- within Coronavirus (COVID-19) and Consumer Protection topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Insurance industries

Even amid the uncertainty of U.S. tariffs and a trade war, there was some positive PE activity in Canada in the first quarter of 2025. What lies ahead after President Trump announced his sweeping global tariff plans on April 2—and the market volatility that has followed—remains to be seen.

In this edition of Bennett Jones PE Briefing, we look at:

- how the Canadian PE market shaped up in Q1 2025 and what might come next;

- where to look for opportunities and areas of demand in a shifting landscape;

- why infrastructure continues to be an attractive asset for PE; and

- how Canadian institutional investors are navigating the impact of tariffs.

The PE Landscape in Canada in Q1 2025

Expectations have changed for private equity since the announcement of U.S. tariffs on Canadian goods on February 1. The start to 2025 was shaping up to be a promising one, but the outlook has changed with the new uncertainty about trade. Despite Canada's reprieve from U.S. reciprocal tariffs on April 2, President Trump's latest announcement has upended the global trading system and raised concerns about what is in store for the world's economy.

On the positive side, PE deals and investment are still taking place. What matters most right now is whether companies are within the tariff regime, adjacent to it, or outside of it. Businesses that are outside still look good to buyers. Demand remains high and the sell side is strong. Companies that sit in the middle of the tariff regime are facing challenges, however.

For private equity, there is a tremendous amount of demand for high quality companies and assets. There continues to be lots of dry powder and the sense of urgency to deploy it is increasing.

We may see more consolidation and distressed sales in response to the shifting landscape. We could also see smaller and medium-sized businesses join forces in a merger of equals play as a way to bolster cash flow and reduce declining unit economics. If we hit a tipping point in these areas we could quickly see more domestic and cross-border PE dealmaking.

PE Opportunities in Canadian Infrastructure

Investment in infrastructure was one of the more prominent growth stories in private equity last year and this continues into 2025. Deal volumes remain strong and the driving forces behind infrastructure demand reach across a number of key industries.

Preqin reported that 87 percent of investors it surveyed said infrastructure investments had met or exceeded their expectations. Bain & Company says that infrastructure was one of only two private asset classes that did not decline in fundraising in 2024. And in 2025, both utilities and industrials have increased in year-over-year deal value, according to Bloomberg.

We expect to see more domestic and international investment in traditional Canadian infrastructure and near-infrastructure assets as private equity looks to put money into ring-fenced assets that are revenue generating. There is a lot of capital available looking for a home and many firms see infrastructure as an asset-based investment or build-out with multiple and creative options for investment across the capital structure.

Tariffs could factor in as well. If trade tensions result in the development of more infrastructure in Canada, we might see more PE looking to buy into ring-fenced opportunities. Ring-fenced assets can also provide more certainty for investors. There is strong demand for data centres, the electricity needed to power them, renewables, and critical minerals projects. We are also seeing more interest in the conventional oil and gas sector.

The 25 percent U.S. tariff on Canadian steel and aluminum remained in place after President Trump's April 2 announcement, however, and this could increase construction costs for projects.

Navigating Trade Tensions: The Impact of Tariffs on Canadian Institutional Investors

The ongoing trade tensions with the United States has created an unpredictable environment for Canadian institutional investors, particularly those investing in PE and VC funds, as well as co-investing or directly investing in U.S. portfolio companies. These uncertainties have led to varying strategies among different types of institutional investors.

Government-backed VC investors in Canada, whose focus is primarily on investing in Canadian VC funds and startups, may be more heavily impacted by the current trade environment. Historically, these investors have allowed limited investments in U.S. VC funds and startups, but with escalating trade tensions and tariffs, the risks associated with U.S. investments have grown including economic, political and public perception risks. As a result, we expect these investors may be more inclined to pause or reduce their investments in the United States and instead direct more capital into Canadian opportunities.

On the other hand, larger institutional investors, such as pension funds, tend to have more expansive mandates that allow for greater global diversification. As a result, we are currently seeing these investors generally continuing to invest in U.S.-sponsored PE funds and directly into U.S. portfolio companies. We expect these investors will take a more nuanced approach, considering the impact of tariffs on a per-portfolio company basis, rather than allowing the impact of tariffs and other geopolitical concerns to dictate their overall investment strategy.

However, the Caisse de dépôt et placement du Québec (CDPQ) has taken a different approach. In response to the uncertainty created by U.S. trade policies, CDPQ has introduced a program designed to steer investment capital toward Québec companies. This initiative encourages investments in projects that increase productivity or open new markets, ultimately aiming to strengthen the local economy and mitigate the risks of external trade disruptions.

