From drug discovery to diagnostics and biotech, the Canadian life sciences industry is becoming increasingly versatile and dynamic. Perhaps these attributes explain the significant expansion the sector has experienced over the last few years, with the pandemic serving as an additional significant catalyst for growth. Investor and consumer interest in the industry continues to rise, and all indications are that the positive momentum in the industry is likely to continue.

VC investment: state of play

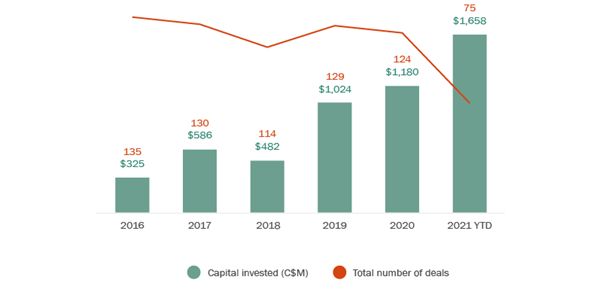

In the last three years, venture capital investment in the Canadian life sciences industry has accelerated by almost 250%. As of mid-September 2021, total venture capital investment in Canadian life sciences companies had already surpassed 2020 full-year investment by almost 50 percent, reaching C$1.658 Billion in the aggregate in 75 companies (Figure 1).

Figure 1: Venture capital investment in Canadian companies

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to

Sept 13, 2021. Excludes failed/cancelled deals. Data has not been

reviewed by PitchBook analysts.

While the volume of deals in the third quarter of 2021 is more or less the same as the volume recorded in Q3 2020, the aggregate amount of capital invested has increased considerably—now at five times the total amount of capital invested in the same quarter last year (Figure 2, below).

Figure 2. Quarterly analysis of Canadian venture capital investment

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to

Sept 13, 2021. Excludes failed/cancelled deals. Data has not been

reviewed by PitchBook analysts.

This is significant, because historically, Canadian companies in the sector have attracted capital that trickled in on an as needed basis which handcuffed the companies in many ways. With larger funding rounds in 2021, these companies have a greater chance of success and to compete effectively with their US counterparts.

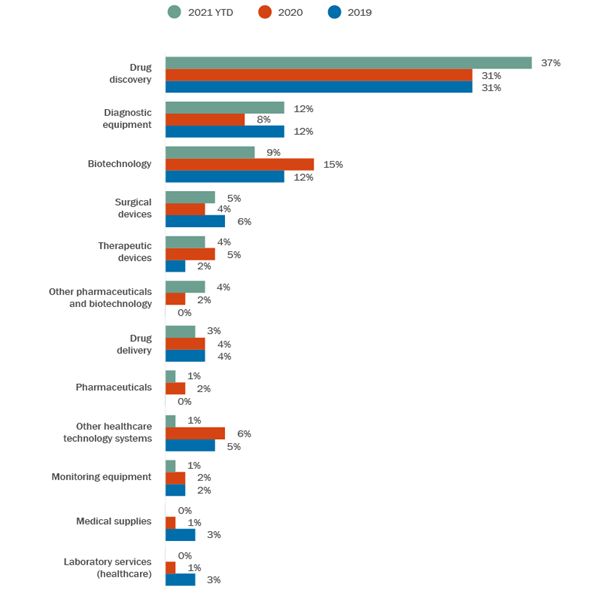

Thus far in 2021, nearly 60% of venture capital investment in Canada in life science companies has gone toward drug discovery, diagnostic equipment and biotech companies (Figure 3).

Figure 3. Venture capital investment in Canada: sector breakdown

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to

Sept 13, 2021. Excludes failed/cancelled deals. Data has not been

reviewed by PitchBook analysts.

A new wave of government support

The pandemic has served as a turning point for life sciences around the world, spurring not just short-term focus on the sector to push through the crisis, but also a growing focus on the importance of and opportunity inherent building a robust life sciences industry.

