1. Overview

Brazilian law applicable to M&A transactions

The purchase and sale of companies or businesses in Brazil is governed mainly by: (i) the chapter on the law of obligations of Law No. 10,106 of January 10, 2002 (Brazilian Civil Code); (ii) certain provisions of Law No. 6,404 of December 15, 1976 ("Brazilian Corporation Law"); (iii) Law No. 6,385 of 1976 December 7, 1976, which created the Brazilian Securities and Exchange Commission ("CVM"); and (iv) Provisional Measure 881/2019 ("Economic Freedom Act") – recently issued by the Brazilian President and explored deeper in the sections below.

Public listed companies involved in M&A transactions (either as acquirers or targets) shall also comply with rules (and interpretation/opinions) enacted by CVM, which address disclosure of information, fiduciary duties of officers and directors, and obligations of controlling shareholders, among others.

There are self-regulatory statutes that may impose additional rules for public listed companies. For instance, the Brazilian Corporation Law ensures an 80% tag-along for holders of common shares in the event of a sale of control, and additionally, by virtue of having adhered to a superior governance standard on the Brazilian Stock Exchange (or "B3"), several listed companies have increased such percentage to 100% and included all types of shares, if applicable.

Most deals (including those involving public company targets) are privately negotiated with controlling or large shareholders. Tender offers to acquire control of Brazilian companies are still rare. The main rule dealing with tender offers (CVM Rule No. 361/2002) requires any tender offer to be fully guaranteed by an intermediary (broker, dealer or financial institution) and to be irrevocable and not subject to conditions (except for conditions which are not under the offeror's control). Mandatory tender offers after a sale of control are sometimes combined with a delisting tender (which requires the acceptance of ⅔ of shareholders who show up for the tender auction to be effective, and a report stating that the offer is being made at a fair value).

Some M&As require regulatory approval (either prior to the closing or as a post-closing action), and these include financial institutions, insurance companies, certain telecoms activities, and certain concession holders. Generally, foreign-controlled buyers are not restricted from investing in most industries, subject to a few exceptions (namely, nuclear energy, post office and telegraph services, and the launch and orbital positioning of satellites, vehicles, aircraft and related activities). Brazil does not have a Committee on Foreign Investments (as is the case, for example, with the United States' CFIUS) but the prior consent of the General Office of the National Security Council is required for acquisition of lands along frontier areas (or of equity in a company that holds such lands).

Since 2011, the pre-merger consent of the Brazilian Competition Authority ("CADE") is required for M&A transactions involving parties that meet certain net revenues criteria (before 2011, approval was made post-merger). CADE has been extremely quick in reviewing fast-tracked transactions (usually 15–30 days, but sometimes less). In more complex transactions, the decision by CADE can take six months or more. CADE has recently issued gun-jumping guidelines stating what is permitted and what is not, pre-approval.

Overview of M&A activity in 2018

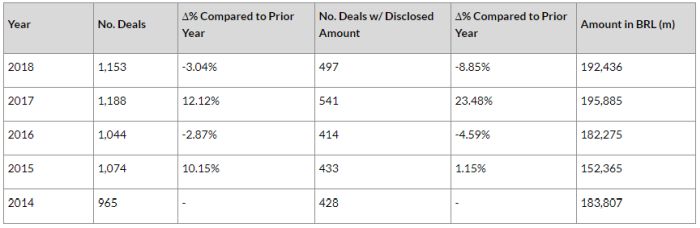

The number of M&A transactions in Brazil in 2018 has shown a slight decrease from 2017, which may have been mainly a symptom of the uncertainties of the Brazilian political scenario and Presidential election held in 2018. See below the recent year's number of deals (with and without disclosed amounts), the amounts involved and year-to-year variation:

Source: https://www.ttrecord.com/pt/publicacoes/relatorio-por-mercado/relatorio-mensal-brasil/Brasil-4T-2018/1848/.

Influenced by the troubled political scenario, in which President Dilma Rousseff's impeachment and Operation Car Wash – an ongoing criminal investigation being carried out by the Federal Police of Brazil and one of the largest corruption scandals in the history of Latin America – are the most relevant events, the Brazilian economy was hit by a deep economic recession around 2014–2015.

During the crisis years, typical players in the Brazilian M&A industry have not been as active. U.S. companies and investment funds have mostly been replaced by investors from Asia; particularly China. Usual targets for M&A transactions have also been replaced by distressed assets or otherwise good assets from distressed companies (especially companies involved in Operation Car Wash) and state-owned targets.

2017 and 2018 already showed a slight growth in M&A activity in comparison to prior years. With the expectation that the worst years are now behind us, there appears to be a lot of renewed interest in Brazil, which will be better explained in the sections below.

2. Significant deals and highlights

Fibria/Suzano

This transaction was the first cash and stock merger which was brought to the CVM and expressly approved by it. Fibria, a eucalyptus pulp producer, and Suzano, a pulp and paper producer, were both public listed companies in the B3.

