Welcome to the April issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger activity has picked up in March, with 51 merger reviews having been completed year-to-date. This is in line with historical averages for this period (between 2017-2021, an average of 51.6 reviews were completed during this period).

- As of April 1, 2022, the filing fee for merger reviews has increased to C$77,452.36.

- The Competition Bureau has published its 2022-2023 Annual Plan: Competition, recovery, and growth, which sets out the Bureau's priorities in the upcoming year.

- In the 2022 federal budget, the Government of Canada announced its intention to introduce legislative amendments to the Competition Act as a preliminary phase in modernizing the Canadian competition regime.

Merger Monitor

March 2022 Highlights

- 29 merger reviews completed

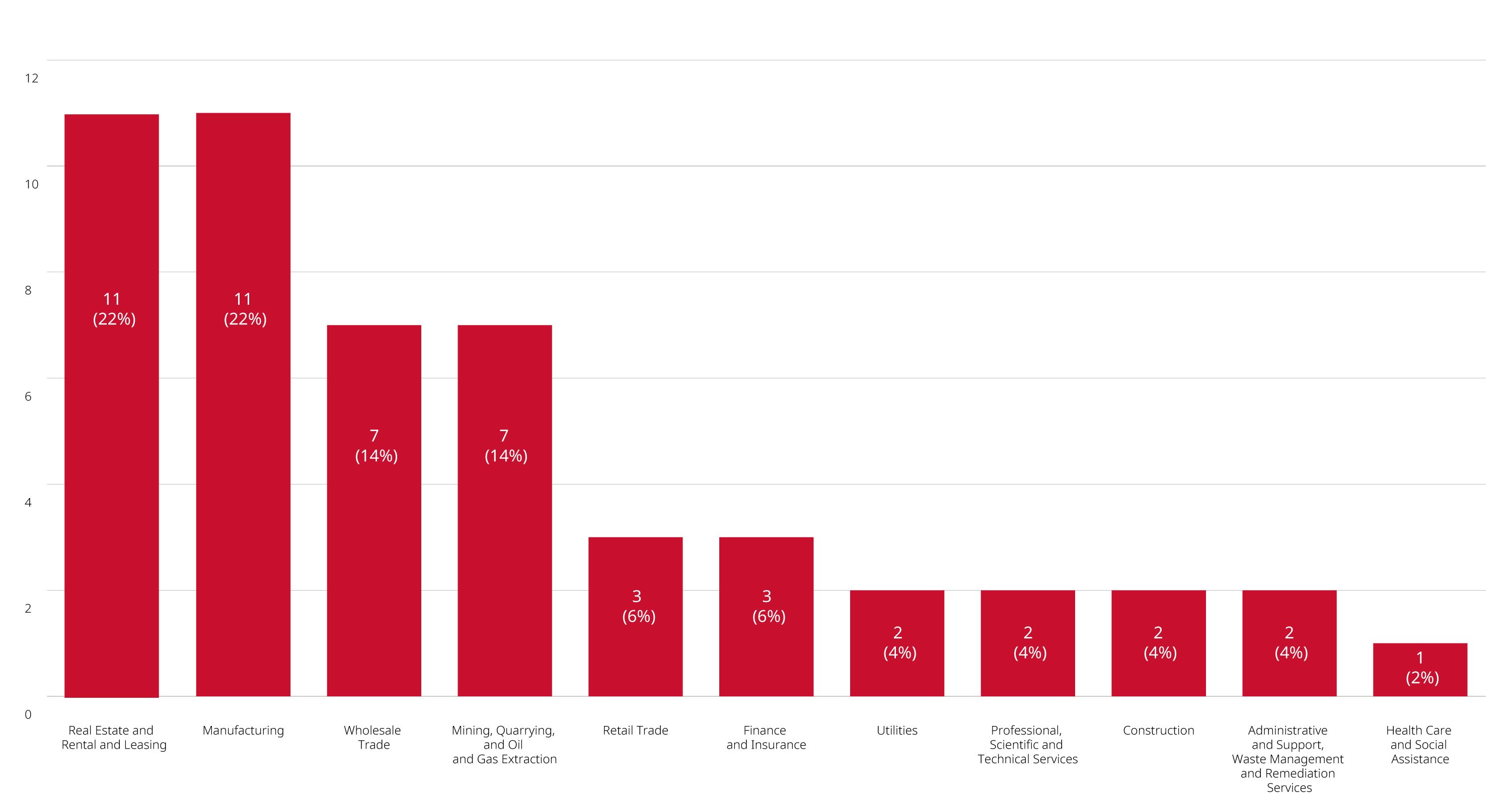

- Primary industries: manufacturing (24 per cent); wholesale trade (21 per cent); real estate and rental and leasing (21 per cent); and mining, quarrying and oil and gas extraction (10 per cent)

- Zero consent agreements (remedies) filed

- 19 transactions received an Advance Ruling Certificate (69 per cent), 10 transactions received a No Action Letter (31 per cent)

January – March 2022 Highlights

- 51 merger reviews completed

- Primary industries: real estate and rental and leasing (22 per cent); manufacturing (22 per cent); wholesale trade (14 per cent); and mining, quarrying and oil and gas (14 per cent)

- Zero consent agreements (remedies) filed

- 32 transactions received an Advance Ruling Certificate (63 per cent), and 19 transactions received a No Action Letter (37 per cent)

Other Enforcement Activity

Competition Bureau closes investigation into the supply crop inputs in Western Canada

- On March 15, 2022, the Competition Bureau announced that it had closed its investigation into allegations that a number of manufacturers and wholesalers disadvantaged, restricted or blocked the supply of crop inputs to Farmers Business Network Canada Inc. (FBN). As summarized in its position statement, the Bureau concluded that the evidence did not sufficiently demonstrate any agreement between competitors in relation to FBN, and that the evidence did not clearly demonstrate that the firms most likely to hold dominant market positions engaged in conduct which resulted in a substantial lessening or prevention of competition.

