Can you serve a bankruptcy notice by email?

If a creditor has received a final judgment or final order the execution of which has not been stayed, and that judgment or order is more than the statutory minimum ($10,000.00), then the creditor can apply to the Australian Financial Security Authority for a bankruptcy notice.

Once the judgment creditor has the bankruptcy notice it needs to be served on the judgment debtor.

There are a number of different ways to serve a judgment debtor with the bankruptcy notice in the Bankruptcy Act 1966 (CTH) ("the Act") and the Bankruptcy Regulations 2021 (CTH) ("the Regs").

One question we get asked is "can you serve a bankruptcy notice by email?"

This article will explain if a bankruptcy notice can be served by email.

What is a Bankruptcy Notice?

A bankruptcy notice is a formal notice issued by the Australian Financial Security Authority ("AFSA").

It is a formal demand for payment:

- From a human debtor (not a company);

- Based upon a final judgment or final order of more than the statutory minimum ($10,000.00);

- The final judgment or final order must not have been stayed; and

- The final judgment or final order must not be more than 6 (six) years old.

A bankruptcy notice states that the judgment debtor must either pay, enter into an arrangement for payment, or apply to set the bankruptcy notice aside – all within 21 days after being served.

If they don't do any of these things then they have committed an act of bankruptcy, allowing the judgment creditor to file creditor's petition in the Federal Circuit Court.

Because the act of bankruptcy is calculated upon the date of service, it is important to get this date correct, and to be able to prove service.

How to Serve a Bankruptcy Notice

The old regulations (the Bankruptcy Regulations 1996 (CTH) used to say:

Regulation 4.02A of the Regs – Service of bankruptcy notices – says:

A bankruptcy notice may be served by any of the methods mentioned in regulation 16.01.

Regulation 16.01(1) of the Regs says:

(1) Unless the contrary intention appears, where a document is required or permitted by the Act or these Regulations to be given or sent to, or served on, a person (other than a person mentioned in regulation 16.02), the document may be:

... (ii) in such a manner (for example, by electronic mail) that the document should, in the ordinary course of events, be received by the person.

Regulation 16.01(1)(e)(ii) used to say that a bankruptcy notice can be served by another mode of electronic transmission in such a manner (for example, by electronic mail) that the document should, in the ordinary course of events, be received by the person.

However, in 2021, the bankruptcy regulations were repealed, and are now the Bankruptcy Regulations 2021 (CTH) ("the Regs").

In these new bankruptcy regulations, the section in relation to service by "by electronic mail" has been removed. So, can we still serve a bankruptcy notice by email?

Repeal of the Bankruptcy Regulations 2021

In 2021, the Bankruptcy Regulations 1996 were repealed as part of the Bankruptcy and Other Legislation Amendment (Repeal And Consequential Amendments) Regulations 2021.

Section 102 of the Regs relates to the service of documents, and all reference to the electronic service have been removed. It says:

(1) Unless the contrary intention appears, if a document is required or permitted by the Act or this instrument to be given or sent to, or served on, a person (other than the Inspector-General, the Official Receiver or the Official Trustee), the document may be:

(a) sent by a courier service to the person at the address of the person last known to the person serving the document; or

(b) left, in an envelope or similar packaging marked with the person's name and any relevant document exchange number, at a document exchange where the person maintains a document exchange facility.

The Regs also have a note which says – see also section 28A of the Acts Interpretation Act 1901. Section 28A says:

(1) For the purposes of any Act that requires or permits a document to be served on a person, whether the expression "serve", "give" or "send" or any other expression is used, then the document may be served:

(a) on a natural person:

(i) by delivering it to the person personally; or

(ii) by leaving it at, or by sending it by pre-paid post to, the address of the place of residence or business of the person last known to the person serving the document ...

Section 28A of the Acts Interpretation Act 1901 also contains a note which says the Electronic Transactions Act 1999 deals with giving information in writing by means of an electronic communication.

Section 9 of the Electronic Transactions Act 1999 deals with the requirement to give information in writing. Section 9(4) says:

This section applies to a requirement or permission to give information, whether the expression give , send or serve, or any other expression, is used.

