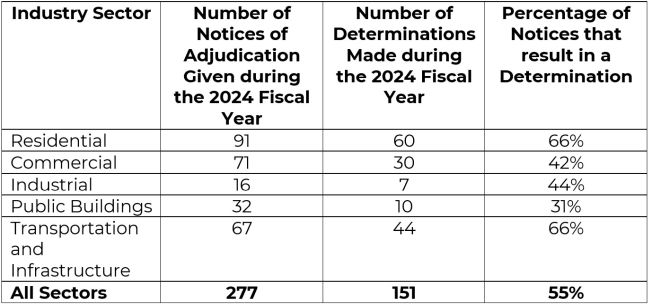

Perhaps the most interesting statistic for readers, however, is how many adjudications have actually resulted in a determination being rendered. On that point, ODACC observes that across all sectors, approximately 55% of the Notices of Adjudication delivered during the 2024 fiscal year resulted in a determination with that year. This ratio is relatively consistent across all sectors, ranging between 42 to 66%, with the exception of public buildings (being at 31%):

With respect to the subject matter of adjudications, the largest categories were related to payment under the contract in question (representing 50% of the total adjudications completed – a modest increase from the 2023 fiscal year). We expect this trend to continue to increase in 2025, as reliance on adjudication as a more expeditious means to obtain payment continues to gain traction in the industry.

Coming in second, the valuation of services or materials under the contract (at 32% of the total adjudications completed) experienced a slight decrease from 2023. Interestingly, matters related to the amounts retained under sections 12 or 17(3) of the Act, as well as the matters relating to payment of a holdback under sections 26.1 or s. 26.2 were not addressed in a determination (in that regard, the former had not been addressed in 2023 either).

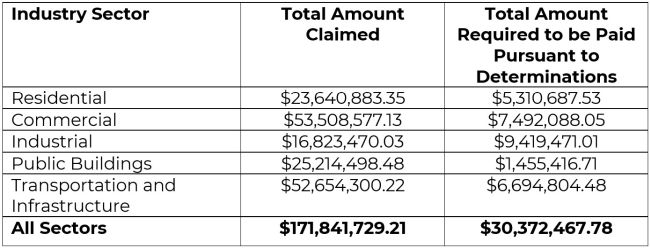

The total, aggregate amount claimed in adjudications in 2024 was approximately $171 million, with an average amount of $201,142.17 per determination across all sectors. However, the median amount sits at $67,407.43, which may suggest that one or more high-value adjudication(s) may have disproportionately impacted the average. Notably, the total claim amount in 2024 was significantly higher than the 2023 fiscal year, as the total claimed amount in the latter year was only $68,870,376.04. As a result, the total amount claimed has more than doubled, notwithstanding the similar numbers of adjudications initiated.

By contrast, the total amount required to be paid under determinations was approximately $30 million. In assessing the average amount to be paid under determinations by each sector, the industrial sector led with an average of $1.3 million per determination, followed by the commercial sector at an average of $249,000, and then followed by the transportation and infrastructure sector at $152,000.

Takeaways

Overall, ODACC's fifth annual report reflects a continued uptake in adjudication as a method of dispute resolution for the construction industry, with a seemingly greater comfort in referring higher-value disputes to adjudication. In part, this may be a result of parties customizing adjudications to fit the nature of the dispute, and it would be interesting to see whether ODACC tracks this detail in the coming year.

Across the various construction industry sectors identified in the report, there generally appears to be sustained growth in the use of adjudication across the board, with notable gains in the industrial, commercial and institutional sectors.

Overall, the statistics appear to suggest a growing comfort with the use of adjudication for a variety of disputes. We will await with interest to see how these trends unfold in the next year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.