Recent Tax Changes: Selected Highlights

Federal changes

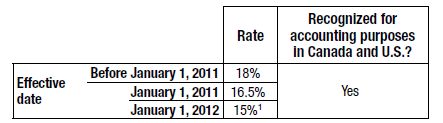

Federal general corporate income tax rate

The federal general corporate income tax rate has decreased:

1. The federal government's goal is to achieve combined 25% federal/provincial and federal/territorial rates.

Taxation of corporate groups

The government remains committed to exploring whether new rules for the taxation of corporate groups could improve the functioning of the corporate tax system. See our Tax memo "Taxation of Corporate Groups – Consultation Paper Released" at www.pwc.com/ca/taxmemo.

Eligible dividend designations

For dividends paid after March 28, 2012:

- a corporation can designate, at the time it pays a taxable dividend, any portion of the dividend to be an eligible dividend; and

- the Minister of National Revenue can accept late designations of eligible dividends that are made within three years after the day the designation was first required to be made.

Using partnerships to avoid tax

New anti-avoidance rules target the use of partnerships to circumvent the intended application in the Income Tax Act of:

- section 88, by generally denying the section 88 "bump" in respect of a partnership interest, to the extent that the accrued gain of that interest is reasonably attributable to the amount by which the fair market value of "income assets" exceeds their cost amount, generally for amalgamations that occur and wind-ups that begin, after March 28, 2012; and

- section 100 by:

- extending the application of this section to the sale of a partnership interest to a non-resident person, unless the partnership uses all of its property in carrying on business through a permanent establishment in Canada, generally for dispositions after March 28, 2012; and

- clarifying that this section will apply to dispositions of a partnership interest when, as part of a series of transactions or events, the interest is acquired by a tax-exempt or non-resident person.

For more information on the section 88 change, see our Tax memo "August 14, 2012 legislative proposals: Important international tax changes" at www.pwc.com/ca/taxmemo.

Partnership waivers

Starting June 29, 2012, a single designated partner of a partnership can waive, on behalf of all its partners, the three-year time limit for making a determination by the Canada Revenue Agency.

Partnership information returns

Information requirements for partnership information returns have been expanded for fiscal periods ending after 2010 (transitional relief is available for 2011 and 2012 fiscal periods). See our Tax memo "Changes to partnership returns: What they mean for you" at www.pwc.com/ca/taxmemo.

Joint venture deferral

Joint venture arrangements can no longer report income using a separate fiscal period. As a result, corporate participants must report their actual share of joint venture income or loss up to the end of their own year-end for tax years ending after March 22, 2011, and in certain cases can claim a transitional reserve for the additional income included in that year. See our Tax memo "Joint Ventures—CRA ends policy allowing separate fiscal periods: How will this affect your company? (Updated March 23, 2012)" at www.pwc.com/ca/taxmemo.

Life insurers Investment Income Tax (IIT)

For life insurance policies issued after 2013, the IIT will be recalibrated when appropriate to neutralize the effects of proposed technical improvements to the IIT base. See our Tax memo "2012 Federal budget: What does it mean for insurers?" at www.pwc.com/ca/taxmemo.

Life insurance policy exemption test

For life insurance policies issued after 2013, the test that determines whether a life insurance policy is an exempt policy will be updated and simplified. See our Tax memo "2012 Federal budget: What does it mean for insurers?" at www.pwc.com/ca/taxmemo.

Specified investment flow-through (SIFTs) entities, real estate investment trusts (REITs) and publicly traded corporations

On July 25, 2012, the Department of Finance released draft legislative proposals that implement measures announced on July 20, 2011, relating to the taxation of SIFTs, REITs and publicly traded corporations. Comments are due by September 25, 2012. See our Tax memo "Proposed changes for SIFTs, REITs and publicly traded corporations: Deductibility of amounts paid in respect of stapled securities" at www.pwc.com/ca/taxmemo.

October 31, 2011 legislative proposals

On October 31, 2011, the federal Department of Finance released a package of draft legislative proposals that include changes relating to corporations that carry on an insurance business.

