- within Government and Public Sector topic(s)

- in United States

- within Insurance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Business & Consumer Services and Insurance industries

This bulletin provides an update on trends we have observed in Indigenous equity investments over the previous two years, from 2023-2025 YTD, as part of our series monitoring announcements of such investments in energy and related infrastructure projects in Canada123.

Indigenous equity investments in projects play a vital role in promoting economic empowerment and self-determination for Indigenous communities. By securing a stake in energy and infrastructure developments, these investments help to build sustainable economic opportunities, foster community growth, and strengthen collaborative relationships between Indigenous groups and industry partners.

To date, we have reviewed 165 energy and related infrastructure projects across Canada partially or wholly owned by Indigenous communities4. Similar to our findings last year5, approximately 29% of all Indigenous equity investments reviewed were announced in the last two years, from 2023-2025 YTD, suggesting continued steady growth but perhaps not yet representing the significant uptick we have been expecting to see once access to affordable capital is unlocked.

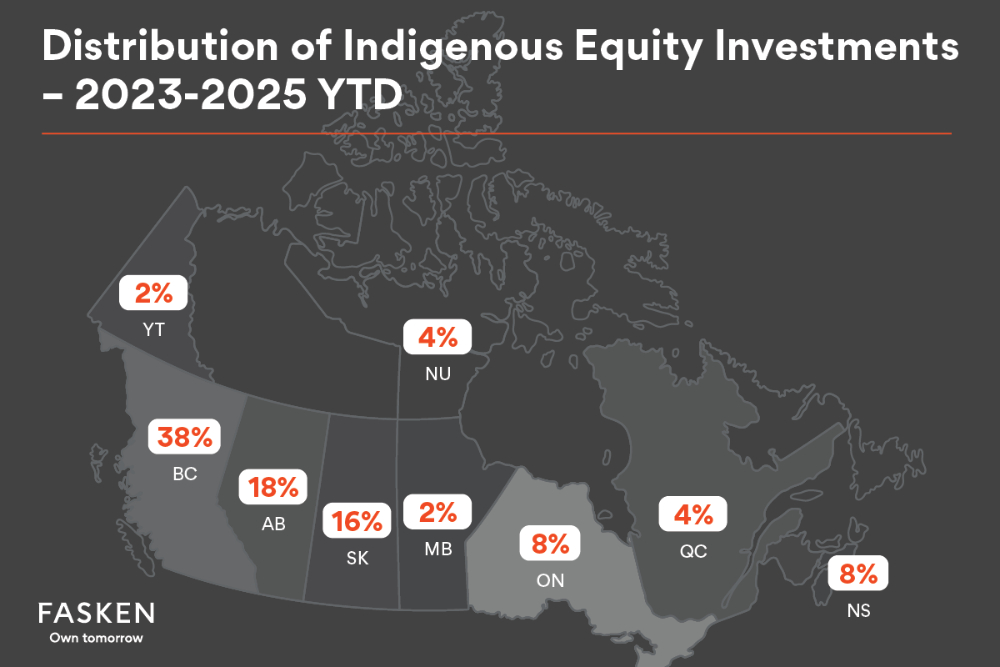

1. Distribution of Indigenous Equity Investments Across Canada

Last year, we predicted that the BC Hydro Call for Power 20246 would drive an increase in the number of equity investments announced in British Columbia7. This prediction was correct: in 2023-2025 YTD, British Columbia saw the highest number of Indigenous equity investments announced in Canada, with 38% of new investments announced. This trend is consistent with the high number of Indigenous equity investments previously announced in British Columbia: 37% of investments made before 2023 were located in British Columbia.

The BC Hydro Call for Power 2024 was a request for proposals aimed at securing power from new renewable energy projects that meet specific eligibility criteria8. A key requirement was that First Nations hold at least 25% equity ownership of the project at the commercial operation date9. With other provincial utilities announcing similar equity requirements or incentives in upcoming procurement processes (e.g. Ontario10 and Manitoba11), we expect to see increased growth in these provinces in future years.

