Welcome to the March issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

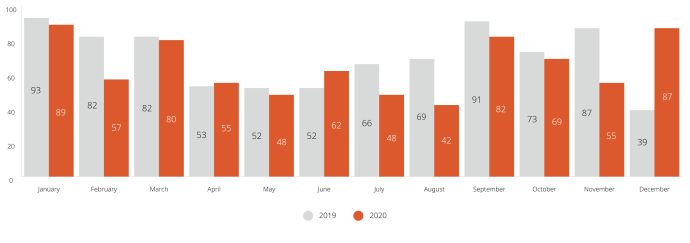

- The number of completed merger reviews through the end of February (32) is consistent with historical volumes (36 in the same period in 2020; 33 in 2019) suggesting that merger activity (in terms of the number of reviews completed by the Bureau) continues to increase following the significant reduction in merger activity resulting from COVID-19 observed in 2020 (particularly in the second quarter and through the summer months).

- FlightHub directors to pay penalties of C$400,000 for deceptive marketing activities.

- Parties made additional submissions to Competition Tribunal regarding legal interpretation question in Parrish & Heimbecker case.

Merger Monitor

February 2021 Highlights

- 17 merger reviews completed

- Primary industries: real estate and rental and leasing (24 per cent); manufacturing (24 per cent); utilities (18 per cent); finance and insurance (18 per cent)

- Zero consent agreements (remedies) filed

- 11 transactions received an Advance Ruling Certificate (65 per cent), while six transactions received a No Action Letter (35 per cent)

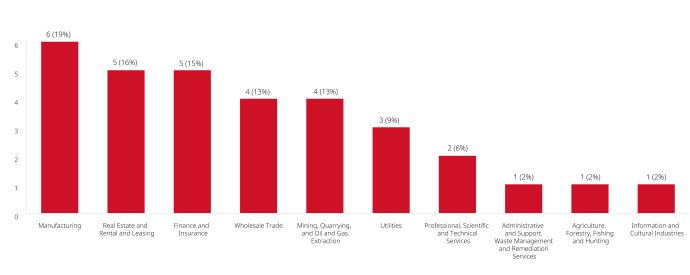

January – February 2021 Highlights

- 32 merger reviews completed

- Primary industries: manufacturing (19 per cent); real estate and rental and leasing (16 per cent); finance and insurance (16 per cent); wholesale trade (13 per cent); and mining, quarrying and oil and gas extraction (13 per cent)

- Zero consent agreements (remedies) required

- 19 transactions received an Advance Ruling Certificate (59 per cent), while 13 transactions received a No Action Letter (41 per cent)

Merger Enforcement

Parties Submit Responses to Supplementary Question in Parrish & Heimbecker Case

- On February 16, 2021, parties to the Parrish & Heimbecker case submitted responses to a legislative interpretation question the Competition Tribunal asked during final arguments. Their responses address whether the absence of the words "in a market" impacts the interpretation of substantial lessening of competition in section 92 of the Competition Act.

Misleading Advertising Enforcement

Directors of FlightHub to Pay C$400,000 in Penalties for Deceptive Marketing Practices

- On February 24, 2021, the Bureau announced that two FlightHub company directors agreed to enter into a Consent Agreement to pay C$400,000 in penalties for deceptive marketing practices. The Bureau concluded that the company made false or misleading claims about its prices and flight-booking services (including in respect of seat selection, cancellation and rebooking, and use of travel credits), charged customers hidden fees and posted company-generated positive customer reviews. FlightHub was previously fined C$5-million as a result of the Bureau's investigation.

Non-Enforcement Activity

Bureau Publishes Summarized Feedback regarding Canada's Digital Health Care Sector

- On February 24, 2021, the Bureau published summaries of the feedback it received from Canadians and other industry stakeholders regarding the digital health care sector. The Bureau intends to use this feedback as part of its ongoing study of the Canadian digital health care sector, which is intended to develop policies that will promote competition in digital health care.

March is Fraud Prevention Month for the

Bureau- The Bureau's annual Fraud Prevention Month campaign launched on March 1, 2021. The campaign focuses on raising awareness about online shopping scams and deceptive practices, including non-delivery of goods, subscription traps and fake online reviews.

Investment Canada Act

December 2020 Highlights

- For non-cultural investments: zero reviewable investment approvals and 87 notifications filed (64 for acquisitions and 23 for establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (55 per cent); U.K. (seven per cent); Denmark (six per cent); Sweden (six per cent); France (five per cent); Germany (five per cent); India (five per cent); and Ireland (five per cent)

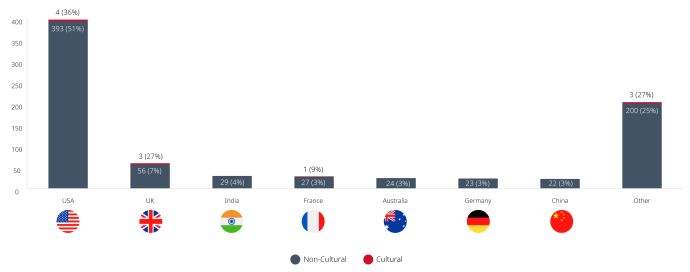

Annual 2020 Highlights

- For non-cultural investments: four reviewable investment approvals and 770 notifications filed (511 for acquisitions and 259 for establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (51 per cent); U.K. (seven per cent); India (four per cent); Australia (three per cent); France (three per cent); China (three per cent); and Germany (three per cent)

Blakes Notes

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

For permission to reprint articles, please contact the Blakes Marketing Department.

© 2020 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.