Q1 2025 Canadian PE Activity

The aggregate value of announced Canadian private equity M&A deals in Q1 2025 was almost $20 billion higher than the previous quarter—bolstered by numerous multi-billion dollar transactions. The utilities sector led the way with $25.78 billion in total deal value. Software and technology services had the highest number of deals at 18.

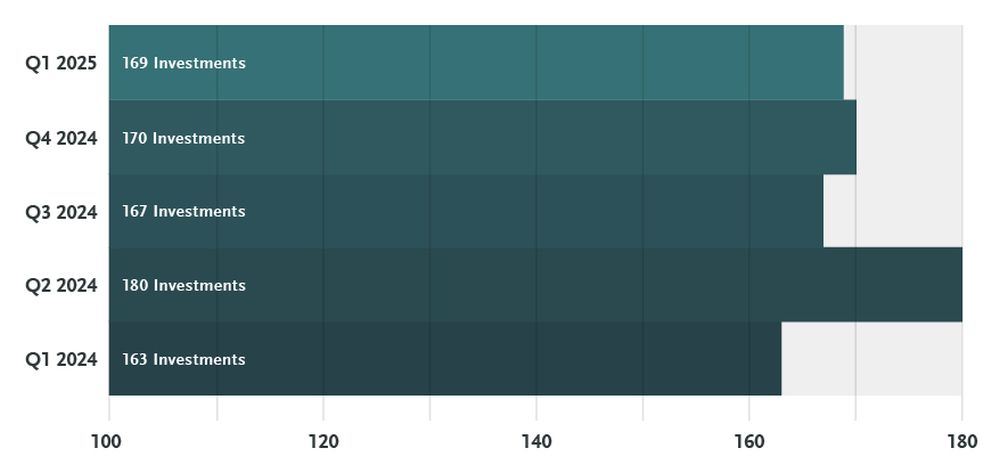

Overall deal count in the first three months of 2025 was effectively flat with Q4 2024 and generally kept pace with all previous quarters from 2024.

Canadian Private Equity Investments

The number of Canadian PE investments—where the acquirer purchases less than 50 percent of the target—held steady in the first quarter of this year, but declined on a monthly basis.

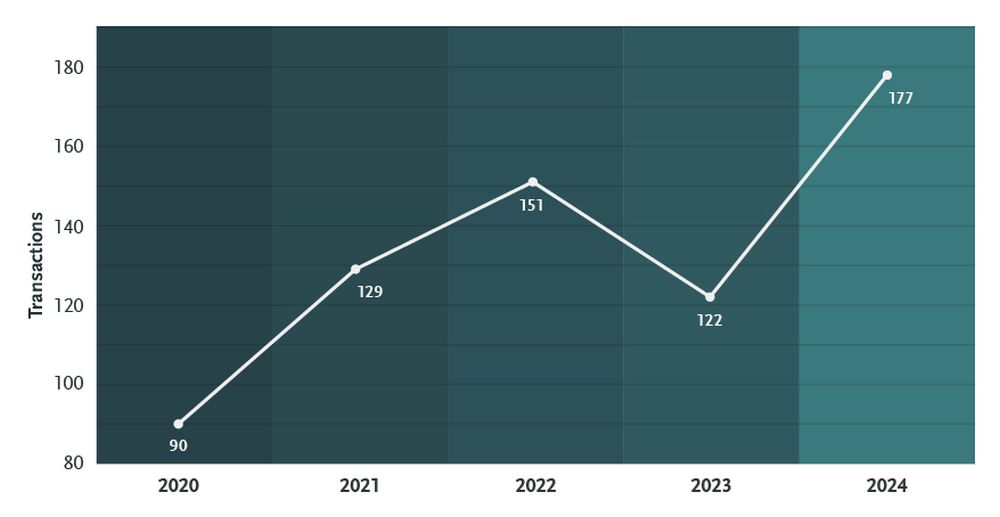

Going Private Transactions: Canada and United States

Going private transactions in Canada and the United States have almost doubled between 2020 and 2024. There were 35 proposed, pending or completed going privates in Q1 of this year, the same number as the first quarter of 2024. There was an upward monthly trend in transactions in 2025 from January to March.

Looking Ahead

The first quarter of 2025 saw some positive developments in PE activity in Canada. We will see in Q2 how seriously the pace of M&A deals and PE investments are affected by President Trump's tariff policies and how investors respond. Significant levies are still in place for some Canadian businesses and our trading relationship with the United States remains uneasy. The forecast for 2025 once again changed quickly and unexpectedly on April 2.

What's needed right now is more certainty on what's ahead for tariffs and trade. This is much, much easier said than done after the tumult we have seen since early February. But it is the determining factor in moving expectations for 2025 back in the direction of where they were at the start of the year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]