Welcome to the November issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity remained strong through the month of October with 181 merger reviews having been completed year-to-date. This is a five per cent increase over the number of reviews completed through the same period in 2019 (172), and a 47 per cent increase over the number of reviews through the same period in 2020 (123).

- Commissioner of Competition, Matthew Boswell, outlines the Competition Bureau's plans to use its increased budget.

- On the class action front, the BCSC struck Competition Act claims on the grounds that section 45 only applies to "sell side" agreements, while the Federal Court denied certification of a class action on the basis that the plaintiffs failed to plead material facts.

Merger Monitor

October 2021 Highlights

- 17 merger reviews completed

- Primary industries: real estate and rental and leasing (41 per cent); mining, quarrying, and oil and gas extraction (18 per cent); and finance and insurance (12 per cent)

- One consent agreement (remedies) filed

- 12 transactions received an Advance Ruling Certificate (71 per cent), while four transactions received a No Action Letter (24 per cent)

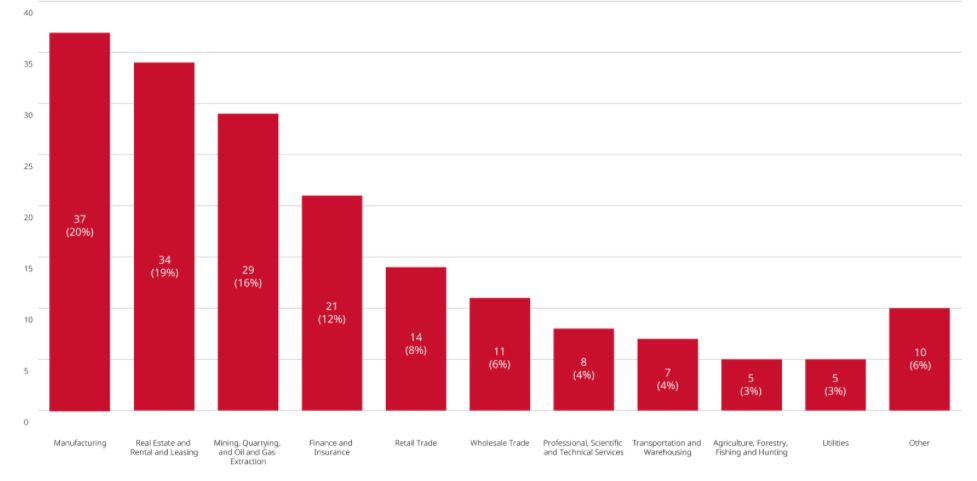

January – October 2021 Highlights

-

181 merger reviews completed

-

Primary industries: manufacturing (20 per cent); real estate and rental and leasing (19 per cent); mining, quarrying and oil and gas extraction (16 per cent); and finance and insurance (12 per cent)

- Two consent agreements (remedies) filed

-

120 transactions received an Advance Ruling Certificate (66 per cent), while 59 transactions received a No Action Letter (33 per cent)

Merger Enforcement

Competition Bureau enters into consent agreement with MacEwan Petroleum Inc.

- On October 29, 2021, the Competition Bureau entered into a consent agreement with MacEwan Petroleum Inc. and its affiliate, Grant Castle Corp. related to their proposed acquisition of 51 Quickie Convenience Stores, 22 of which include gas stations, in Ontario and Quebec. In the Bureau's review of the transaction, it concluded that the proposed acquisition would likely substantially lessen competition in the supply of gasoline to customers located in Kemptville, Ontario. To resolve the Bureau's concerns, MacEwan Petroleum and its affiliate agreed to divest the Quickie gas station located in Kemptville to a single purchaser.

Other Enforcement Activity

Competition Bureau obtains court order relating to its civil investigation into Google Canada Corporation

- On October 22, 2021, the Competition Bureau obtained a court order to advance its civil investigation into conduct by Google related to its online advertising business to determine whether its conduct is harming competition in the online display advertising industry in Canada.