The Canadian government's Strategic Innovation Fund will provide up to $792 million to support, among other things, research and development, clinical trials and the manufacturing of vaccines. Moreover, the Government of Canada's Budget for 2021 proposed to invest over $3 billion toward Canadian researchers and science, which includes the support of cutting-edge life sciences research and biotechnology1. The Canada Biomedical Research Fund also intends to invest $250 million over four years starting in 2022-2023 and the Biosciences Research Infrastructure Fund has pledged to invest $500 million over four years starting in 2021-20222. This is all in addition to the approximately $3 billion provided annually to Canadian companies through the Scientific Research and Development tax incentive program3.

This financial support, together with the signs of improved venture capital funding and increased health-conscious consumerism and the expectations, needs and desires for health innovation for Canada's aging population, will likely pave the way for further momentum in the Canadian life sciences industry.

Foreign investment in the Canadian life sciences industry

It is not just Canadian venture capital investors who are injecting capital into the Canadian life sciences sector. Foreign venture capital funds are actively investing in Canada, with United States investors representing the largest source of investment into the Canadian life sciences industry in 2021 to date and increasing interest from China and Hong Kong (figure 4).

Figure 4. Top countries investing in Canadian life science companies in 2021 based on total deal value

| Country | Total Deal value (millions, CAD) |

| United States | 754 |

| Canada | 712 |

| United Kingdom | 266 |

| China | 240 |

| Hong Kong | 100 |

| Japan | 90 |

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to Sept 13, 2021. Excludes failed/cancelled deals. Data provided by PitchBook analysts.

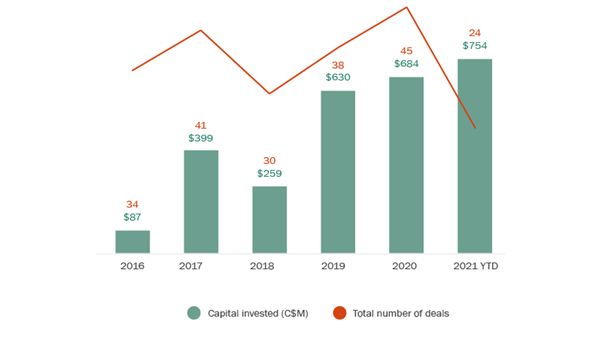

The growth of U.S. investment in Canadian life sciences companies—which at $754 million in 2021 through mid-September 2021, has already surpassed the amount of U.S. capital invested in all of 2020 (Figure 5)—can be attributed, at least in part, to the heightened competition for life sciences targets in Silicon Valley and Boston and high deal valuations, all of which are encouraging U.S. investors to seek diversified investment opportunities in Canada. In particular, Toronto has become a market of choice in the last few years and it is viewed as an important life science cluster, behind Boston, San Francisco/Silicon Valley and San Diego but growing at faster rate.

Figure 5. U.S. investments in Canadian life sciences companies

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to

Sept 13, 2021. Excludes failed/cancelled deals. Data has not been

reviewed by PitchBook analysts.

Provincial Breakdown of Investment

So far this year, the province of Ontario has attracted in excess of $1 Billion in venture capital investment from investors, with British Columbia and Québec representing the second and third destinations of choice for VC investors, as exemplified by Figure 6 below.

Figure 6: Venture capital investment in Canada: breakdown by province

| Province in Canada | Capital invested – 2021 YTD (CAD millions) |

| Ontario | 1,087.55 |

| British Columbia | 304.49 |

| Québec | 198.84 |

| Alberta | 64.00 |

| Saskatchewan | 19.27 |

| Nova Scotia | 7.27 |

Source: PitchBook Data, Inc. based on deals from Jan 01, 2016 to Sept 13, 2021. Excludes failed/cancelled deals. Data has not been reviewed by PitchBook analysts.

Of the 75 venture capital deals completed in life sciences through Q3 2021, a combined 60 were done in British Columbia, Ontario and Québec4.

Concluding Thoughts

With money coming in from Canadian venture capitalists, as well as from American and other foreign investors, combined with government funding and incentives, the Canadian life science sector is becoming increasingly robust. Canadian scientific innovation has been world class and now with the increased access to capital, Canada is well poised to attract the top talent in the industry to lead its companies and bring cutting edge products to market.

Footnotes

2. https://www.sshrc-crsh.gc.ca/funding-financement/cbrf-frbc/overview-apercu-eng.aspx.

4. Pg 6: Page 6 Pitchbook: CVCA VC Canadian Market Overview Reports.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.