Section 9(5) gives a list of things it considers "giving information" to be:

For the purposes of this section,

giving information includes, but is not limited

to, the following:

(a) making an application;

(b) making or lodging a claim;

(c) giving, sending or serving a

notification;

(d) lodging a return;

(e) making a request;

(f) making a declaration;

(g) lodging or issuing a certificate;

(h) making, varying or cancelling an election;

(i) lodging an objection;

(j) giving a statement of reasons.

This is not an exhaustive list, so an argument can be made that pursuant to Section 102 of the Bankruptcy Regulations 2021, and section 28A of the Acts Interpretation Act 1901, and Section 9 of the Electronic Transactions Act 1999.

However, no legal arguments have been made as at the time of writing this article.

Looking at the cases referring to section 9 of the Electronic Transactions Act 1999 (CTH), they are silent on the service of bankruptcy notices.

As at the date of writing this article, there are cases which discuss the form of document given electronically by email by AFSA, but nothing relevant in relation to service of bankruptcy notices.

Can you Serve a Bankruptcy Notice by Email?

It is unsettled in our view, subject to the repeal of the 1996 Regulations and the provisions contained in the new 2021 Regulations.

A enforcement creditor could serve a bankruptcy notice by email pursuant to the 1996 Regulations, but this has been removed from the 2021 Regulations.

However, if this argument is successful, then there are a number of issues to consider.

When is an Email Received by a Judgment Debtor?

If allowable, service is effected when the document is delivered or transmitted.

Obviously, these words have different meanings, so how have the authorities decided what "received" means in the context of service of a bankruptcy notice?

The main case on this point is American Express Australia Limited v Michaels [2010] FMCA 103 where Smith FM provides commentary on the authorities and says at [23]:

The specific provisions in Bankruptcy Regulations regs.16.01(1)(e) and (2)(b) appear to be self-supporting, and appear intended to identify a deemed time of receipt of service which is simple to establish, and which is rebuttable by the recipient. In my opinion, these provisions implicitly exclude the application of ss.14(3) and (4) of the Electronic Transactions Act in relation to findings as to receipt and time of receipt.

Smith FM then went on to say at [24]:

This conclusion still leaves the possible ambiguity of the word 'transmitted' in reg.16.01(2)(b), which must be solved by a consideration of the context and objects of the provision. Clearly, it is intended to assist the making of findings as to receipt of an emailed document, and to dispense with proof of actual receipt of the email, "in the absence of proof to the contrary". It takes its flavour from the language of reg.16.01(1)(e), which it is intended to assist. That provision refers to a document "sent by" electronic transmission, referring to a mode of dispatch by a sender. Regulation 16.01(2)(b) appears to make an understandable assumption that electronic transmissions will normally reach the intended destination almost instantaneously. Considering all these points, and the general context of the regulation, I accept the submission of counsel for AMEX that reg.16.01(2)(b) raises a rebuttable presumption of receipt and time of receipt occurring when the email is transmitted by its sender, being when it is irretrievably sent by the electronic mail facility used by the person serving the electronic document.

American Express Australia Limited v Michaels [2010] FMCA 103 therefore says that in relation to regulation 16.01 of the Regs, an email is presumed to be received by the judgment debtor when it is transmitted by the judgment creditor, being when it is irretrievably sent by the email facility used by the person sending the bankruptcy notice.

This was followed in Noonan v BMW Australia Finance Limited [2013] FCCA 2222 when Judge Whelan said:

With respect to the provisions of Reg.16.01(1)(e) of the Regulations, Smith FM (as he then was) considered ... that the provision was intended to identify a time of receipt which is simple to establish. It raises a rebuttable presumption that receipt, and time of receipt, occurred when the email is transmitted by its sender, being when it is irretrievably sent by the electronic mail facility used by the person serving the electronic document.

It was also followed in The Council Of The New South Wales Bar Association v Archer [2012] FMCA 81 Lloyd-Jones FM said:

In American Express Australia v Michaels [2010] FMCA 103 ... [H]is Honour says that the presumption arises when the notice is transmitted, not when it is received.

