Many predicted that 2017 would be another record year for Canadian mergers and acquisitions (M&A). There are also currently some predictions that interest rates will continue to rise despite the recent announcement of a contraction in the economy. In this blog post we consider these two factors.

As depicted in Figure 1 below, while 2017 has seen a greater number of deals as compared to 2016, the value of these deals has generally been lower. Given the expectation of rising interest rates, this is consistent with our analysis that rising rates has little effect on the number of deals but a negative effect on deal value.

As previously reported, the Bank of Canada increased the overnight lending rate from 0.75 per cent to 1.0 per cent on September 6, 2017 but, as reported here, refrained from increasing the rate any further on October 25, 2017. Observers predicted that increasing interest rates were unlikely to affect M&A activity. However, statistical analyses are not entirely corroborative.

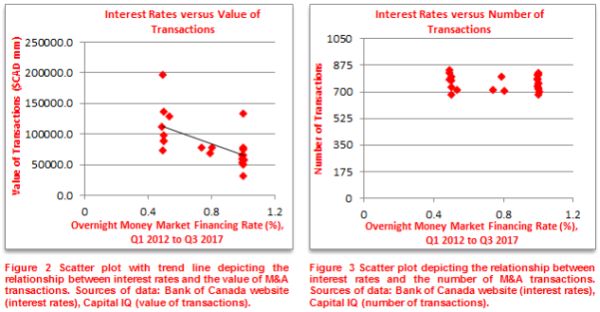

To explore the relationship between interest rates and M&A activity, we conducted a regression analysis of the Overnight Money Market Financing Rate (OMMFR) in relation to the value of M&A transactions and the number of M&A transactions from the first quarter of 2012 to the third quarter of 2017. The following explores this analysis and presents some of the main results.

Some key definitions

Before delving into the analysis, it is worthwhile to differentiate between two related yet oft-confused terms: (1) target for the Overnight Rate and (2) Overnight Rate. As the name suggests, the target for the Overnight Rate is the target level set by the Bank of Canada. Acting as a reference point for banks and other financial institutions, this rate thereby impacts other interest rates. For example, interest rates for consumer loans and mortgages. In turn, the Overnight Rate is "the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves". In our analysis below, we employed the OMMFR, which is "an estimate of the collateralized overnight rate compiled at the end of the day by the Bank of Canada through a survey of major participants in the overnight market".

Regression analysis summary

Methodology1

Drawing on data from Capital IQ, we conducted a regression analysis of OMMFR as compared to the value and number of transactions announced within each quarter of 2012 and up to the third quarter of 2017. We limited our review to transactions where at least one party – that is, buyer, seller or target – was based in Canada. We also used the Bank of Canada OMMFRs for each quarter (January to March, April to June, July to September and October to December) over the same five year period. Because OMMFRs change daily, in order to obtain the OMMFR for each quarter, we averaged the daily rates for the three months comprising each quarter. Moreover, because we were exploring how transaction value and number change in response to interest rates, we assigned the OMMFRs as the independent variables and transaction value and number of transactions as the dependent variables. We then ran separate regression analyses for each of the latter dependent variables.

Results & analysis

Value of Transactions (Figure 2). Our results showed a negative relationship between interest rates and transaction values with transaction values tending to decrease as interest rates increased. In particular, the inverse correlation between interest rates and transaction value was approximately 0.616 and, for every 10bps increase in interest rates, overall transaction value decreased by approximately $96 mm. Moreover, as indicated by the R-Square value, interest rates accounted for approximately 38 per cent of the variance in transaction value.

Number of Transactions (Figure 3). In contrast to the above, the relationship between interest rates and the number of M&A transactions was not nearly as significantly related. In particular, the R-Square value for this set of data was 0.013. This suggests that interest rates did not have a significant effect on the number of transactions during the period we studied. Similarly, the correlation was rather weak and negative (-0.115). This is not a particularly surprising result given that for many companies, M&A is a strategic business decision where the perceived benefits presumably outweigh the costs of higher interest rates. Furthermore, for companies that finance M&A deals with equity rather than debt, rising interest rates are also likely not particularly prominent considerations. In fact, if interest rates continue to rise in the future, there may be a corresponding rise in equity-financed M&A transactions.

Conclusion

With the Bank of Canada's recent announcement to maintain the target Overnight Rate at 1.0 per cent, as well as the upcoming interest rate-related announcement due December 6, 2017, we are seeing clients taking a cautious approach when considering transactions

Footnote

[1] It is important to keep in mind the limitations of such statistical analyses. First, the data covered both reported public and private transactions, but not all transactions are fully reported, if at all. Similarly, many other factors can affect deal value and number and a regression analysis of a single factor cannot account for these variables. Finally, our analysis went back just five years when the OMMFR was approximately 1.0 per cent , which is equal to the current target Overnight Rate. As such, if we expanded our review, our results may change.

The author would like to thank Samantha Sarkozi, Articling Student, for her assistance in preparing this legal update.

About Norton Rose Fulbright Canada LLP

Norton Rose Fulbright is a global law firm. We provide the world's pre-eminent corporations and financial institutions with a full business law service. We have more than 3800 lawyers and other legal staff based in more than 50 cities across Europe, the United States, Canada, Latin America, Asia, Australia, Africa, the Middle East and Central Asia.

Recognized for our industry focus, we are strong across all the key industry sectors: financial institutions; energy; infrastructure, mining and commodities; transport; technology and innovation; and life sciences and healthcare.

Wherever we are, we operate in accordance with our global business principles of quality, unity and integrity. We aim to provide the highest possible standard of legal service in each of our offices and to maintain that level of quality at every point of contact.

For more information about Norton Rose Fulbright, see nortonrosefulbright.com/legal-notices.

Law around the world

nortonrosefulbright.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.