The second highest number of Indigenous equity investments announced in 2023-2025 YTD (18%) were located in Alberta, with the majority (75%) of these investments occurring in 2023. In our previous bulletin, Alberta placed first with the highest number of announced investments12. It is interesting to note that the projects announced in Alberta in 2024 were wind and solar projects; whereas a number of the investments announced in 2023 included larger oil and gas projects or existing infrastructure. We did not identify any new equity investment announcements in 2023-2025 YTD for projects located in New Brunswick, PEI, Newfoundland and Labrador, or Northwest Territories. The distribution across other provinces was as follows: BC: 38%; AB: 18%; SK: 16%; MB: 2%; ON: 8%; Québec: 4%; Nova Scotia: 8%; YT: 2%; and NU: 4%.

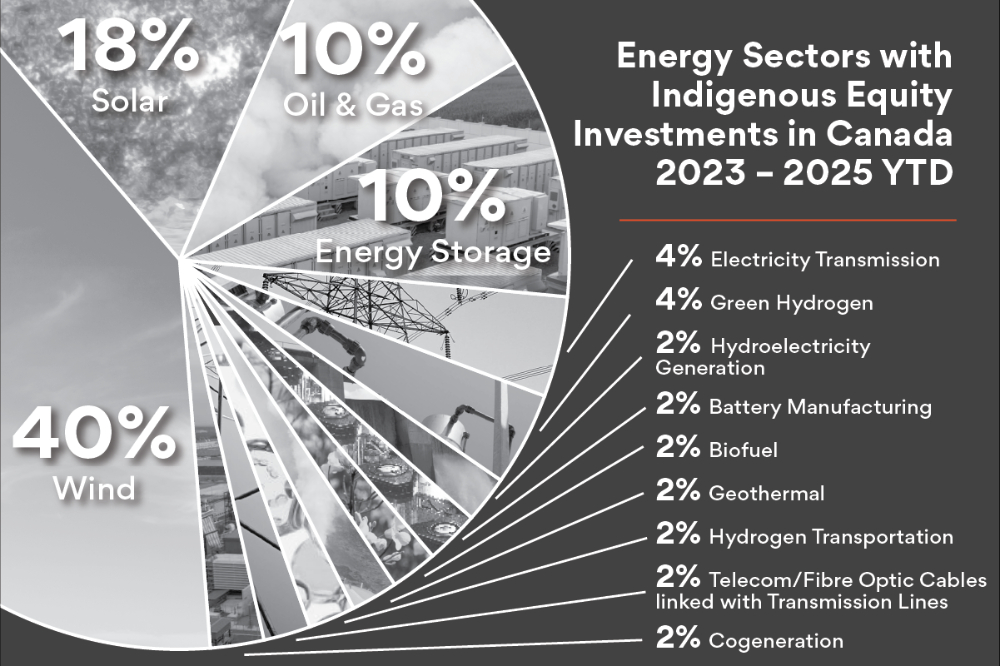

2. Breakdown Across Sectors

Wind is again the dominant sector for Indigenous equity investments announced in 2023-2025 YTD, representing 40% of new Indigenous equity investment announcements. Solar follows, representing 18% of Indigenous equity investments announced during this time period. This represented a shift from our previous bulletin, in which oil & gas was the second-most dominant sector, owing in large part to the large Alberta transactions announced in 202313.

Other sectors represented in announcements from 2023-2025 YTD included oil & gas (10%), energy storage (10%), electricity transmission (4%), green hydrogen (4%), hydroelectricity generation (2%), battery manufacturing (2%), biofuel (2%), geothermal (2%), hydrogen transportation (2%), telecom/fibre optic cables linked with transmission lines (2%) and cogeneration (2%).