New Canada Revenue Agency (CRA) audit approach

The CRA has advanced to the next stage of categorizing large corporations in implenting its new risk assessment approach of selecting files for audit. See our Tax memo "CRA risk assessment audit approach – What it can mean for your corporation" at www.pwc.com/ca/taxmemo.

Transfer pricing adjustments

All upward transfer pricing adjustments to a taxpayer's income will be treated as deemed dividends subject to withholding tax. The withholding tax can be eliminated, at the discretion of the Minister of Revenue, if the amount of the primary transfer pricing adjustment is repatriated to the Canadian corporation.

Shareholder loan rules

Canadian corporations will be permitted, on an elective basis, to make certain loans to foreign parent companies or related non-resident companies without incurring the deemed dividend withholding tax. To benefit from this elective relief, the Canadian corporation must include in income interest at the prescribed rate plus 4% (thus, 5% for the third quarter of 2012). Once the election is made, it will apply to all loans and indebtedness that become owing after March 28, 2012, from the foreign parent or related non-resident to the Canadian corporation. See our Tax memo "August 14, 2012 legislative proposals: Important international tax changes" at www.pwc.com/ca/taxmemo.

Foreign affiliate dumping

New rules will curtail a variety of transactions, generally occurring after March 28, 2012, involving an investment in a foreign affiliate by a Canadian subsidiary of a foreign parent corporation (except certain transactions occurring before 2013 between arm's length persons).

See:

- our Tax memos "August 14, 2012 legislative proposals: Important international tax changes" and "Canadian federal budget targets Canadian subsidiaries of foreign multinationals" at www.pwc.com/ca/taxmemo; and

- PwC's submission to the Department of Finance on the federal budget proposals regarding "foreign affiliate dumping" and "thin capitalization rules" at www.pwc.com/ca/cnts.

Thin capitalization rules

Changes:

- reduce the debt-to-equity ratio from 2-to-1 to 1.5-to-1, for taxation years beginning after 2012;

- extend the rules to apply to debts of a partnership in which a Canadian-resident corporation is a member, for taxation years beginning after March 28, 2012;

- treat disallowed interest as dividends for Part XIII withholding tax purposes, for taxation years ending after March 28, 2012; and

- prevent double taxation when a controlled foreign affiliate of a Canadianresident corporation lends funds to the corporation and the interest is both disallowed as a deduction in Canada and included in the foreign accrual property income of the affiliate, for taxation years ending after March 28, 2012.

See:

- our Tax memos "August 14, 2012 legislative proposals: Important international tax changes" and "Canadian federal budget targets Canadian subsidiaries of foreign multinationals" at www.pwc.com/ca/taxmemo; and

- PwC's submission to the Department of Finance on the federal budget proposals regarding "foreign affiliate dumping" and "thin capitalization rules" at www.pwc.com/ca/cnts.

Cross-border tax evasion

To facilitate and improve the exchange of tax information and combat cross-border tax evasion, Canada has signed a Protocol amending the Convention on Mutual Administrative Assistance in Tax Matters. The member States of the Council of Europe and the member countries of the Organisation for Economic Co-operation and Development are signatories.

Tax Information Exchange Agreements (TIEAs)

Canada is negotiating fourteen TIEAs. Sixteen TIEAs have entered into force (one on behalf of five jurisdictions).

Goods and Services Tax/Harmonized Sales Tax (GST/HST)

Newly enacted rules relating to the GST/HST treatment of imported services for insurers may result in a seven year GST/HST exposure on non-arm's length reinsurance services received from a non-Canadian entity. Basically, under these new rules, the "loading" component of the reinsurance premiums paid by a Canadian insurer to a non-arm's length non-resident is subject to self-assessment, retroactive to 2005. Early experience has shown that the CRA will identify the loading content between a third of the premium and its entire value. Given the significant amounts of tax involved, Canadian insurers are encouraged to perform a serious selfexamination. See our article "A seven-year (retroactive) plague on cross-border reinsurance," which has been reproduced in Insurance Review: A Canadian Perspective, Spring 2012 edition at www.pwc.com/ca/insurance.

