- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Transport and Construction & Engineering industries

With insolvencies surging by 43% in the quarter ending 29 September 2024, many small and medium businesses — and their owners — are feeling the financial strain.

For directors and their families, the impact can be especially severe if personal guarantees are enforced and the family home is used as security for business loans.

This article explains the "equity of exoneration" (EOO) — a lesser-known legal principle—and how it may help a non-bankrupt spouse protect the family home or other jointly owned property after a business failure and personal bankruptcy of one of the spouses.

What is the Equity of Exoneration?

The EOO applies when co-owners mortgage jointly owned property, but the funds are used solely for the benefit of one of them. It often comes into play when bankruptcy trustees seek to claim a share of jointly owned property, used as security for loans advanced to one spouse's business.

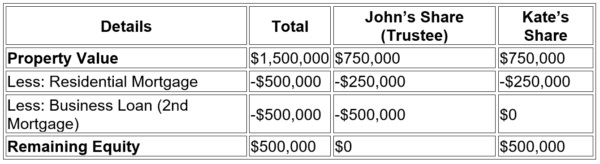

Here's how it works in a simplified example:

- John and Kate own their family home as joint tenants, valued at $1,500,000.

- The property has two loans secured against it:

- A $500,000 residential mortgage; and

- A $500,000 business loan tied to John's building company.

- John is the sole director and shareholder of the company, while Kate has no involvement in the business.

When John's business fails and ends up in liquidation, suppliers enforce personal guarantees and he is declared bankrupt. Upon bankruptcy, John's share of the property transfers to his trustee in bankrupcty. The trustee demands $250,000 from Kate (representing 50% of the remaining equity) or asks that the property be sold and proceeds divided equally.

How the EOO Protects Kate

The EOO changes the equation. It ensures that loans benefiting only one party (in this case, John) must first be repaid from that party's share of the property.

Here's how the equity would be distributed:

Thanks to the EOO, Kate retains the entire $500,000 equity. If she can continue making mortgage payments, she may be able to keep the property.

When the EOO May Not Apply

The EOO might not be available if the non-bankrupt spouse received a "tangible benefit" from the loan secured against the property.

For example:

- In Parsons & Parsons v McBain [2001] FCA 376 a wife successfully relied on the EOO even though the business loan was intended to keep her husband's transport business running, which indirectly supported her family. The court ruled this benefit was too remote to disqualify her from asserting the EOO.

- In Arvanis (Trustee) v Kapp [2023] FCA 702 a wife was allowed to claim the EOO after charging her property to secure payment of her husband's legal fees. Even though the husband was sued in his capacity as trustee of a trust in which the wife was a beneficiary, the court found any benefit to her was speculative and not sufficient to deny her claim.

Take Action Early

The equity of exoneration is a powerful legal tool that can significantly benefit non-bankrupt spouses, especially during emotionally and financially challenging times.

However, asserting this right requires a clear understanding of its nuances and timely action. Seeking professional advice early may make the difference between losing the family home or retaining enough equity to make a meaningful fresh start.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.