Non-Enforcement Activity

Government of Canada signals legislative amendments to the Competition Act forthcoming

- On April 7, 2022, the Government of Canada published Budget 2022: A Plan to Grow Our Economy and Make Life More Affordable. In the Budget, the Government of Canada has indicated that it will introduce legislative amendments to the Competition Act aimed at fixing loopholes, tackling practices harmful to workers and consumers, modernizing access to justice and penalties, and adapting the law to "today's digital reality". These amendments are described as a preliminary phase in modernizing Canada's competition regime.

Competition Bureau publishes its 2022-2023 Annual Plan: Competition, recovery and growth

- On April 4, 2022, the Competition Bureau published its 2022-2023 Annual Plan: Competition, recovery and growth. The Annual Plan outlines the Bureau's priorities in the coming year, including: targeting ongoing issues linked to the COVID-19 pandemic, such as anti-competitive conduct related to supply chain issues and deceptive claims about support benefits; focusing enforcement on sectors of the economy that are vital to Canada's long-term economic well-being, such as digital services, health, infrastructure, telecommunications and natural resources; and supporting the Government of Canada's review and update of the Competition Act, and continuing to encourage pro-competitive laws, regulations and policies at all levels of government in Canada.

Investment Canada Act

Non-Cultural Investments

February 2022 Highlights

- For non-cultural investments: zero reviewable investment approvals and 92 notifications filed (73 for acquisitions and 19 for establishment of a new Canadian business)

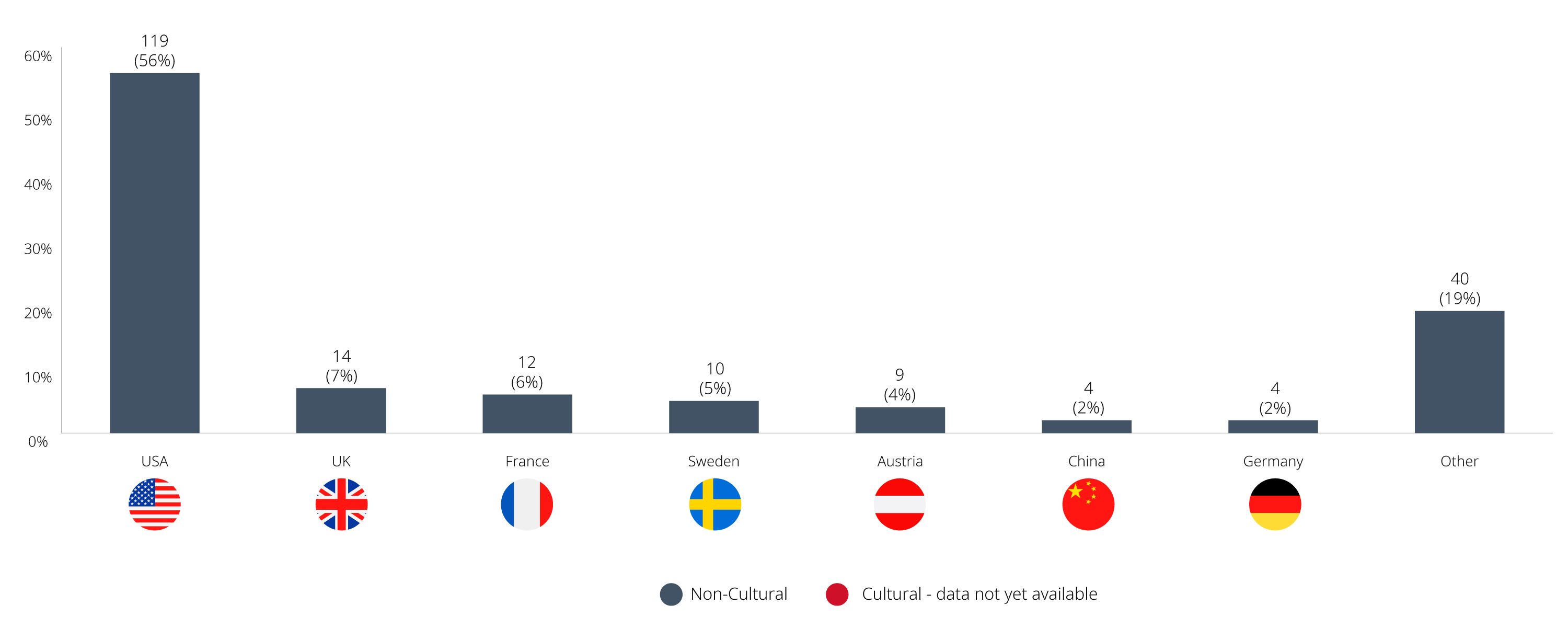

- Country of origin of investor (non-cultural): U.S. (57 per cent); UK (seven per cent); Sweden (four per cent); France (seven per cent); Austria (four per cent)

January – February 2022 Highlights

- For non-cultural investments: zero reviewable investment approvals and 212 notifications filed (164 for acquisitions and 48 for establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (56 per cent); UK (seven per cent); France (six per cent) Sweden (five per cent); Austria (four per cent)

Blakes Notes

- On March 2, 2022, members of the Blakes Competition Litigation group hosted a webinar titled Competition Class Actions in Canada: Recent Trends. If you missed it, you can watch a recording of the session here, or read five key takeaways in our Five Under 5 article.

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.