For insurers, the implications of draft regulations affecting Selected Listed Financial Institutions (SLFIs), which are effective July 1, 2010, include:

- The definition of an SLFI is amended to deem an insurer to be

an SLFI if it insures risk in respect of:

- property ordinarily situated in a participating province and property ordinarily situated in any other province; or

- a resident of a participating province and a resident of any other province.

- Financial institutions, including insurers, that are SLFIs are subject to specific rules regarding the calculation and reporting of net tax on their GST/HST returns. An SLFI cannot claim input tax credits for the provincial portion of HST paid on purchases of property or services and must adjust its net tax calculation on its final GST/HST return using the Special Attribution Method (SAM).

The following enacted GST/HST rules affect the financial services sector, including insurers:

- "Arranging for" – Generally for supplies

made after December 14, 2009, the definition of "financial

service" excludes the following activities, because they do

not constitute "the agreeing to provide, or the arranging

for" a financial service:

- facilitator services comprising market research, product design, promotional services, advertising or the collection of information; and

- credit management services in respect of a:

- ° credit or charge card or similar payment card; or

- ° credit, charge or loan account, such as credit checking, authorization, valuation, record-keeping, monitoring or dealing with payments.

- Pension rules – For fiscal years commencing after September 22, 2009, all employers, including insurers, that participate in a registered pension plan must account for GST/HST on certain supplies of property or services that the employer is deemed to make to the plan. The registered pension plan can then claim a rebate equal to 33% of the tax actually paid or deemed to have been paid.

Caseload management of the Tax Court of Canada (TCC)

To improve the caseload management of the TCC, draft legislative proposals:

- update the monetary limits for access to the informal appeal procedure;

- remove the requirement for the TCC to deal with all issues raised in an appeal of an assessment together, enabling some issues to be disposed of independently; and

- permit the TCC to hear a question affecting a group of taxpayers that arises out of substantially similar transactions, and provide that the resulting judicial determination is binding on each taxpayer in the group.

Automobile deductions and benefits

The 2012 prescribed rates:

- will remain at their 2011 levels for purposes of determining capital cost allowance, interest and leasing deductions; and

- for purposes of determining:

- automobile allowance deductions and tax-exempt allowances are 1¢ per kilometre higher; and

- taxable benefits are 2¢ per kilometre higher, than for 2011. For more information, see Car expenses and benefits—A tax guide (2012) at www.pwc.com/ca/carexpenses.

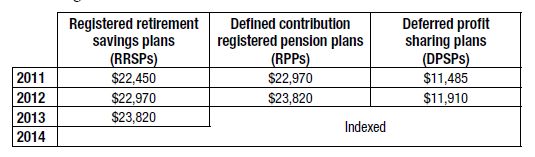

Retirement savings plans and deferred profit sharing plans

Contribution limits for retirement savings plans and profit sharing plans are increasing:

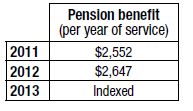

Defined benefit registered pension plans (RPPs)

The maximum pension benefit that can be paid from defined benefit RPPs is increasing:

Employee profit sharing plans (EPSPs)

For EPSP contributions generally made after March 28, 2012, a new tax will be imposed on the portion of an employer's EPSP contribution, allocated by the trustee to a "specified employee," that exceeds 20% of the employee's salary received in the year from the employer. A specified employee generally includes an employee who has a significant equity interest in his or her employer or does not deal at arm's length with the employer.

Retirement Compensation Arrangements (RCAs)

Anti-avoidance rules for RCAs engaged in non-arm's length transactions will parallel the "prohibited investment" and "advantage" rules applicable to Tax-Free Savings Accounts, Registered Retirement Savings Plans and Registered Retirement Income Funds. They will apply to:

- investments acquired, or that become prohibited after March 28, 2012; and

- advantages extended, received or receivable after March 28, 2012.