We expect to see continued strong results in projects involving renewable energy with the programs referenced above, as well as perhaps an increase in electricity transmission as a result of programs announced over the last few years as these projects make their way through the development lifecycle (e.g. Hydro One14 and BC Hydro15).

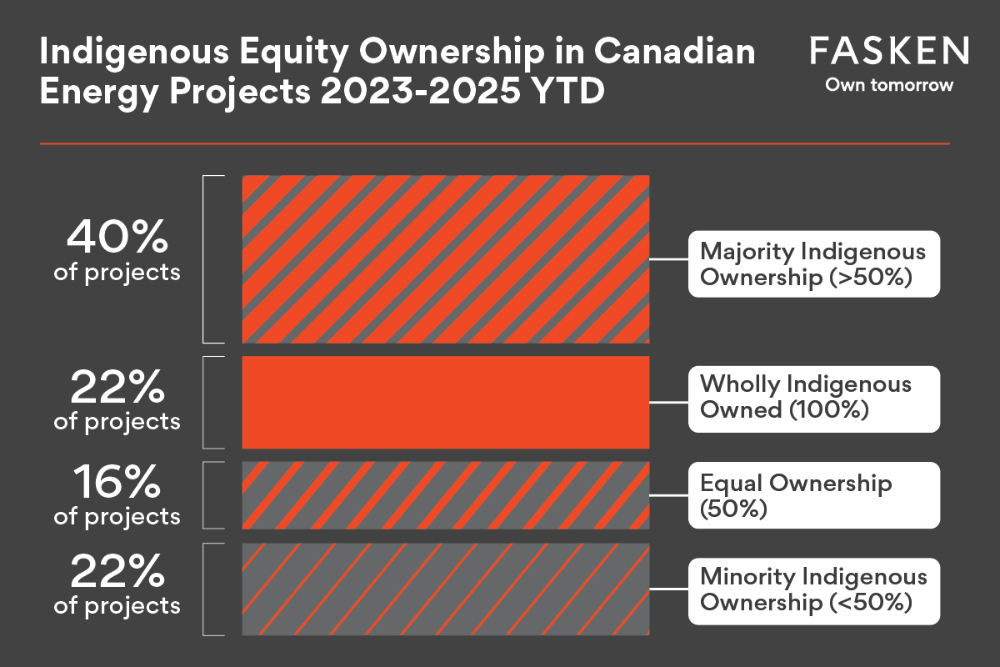

3. Size of Equity Interest

Where data on the size of Indigenous communities' equity interest in a project was reported for investments announced in 2023-2025 YTD, we observed that most projects (40%) were majority-owned by Indigenous communities (i.e. more than 50% ownership interest but excluding 100% ownership), while 22% of projects were wholly owned by Indigenous communities. In other words, most Indigenous equity investment announcements were for projects majority or wholly owned by Indigenous communities, and another 16% of projects were owned equally between Indigenous communities and non-Indigenous partners.

In comparison, only 22% of investments announced had Indigenous communities holding a minority equity interest (i.e. less than 50% ownership interest), indicating a clear trend in favour of at least 50% Indigenous equity ownership.

4. Number of Indigenous Communities Involved

We have identified at least 243 Indigenous communities that have obtained or announced an equity interest investment across all projects in our database.

In 2023-2025 YTD, we identified 75 different Indigenous communities that had announced an equity investment in this period. This represents a reduction in the number of Indigenous communities announcing equity investments in comparison to our previous bulletin, which may be due in part to the change in the type of projects in which such investments were announced (i.e. more non-linear projects, in which investments tend to include fewer Indigenous communities compared to linear infrastructure)16.

Of these 75 Indigenous communities, 64% announced their first equity investment during this time period, while 36% had already announced a previous equity investment.

Where the number of Indigenous communities investing in a project was publicly available, more projects were owned by a single Indigenous community than by two or more communities. In 2023-2025 YTD, 76% of projects announced were owned by only one Indigenous community, while 24% were owned by two or more communities. The median number of Indigenous communities involved in a project was 4.5, up to a maximum of 13 Indigenous communities.

