A Tool for Portfolio Management

While the secondaries market has traditionally provided opportunities for limited partners to exit from private equity funds, there has been an increase in General Partner (GP)-led secondary transactions in recent years. As part of this trend, private fund sponsors are using the formation of Continuation Funds as a portfolio management tool, providing benefits to the various parties involved, which contrasts with the historical perception that such vehicles are a last resort to manage underperforming portfolio investments of an otherwise successful fund. Rather than using Continuation Funds as vehicles for distressed assets, they are now being used as a mechanism to extract further value from well-performing investments that have yet to reach their full potential or to relieve the pressure to sell a stable performing asset that at least some partners would be happier to hold for a longer term.

CPP Investments, one of the world's largest investors in private equity, confirmed recently that it plans to deploy approximately $1 billion specifically into single-asset GP-led deals in 2022 and its secondaries team has already approved one. As a highly influential player in the secondaries market, CPP's interest in pursuing such deals as part of its secondaries strategy is a strong indication that the trend in Continuation Funds is here to stay for the foreseeable future. The market terms defining that trend and the transaction processes that will attract and hold investor interest, will continue to unfold.

Structure

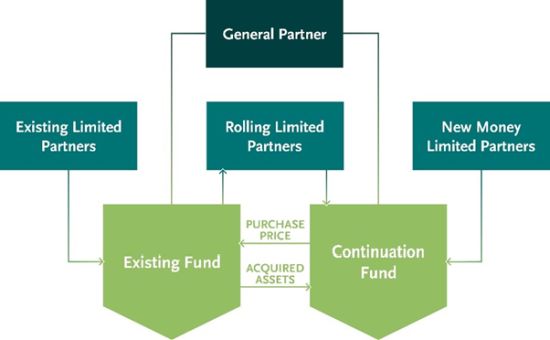

The structure of a Continuation Fund involves the formation of a new fund for the purpose of acquiring one or more assets from an original fund. The same fund sponsor continues to manage those assets as part of the investment objectives of the new fund. Limited partners in the original fund are typically given the option to either roll their existing interests into the Continuation Fund or cash out of the original fund and exit. Continuation Fund interests are offered to "new money" investors who make cash contributions to the new fund which are used in turn to cash out the original fund investors that have opted to sell.

The Sponsor's Perspective

In structuring Continuation Funds, fund sponsors are able to continue managing the acquired investments and may benefit from crystallizing existing carried interests. Further, they may be able to optimize the performance of these investments from which they may otherwise be required to exit if bound by the terms of the original fund. GPs may use single-asset Continuation Funds in particular to spin out a secure asset in need of additional capital that the existing fund may be unable to provide due to limits on investment concentration. Continuation Funds also provide sponsors with an opportunity to raise new capital for accretive follow-on investments, reset the hold period for such investments and also reset the GP's incentive structure.

The Investors' Perspective

Continuation Funds also provide investors with a number of attractive options. Limited partners in the original fund have the benefit of liquidity and also a new investment opportunity. Rolling investors have the opportunity to capitalize on the enhanced value generated in the investments acquired by the new fund. New investors will have a relatively transparent investment opportunity to invest in a fund with known assets to diligence and assess from the outset. They will also have the opportunity to participate in the upside of mature assets with potentially shorter hold periods. Both rolling and new limited partners will have the opportunity to negotiate fresh terms to govern the Continuation Fund.

Some investors have criticized the Continuation Fund formation process and argue that the window for deciding whether to roll or to sell is generally too short, given that valuation is subjective and subject to potentially conflicting interests. Investors may face challenges making meaningful investment decisions within the time frame allotted or regard such investment decisions as a pertinent duty of the GP and one for which the GP gets paid.

Managing the Transaction

Fund sponsors will face unique challenges in structuring Continuation Funds and being mindful of the issues before commencing the process will create a more streamlined experience for all of those involved. The Institutional Limited Partners Association (ILPA) has provided guidance on best practices for GP-led secondary fund restructurings and recommends involving limited partners as early in the process as possible, even before preparing a formal proposal. The issues that arise in the Continuation Fund context are many of the same issues that typically require the oversight of a limited partner advisory committee (LPAC) in a traditional private fund structure. The GP will need to manage conflicts of interest that will inevitably arise given that the GP will be on both sides of the transaction. In one instance the GP will have a duty to act in the best interests of existing investors, striving to obtain the best value for the assets being acquired by the Continuation Fund. In the other instance, the GP will be negotiating and reconstituting the economic terms of the Continuation Fund and the valuation of the transferred assets will have an impact on the GP's incentive allocation in the new structure. Requiring LPAC review of the transaction price, with the help of an independent fairness opinion, is one way to deal with the GP's position of conflict and assure a fair valuation. Detailed advance disclosure regarding the rationale behind the restructuring and a reasonable timeline that allows investors to evaluate their options will help create a transparent and efficient process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.