The legal presumption that the bankruptcy notice has been served by email when it is transmitted or sent by the person sending is rebuttable. The judgment debtor will need to provide evidence that the bankruptcy notice was not delivered by email.

The judgment debtor will need to adduce evidence of non-delivery and not non-receipt.

Proof of Non-Delivery or Non-Receipt

The authority case on this point is the Hight Court case of Fancourt v Mercantile Credits Ltd [1983] HCA 25. In Fancourt the High Court said:

Despite remarks in the judgments about non-receipt, it was non-delivery which was significant because the second limb of s. 26 of the Interpretation Act refers to proof of the contrary of delivery. As the present case shows, delivery may be different from receipt by the intended recipient and, provided that delivery is not disproved, the fact of non-receipt does not displace the result that delivery is deemed to have been effected at the time at which it would have taken place in the ordinary course of the post.

Fancourt was followed in relation to a bankruptcy notice and regulation 16.01(2) in Skalkos v T & S Recoveries Pty Ltd [2004] FCAFC 321 where Sundberg, Finkelstein & Hely JJ said:

If, on the proper construction of reg 16.01(2), the words "proof to the contrary" permit proof that the document was not delivered, there is no such proof in the present case. It is clear from Fancourt that proof of non-receipt as opposed to non-delivery is not permitted ... Thus on either view of reg 16.01(2), the primary judge correctly said there was no point in the appellant filing an affidavit of non-receipt.

Practically this makes a lot of sense. Debtors always say things like "we didn't get the email" or "we didn't get the invoice" or "we didn't get the letter".

So, to rebut the presumption that service was made, the judgment debtor will need to adduce evidence of non-delivery and not non-receipt of the bankruptcy notice.

Can we Serve a Bankruptcy Notice by Email?

It is unsettled in our view, subject to the repeal of the 1996 Regulations and the provisions contained in the new 2021 Regulations.

A enforcement creditor could serve a bankruptcy notice by email pursuant to the 1996 Regulations, but this has been removed from the 2021 Regulations.

If the Courts find that service is allowable by email pursuant to Section 102 of the Bankruptcy Regulations 2021, and section 28A of the Acts Interpretation Act 1901, and Section 9 of the Electronic Transactions Act 1999, then the bankruptcy notice is deemed served when it is transmitted by the sender, being when it is irretrievably sent by email, and proof of non-delivery is not adduced to rebut that presumption.

Best practice when serving a bankruptcy notice by email is to get a delivery and read receipt.

However, for the time being, it would be safer to serve the bankruptcy in accordance with Section 102 of the Bankruptcy Regulations 2021, and section 28A of the Acts Interpretation Act 1901 – by sending by post, or hand-delivering the bankruptcy notice to the enforcement debtor.

Delivery and Read Receipts

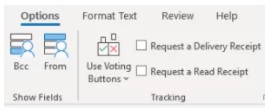

To get a delivery receipt or a read receipt you need to go to options in your Outlook, then tick the "request a delivery receipt" box and the "request a read receipt box".

For a delivery Receipt you will either get a relayed response or a delivered response.

- Relayed – Delivery to these recipients or groups is complete, but no delivery notification was sent by the destination server.

- Delivered – Your message has been delivered to the following recipients.

Either way, you can annex these receipts to your affidavit as evidence of delivery.

You may not get a read receipt as it requires the judgment debtor to click to send the read receipt, but it does happen sometimes, so it is worth a go.

Serving a Bankruptcy Notice by Email

This article explains how to serve a bankruptcy notice by email.

Don't just serve by email if there are other avenues open to you. If you can fax, then fax too. If you can get the judgment debtor personally served, or you know where the judgment debtor lives, then serve him or her there too. If you know the address, then post it to the enforcement debtor too.

The law around whether you can serve a bankruptcy notice by email is unsettled in our view, subject to the repeal of the 1996 Regulations and the provisions contained in the new 2021 Regulations. There is certainly an argument for it, but there is currently no cases to support service by email.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.