Because cash mergers do not have clear statutory permission in Brazilian law, the transaction occurred in four distinct steps that took place on the same day: (i) Suzano contributed in the same amount as the cash portion of the deal to a non-operating holding company ("Holding Company"); (ii) the Holding Company and Fibria performed a merger of the Holding Company's shares by Fibria for their fair market value (i.e.for each Fibria common share, there was one common share and one preferred share redeemable by the Holding Company); (iii) each preferred share issued by the Holding Company was redeemed for a cash payment; and (iv) the Holding Company merged into Suzano, and in return, Suzano shares were given to the former shareholders of Fibria.

The Fibria/Suzano merger had a couple of particularities: (i) it was proposed by the controlling shareholders of the companies – and not by their managements; and (ii) 80% of the value to Fibria shareholders was paid in cash.

Certain minorities filed a complaint about the structure with the CVM. By a majority opinion, CVM's board upheld the freedom to contract and deal flexibility and considered the case a regular transaction, asserting that multiple phases' deals must be evaluated independently and will be held valid when (i) each phase is legally executed, and (ii) the transaction as a whole does not violate any law or by-law's provision.

Multiplus/LATAM

In 2018, two deals involving the delisting of companies dependent on their controlling shareholder caught the Brazilian market's attention. The transactions were somewhat similar, since each of them involved an airline company (LATAM and GOL) and its loyalty mileage programme (Multiplus and Smiles, respectively). We highlight their particularities below.

Tam S.A., a Brazilian subsidiary of Chile's Latam Airlines Group S.A., announced that it (i) did not intend to renew the partnership agreement with Multiplus, and (ii) intended to hold a public tender offering for the capital closing of Multiplus ("DTO").

Although Latam's announcement that it would not renew the Latam/Multiplus partnership agreement affected the valuation of Multiplus, Latam would offer in the DTO the 90-day average price per share pre-announcement (a 11.6% premium on the pre-annoucement price). As a result, the price of Multiplus shares were not significantly affected by Latam's announcement.

The DTO was very successful, there remaining only a 2.79% stake, which enabled Multiplus to conduct a squeeze-out and delist itself.

Smiles/Gol

The Smiles/Gol transaction had a similar structure to the Fibria/Suzano case, which involved the merger of shares, payment for redeemable preferred shares (cash portion) and common shares of the merging company.

In the first structure set out for the transaction, preferred shares of GLA – the operational company from GOL group – would be issued to Gol to comply with (then existing) limits on foreign shareholders of GLA. However, after: (i) the restriction on foreign shareholders of Brazilian airlines ended; and (ii) B3 denied Gol's listing on the Novo Mercado special segment, Gol reported that it would consider "additional options for the potential merger of Smiles".

When Gol's transaction was disclosed, Gol said it would not renew its partnership agreement with Smiles. Without a price for Smiles shares in the restructuring, the market reacted negatively – Smiles shares dropped about 40%.

CVM filed an administrative proceeding after the announcement of the transaction but has not specifically commented on the deal structure as at the time of writing.

The main leverage for shareholders is to evidence whether the transactions among related parties (e.g. purchase of Gol tickets) are performed only to the benefit of Smiles or not.

Eletropaulo

Eletropaulo, a major Brazilian power distributor, was involved in a multi-bidder tender (bids came in from Energisa, Neoenergia and Enel), the first such transaction in more than 10 years. Energisa launched its hostile takeover bid on April 5, 2018 at BRL18 per share. On April 14, Eletropaulo announced it signed a contract with Neoenergia, whereby Neoenergia committed to underwrite a share offering with a price per share of BRL25.51, in addition to its public tender offer at the same price per share offered by Energisa. On April 17, Enel submitted a competing tender offer with a share price of BRL28. Enel's proposal also established the capitalisation of the company in an amount equal to that of the follow-on offer.

After a tense dispute with CVM and an arbitration session related to Neoenergia's agreement signed with Eletropaulo in Brazilian courts and by the European Commission, Enel offered a higher bid (BRL45.22 per share vs. Neoenergia's offer of BRL39.54 per share) and acquired control of Eletropaulo.

As a consequence of three public offerings with materially the same conditions (other than price), CVM authorised the adoption of specific procedures and the execution of a joint auction. According to the CVM ruling, any price increase in the auction should only occur in case of a buyer interference. The general rule states that price increases on the day of the auction do not apply to public tender offers with increased participation when there has been a publicly announced bid for a competing public tender offer. Price increases may occur up to 10 days prior to the joint auction.

TAG

On May 5, 2019, the Brazilian state-owned company Petrobras executed binding agreements to dispose 90% of its shares heled in Transportadora Associada de Gás ("TAG") after a bid won by the consortium formed by the French group Engie and the Canadian fund Caisse de Dépôt et Placement du Québec. The sale of TAG's shares is part of Petrobras' destatisation programme.