5. Conclusions

We will continue to monitor announcements of new Indigenous equity investments in these projects. With the recent announcement that the federal government plans to double the funds available through the new federal Indigenous loan guarantee program1718, we continue to expect to see growth in Indigenous equity investments in energy and related infrastructure projects across the country.

Further, given the success of the 2024 BC Hydro Call for Power in increasing Indigenous equity participation in British Columbia projects, we also expect jurisdictions adopting a similar approach in public procurement processes, by requiring minimum levels of Indigenous equity participation, will see similar growth in such investments.

Footnotes

1 See "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

2 "Indigenous Equity in Energy Infrastructure Projects in Canada" (22 November 2023), online: [i]Fasken[/i]

3 and "Four Trends in Equity Participation in Canada" (6 March 2023), online: [i]Fasken[/i]

4 Our database includes energy and related infrastructure projects jointly owned by one or more Indigenous communities and non-Indigenous partners, as well as large-scale 100% Indigenous-owned projects (e.g. projects with a generating capacity of greater than 1 MW, transmission lines, etc.). Note that several new projects are announced every month; this update uses data last updated March 31, 2025. Our analysis is based solely on publicly available information that we have reviewed regarding Indigenous ownership in energy and related infrastructure projects, which is not consistently reported, and does not necessarily reflect an exhaustive analysis of all such investments. Given the limited information available, it is likely that some of these observations are not statistically significant.

5 "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

6 "2024 Call for Power", online: [i]BC Hydro[/i]

7 "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

8 "Request for Proposals RFP Number 20329" (3 April 2024), online (pdf): [i]BC Hydro[/i]

9 "Request for Proposals RFP Number 20329" (3 April 2024), online (pdf) at PDF 5: [i]BC Hydro[/i]

10 In a recently released draft Long-Term Energy Supply Request for Proposals, the Ontario Independent Electricity System Operator ("IESO") incentivizes Indigenous equity participation by increasing a power generation proposals' rating where there is greater "Indigenous Community Participation" (more points are awarded for greater levels of equity participation, with the most points awarded for 50% or greater Indigenous ownership of the project proponent; no points are awarded for Indigenous ownership below 10%). Further points are awarded for "Local Indigenous Community Participation". See "Draft IESO Long-Term 2 Energy Supply (Window 1) Request for Proposals" (17 January 2025), ss 4.3(a)-(b) and Appendix A (PDF 34-35 and 57), available online: "Resource Acquisition and Contracts" (2025), online: [i]Independent Electricity System Operator[/i]

11 In its 2024 Affordable Energy Plan, the Province of Manitoba stated that Manitoba Hydro would soon announce an expression of interest for near-term wind generating projects with Indigenous majority interest for up to 600 MW of power. The 2024 Affordable Energy Plan also stated that a new provincial Indigenous loan guarantee program would be announced in Budget 2025 to "finance new partnerships in wind generation", which will align with existing Federal credits. See "Manitoba's Affordable Energy Plan: Building the Next Generation of Clean Energy" (September 2024), online (PDF 10-11): [i]Government of Manitoba[/i]

12 "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

13 "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

14 "Hydro One Indigenous Partnership" (2025), online: [i]Hydro One Networks Inc.[/i]

15 "Province will streamline permitting of major electrical infrastructure" (14 January 2025), online: [i]Government of British Columbia[/i]

16 "Update on Trends in Indigenous Equity Investments in Canada" (22 April 2024), online: [i]Fasken[/i]

17 Prime Minister Carney meets with the leaders of the National Indigenous Organizations" (21 March 2025), online: [i]Prime Minister of Canada[/i]

18 see also "Indigenous Loan Guarantee Program" (2025), online: [i]The Canada Indigenous Loan Guarantee Corporation[/i]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.