For RCA contributions made after March 28, 2012, RCA tax refunds are restricted in certain cases when the RCA property, reasonably attributable to a prohibited investment or advantage, has declined in value.

Group sickness or accident insurance plans

Employer contributions to a group sickness or accident insurance plan generally made after March 28, 2012, relating to coverage after 2012, will be included in an employee's income for the year in which the contributions are made. An exception applies for contributions in respect of wage-loss replacement benefits payable on a periodic basis. This measure will not affect the tax treatment of private health service plans or certain other plans. See our Tax memo "2012 Federal budget: What does it mean for insurers?" at www.pwc.com/ca/taxmemo.

Provincial changes

Alberta

Tax system

Alberta will engage in a discussion about its tax system to build a more predictable, sustainable revenue base, while retaining its tax advantage.

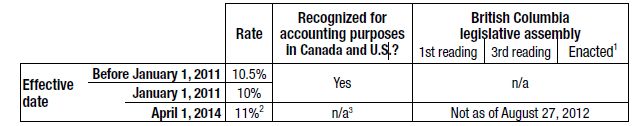

British Columbia

General corporate income tax rate

British Columbia's general corporate income tax rate is changing:

1. In the United States, the change is recognized for accounting purposes when it is enacted.

2. The 11% rate will be triggered only if British Columbia's fiscal situation worsens.

3. The status of legislation implementing the change is shown because the change was not recognized before Canada's January 1, 2011, adoption of IFRS.

Harmonized Sales Tax (HST)

On April 1, 2013, the 12% HST will be replaced with a sales tax regime similar to the one that applied before July 1, 2010 (i.e., 7% provincial sales tax and 5% federal Goods and Services Tax). See our Tax memos "B.C. votes to extinguish HST" and "Eliminating the HST in British Columbia: Canada's Department of Finance proposes transitional rules" at www.pwc.com/ca/taxmemo.

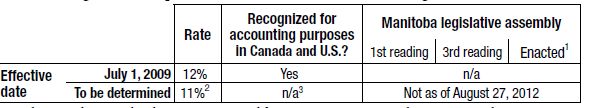

Manitoba

General corporate income tax rate

Manitoba's general corporate income tax rate is decreasing:

1. In the United States, the change is recognized for accounting purposes when it is enacted.

2. Subject to balanced budget requirements.

3. The status of legislation implementing the change is shown because the change was not recognized before Canada's January 1, 2011, adoption of IFRS.

Neighbourhoods Alive! Tax Credit

Retroactive to April 13, 2011, clarifications will allow:

- donations made over multiple tax years to accumulate to the $50,000 minimum threshold;

- large up-front donations of up to $200,000 to be used to earn the $15,000 maximum tax credit in subsequent years if in-kind contributions are made in each of those years; and

- limiting donations to the first four years of the new social enterprise and providing in-kind services for years two through five.

Corporate tax underpayment interest rate

Starting July 1, 2012, the interest rate on tax underpayments will increase from prime plus 4% to prime plus 6%.

Retail Sales Tax (RST)

Starting July 15, 2012, a 7% RST will apply on certain insurance contracts that relate to Manitoba (e.g., property and casualty, group life, trip cancellation, baggage and land titles). It will apply when the insured person is a resident of Manitoba or on the premiums paid in respect of property located in Manitoba. Some insurance services are exempt, such as health insurance, reinsurance, accident or sickness, Autopac vehicle premiums and individual life insurance.

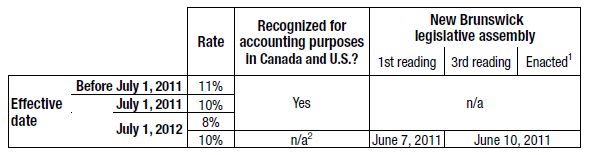

New Brunswick

General corporate income tax rate

New Brunswick's general corporate income tax rate has changed:

1. In the United States, the change was recognized for accounting purposes when it was enacted (i.e., June 10, 2011).

2. The status of legislation implementing the change is shown because the change was not recognized before

Canada's January 1, 2011, adoption of IFRS.