However, on May 24, Justice Edson Fachin of the Supreme Court issued a preliminary decision suspending the sale of the shares held by Petrobras. According to the decision, the sale of controlling shares of public companies and their subsidiaries should be preceded by a public bid and legislative authorisation (according to Justice Ricardo Lewandowski's preliminary decision). To a certain degree, the matter was unclear and imposed great legal and regulatory uncertainty on private players willing to acquire assets held by public companies.

On May 30, the Supreme Court plenary began the trial to give a final answer on the case, and decided that: (i) the sale of the controlling shares of directly state-owned or -controlled companies depends on the prior legislative authorisation and formal bid proceedings; and (ii) the sale of controlling shares of subsidiaries of state-owned or -controlled companies does not depend on the prior legislative authorisation or formal bid proceedings, but shall observe a competitive proceeding. The Supreme Court decision was a positive signal to the market and particularly to those private players willing to acquire assets from state-owned companies.

3. Key developments

In recent years, the Brazilian market has seen profound changes in the structuring of M&A transactions and their legal framework. On the structuring front, the CVM expressly authorised for the first time a cash and stock merger in the Brazilian securities market (please see Fibria/Suzano subsection above), and M&A practitioners are having to account for the antitrust authority ("CADE") playing a more active role. With respect to changes in the legal framework, the Brazilian President recently passed the Economic Freedom Act, which, among others, aims at reducing judicial interference in private transactions. This section dives deeper into those interesting developments.

Cash and stock mergers

U.S. and Brazilian mergers are different in one fundamental aspect: while shareholders of U.S. companies may receive stock or cash in lieu of their shares, shareholders of Brazilian companies can only receive stock of the surviving entity. Therefore, even though mergers can be less complicated than direct acquisitions of control – as change of control acquisitions trigger a complex, costly and time-consuming mandatory tender offer for the shares held by minority shareholders – mergers in Brazil can only be used in stock-for-stock transactions.

In order to perform cash and stock mergers, many companies have used a two-step merger structure, whereby a target is merged into a cash company, the cash company pays out cash to the target's shareholders and, afterwards, the cash company is merged into the surviving entity – with the target's shareholders receiving stock in the surviving entity. Though this type of transaction is not particularly new, the 2018 merger between Fibria and Suzano was a relevant development in a market that offers no alternative to cash-only mergers. The CVM decision may result in cash and stock mergers becoming more common in the future.

Antitrust

Another interesting development in the Brazilian M&A landscape is a more active role being played by CADE. A few years ago, discussions about break-up fees and "Hell-or-High-Water" provisions were almost non-existent in Brazil. However, since CADE started to adopt a more rigorous approach to antitrust review – which culminated with the rejection of several high-profile deals, such as the acquisition of Liquigás by Grupo Ultra and of Estácio by Kroton – antitrust clearance, purchaser's obligations to divest and substantial break-up fees have become some of the most negotiated topics in deals involving competitors or players in the same industry. As consolidation increases within industries, these topics will likely become even more central in future transactions.

Economic Freedom Act

It has long been a consensus that one of the major sources of uncertainty in M&A transactions in Brazil is the constant interference by the courts, which are entitled to replace the terms agreed by the parties by others that judges see fit. The ability of the courts to interfere in private transactions is generally based on open-ended concepts such as objective good-faith, reasonableness and the social function of agreements. In order to bring more certainty to private transactions, the recently elected Brazilian President has passed the Economic Freedom Act, which, among others, aims at reducing judicial interference in private agreements. M&A practitioners now expect that negotiated terms will finally have a better chance of surviving the scrutiny of the courts.

End to foreign ownership cap of Brazilian airlines

A new rule lifted the restrictions on foreign capital shareholding in Brazilian air transportation companies. As a result, foreign investors are from now on able to hold up to 100% of the voting capital of Brazilian airlines.

The new rule was enacted – originally by the Brazilian Federal Government and later approved by the legislative branch – in light of the impact of Brazil's current economic situation on the national airline industry, taking into account, especially, one of the main challenges of Brazilian airline market: the shortage of capital sources. Moreover, the new rule has the potential to render the Brazilian airline sector more competitive (i) by permitting current foreign shareholders to increase their interest in the capital stock of an existing national airline company, and (ii) by opening the Brazilian market to the entry of new airline companies.

4. The year ahead

With the expectations of less uncertainty in the political realm and that the crisis years are now behind us, there appears to be a lot of renewed interest in Brazil. In the first quarter of 2019, M&A volume was around BRL29.5 billion. Foreign investors, for instance, have increased participation in recent auctions of state-owned companies and public concessions, and it is expected that this trend will grow stronger as new opportunities are made available. Measures of less bureaucracy and less estate intervention – such as a less active Brazilian National Development Bank – suggest that more opportunities may also be available in the financing of M&A transactions.

It is our expectation that the positive outcomes of the market-oriented reforms, concession and privatisation programmes, in addition to the measures mentioned above, may significantly boost M&A activity in Brazil.

5. Sources

This chapter is based on reports in the press, specialist reports, and company and financial websites.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.