Non-Enforcement Activity

Commissioner Boswell delivers speech discussing possible changes in Bureau enforcement policy

- On October 20, 2021, the Commissioner of Competition, Matthew Boswell, gave pre-recorded remarks at the Canadian Bar Association's Competition Law Fall Conference. In his remarks, the Commissioner discussed how the Bureau intended to make use of the additional resources earmarked for it in the 2021 federal budget (C$96-million over the next five years and C$27.5-million per year ongoing), including by adopting a more aggressive enforcement approach and by increasing its litigation capacity and more frequently engaging external experts. The Commissioner noted that the increased funds will not directly impact the Bureau's merger review program, which is funded through filing fees. Commissioner Boswell also discussed aspects of Canadian competition policy which he considers in need of an update, including the maximum available criminal fines and civil penalties, the current private enforcement tools and the efficiencies defence. This discussion was motivated at least in part by recent policy developments in jurisdictions such as the U.S. and E.U. You can watch the Commissioner's speech as well as read the speech here.

Section 36 Remedies under the Competition Act

- In Fogelman c. Pioneer North American Inc., 2021 QCCS 4606, the Quebec Superior Court authorized a settlement agreement between the plaintiffs, Pioneer North America, Inc., Pioneer Electronics (USA) Inc., Pioneer Electronics of Canada, Inc., BenQ America Corporation and BenQ Canada Corp. The plaintiffs had alleged that the defendants had conspired to fix the prices of optical disk drives. The plaintiffs' claims against the Pioneer companies were settled for C$1,185,000 and the plaintiffs claims against the BenQ companies were settled for C$424,000.

- In Latifi v. The TDL Group Corp., 2021 BCSC 2183, the British Columbia Supreme Court approved TDL's motion to strike the plaintiffs' Competition Act claims on the basis that section 45 (the criminal conspiracy provision of the Competition Act) only applies to "sell-side" agreements, while the impugned agreements were "buy-side" agreements. The case relates to provisions in contracts between TDL and its franchisees which prohibited franchisees from hiring employees from other TDL franchisees without TDL's advance written consent.

- In Jensen v. Samsung Electronics Co., Ltd., 2021 FC 1185, the Federal Court of Canada denied certification on the grounds that the plaintiffs failed to plead material facts to support their allegation of a conspiracy, and that the plaintiffs' claims were speculative to the point that they boiled down to bald assertions. In the course of its decision, the Federal Court reiterated that conscious parallelism is not sufficient to constitute a conspiracy under section 45 and confirmed that certification remains a "meaningful screening device" for unfounded claims (see our Blakes Bulletin: Provincial and Federal Courts Decline to Advance Competition Act Claims in Proposed Class Actions | Blakes for more information on this and the Latifi v The TDL Group Corp. decisions.)

Investment Canada Act

June 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 81 notifications filed (58 for acquisitions and 23 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (63 per cent), Germany (nine per cent), Sweden (five per cent), Hong Kong (four per cent), and UK (four percent)

July 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 105 notifications filed (72 for acquisitions and 33 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (58 per cent), Austria (seven per cent), UK (five per cent), Hong Kong (four per cent), and Germany (four per cent)

August 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 108 notifications filed (89 for acquisitions and 19 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (68 per cent), UK (six per cent), China (three per cent), and France (three per cent)

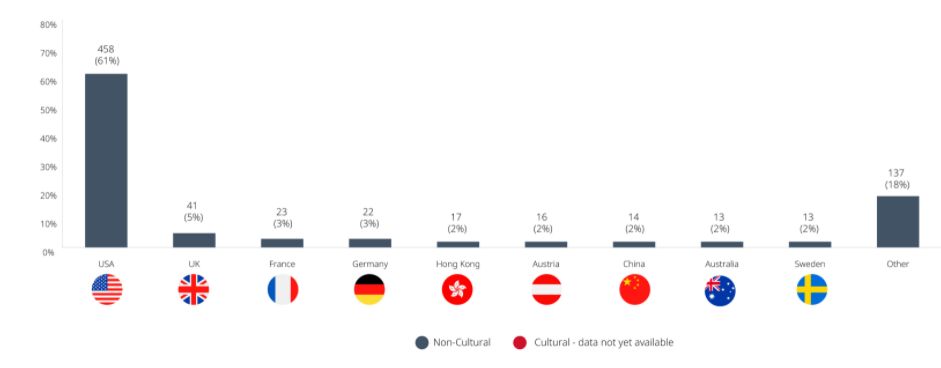

January - August 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 754 notifications filed (566 for acquisitions and 188 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (61 per cent), UK (five per cent), France (three per cent), and Germany (three per cent)

Blakes Notes

- On November 3, 2021, members of Blakes Competition, Antitrust & Foreign Investment group hosted a webinar titled Antitrust Regulation Intensifies in the U.S. and Europe: Can Canada be Far Behind?. If you missed it, you can watch a recording of the session here.

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.