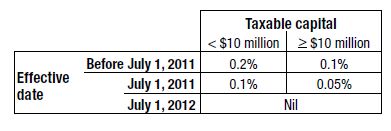

Nova Scotia

Capital tax rate

Nova Scotia's general capital tax has been phased out:

Harmonized Sales Tax (HST)

Nova Scotia will reduce its HST rate from 15% to 14% by July 1, 2014, and to 13% by July 1, 2015 (i.e., the provincial portion of the HST will decrease from 10% to 9% and to 8%, respectively).

Ontario

General corporate income tax rate

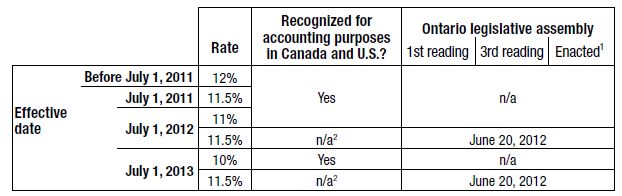

Ontario's general corporate income tax rate is changing:

1. In the United States, the change was recognized for accounting purposes when it was enacted (i.e., June 20, 2012).

2. The status of legislation implementing the change is shown because the change was not recognized before Canada's January 1, 2011, adoption of IFRS.

Corporate tax avoidance

Ontario will consider implementing various measures used by Quebec to fight aggressive tax planning, and will work with the Canada Revenue Agency to see if the tax collection agreement can be used to counter inter-provincial income shifting.

Employer Health Tax (EHT)

For EHT assessments issued after March 27, 2012, Ontario will not be bound by federal rulings that determine the existence of an employer-employee relationship.

Federal/Ontario tax issues

Ontario will explore ways to protect its fiscal interest from unilateral federal changes to the common tax bases. It will work with the federal government on the allocation of inter-jurisdictional losses, the efficient and effective federal administration of Ontario taxes, the integrity and effectiveness of the tax system and ways to combat corporate tax avoidance and underground economy activities.

Compliance with tax obligations

Taxpayers will be required to be compliant with their tax obligations before:

- receiving government grants and other forms of direct government assistance; and

- bidding on projects and contracts that involve provincial funding.

Prince Edward Island

Harmonized Sales Tax (HST)

On April 1, 2013, a 14% HST (i.e., 9% provincial component plus the 5% federal Goods and Services Tax (GST)) will replace the combined provincial sales tax (PST)/GST rate of 15.5% (i.e., 10% PST, which applies on the 5% GST). Transitional rules will apply.

Quebec

Compensation tax for insurers

For taxation years beginning after March 31, 2014, the tax rate will decrease from 0.55% to 0.35%.

Health Services Fund

Starting 2013, employers can reduce contributions to this fund for employees who are 65 or older.

Financial services corporations

New financial services corporations that hire eligible employees or incur eligible expenditures can claim two new refundable tax credits.

Share issue costs

Cost incurred after March 20, 2012, to issue shares as part of an initial public offering under the stock savings plan II are eligible for a new 30% refundable tax credit.

Taxation of trusts

The tax rate for inter vivos trusts (including mutual fund and specified investment flow-through trusts) increased from 20% to 24%, for trust taxation years ending after March 19, 2012.

Quebec Sales Tax (QST)

The QST rate increased from 8.5% to 9.5% on January 1, 2012. The QST will be further harmonized with the GST on January 1, 2013, with an effective rate of 14.975%. See our Tax memo "QST to be harmonized with GST by 2013" at www.pwc.com/ca/taxmemo .

Newfoundland and Labrador, Northwest Territories, Nunavut, Saskatchewan and Yukon

No significant changes were made to the rules that apply to insurers in Newfoundland and Labrador, the Northwest Territories, Nunavut, Saskatchewan or the Yukon.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.