On January 3, 2019, the final phase of the Canadian Securities Administrators ("CSA")'s Modernization of Investment Fund Product Regulation Project relating to the establishment of a regulatory framework for alternative mutual funds came into effect. These amendments introduced a new category of mutual funds, "alternative mutual funds", which are mutual funds that have adopted investment objectives that permit those funds to invest in physical commodities or specified derivatives, borrow cash or engage in short selling in a manner not typically permitted for "regular" mutual funds.

These amendments moved most of the regulatory framework then applicable to commodity pools under National Instrument 81-104 – Commodity Pools (now renamed "Alternative Mutual Funds") ("NI 81-104") into National Instrument 81-102 – Investment Funds, with the exception of the proficiency standards for mutual fund dealers distributing alternative mutual funds. These proficiency standards actually prevent mutual fund restricted individuals1 ("Restricted Individuals") from distributing alternative mutual funds unless they possess one of the courses set forth under Part 4 of NI 81-104. These provisions were retained by the CSA "in recognition that alternative mutual funds can be more complex than other types of mutual funds and that additional proficiency may be needed for mutual funds dealers selling these products2". It was the CSA's view that maintaining more robust dealer proficiency standards for alternative mutual funds ensured Restricted Individuals were better equipped to sell these products.

Recognizing that the proficiency standards set forth under NI 81-104 have in fact limited retail investors' access to alternative investment strategies through the mutual fund dealer channel, each member of the CSA issued on January 28, 2021 a blanket relief (the "Blanket Relief") so as to provide Restricted Individuals and individuals designated to be responsible for the supervision of trades of securities of alternative mutual funds ("Supervisors") with additional proficiency options in order to be authorized to distribute alternative mutual funds. These additional proficiency options are meant to expedite retail investors' access to alternative mutual funds and enable them to benefit from additional portfolio diversification opportunities through alternative strategies.

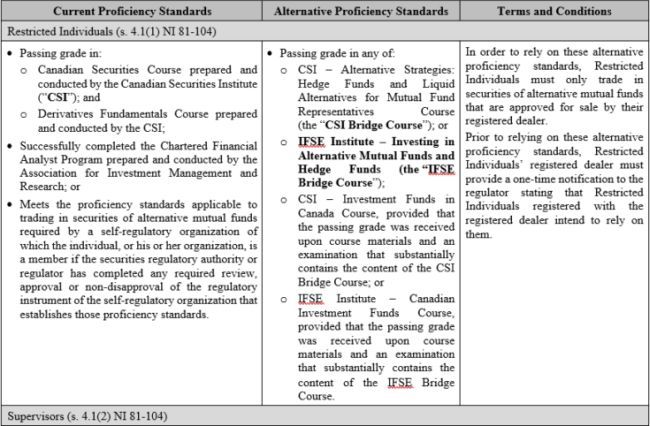

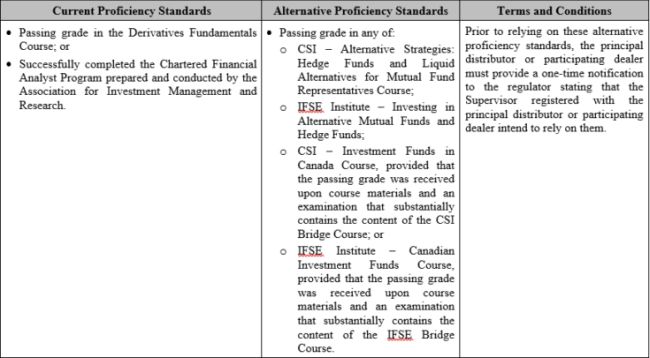

Below is a table listing current and additional proficiency standards for Restricted Individuals and Supervisors and the terms and conditions set forth in the Blanket Relief. Note that a dealer must provide its principal regulator with a one-time notice prior to the first of any of its Restricted Individuals or Supervisors relying on the Blanket Relief.

Finally, note that this Blanket Relief is permanent in every jurisdiction except for Ontario, New Brunswick and the Northwest Territories where the Blanket Relief will cease to be effective on July 28, 2022. We expect this Blanket Relief to be codified prior to that date to make these additional course options a permanent solution.

Footnotes

1. An individual registered as a dealing representative of a registered dealer, if the activities of that individual are restricted to trading in securities of mutual funds.

2. See CSA Notice of Publication "Modernization of Investment Fund Product Regulation – Alternative Mutual Funds", October 4, 2018.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.